Practicing the CBSE Sample Papers for Class 12 Economics with Solutions Set 3 allows you to get rid of exam fear and be confident to appear for the exam.

CBSE Sample Papers for Class 12 Economics Set 3 with Solutions

Time: 3 Hours.

Max. Marks: 80

General Instructions:

- This question paper contains 34 questions.

- Marks are indicated against each question.

- Answers should be brief and to the point.

- Answers to the questions carrying 3 marks may be from 50 to 75 words.

- Answers to the questions carrying 4 marks may be about 150 words.

- Answers to the questions carrying 6 marks may be about 200 words.

Section-A (Macro Economics)

Question 1.

Read the following statements carefully: [1]

Statement 1: Flexible exchange eliminates the problem of undervaluation and overvaluation of currency.

Statement 2: With flexible exchange system there is no need for the government to hold any reserves.

In the light of the given statements, choose the correct alternative from the following:

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Flexible exchange is that rate which is determined by the demand for and supply of different currencies in the foreign exchange market so flexible exchange eliminates the problem of undervaluation and overvaluation of currency. In the flexible exchange system there is no need for the government to hold any reserves

Question 2.

An Indian real estate company receives rent from Google in New York. This transaction would be recorded on the credit side of which account. [1]

(a) Current

(b) Capital

(c) Revaluation

(d) None of these

Answer:

(a) Current

Explanation: This transaction would be recorded on the credit side of the current account because the rent received by an Indian company from Google which is in New York is an income received from abroad.

Question 3.

National Income and domestic income will be ________ in a closed economy where net factor income from abroad is zero. [1]

(a) constant

(b) equal

(c) zero

(d) none of these

Answer:

(b) equal

Explanation: National Income and domestic income will be equal in a closed economy where net factor income from abroad is zero.

![]()

Question 4.

Read the following statements carefully: [1]

Statement 1: Net exports are the components of aggregate demand.

Statement 2: Both aggregate demand and aggregate supply are ex-ante

In the light of the given statements, choose the correct alternative.

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: The components of aggregate demand are :

(i) Government spending

(ii) Consumption

(iii) Investment

(iv) Net Exports (X-M)

And aggregate demand and aggregate supply both are ex-ante

Question 5.

Read the following statements carefully: [1]

Statement 1: Open market operation is one of the quantitative tool used by the Central Bank to control the credit.

Statement 2: Central bank acts as a lender of last resort for the Commercial Banks.

In the light of the given statements, choose the correct alternative from the following:

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Quantitative method is the tool which effect the overall supply of credit in the economy. Open market operation is one of the Quantitative method used by central Bank for credit control. Central bank act as a lender of last resort if the commercial bank fails to get financial accommodation from anywhere. Its aim is to prevent banking system from collapse.

OR

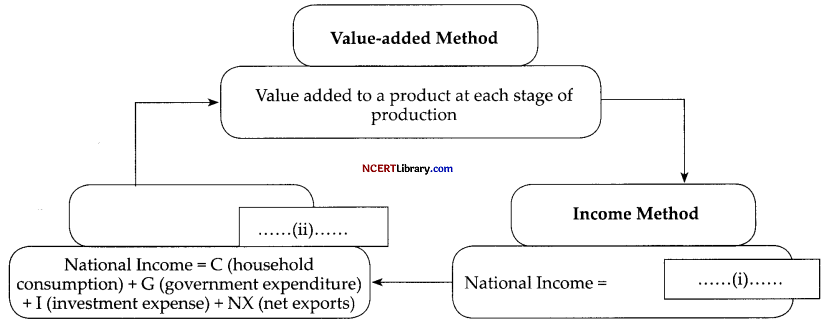

Read the following figure carefully and choose the correct pair from the alternatives given below: [1]

Alternatives:

(a) C (household consumption) + G (government expenditure) + I (investment expense) , Expenditure method

(b) Rent + Compensation + Interest + Profit + Mixed income, Product Method

(c) G (government expenditure) +1 (investment expense) + NX (net exports), Product method

(d) Rent + Compensation + Interest + Profit + Mixed income, Expenditure Method

Answer:

(d) Rent + Compensation + Interest + Profit + Mixed income, Expenditure Method

Explanation: The income method takes into account when the income generated from the basic factors of production like labour, land, entrepreneur, and capital.

Question 6.

In consumption function C = c + bY, b represents: [1]

(a) autonomous consumption

(b) savings

(c) MPC

(d) MPS

Answer:

(c) MPC

Explanation: The consumption function is represented as:

C =c + bY

Where,

c is the autonomous consumption

b is the marginal propensity to consume

Y is the income

MPC is the ratio of change in consumption to the change in income.

OR

In a two-sector economy, aggregate demand equals to: [1]

(a) consumption + private consumption expenditure.

(b) consumption + exports.

(c) consumption + investments.

(d) consumption + government expenditure

Answer:

(c) consumption + investments.

Explanation: Aggregate Demand refers to the sum of total of aggregate consumption and the aggregate investment.

Question 7.

The causes of excess demand and inflationary gap are ________. (Choose the correct alternative) [1]

1. Increase in investment demand

2. Increase in disposable income

3. Increase in export demand

4. Decrease in consumption demand

Alternatives:

(a) 1, 2, and 3 are correct

(b) 2, 3, and 4 are correct

(c) 1, 3, and 4 are correct

(d) 1, 2, and 4 are correct

Answer:

(a) 1, 2, and 3 are correct

Explanation: The causes of excess demand and inflationary gap are

A. Increase in investment demand

B. Increase in disposable income

C. Increase in export demand

Question 8.

If Export is equal to ₹ 1,000 lakh, Import is equal to ₹ 1,650 lakh, balance of trade shows: [1]

(a) Surplus of ₹ 650 lakh

(b) Deficit of ₹ 650 lakh

(c) Balance of ₹ 2650 lakh

(d) None of these

Answer:

(b) Deficit of ₹ 650 lakh

Explanation: Balance of trade = Export- Import

= 1600-1000

= 650

Here the exports is more than imports by ₹ 650 lakh. This indicate that there is deficit balance of ₹ 650 lakh.

OR

Identify which of the following statement is true? [1]

(a) Balance of payment account does not record transactions of capital nature.

(b) Balance of trade is the summation of exports and imports of visible items.

(c) When exports are more than imports, balance of trade account is in deficit.

(d) Balance of payment account includes visible items, invisible items, capital transfer and unilateral transfer.

Answer:

(d) Balance of payment account includes visible items, invisible items, capital transfer and unilateral transfer.

Explanation: In Balance of Payments, we include not only the value of goods through exported and imported i.e., visible items but also invisible items and capital transactions.

![]()

Question 9.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below: [1]

Assertion (A): In India, CRR and SLR are fixed by the Commercial banks.

Reason (R): In India, CRR and SLR are fixed by the Reserve Bank of India.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(d) Assertion (A) is false, but Reason (R) is true

Explanation: In India, CRR and SLR is fixed by Central bank ie., RBI to control credit in the market.

Question 10.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below: [1]

Assertion (A): MPC of poor people is more than that of rich people.

Reason (R): MPC falls with successive increase in income.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

Explanation: The MPC is higher in the case of poorer people than that of rich people. In a developing country, on the other hand, most of the basic needs of the people remain unsatisfied so that additional increments of income go to increase consumption, resulting in a higher marginal propensity to consume and a lower marginal propensity to save.

Question 11.

In a single day Raju, the barber collects ₹ 500 from haircuts; over this day his equipment depreciates in value by ₹ 50 and the remaining ₹ 450, Raju pays sales tax worth ₹ 30 takes home ₹ 200 and retains ₹ 220 for improvement and buying of new equipment. He further pays ₹ 20 as income tax from his income. Based on this information, complete Raju’s contribution to the following measures of income. [3]

(i) Gross Domestic Product

(ii) NNP at market price

(iii) NNP at factor cost

Answer:

Given, Indirect taxes = ₹ 30, Personal tax = ₹ 20

Depreciation = ₹ 50, Retained earnings = ₹ 220

(i) GDPMP = ₹ 500

(ii) NNPMP = GDPMp- Depreciation

= 500 – 50 = ₹ 450

(iii) NNPFC =NNPMP – NIT

= 450 – 30 = ₹ 420

Question 12.

Where is ‘borrowings from abroad’ recorded in the Balance of Payments Accounts? Give reasons. [3]

OR

Explain the effect of appreciation of domestic currency on imports. [3]

Answer:

(a) Borrowing from abroad is a part of Capital Account.

(b) Borrowing from abroad can be private transactions or official transactions.

(c) For example,

1. All transactions relating to borrowings from abroad by private sector are recorded on the positive (credit) side as it is inflow of foreign currency.

2. Similarly, transactions relating to borrowings from abroad by government sector are recorded on the positive (credit) side as it is inflow of foreign currency.

OR

Appreciation implies an increase in the value of the domestic currency in terms of foreign currency through market forces. As a result rate of exchange declines and the price of domestic currency increases. For instance, if the price of one pound has decreased from ₹ 72 to ₹ 60. It implies that Indian citizens now can buy goods of worth one pound by parting only ₹ 60 compared to ₹ 72, due to the fall in exchange rate. Since goods in England have become cheaper in terms of Indian rupee, they will buy more of them. As a result, Indian imports from England will increase.

Question 13.

If National Income is ₹ 50 crore and saving is ₹ 5 crore, find out Average Propensity to Consume. When income rises to ₹ 60 crore and saving to ₹ 9 crore, what will be the Average Propensity to Consume and Marginal Propensity to Save? [4]

Answer:

Here, in first condition,

Y = ₹ 50 crore

S = ₹ 5 crore

Hence,

C = Y- S

= 50 – 5 = ₹ 45 crore

Average Propensity to Consume,

\(\begin{aligned}

\mathrm{APC} &=\frac{\mathrm{C}}{\mathrm{Y}} \\

&=\frac{45}{50}=0.90

\end{aligned}\)

Again, when income and savings rise,

Y = ₹ 60 crore

S = ₹ 9 crore

Average Propensity to Consume (APC)

\(\begin{aligned}

&=\frac{C}{Y} \\

&=\frac{Y-S}{Y}=\frac{60-9}{60}=0.85

\end{aligned}\)

Again,

ΔS = 9 -5 = ₹ 4 crore

ΔY = 60- 50 = ₹ 10 crore

Hence, Marginal Propensity to Save,

\(\mathrm{MPS}=\frac{\Delta \mathrm{S}}{\Delta \mathrm{Y}}=\frac{4}{10}=0.40\)

Question 14.

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumption occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as marginal propensity to consume.

MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the MPC is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend more than the extra dollar (without borrowing).

The MPC is higher in the ase of poorer people than in rich. In the light of the given statement identify the relation between the income and MPC. [4]

Answer:

1. Marginal propensity to consume refers to the change in consumption with respect to the change in income.

2. When there is an increase in income it reflects in better purchasing power of consumer.

3. The change in income not only affects consumption but also induces changes in savings.

4. The proportion of consumption depends upon the income levels and corresponding necessities of the consumer.

5. It is used widely in economics to calculate the required additional production for the increased demand (consumption).

![]()

Question 15.

Read the following text carefully, discuss the question given below. [4]

“Banks are financial institutions associated with the functions of credit creation via giving short-term and long-term loans to business houses, shopkeepers, and individuals. They are the financial intermediaries in the economy. People can deposit their savings in banks and also take loans when the need comes. The schemes like – The PM Jan Dhan Yojana, The Bank Recapitalisation Scheme, and the nationalisation of banks in 1969 highlight the important role that banks play in India.”

In the context of above mentioned case, ‘JAN DHAN YOJNA’ led to rise in bank deposits. How would it impact the national income in India?

OR

Explain the process of credit creation by Commercial Banks with suitable numerical example.

Answer:

With the introduction of ‘Jan Dhan Yojana’ by the government of India, millions have opened their bank account in the country. This has enhanced primary deposits of Commercial bank. It is on the basis of their primary deposit that the banks are able to create secondary deposits. Expansion of cash deposits leads to expansion of credit creation capacity of the Commercial bank.

This is expected raise in demand for credit and for investment purpose. Higher investment leads to increase in national income of the country.

OR

The process of credit creation by Commercial Bank can be easily understood by taking an example. Suppose a person, say X, deposits 2000, with a bank and the LRR is 10% which means the bank keeps only the minimum required 200 as cash reserve. Tire bank can use remaining amount 1800 = (2000- 200) for giving loan to someone.

The bank lends 1800 to, say F, for their purpose an account is opened in the name of Y and amount is credited in his account. This is the first round of credit creation in the form of secondary deposit (1800) which equals 90% of the initial deposit. Now again from the deposit of Y bank keep 10% or LRR i.e. 180 and remaining 1620 is advanced to, say Z.

The bank get new demand deposit. This is the second round of credit creation till secondary deposit becomes zero. In the end, volume of total credit created in this way becomes multiple of initial deposit. The quantitative outcome is called money multiplier. In short, money (or credit) creation by commercial banks depends on two factors:

(i) amount of initial deposit (ii) and, LRR. Symbolically:

Question 16.

(a) Explain the precautions that are taken while estimating national income by value added method.

(b) Explain the circular flow of income. [6]

Answer:

(a) Precautions that are taken while estimating national income by value added method are:

(i) Imputed rent of owner-occupied houses be included because all houses have rental value irrespective of its use by self or tenant.

(ii) Imputed value of goods and services produced for self-consumption or for free distribution should be included.

(iii) Only value added and not value of output by production units should be included.

(iv) Value of own-account production of fixed assets by enterprises, government and the households should be included.

(v) The value of sale and purchase of second-hand goods should be excluded.

(vi) Sale of bonds by a company should also be excluded since it is merely a financial transaction which does not contribute directly to the flow of goods and services.

(b) Circular flow of income refers to continuous circular flow of goods, services and income among different sectors of an economy. Flow of money is the aggregate value of goods and services either as factor payments or as expenditure on goods and services. It is circular since it has neither any beginning nor an end. It can be explained as household sector supply factor services and spend their income on consumption.

The firms use these services in producing goods and other services. The households as owner of factors for production receive the payments in terms of money or reward for rendering productive services. The recipients of these incomes (i.e. households) in turn, spend their incomes on purchase of goods and services to satisfy their wants.

In short, income is generated by production units, then distributed among households for rendering productive services and ultimately comes back to production units by way of expenditure by the households.

Circular flow works on two principles:

(i) In an exchange process, the seller (producer) receives the same amount which the buyer (or consumer) spends.

(ii) Goods and services flow in one direction and the money paid to acquire them, flow in the reverse direction giving rise to a circular flow.

Question 17.

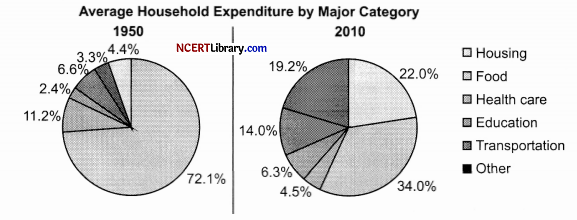

(a) Compare the pie chart given below:

(b) Elaborate the objective of ‘allocation of resources’ in the Government Budget. [6]

OR

(a) Explain the basis of classifying taxes into direct and indirect tax. Give examples

(b) Is the following a revenue receipt or a capital receipt in the context of government budget and why? [6]

(i) Tax receipts (ii) Disinvestment

Answer:

(a) (i) The two pie charts evaluate the average nationwide expenses on various household groups, including food, transportation, housing, education, and healthcare in 1950 and 2010.

(ii) The expenditure ratio for food soared in 6 decades while an overwhelming portion of the expenditure went on to housing in 1950.

(iii) In 1950, the bulk expenses were made for food and housing, accounting for 11.2% and 72.1% of the total expenditures respectively. In opposite, it can be seen that people prioritised buying food, i.e., 34% more than housing, i.e., 22% six decades later.

(iv) Health care is the lowest category to spend on in both years. Additionally, transportation expenses had extremely increased roughly three times, from only 3.3% in 1950 to 14% in 2010. Aside from that, spending on other things rose to 19.3% from 4.4% in 1950.

(v) However, the education expense ratio had slightly decreased, where people insignificantly spent 0.3% more in 1960 than in 2010.

(vi) To summarise, necessities such as food and housing are the two main categories people spend most of their money on. However, health care was the least prioritised.

(b) The government of a country, through its budgetary policy, directs the allocation of resources in a manner such that there is a balance between the goals of profit maximisation and social welfare by ensuring that there should be production of necessity goods as well as comfort and luxury goods and the goods which cannot be provided through market mechanism like, roads, parks, street lights etc., provided by government.

Government provides more resources into socially productive sectors where private sector is not involved.

OR

(a) The taxation is a legal essential payment imposed by the government. The basis of classifying taxes into direct and indirect tax are as follows:

Final Burden: Direct taxes are those that are fully paid to the government by the tax payer. It can also be described as a tax on which the burden of both liability and payment falls on the same person. Whereas, indirect taxes are those which are paid to the government by one person but their burden is bourne by another person.

Shifting of Tax: Direct taxes are never shifted to other persons. Whereas the indirect taxes can be shifted.

Progressiveness: Direct taxes are generally progressive in nature. Their real burden is more on the poor. Whereas, indirect taxes are regressive in nature as every person contributes equally to the payment of taxes.

(b) (i) Tax receipts or revenue receipts are those receipts which can be neither creates any liability nor creates any reduction in the assets of the government.

(ii) Disinvestment is treated as capital receipts because it results in the reduction of government assets.

Section-B (Indian Economic Development)

Question 18.

Agriculture was exploited through, ________ system of land revenue. [1]

(a) jagirdar

(b) feudal

(c) colonial

(d) zamindari

Answer:

(d) zamindari

Explanation; Agriculture was exploited through the zamindari system of land revenue. Under this system, the zamindars, who were recognised as the owners of the lands, exploited the farmers and made them more tenants.

Question 19.

________ is the term used for the policy which promote setting up of an upper limit of the land that could be owned by a landowner. [1]

(a) Land fragmentation

(b) Land ceiling

(c) Land cultivation

(d) Land tilling

Answer:

(b) Land ceiling

Explanation: The law set a limit on how much land an individual or corporation could hold, also known as a land ‘ceiling’, and allowed the government to reapportion surplus land to the landless labourers or farmers.

OR

India has adopted, ________ policy of economic development since 1991. (Fill in the blank with the correct alternative) [1]

(a) liberal

(b) restrictive

(c) strict

(d) normal

Answer:

(a) liberal

Explanation: India has adopted regulations liberal policy of economic development since 1991. i.e., relaxation or reduction in government.

![]()

Question 20.

One child norm is a feature of the policy of which country ________. (Choose the correct alternative) [1]

(a) France

(b) India

(c) Pakistan

(d) China

Answer:

(d) China

Explanation: The one-child was a rule implemented by the Chinese government mandating that the vast majority of couples policy in was the country could only have one child.

OR

A campaign in ________ in 1958 where people were encouraged to set up industries in their backyard was named as ________. [1]

I. China

II. Great Leap Forward

III. India

IV. Anti-Rightist Movement

Answer:

(a) I or II

Explanation: The Great Leap Forward (GLF) was a campaign initiated in 1958 in China by Mao’s, which was aimed to modernise the China’s economy. The campaign was directed towards the large-scale industrialisation in the country not concentrated only in the urban areas.

Question 21.

Absorptive capacity is defined as: [1]

(a) ability of the environment to absorb degradation.

(b) resource generation within the assimilating capacity of the environment.

(c) average number of organisms living in a given environment.

(d) the minimum population surviving in the world as a whole.

Answer:

(a) ability of the environment to absorb degradation

Explanation: It is the maximum amount of waste material that can be naturally absorbed by the environment on a sustainable basis, without causing environmental damage, is called as absorptive capacity.

Question 22.

From the set given in column-I and corresponding facts given in column II choose the correct pair of statement. [1]

| Column-I | Column-II | ||

| i | India | (A) | Mixed Economy |

| ii | China | (B) | Two-Child norm |

| Iii | Pakistan | (C) | Low density of population |

| Iv | Human Development Indicator | (D) | Pakistan ahead if India and China |

Alternatives:

(a) i-(A)

(b) ii-(B)

(c) iii-(C)

(d) iv-(D)

Answer:

(a) i-(A)

Question 23.

Read the following statements carefully: [1]

Statement 1: Absolute poverty means that the person is not able to achieve a minimum level of consumption.

Statement 2: Relative poverty means that a person is poor in comparison of certain other person.

In the light of the given statements, choose the correct alternative:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Question 24.

Read the following statements carefully: [1]

Statement 1: Great proletarian Cultural Revolution was started by Mao in China.

Statement 2: Since 1978, china began to introduce many reforms in phases. In the light of the given statements, choose the correct alternatives

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Great proletarian Cultural Revolution was started by Mao in China. In this revolution students and professionals Were send to work and learn from the countryside. Since 1978, china began to introduce many reforms in phases. These reforms are initiated in agriculture, foreign trade and investment.

Question 25.

Sustainable development that meets the need of the present generation without compromising the ability of the future generation to meet their own needs. This definition given by ________. [1]

(a) Brundtland Commission

(b) Edward Barbier

(c) UNCED

(d) None of these

Answer:

(c) UNCED

Explanation: The concept of sustainable development was emphasised by the United Nations Conference on Environment and Development (UNCED), which defined it as: ‘Development that meets the need of the present generation without compromising the ability of the future generation to meet their own needs’.

OR

Disguised unemployment is common in ________. (Choose the correct alternative) [1]

(a) Agricultural sector

(b) Industrial sector

(a) Agricultural sector

(b) Industrial sector

Answer:

(a) Agricultural sector

Explanation: Disguised unemployment is a kind of unemployment in which people who are visibly employed but are actually unemployed. In rural areas, this type of unemployment is generally found in agricultural sector.

Question 26.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below: [1]

Assertion (A): The major policy initiatives i.e., land reforms and Green Revolution helped India to become self-sufficient in food grains production.

Reason (R): The proportion of people depending on agriculture did not decline as expected.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

Explanation: Green Revolution means a large increase in crop production in developing countries achieved by the use of chemical fertilisers, pesticides, and high-yield crop varieties of seeds. India adopted major land reforms but still people are engaged in agriculture and they have not shifted from agriculture to other services.

Question 27.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below: [1]

Assertion (A): China’s rapid industrial growth can be traced back to its reforms in 1978.

Reason (R): The system of collective farming known as the Commune System, was implemented in china to achieve more equitable distribution of food grains.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

Explanation: China’s rapid industrial growth can be traced back to its reforms in 1978. Then, reforms were introduced in phases in China. In the first phase, reforms were initiated in agriculture, foreign trade and the investment sector. Then, reforms in the industrial sector were initiated in the second phase.

![]()

Question 28.

Interpret the given picture on account of current environmental changes. [3]

Answer:

The picture indicates the phenomena of global warming. Global warming is the phenomenon of a gradual increase in the temperature near the earth’s surface.

This phenomenon has been observed over the past one or two centuries. This change has disturbed the climatic pattern of the earth. However, the concept of global warming is quite controversial but the scientists have provided relevant data in support of the fact that the temperature of the earth is rising constantly.

There are several causes of global warming, which have a negative effect on humans, plants and animals. These causes may be natural or might be the outcome of human activities. In order to curb the issues, it is very important to understand the negative impacts of global warming.

Following are the major effects of global warming:

(i) Rise in Temperature

(ii) Threats to the Ecosystem

(iii) Climate Change

(iv) Spread of Diseases

(v) High Mortality Rates

(vi) Loss of Natural Habitat

Question 29.

Defend or refute the following statement with the valid explanation:

“Human Capital Formation gives birth to innovation, invention and technological improvements.” [3]

OR

What is organic farming and how does it promote sustainable development? [3]

Answer:

I agree with the statement that “Human Capital Formation gives birth to innovation, invention and technological improvements” by:

Expenditure of Education: It is the most effective way of raising a productive workforce in the country. Labour skill of an educated person is more than that of an uneducated person. Individuals invest in education to increase their future income and raise their standard of living.

Expenditure in Health: It is also an important expenditure to build and maintain productive labour force and to improve quality of life of people in the society. It makes a man more efficient and therefore more productive. Their contribution to the production process tends to rise and adds more to GDP than a sick person.

Expenditure on the Job-training: It helps the workers to sharper their specialised skills. It increases the skill, efficiency and capacity of the workers. It also make workers more creative and innovative which result in increase in production and productivity.

OR

Organic farming refers to a system of farming that sustains and enhances the ecological balance. In other words, this system of farming relies upon the use of organic inputs for cultivation. The traditional farming involves the use of chemical fertilisers, toxic pesticides, etc. that harms the eco system drastically so, this type of farming is practiced to produce toxic-free food for the consumers while simultaneously maintaining the fertility of the soil and contributing to ecological balance. This type of farming enables eco-friendly sustainable economic development.

Question 30.

Compare and analyse the given data of distribution of workforce (in 2018-19) with valid reasons: [4]

| Country | Agricultural (%) | Industry (%) | Services (%) |

| India | 43 | 25 | 32 |

| China | 26 | 28 | 46 |

| Pakistan | 41 | 24 | 35 |

Answer:

As evident from the table, the percentage of workforce engaged in agricultural sector is the highest in case of India, which stands at 43%. The corresponding rates for China and Pakistan are 26% and 41% respectively.

The percentage of workforce engaged in industry is the highest in China, which stands at 28%. The corresponding rates for India and Pakistan are 25% and 24% respectively. The percentage of work force engaged in services sector is again the highest in China, which stands at 46%. The corresponding rates for India and Pakistan are 32% and 35% respectively.

These observations point to a fact that China is far ahead of India and Pakistan in industrialising its production activity which is a sign of long-period growth and development.

Higher percentage of workforce in services sector in China is also a sign of its faster growth compared to India and Pakistan. However, the fact should also be not ignored that Pakistan has taken over India as regards the growth of services sector. This points to rapid urbanisation in Pakistan.

Question 31.

(a) Why government has decided to retain Navratnas in the public sector? [4]

(b) Under the colonial regime, basic infrastructure such as railways, ports, water transport, posts and telegraphs develop. However, the real motive behind infrastructure development was not to provide basic amenities to the people but to sub-serve various colonial interests. Support the given statement with a valid explanation.

OR

Discuss briefly the rationale behind choosing ‘self-reliance’ as a planning objective for Indian economy. [4]

Answer:

(a) Government has decided to retain Navratnas in the public sector since they are profit-making and help the government to raise the financial resources for themselves.

(b) The objective that British intend to achieve through their policy are:

(i) The roads that were built primarily served the purp and drawing out raw materials from the countryside to the nearest railway station or the port to send these to England or other foreign destinations. There always remained an acute shortage of all-weather roads to reach out to the rural areas during the rainy season. Therefore, people suffered grievously during natural calamities or famines.

(ii) The introduction of railways by the British in 1850 fostered commercialisation of Indian agriculture which adversely affected the self-sufficiency of the village economies in India. The benefits of exports surplus rarely accrued to the Indian people.

(iii) The inland waterways, at times, proved uneconomical as in the case of the coast canal on the Orissa coast, which had to be ultimately abandoned.

(iv) The introduction of the expensive system of electric telegraph in India served the purpose of maintaining law and order by the British colonial government.

(v) The postal services, despite serving a useful public purpose, remained inadequate of mobilising the army within India.

OR

The rationale behind choosing ‘Self-Reliance’ as a planning objective for Indian economy are:

Self-Reliant: The major objective is to make the economy self-reliant. It means overcoming the need of external assistance. In other words, it means to have development through domestic resources.

Promote economic growth: To promote economic growth and modernization, the five-year plans stressed on the use of own resources, in order to reduce our dependence on foreign countries.

Reduce foreign dependence: To reduce foreign dependence, as India was recently freed from foreign control, it is necessary to reduce our dependence on foreign countries especially for food. So, stress should be given to attain self-reliance.

Avoid foreign interference: To avoid foreign interference, it was feared that dependence on imported food suppliers, foreign technology and foreign capital may increase foreign interference in the policies of our country.

Question 32.

State weather the following statements are true or false with valid arguments: [4]

(a) “India is often called as Outsourcing Destination of the world.”

(b) “New Economic Policy stimulated economic growth.”

Answer:

(a) The statement given is true. India has become a favourable destination of outsourcing for the world because of the following prime reasons:

Easy availability of cheap labour: The wage rates in India are comparatively lower than that of in the developed countries. As a result, MNCs outsource their business in India.

Availability of skilled manpower: India has vast skilled manpower, which enhances the faith of MNCs in outsourcing their business in India.

Favourable government policies: MNCs get various types of lucrative offers from the Indian government like tax holidays, low tax rates, etc.

(b) The given statement is true. “The New economic Policy has stimulated economic growth.”

(i) This policy have stimulated the process of industrial production leading to increase in productivity.

(ii) It leads to considerable increase in the foreign reserve.

(iii) It helped in controlling fiscal deficit

(iv) FDI has increased manifolds since the implementation of this policy

![]()

Question 33.

(a) Why is there a need for improving the quality and quantity of infrastructure in rural areas?

(b) What is meant by environment?

(c) Why calorie based norm is not adequate to identify the poor? [6]

OR

(a) Rural Development is the need of hour? Give valid argument in support of your answer.

(b) Air pollution and groundwater depletion is the two major environmental concerns faced by India in the present times. Defend or refute the given statement with valid reason. [6]

Answer:

(a) It is necessary to develop quality and quantity of infrastructure such as banking, marketing, storage, transport and communication etc. to realise its true potential so that rural development can be enhanced.

(b) Environment is defined as the total planetary inheritance or the totality of all resources. It includes all the biotic (e.g. birds, animals, plants, forests, etc.) and abiotic (e.g. water, sun, and, mountains, etc.) factors that influence and depend upon each other.

(c) Calorie based norm is not an adequate measure to identify poor people because of the reasons mentioned below:

(i) This system categories poor in a single category and does not differentiate between poor and very poor.

(ii) This mechanism considers calories intake as the only basis of determining poverty. It fails to consider factors such as healthcare, provision of clean drinking water, proper sanitation, basic education, etc.

(iii) This measure fails to explain social factors that cause poverty such as ill health, lack of access to resources, lack of civil and political freedom, etc.

OR

(a) Rural development is quite as a comprehensive term but it essentially means a plan of action for the development of rural areas which are lagging behind in socioeconomic development. Inadequate infrastructure, lack of alternate employment opportunities in the industry or service sector, increasing casualisation of employment, etc., impede rural development.

The impact of this phenomenon can be seen from the growing distress witnessed among farmers across different parts of India. During 2007-12, the growth rate of agriculture output was only 3.2%

(b) Yes we agree with the given statement. There are many environmental issues faced by India in present times. Some of them are: Air pollution, growing water scarcity, water pollution, biodiversity loss, etc.

The two major environmental concerns are as follows:

Air pollution: Air pollution is one of the worst pollution affecting India. Average life expectation is likely to go down for more than one year due to air pollution. India has most polluted cities of the world. India ranks 141 out of 180 countries in terms of air pollution.

Groundwater depletion: It is one of the biggest threat because as groundwater is declining it is affecting food security and livelihood in the country. It is also responsible for most of the country’s agriculture production and food crisis.

Question 34.

Read the following text carefully and answer the given questions on the basis of the same and common understanding: [6]

Criticism on the effects of the green revolution includes the cost for many small farmers using HYV seeds, with their associated demands of increased irrigation systems and pesticides. A case study is found in India, where farmers are buying Monsanto BT cotton seeds—sold on the idea that these seeds produced ‘non-natural insecticides’.

In reality, they need to still pay for expensive pesticides and irrigation systems, which might lead to increased borrowing to finance the change from traditional seed varieties. Many farmers have difficulty in paying for the expensive technologies, especially if they have a bad harvest. These high costs of cultivation push rural farmers to take out loans—typically at high-interest rates.

Overborrowing commonly entraps farmers into a cycle of debt. On top of this, India’s liberalized economy further exacerbates the farmers’ economic conditions. Indian environmentalist Vandana Shiva writes that this is the “second Green Revolution”. The first Green Revolution, she suggests, was mostly publicly funded (by the Indian Government). Farmer’s financial issues have become especially apparent in Punjab, where its rural areas have witnessed an alarming rise in suicide rates.

Excluding the countless unreported cases, there has been estimated to be a 51.97% increase in the number of suicides in Punjab in 1992-93, compared to the recorded 5.11% increase in the country as a whole. According to a 2019 Indian news report, indebtedness continues to be a grave issue affecting Punjabi people today, demonstrated by the more than 900 recorded farmer committed suicide in Punjab in the last two years.

(a) What do you understand by HYV of seeds?

(b) ‘HYV seeds have played a very important role in green revolution but it also have some disadvantages’

Justify the following statement with valid explanation in context of the text given above.

Answer:

(a) HYV of seeds are better quality seeds which have low maturity period, are highly productive and are disease resistant. The yield from these seeds exceeds 25% to 100% as compared to yield from normal seeds. The government encourages the use of these seeds to increase crop productivity.

(b) The HYV of seeds have certain disadvantages which are as under:

(i) HYV of seeds required the use of expensive pesticides and good irrigation facilities.

(ii) Poor farmers cannot afford the use expensive pesticides and good irrigation facilities as a result they have to take loans. Overborrowing commonly entraps farmers into a cycle of debt.

(iii) Indebtedness is a grave issue affecting farmers today, as more than 900 farmer committed suicide in Punjab in the last two years.

![]()