Practicing the CBSE Sample Papers for Class 12 Economics with Solutions Set 4 allows you to get rid of exam fear and be confident to appear for the exam.

CBSE Sample Papers for Class 12 Economics Set 4 with Solutions

Time: 3 Hours.

Max. Marks: 80

General Instructions:

- This question paper contains 34 questions.

- Marks are indicated against each question.

- Answers should be brief and to the point.

- Answers to the questions carrying 3 marks may be from 50 to 75 words.

- Answers to the questions carrying 4 marks may be about 150 words.

- Answers to the questions carrying 6 marks may be about 200 words.

Section-A (Macro Economics)

Question 1.

Read the following statements carefully:

Statement 1: Full employment refers to a situation where all those who are able to work and are willing to work are getting work.

Statement 2: Involuntary unemployment refers to a situation where some people are not getting work even when they are willing to work at the existing wage rate. In the light of the given statements, choose the correct alternative from the following:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Full employment refers to a situation where all those who are able to work and are willing to work are getting work while involuntary unemployment refers to a situation where some people are not getting work even when they are willing to work at the existing wage rate. Full employment never implies a situation of zero involuntary unemployment. There always occurs some degree of unemployment.

Question 2.

Country’s trade turned surplus for the first time in 18 years as imports dropped by a steeper 47.59%. The country posted a trade surplus of $0.79 billion in June. It is because of the government’s effort to support and promote domestic manufacturing and industry. Favorable balance of payments is due to:

(a) restrictions on exports

(b) increase in imports

(c) encouragement to domestic industries

(d) none of these

Answer:

(c) encouragement to domestic industries

Explanation: The development domestic industries will help to boost exports and reduce imports by making India self-sufficient in some of the goods thus leading to favorable BOP situation.

Question 3.

The ratio of total deposits that a Commercial Bank has to keep with Reserve Bank of India (RBI) called_________(Fill up the blank with correct alternative)

(a) Statutory Liquidity Ratio

(b) Deposit Ratio

(c) Cash Reserve Ratio

(d) Legal Reserve Ratio

Answer:

(c) Cash Reserve Ratio

Explanation: The Commercial Banks have to hold a certain minimum amount of deposit as reserves with- the Central Bank. The percentage of cash required to be kept in reserves as against the bank’s total deposits with RBI, is called the Cash Reserve Ratio (CRR).

![]()

Question 4.

Read the following statements carefully:

Statement 1: Foreign exchange rates are determined by the demand and supply of foreign exchange.

Statement 2: The rate of the foreign exchange is said to be in equilibrium when the demand for some currency in terms of another currency is equal to its supply. In the light of the given statements, choose the correct alternative

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Foreign exchange rates are determined by the demand and supply of foreign exchange while the rate of the foreign exchange is said to be in equilibrium when the demand for some currency in terms of another currency is equal to its supply.

Question 5.

Read the following statements carefully:

Statement 1: Stock variables are the variables whose magnitude is measured at a particular point in time.

Statement 2: Production, consumption, and capital formation are the vital (Basic) economic activities. In light of given statements, choose the correct alternative from the following:

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

OR

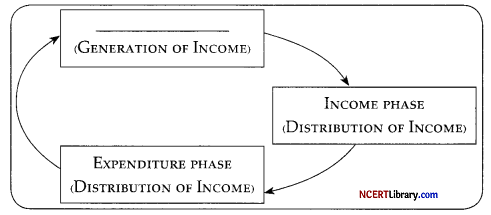

Read the following figure carefully and choose the correct pair from the alternative given below.

Alternatives:

(a) Production phase

(b) Income phase

(c) Expenditure phase

(d) Consumption phase

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Stock variables are the variables whose magnitude is measured at a particular point in time. For example population of India as on 31 March 2014. It is a static concept. While production, consumption, and capital formation are the vital (Basic) economic activities.

OR

(a) Production phase

Explanation: In the production phase firm produces the goods and services with the help factor services. Income is first generated in the production units, then distributed to households, and finally spent on goods and services produced by these units to make the circular flow complete its course.

Question 6.

If income rises from to ₹60,000, consumption increases from ₹40,000 to ₹48,000. In this situation, what will be the value of Marginal Propensity to Consume (MPC)?

(a) 0.80

(b) 0.20

(c) 0.10

(d) 0.90

OR

At zero level of income, consumption is:

(a) zero

(b) positive

(c) negative

(d) zero or negative

Answer:

(a) 0.80

Explanation:

\(\mathrm{MPC}=\frac{\Delta \mathrm{C}}{\Delta \mathrm{Y}}\)

Given, AC = ₹ (48,000- 40,000) = ₹ 8,000

AY = ₹(60,000- 50,000) = ₹ 10,000

\(\mathrm{MPC}=\frac{8,000}{10,000}=0.8\)

OR

(b) positive

Explanation: Even at zero level of income i.c., even if there is no income, there will be some consumption. Thus, consumption is always positive. Such consumption is known as autonomous consumption.

![]()

Question 7.

The primary functions of the Commercial Bank are________.

1. Accepting deposits

2. Lending money

3. Lender of last resort

4. Discounting of bills of exchange

Alternatives:

(a) 1,2 and 3 are correct

(b) 2, 3, and 4 are correct

(c) 1, 3, and 4 are correct

(d) 1, 2, and 4 are correct

Answer:

(d) 1, 2, and 4 are correct

Explanation: The Primary functions of the Commercial Bank are.

(i) Accepting deposits

(ii) Lending money

(iii) Discounting of bills of exchange

Question 8.

Find the current account balance from the following:

| S. No. | Items | ₹ in Crores |

| 1. | Export of goods | 80 |

| 2. | Export of services | 20 |

| 3. | Balance of visible trade | 50 |

| 4. | Transfer from one country to another country | 5 |

(a) 100 crore

(b) 50 crore

(c) 25 crore

(d) 75 crore

Answer:

(d) 75 crore

Explanation:

Current account balance = Balance of visible trade + Export of services + Transfer from one country to another country

= 50 + 20 + 05

= ₹ 75 crores

OR

The following information is given from an imaginary country:

| S. No. | Items | ₹ in crores |

| 1. | Export | 3,37,237 |

| 2. | Import | 5,17,519 |

| 3. | Invisible (Net) | 1,23,026 |

The trade balance is in_______.

(a) deficit

(b) surplus

(c) zero

(d) none of these

Answer:

(a) deficit

Explanation: Trade balance = Export- Import

= 3,37,273-5,17,519

= -1,80,282

Question 9.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): In a situation of excess demand, there is no employment in the economy.

Reason (R): Excess demand raises the real value of the output.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion(A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

Explanation: Excess demand increases the general price level because it arises when aggregate demand is more than aggregate supply at a full-employment level. The economy is already operating at full employment equilibrium, and hence (here is no employment.

Question 10.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Full employment implies zero unemployment when nobody is ever unemployed in the economy.

Reason (R): There is always some minimum level of unemployment called natural unemployment or voluntary unemployment.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion(A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(d) Assertion (A) is false, but Reason (R) is true.

Explanation: Full employment is an economic situation in which all those who can work and willing to work (at the existing wage rate) are getting work. But even in a healthy economy, there is a presence of frictional, structural and cyclical unemployment so the assertion is false.

![]()

Question 11.

If the Nominal GDP is ₹1200 and price index (with base = 100) is 120. Calculate Real GDP.

Answer:

National GDP = ₹ 1,250

Price Index = 120

Real GDP =?

\(\begin{aligned}

\text { Price Index } &=\frac{\text { National GDP }}{\text { Real GDP }} \times 100 \\

120 &=\frac{1,200}{\text { Real GDP }} \times 100 \\

\text { Real GDP } &=\frac{1,200}{120} \times 100=₹ 1,000

\end{aligned}\)

Question 12.

Briefly explain the different types of the foreign exchange systems in effect in the foreign exchange market.

OR

Distinguish between Current Account Deficit (CAD) and Current Account Surplus (CAS).

Answer:

There are three types of Exchange Rate Systems:

1. Fixed Exchange Rate System: This is also called pegged exchange rate system. In this type of system weaker currency of the two currencies in question is pegged or tied to the stronger currency by the government.

2. Flexible Exchange Rate System: This is also known as the floating exchange rate system as it is dependent on the market forces of supply and demand. There is no intervention of the Central Banks or the government in the floating exchange rate system.

3. Managed Floating Exchange Rate System: Managed floating exchange rate system is the combination of the fixed (managed) and floating exchange rate systems. Under this system the Central Banks intervene or participate in the purchase or selling of the foreign currencies as and when required.

OR

| S. No. | Current Account Deficit | Current Account Surplus |

| 1. | When import is greater than export then the country has a trade deficit. | When export is greater than import then the country has a trade surplus. |

| 2. | More investment in foreign country. | Foreigners invest in our country which causes increase in surplus. |

| 3. | When currency is overvalued. | When currency is undervalued. |

Question 13.

In an economy, total savings are ₹ 2,000 crore and the ratio of average propensity to save and average propensity to consume is 2 : 7. Calculate the level of income in an economy.

Answer:

Here, S = ₹ 2,000 crore

\(\begin{aligned}

\frac{\mathrm{APS}}{\mathrm{APC}} &=\frac{2}{7}, \mathrm{APS}=\frac{2}{9}, \mathrm{APS}=\frac{\mathrm{S}}{\mathrm{Y}} \\

Hence, \mathrm{S} &=\mathrm{APS} \times \mathrm{Y}=\frac{2}{9} \times \mathrm{Y} \\

(Where, Y = Income)

or, 2,000 &=\frac{2}{9} \times \mathrm{Y} \\

or, \mathrm{Y} &=\frac{9}{2} \times 2,000

\end{aligned}\)

So, National Income = ₹ 9,000 crore

Question 14.

As per the following news published in ECONOMIC SURVEY, 2019-20.

Along with the weakening of global economic activity, inflation the world over also remained muted in 2019. Inflation softened in advanced and emerging economies reflecting a slack in consumer demand. From the supply side, lower energy prices in 2019 also contributed to softening of inflation. In India, inflation slightly rose to 4.1% in April- December 2019, after a sharp decline from 5.9% in 2014 to 3.4% in 2018

What is deficient demand in an economy? What is its impact on output, employment, and prices?

Answer:

Deficient demand refers to a situation when Aggregate Demand is short of Aggregate Supply corresponding to the full employment level in the economy.

1. Effect on output: Low level of investment and employment implies a low level of output.

2. Effect on employment: Because of the deficiency of demand, the investment level is reduced. Accordingly, the level of employment tends to fall.

3. Effect on prices: A fall in prices is the immediate consequence of deficient demand.

![]()

Question 15.

Read the following text carefully, discuss briefly the relevant functions of the Central Bank indicated:

The modern banking system is two tiered. This means that at the bottom there are commercial banks i.e., the banks that we interact with on a day to day basis. They are then managed by a central bank which forms the next level in the hierarchy. The modem banking system provides Central Banks with considerably more rights and responsibilities.

(i) Banker’s bank

(ii) Lender of last resort

OR

Define Credit Multiplier. What role does it play in determining the credit creation power of the banking system? Use a numerical illustration to explain.

Answer:

(i) Banker’s Bank: As a banker to the banks, the Central Bank holds surplus cash reserves of commercial banks. It also lends to commercial banks when they are in needs of funds Central Bank also provides a large number of routine banking functions to the commercial banks. It also act as a supervisor and regulator of the banking system.

(ii) Lender of last resort: The Central Bank is the only institution which issue currency when commercial banks need more funds in order to be able to create more credit, they may go to market for such funds or go to the Central Bank. This role of Central Bank, that of being ready to lend to banks at all times is another important function of the Central Bank, and due to this it is said to be the lender of last resort.

OR

The credit multiplier measures the amount of money that the banks are able to create in the form of deposits with every initial deposits. The credit creation of the commercial bank depends on credit multiplier as it is inversely related to LRR. Higher the credit multiplier, higher will be the total credit created and vice versa. Numerical example – Suppose the amount of the initial deposit is ₹1000 and LRR is 10%. The banks will keep 10% i.e., ₹100 as reserve and lend the remaining to borrowers. The borrowers will spend this money. It is assumed that comes back to the banks. Bank again keep 10%, ₹900, i.e., ₹90 as reserve and lend This will further raise, the amount of deposits with the banks. In this way, deposits go on increasing number of times and the total deposit will be determined by the money multiplier.

\(\text { Money multiplier }=\frac{1}{\mathrm{LRR}}=\frac{1}{0.10}=10\)

The total deposit (will be) = Initial deposit x money multiplier

= 1,000 x 10 = ₹ 10,000

Question 16.

(a) Distinguish between Stocks and Flows. Give an example of each.

(b) Giving reason explain how should the following be treated in estimation of national income:

(i) Expenditure by a firm on payment of fees to a chartered accountant.

(ii) Payment of corporate tax by a firm.

(iii) Purchase of refrigerator by a firm for own use.

Answer:

(a) Difference between Stocks and Flows:

| S. No. | Stock | Flow |

| 1. | Stock refers to the value of a variable at a point of time. | Flow refers to the value of a variable during a period of time. |

| 2. | It is measured at a specific point of time. | It is measured per hour, per month or per year. |

| 3. | Stock impacts the flow. Greater the stock of capital greater is flow of goods and services. | Flow impacts the stock, greater the flow of income greater is the stock of wealth with the people. |

| 4. | Example : Capital and quantity of money. | Example : Export and imports. |

(b) (i) The services of chartered accountant hired by the firm should not be included in the estimation of national income. This is because it forms a part of the firm’s intermediate consumption.

(ii) Payment of corporate tax is not included in the national income as it is a mere transfer payment from the firm to the government. It is a part of corporate profits which already form part of national income, therefore, it should not be separately included in national income (in addition to corporate profits).

(iii) Purchase of refrigerator by a firm for own use will be included in the national income as it is regarded as final consumption expenditure.

Question 17.

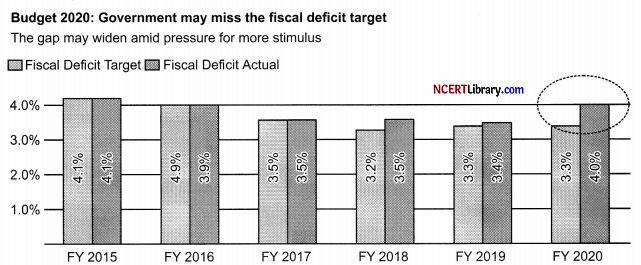

(a) What is fiscal deficit? Compare the trends of fiscal deficit given in the figure for the year 2020 given below.

(b) Define revenue receipts in a Government Budget. Explain how Government Budget can be used to bring in price stability in the economy.

OR

(a) How are tax receipts different from non-tax receipts? Discuss briefly

(b) Tax rates on higher income group has increased. Which economic value does it reflect? Explain.

Answer:

(a) The fiscal deficit is the difference between the government’s total expenditure and its total receipts (excluding borrowing). A fiscal deficit occurs when this expenditure exceeds the revenue generated. Since FY 2015 to FY 2019 the gap between fiscal deficit target and actual fiscal deficit is very less. The latest government data shows that the government has missed its annual fiscal deficit target by 0.7% as economic slowdown has hit tax collections during the current year FY 2020. Government has to cover this deficit through borrowing from either the central bank of the country or raising money from capital markets by issuing different instruments like treasury bills and bonds.

(b) Receipts which do not create a liability for the government or do not lead to reduction in assets, are known as revenue receipts. Revenue receipts are those receipts of the government which are not redeemable, i.e., they cannot be re-claimed from the government. These are divided into tax and non-tax revenue:

(i) Tax revenue: It consists of the proceeds of taxes and other duties levied by the Central and the State Governments, Tax revenues comprise of direct taxes and indirect taxes.

(ii) Non-tax revenue: Non-tax revenue of the government mainly consists of interest receipts on account of loans by the government, dividends and profits on investments made by the government, fees and other receipts for services rendered by the government, Grants-in-aid from foreign countries and international organization are also a part of non-tax revenue. The Government Budget is a statement of estimated receipts and expenditures of the Government during the financial year. One of the objectives of the Government Budget is to achieve economic stability.

The government tries to establish economic stability by its budgetary policies related to income and expenditure.

OR

(a) Difference between basis of the Tax Receipt and Non-Tax Receipt:

| Basis | Tax Receipt | Non-Tax Receipt |

| (i) Meaning | Tax revenue includes receipts from all types of taxes. | Non-tax revenue is the revenue of the government from sources other than taxes. |

| (ii) Nature | A tax is a legal and compulsory payment imposed by the government. | It is not a compulsory payment. |

| (iii) Benefit | No direct benefit is received in exchange of tax paid. | It is a paid in lieu of the benefit or services received. |

| (iv) Examples | Income tax, wealth tax, GST, etc. | Fees, fines, licence fee, etc. |

(b) The economic value that is reflected in the rise in tax rate for higher income group is the ‘equality and social welfare’. The main objective of the budgetary policy of the government is to reduce inequalities of income and wealth in the country. For this, it performs the function of equal distribution of income and wealth.

Even distribution of wealth and social welfare remains the main objective of budgetary policy. The government uses progressive taxation policy to reduce the inequalities of income and wealth in the country. Government imposes high tax rates on higher income group and low tax rates on lower income group. People with income below a certain level are not levied any direct tax altogether. On the other hand, the government spends these tax receipts on granting subsidies and providing other public services such as health and education to people with lower income groups. Thus, the wealth gets redistributed and reduction in inequalities is achieved.

![]()

Section-B (Indian Economic Development)

Question 18.

With reference to industrial sector state the correct combination of statement.

1. British wanted to reduce India to a mere supplier of raw materials.

2. India was a market for British finished goods.

3. Improvement was the basis of Indian Economy due to the improvement of industries.

Alternatives:

(a) 1 only

(b) 1 and 2 only

(c) 3 only

(d) All of these

Answer:

(b) 1 and 2 only

Explanation: British policies (ruined the small scale manufacturing industries of India as these industries faced a stiff competition by the British machine made products and India was reduced to a cheap raw material provider. Moreover, British machine made products or finished goods were imported in India on a large scale.

Question 19.

What is the main feature of New Economic Policy?

(a) Liberalisation

(b) Privatisation

(c) Globalisation

(d) All of these

OR

India has adopted_________policy of economic development since 1991. (Choose the correct alternative).

(a) liberal

(b) restrictive

(c) strict

(d) normal

Answer:

(d) All of these

Explanation: The New Education policy of 1991 focussed on bringing globalization, privatization, and liberalization in the economy.

OR

(a) liberal

Explanation: India has adopted liberal policy of economic development since 1991. i.e., relaxation or reduction in government regulations.

Question 20.

Reforms in________were introduced in 1988.

(a) China

(b) Pakistan

(c) India

(d) USA

OR

Reforms in_________started in the year___________.

I. China

II. 1978

III. Pakistan

IV. 1991

Alternatives:

(a) I or II

(b) II or III

(c) III or IV

(d) I or IV

Answer:

(b) Pakistan

Explanation: Pakistan adopted economic stabilization and structural reforms policy in 1988 in an effort to reduce domestic financial imbalances and external deficits.

OR

(a) I or II

Explanation: Deng Xiaoping, was often credited as the “General Architect” of the reforms. The reforms in China were launched by reformists within the Chinese Communist Party (CCP) on December 18, 1978, during the “Bolduan Fanzheng” period.

Question 21.

Identify the sector in which Agriculture laborers, farmers, and owners of small enterprises which employ less than 10 workers fall:

(a) Formal sector

(b) Informal sector

(c) Casual workers

(d) Regular workers

Answer:

(b) Informal sector

Explanation: It is an unorganized sector of an economy that includes all those private sector enterprises which employ less than 10 workers. Examples: agriculture laborers, farmers, owners of small enterprises, etc.

![]()

Question 22.

From the set given in column-I and the corresponding facts given in column II choose the correct pair of statements.

| Column-I | Column-11 | ||

| i | Commune System of agricultural production. | (A) | India |

| ii | Great leap forward campaign. | (B) | Pakistan |

| iii | Great Proletarian Cultural revolution. | (C) | China |

| iv | One Child Norm | (D) | England |

Alternatives:

(a) i-(A)

(b) ii-(B)

(c) iii-(C)

(d) iv-(D)

Answer:

(c) iii-(C)

Question 23.

Read the following statements carefully:

Statement 1: In India public sector is the largest employer in the formal sector.

Statement 2: Those working in the formal sector remains unprotected by labour laws and are therefore highly vulnerable to the uncertainties of the market. In the light of the given statements, choose the correct alternative from the following:

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(a) Statement 1 is true and statement 2 is false.

Explanation: In India public sector is the largest employer in the formal sector. Those employees working in the formal sector remains protected as the government exercise control over that sector by passing necessary Acts and formulating rules and regulations. The workers working in the formal sector are entitled to social security benefits.

Question 24.

Read the following statements carefully:

Statement 1: India announced its first five year plan in the year 1951.

Statement 2: In India, overall objectives of five year plans focussed on the socialistic pattern of society. In the light of the given statements, choose the correct alternative:

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: India announced its first five year plan in the year 1951.1n India, overall objectives of five year plans focussed on the socialistic pattern of society. The Socialistic Pattern of Societyimplies is that there should not be a private profit gain, and the socio-economic relations, as well as the developmental patterns, should be keenly planned. There should be equality in terms of income and wealth of the people, and employment disparities should be reduced as much as possible.

Question 25.

Banning the use of chlorofluorocarbon compounds and other chlorine and bromine compounds is adopted under______.

(a) Chipko movement

(b) Apiko movement

(c) Montreal protocol

(d) None of these

Answer:

(c) Montreal protocol

Explanation: Montreal protocol is a treaty that was designed to protect the ozone layer from depletion by phasing out certain substances. Such as chlorofluorocarbon compounds and other chlorine and bromine compounds.

OR

__________is a type of unemployment in which the marginal productivity of the workers as zero?

(a) Disguised Unemployment

(b) Involuntary Unemployment

(c) Seasonal Unemployment

(d) Structural Unemployment

Answer:

(a) Disguised Unemployment

Explanation: : Disguised Unemployment exists when part of the labor force is either left without work or is working in a redundant manner such that worker productivity is essentially zero. It is unemployment that does not affect aggregate output.

![]()

Question 26.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Alternative marketing channels are a ray of hope for small and marginal workers.

Reason (R): Current marketing channels have not been able to defend the interest of small and marginal farmers from the middlemen.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion(A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

Explanation: Current marketing channels have not been able to defend the interest small and marginal farmers from the middlemen. The middlemen exploit the farmers by forcing them to sell their products at a very low price. Alternative marketing channels are a ray of hope for small and marginal workers.

Question27.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): China has the lowest density of population as compared to India and Pakistan.

Reason (R): China has a very large geographical area.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion(A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

Explanation: China has the lowest density of population as compared to India and Pakistan. China has the very large geographical area. Density of the population is calculated by dividing the total population with total area. More is the area less will be the density of population.

Question 28.

Interpret the given picture and write the strategies to achieve the goals indicated in the picture.

Answer:

Sustainable development: It refers to that development which will allow all future generation to have an average quality of life; the aim of it is to ensure that present generation should leave quality of life for next generation The term sustainable development has its origin in IUCN (International Union for the Conservation of Natural Resources).

Strategies of sustainable development:

1. Use of environment friendly fuels: In urban areas, use of CNG is being promoted to be used as fuel. In Delhi, use of CNG in public transport has significantly lowered air pollution. In rural areas, households generally use wood, dung cake or other biomass as fuel. These fuels have several adverse implications like deforestation, reduction in green cover, wastage of cattle dung and air pollution. To overcome this problem, use of LPG and global gas is being promoted as they are cleaner fuels.

2. Establishment of Mini-hydel Plants: In mountain regions perpetual streams can be found almost everywhere. These streams can be used to generate electricity through mini-hydel plants. These power plants are more or less environment friendly and generate enough power to meet local demands. Moreover, large scale transmission towers and cables are also not required in such plants.

Question 29.

Defend or refute the following statement with the valid explanation:

“The Prime Minister urged to increase the rural income by increasing non-farm activities.”

Answer:

The statement is defended as Non-farm activities can lead to rise in income of people in rural sector in the following ways.

1. Animal husbandry: It is that branch of agriculture which is concerned with the breeding, rearing and caring for farm animals. Sheep rearing is an important income augmenting activity in rural areas. Livestock production provides increased stability in income, food security, transport, fuel and nutrition. A significant number of women’s also find employment in the livestock sector.

2. Horticulture: It refers to the science or art of cultivation of fruits, vegetables, tuber crops, flowers, medicinal and aromatic plants and plantation crops. India has adopted horticulture as it is blessed with a varying climate and soil conditions. It is an important sector for potential diversification and value addition in agriculture.

3. Fisheries: It refers to the occupation devoted to the catching, processing or selling of fish and other aquatic animals. In India, after the progressive increase in budgetary allocations and the introduction of new technologies in fisheries and aquaculture. In India: West Bengal, Andhra Pradesh, Kerala, Gujarat, Maharashtra and Tamil Nadu are major fish-producing states.

OR

As compared to the urban women more rural women, accounts for higher share in the female workforce. Clarify?

The difference in participation rates is very high between urban and rural women. In urban areas, for every 100 urban females, only about 14 are engaged in some economic activities. In rural areas, for every 100 rural women, about 26 of them participate in the employment market. Hence, where men are able to earn high incomes, families discourage female members from taking up jobs.

Earnings of urban male workers are generally higher than rural males and so urban families do not want females to work. Apart from this, many activities of the household in which urban women are engaged, are not recognised as productive work, while women working on farms in rural areas are considered a part of the workforce if they are being paid wages in cash or in the form of Food grains.

![]()

Question 30.

Compare and analyse the given data of distribution of workforce (in 2018-19 with valid reasons:

| Country | Agricultural (%) | Industry (%) | Services (%) |

| India | 43 | 25 | 32 |

| China | 26 | 28 | 46 |

| Pakistan | 41 | 24 | 35 |

Answer:

As evident from the table, the percentage of workforce engaged in agricultural sector is the highest in case of India, which stands at 43%. The corresponding rates for China and Pakistan are 26% and 41% respectively.

The percentage of workforce engaged in industry is the highest in China, which stands at 28%. The corresponding rates for India and Pakistan are 25% and 24% respectively. The percentage of workforce engaged in services sector is again the highest in China, which stands at 46%. The corresponding rates for India and Pakistan are 32% and 35% respectively. These observations point to the fact that China is far ahead of India and Pakistan in industrializing its production activity which is a sign of long period growth and development.

Higher percentage of workforce in services sector in China is also a sign of its faster growth compared to India and Pakistan. However, the fact should also be not ignored that Pakistan has taken over India as regards the growth of services sector. This points to rapid urbanisation in Pakistan.

Question 31.

What is meant by the term privatisation?

Answer:

Privatisation is the process of involving private sector in the ownership and operation of a state owned enterprise.

OR

How does privatisation lead to fiscal consolidation?

Answer:

Privatization implies the transfer ownership and management of public sector enterprises private entrepreneurs. It is a process involving disinvestment in public sector enterprises. By and large disinvestment is planned for such public sector enterprises which are inefficient and run into huge losses. Disinvestment leads to fiscal consolidation in two ways :

(i) Losses of the public sector enterprises are plugged, and

(ii) Revenue of the government rises on account of the sale of shares of public enterprises.

Question 32.

State whether the following statements are true or false with valid arguments:

(a) “Organic farming promotes sustainable development”.

(b) “Education for All- Still a Distant Dream”.

Answer:

(a) Organic farming refers to a system of farming that sustains and enhances the ecological balance. In other words, this system of farming relies upon the use of organic inputs for cultivation. The traditional farming involves the use of chemical fertilisers, toxic pesticides, etc. that harms the ecosystem drastically so, this type of farming is practiced to produce toxic-free food for the consumers while simultaneously maintaining the fertility of the soil and contributing to ecological balance. This type of farming enables eco-friendly sustainable economic development.

(b) Though literacy rates for both – adults as well as youth have increased, still the absolute number of illiterates in India is as much as India’s population was at the time of independence. In 1950, when the Constitution of India was passed bv the Constituent Assembly, it was noted in the Directive Principles of the Constitution that the government should provide free and compulsory education for all children up to the age of 14 years within 10 years from the commencement of the Constitution. Had we achieved this, we would have cent percent literacy by now. Therefore, we cannot be complacent about the upward movement in the literacy rates and we have miles to go in achieving cent percent adult literacy.

Question 33.

(a) Why are less woman found in regular salaried employment?

(b) Is environmental crisis a recent phenomenon? If so, why?

(c) State and discuss any two environmental concerns faced by India in the present times.

Answer:

(a) Less woman are found in regular salaried employment due to the following reasons:

(i) Lack of education facilities: Female education is not given due importance in India and hence, the majority of the woman in India do not have the educational qualification and professional skills required for regular salaried employment.

(ii) Discouragement from family in India: Many families still do not want the female members to step out from the house for work especially it is for long hours, as in regular salaries employment.

(b) Yes, environmental crisis is a recent phenomenon. The environment was able to perform its functions without any interruption till the resource extraction was not above the rate of regeneration of the resource and the wastes generated were within the assimilating capacity of the environment. But today, environment fails to perform its vital function of life sustenance resulting in an environmental crisis.

The rising population of the developing countries and the affluent consumption and production standards of the developed world have placed a huge stress on the environment. Many resources have become extinct and the wastes generated are beyond the absorptive capacity of the environment. As a result, we are today at the threshold of environmental crisis.

(c) There are many environmental issues faced by India in present times. Some of them are: Air pollution, growing water scarcity, water pollution, biodiversity loss etc.

Here, two environmental concerns are as follow:

(1) Airpollution: Air pollution is one of the worst pollution affecting India. Average life expectation is likely to go down for more than one year due to air pollution. India has most polluted cities of the whole world. India ranks 141 out of 180 countries in terms of air pollution.

(2) Ground water depletion: It is one of the biggest threat because as ground water is declining it is affecting food security and livelihood in the country. It is also responsible for most of the country’s agriculture production and food crisis.

OR

(a) Do you think that in the last 50 years, employment generated in the country is commensurate with the growth of GDP in India? Defend or refute the given statement with valid reason.

(b) It is necessary to generate more employment in the formal sector? Give a valid argument in support of the given statement.

Answer:

(a) No, I don’t think that in the last 50 years, employment generated in country is commensurate with the growth of GDP in India. In 2005, the growth rate in employment was 2.89% while growth rate in GDP was 6.1%. The difference between the growth rate of GDP and the growth rate of employment is indicative of the phenomenon of ‘jobless growth.

Jobless growth is a situation in which there is an overall acceleration in the growth rate of GDP in the economy which is not accompanied by an expansion in employment opportunities. This means that in an economy without generating additional employment, we have been able to produce more goods and services. This is because of the use of capital-intensive methods of production.

(b) Formal sector refers to the organised sector of the economy. Workers of the formal sector enjoy social security benefits and also they remain protected by the labour laws. On the other hand, the informal sector is an unorganised sector of the economy. People engaged in this sector do not enjoy any social security benefits and do not have any trade unions and consequently, have low bargaining power.

This makes them more vulnerable to the uncertainties of the market. Creating more jobs in the formal sector helps in reducing poverty and income inequalities. Thus, in order to safeguard the interests of informal sector and to utilise this portion of the workforce for achieving economic growth, it is very important to generate more employment opportunity in the formal sector.

![]()

Question 34.

Read the following text carefully and answer the given questions on the basis of the same and common understanding:

Demonetization: Three times India faced the big move

The Narendra Modi government shook the country last week by announcing the demonetization policy and turning notes of ₹ 500 and ₹ 1000 into paper. While people were allowed to exchange their old notes for valid currency, deposit the money, or withdraw a certain amount from the ATM, the move saw unprecedented lines outside banks and ATMs with bank employees working overtime to make up for the cash crunch in the common man’s life.

The move to make currency illegal overnight has, however, happened earlier, both times with a view to interrupt black money deals and tender black money hoarded as illegal. By putting a cap on the money that one is able to deposit without coming under the scanner of the Income Tax department, the government aims at investigating possible tax evasions as well.

(a) What do you mean by demonetization?

(b) What are the reasons behind the demonetization?

Answer:

(a) Demonetisation is the act of stripping a currency unit of its status as legal tender. It occurs whenever there is a change of national currency. The current form or forms of money is pulled from circulation and retired, often to replaced with new notes or coins. In India, during the demonetization of 2016 the currency notes of ₹ 500 and ₹ 1000 was withdrawn from the economy and they lost the status of being legal tender.

(b) The reason behind demonetization is as under:

(1) To tackle the menace of black money/parallel economy/shadow economy.

(2) The cash circulation in India is directly connected to corruption hence government wants to reduce cash transactions and also control corruption and thereby moving towards cashless transactions.

(3) To counter the menace of counterfeit currency.

(4) To prevent the cash being used for terrorist activities/terror funding.