Practicing the CBSE Sample Papers for Class 12 Economics with Solutions Set 2 allows you to get rid of exam fear and be confident to appear for the exam.

CBSE Sample Papers for Class 12 Economics Set 2 with Solutions

Time: 3 Hours.

Max. Marks: 80

General Instructions:

- This question paper contains 34 questions.

- Marks are indicated against each question.

- Answers should be brief and to the point.

- Answers to the questions carrying 3 marks may be from 50 to 75 words.

- Answers to the questions carrying 4 marks may be about 150 words.

- Answers to the questions carrying 6 marks may be about 200 words.

Section-A (Macro Economics)

Question 1.

Read the following statements carefully:

Statement 1: The average between the total consumption expenditure and the total income at the given level of income is called APC.

Statement 2: APC does not represent the fraction of total income which is consumed. In light of the given statements, choose the correct alternative from the following.

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(a) Statement 1 is true and statement 2 is false.

Explanation: The ratio between the total consumption expenditure and the total income at the given level of income is called as APC. In other words APC is the ratio of aggregate consumption expenditure (c) and aggregate income (I).

APC =C/Y

APC represents the fraction of total income which is consumed.

Question 2.

Without limiting the generality of the foregoing, a current account transaction is defined as a transaction that is not a capital account transaction. Identify the correct option that such a type of transaction includes:

(a) Borrowing in Indian rupees and foreign exchange

(b) Remittances of living expenses residing abroad

(c) Overseas direct investment (ODIs) from India

(d) None of the above

Answer:

(b) Remittances of living expenses residing abroad

Explanation: The correct answer is (b) because it is a current account transaction and the remaining others are capital account transactions

Question 3.

Supply of money refers to_________.

(a) currency held, by the public

(b) currency held by Reserve Bank of India (RBI)

(c) currency held by the public and demand deposits with commercial banks

(d) currency held in the government account

Answer:

(c) currency held by the public and demand deposits with commercial banks

Explanation: Money supply refers to the total stock of money of all types (currency as well as demand deposits) held by the people of a country at a given point of time. Money supply includes both currency held by the public in terms of coins and paper notes as well as demand deposits of the people with the commercial bank.

Question 4.

Read the following statements carefully:

Statement 1: Value of exports of goods is credited and import of goods is debited.

Statement 2: All the types of the physical goods imported and exported is known as invisible items. In the light of the given statements, choose the correct alternative from the following:

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(a) Statement 1 is true and statement 2 is false.

Explanation: All export of goods and services are recorded as the positive item on the credit side while all import of goods and services are recorded as the negative item on the debit side Value of all the types of the physical goods imported and exported is known as visible items.

![]()

Question 5.

Read the following statements carefully:

Statement 1. GDP of an economy is equal to GNP, when Net Factor Income from Abroad is zero.

Statement 2. GDP at market price refers to the market value of final goods and services produced during a year within the domestic territory of the country inclusive of depreciation. In the light of the given statements, choose the correct alternatives

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 1 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

OR

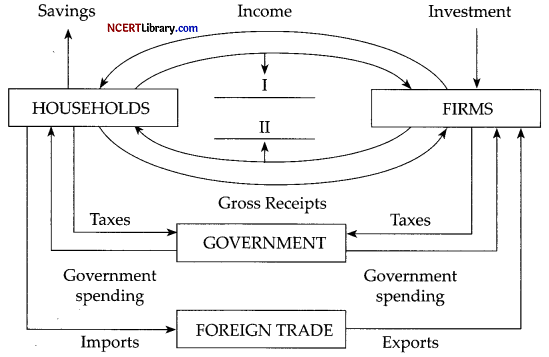

Read the following figure carefully and choose the correct pair from the alternatives given below.

Alternatives:

(a) Goods and services, Income

(b) Income, Goods and services

(c) Factor services, Goods and services

(d) Goods and services, Factor services

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Gross Domestic Product will be equal to Gross National Product, when net factor Income from Abroad is zero.

OR

(c) Factor services, Goods and services

Explanation: Households provide factor services such as land, labour and capital and, in return, they receive income. Also, firms provide goods and services to households.

Question 6.

The value of MPC when MPS is zero is:

(a) 1

(b) 0

(c) 0.5

(d) oo

OR

At zero level of income, consumption is:

(a) zero

(b) positive

(c) negative

(d) zero or negative

Answer:

(a) 1

Explanation:

If MPS =0

MPC + MPS =1

MPC+0 =1

MPC =1

OR

(b) positive

Explanation: Even at zero level of income i.e., even if there is no income, there will be some consumption. Thus, consumption is always positive. Such consumption is known as autonomous consumption.

Question 7.

The quantitative method of credit control used by a central banks to control credit are__________.

1. Bank Rate Policy

2. Open market Operations

3. CRR

4. Margin Requirement

Choose the correct alternative:

(a) 1, 2, and 3 are correct

(b) 2, 3, and 4 are correct

(c) 1, 3, and 4 are correct

(d) 1, 2, and 4 are correct

Answer:

(a) 1, 2 and 3 are correct

Explanation: The quantitative method of credit control use by central bank to control credit are

1. Bank Rate Policy

2. Open market Operations

3.CRR

![]()

Question 8.

The following information is given for an imaginary country: (In lakhs)

| Year | Trade balance | Import of goods |

| 2016 | 1000 (Trade deficit) | 1600 |

| 2019 | 1750 (Trade surplus) | 1150 |

What will be the amount of export of goods in 2016 and 2019?

(a) 2600,600

(b) 600, 2900

(c) 500,2900

(d) 1000,600

OR

The following information is given for an imaginary country:

| Account | Particulars | Amount (in ₹) |

|

Current Account |

Export of goods | 3,50,000 |

| Export of services | 1,75,000 | |

| Import of goods | 5,00,000 | |

| Import of services | 1,95,000 | |

| Capital Account | Net capital account balance | 45,000 |

| Financial Account | Net financial account balance | 60,000 |

Balance of payment will be_______and overall country’s economy is in________.

(a) 65000, Surplus

(b) 75000, Deficit

(c) 75000, Surplus

(d) 65000, Deficit

Answer:

(b) 600,2900

Explanation:

In 2016, Import- Export = Trade deficit

1600- Export = 1000

Export = 1600- 1000

= 600

In 2019, Export- Import = Trade surplus

Export -1150 =1750

Export = 1750 + 1150

= 2900

OR

(d) 65000, Deficit

Explanation:

BOP = Current account + Capital account + Financial account

= (Export of goods- Import of goods + Export of services- Import of services) + Capital account + Financial account

= (350000- 500000 + 175000- 195000) + 45000 + 60000

=- 65000

Question 9.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): Average propensity to save is always greater than zero.

Reason (R): Value of investment multiplier varies between one to infinity.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(d) Assertion (A) is false, but Reason (R) is true.

Explanation: APS can be negative at low level of income when consumption expenditure is greater than income. The reason is true as it varies from 1 to infinity. The minimum value of the multiplier can be 1 when there is one time change in income or when MPC = 0 and maximum value of multiplier can be infinity when there is infinite change in income or MPC = 1.

Question 10.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): There are two important concepts of propensity to consume, the one being average propensity to consume and the other marginal propensity to consume.

Reason (R): They should be carefully distinguished, for they are equal in some cases but different in others.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion(A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

Explanation: How much consumption changes in response to a given change in income depends upon the average and marginal propensity to consume. Thus, propensity to consume of a community can be known by the average and marginal propensity to consume.

![]()

Question 11. Suppose the GDP at a market price of a country in a particular year ₹ 1,100 crores. Net Factor Income from Abroad was ₹ 100 crore. The value of indirect taxes less subsidies was ₹ 150 crore and National Income was ₹ 850 crore. Calculate the aggregate value of depreciation.

Answer:

Given, GDP = ₹ 1,100 crore, NFIA = ₹ 100 crore, NIT = ₹ 150 crore, NNPFC= ₹ 850 crore.

GDPFC =GDPmp-NIT

= 1,100 -150 = ₹ 950 crore

GNPFC = GDPFC + NFIA

= 950 + 100 = ₹ 1,050 crore

GNPFC = NNPFC + Depreciation

₹ 1,050 = 850 + Depreciation

Depreciation = 1,050- 850 = ₹ 200 crore.

Question 12.

Briefly explain the different types of foreign exchange systems in effect in the foreign exchange market.

OR

Why managed floating rate of exchange is more beneficial for a country like India? Justify.

Answer:

There are three types of Exchange Rate Systems:

1. Fixed Exchange Rate System: This is also called pegged exchange rate system. In this type of system weaker currency of the two currencies in question is pegged or tied to the stronger currency by the government.

2. Flexible Exchange Rate System: This is also known as the floating exchange rate system as it is dependent on the market forces of supply and demand. There is no intervention of the central bank or the government in the floating exchange rate system.

3. Managed Floating Exchange Rate System: Managed floating exchange rate system is the combination of the fixed (managed) and floating exchange rate systems. Under this system the central bank intervene or participate in the purchase or selling of the foreign currencies when they were required.

OR

There are many reasons to justify that managed floating rate of exchange is more beneficial for a country like India. Some of them are:

1. Pegged exchange rate reduces exchange rate volatility in international market with much stronger and more resilient monetary policy.

2. A managed float ensures that India’s reserves have enough foreign exchange that can be sold at fair market prices during crises.

3. A managed floating exchange prevents such practices and ensures balance. It also curbs speculative activities in the foreign exchange market.

4. Despite the ‘Make in India’ and ‘Stand Up India’ schemes, the country still has to import a sizeable range of products from overseas. To ensure fair competition and maintain adequate BOP, a managed floating exchange rate is necessary. Thus, it is clear that domestic economy is hardly impacted by the actions taken under a managed floating regime. It must be remembered that a high amount of self-sufficiency to the market forces to correct themselves and the economy by extension. If this does not happen, the authorities intervene to make changes.

Question 13.

Suppose marginal propensity to consume is 0.8. How much increase in investment is required to increase national income by ₹ 2,000 crores? Calculate.

Answer:

Marginal propensity to consume (MPC) = 0.8

Change in income = ₹ 2,000 crore

\(\mathrm{K}=\frac{1}{1-\mathrm{MPC}}\)

\(\begin{aligned} &=\frac{1}{1-0.8}=\frac{1}{0.2}=5 \\ \mathrm{~K} &=\frac{\Delta \mathrm{Y}}{\Delta \mathrm{I}} \\ 5 &=\frac{2000}{\Delta \mathrm{I}} \\ 5 \Delta \mathrm{I} &=2,000 \\ \Delta \mathrm{I} &=\frac{2,000}{5}=₹ 400 \text { crore } \end{aligned}\)

Question 14.

The COVID-19 pandemic has brought renewed interest understanding how households’ consumption and saving respond to income changes. Micro data sets, including timely household survey data and transaction-level datasets from financial budget applications, have allowed economists to estimate the marginal propensity consume (MPC) out income shocks quite swiftly during the pandemic. The available evidence points to households mostly saving or paying down debt when receiving a one-off payment during the pandemic.

This suggests that typical untargeted direct transfers to the average household may not stimulate aggregate demand as much during pandemics as during other crises. In this context, understanding which household characteristics predict a higher MPC out of income windfalls is of key importance for the design of fiscal support measures. Identify the impact of Covid-19 pandemic on the aggregate demand and aggregate supply.

Answer:

The second wave of the COVID-19 pandemic in India had a big impact on aggregate demand. “The biggest impact of the second wave is in terms of a demand shock (aggregate demand). The localised nature of lockdowns, work from home protocols, online delivery models, e-commerce and digital payments reduces the total expenditure to be incurred on purchase of goods and services by the people.

On the other hand, there is less impact on aggregate supply. If aggregate demand remains constant but the supply shock causes the price level to rise, the economy experiences stag flation (falling output and rising price levels). To fix supply shocks, government has to influence aggregate demand by increasing prices and lowering output.

![]()

Question 15.

Read the following text carefully, and discuss the money creation techniques briefly by commercial banks:

The Reserve Bank of India controls the monetary policy of the Indian government. The role of the Reserve Bank of India has undergone a substantial change after introducing the New Economic Policy in 1991. The Reserve Bank of India is accountable for the supply and issue of the Indian rupee. It also operates the country’s main payment systems and works to stimulate its economic development.

OR

Explain the role of the Central Bank as the “Lender of last resort”.

Answer:

The money creation techniques used by commercial banks are :

1. Cash Reserve Ratio: It refers to the percentage of deposits with the commercial banks, which the commercial banks are bound to kept as a reserve with the RBI. In case of inflation, RBI raises CRR, reducing commercial banks’ lending capacity. Hence, people will have less money in their hands, leading to less demand for a product, thus reducing the prices and situation inflation curbs.

2. Statutory Liquidity Ratio: It refers to the minimum percentage of deposits with the commercial banks, which the commercial banks are bound to kept in the form of liquid assets as reserves. It is the same as CRR. In case of inflation, RBI raises SLR, reducing commercial banks’ landing capacity. Hence, people will have less money in their hands, leading and demand less products, thus reducing the prices and inflation.

3. Repo Rate: It is the rate at which a country’s Central Bank lends funds to commercial banks. In the case of inflation, Central Bank decrease the repo rate. Lending funds to commercial banks by the central bank reduces, which reduces the money supply in the country and thus helps to curb inflation.

4. Reverse Repo Rate: It is the rate at which a country’s Central Bank borrows funds from commercial banks. In the case of inflation, RBI increases the reverse repo rate. As a result, RBI borrows more funds from commercial banks, thus reducing the money supply in the market and curbing inflation.

OR

A person or organization which is ready to help the individual or organisation who is in need of immediate financial help to come out of the financial struggles is the lender of the last resort. It means that if a commercial bank fails to get financial accommodation from anywhere, it approaches the Central Bank as a last resort. Central Bank advances loan to such banks against approved securities. By offering loan to the commercial bank in situations of emergency, the Central Bank ensures that:

(a) The banking system of the country does not suffer from any set back.

(b) Money market remains stable.

It preserves the stability of the banking and financial system by protecting individual’s deposited funds and preventing panic ridden withdrawals from banks with temporary limited liquidity. For more than century and a half, Central Bank have been trying to avoid great depressions by acting a lenders.

Question 16.

(a) “Gross Domestic Product (GDP) does not give us a clear indication of economic welfare of a country.” Defend or refute the given statement with a valid reason.

(b) Describe the steps involved in the National Income by income method.

Answer:

(a) The given statement is completely true that GDP does not give us a clear indication of economic welfare of a country. GDP is a measure of the economy’s production or it can be considered a component of welfare. A higher GDP means more production of goods and services in an economy during a given year. Therefore, a higher GDP also means that more goods and services were available to the people of the country during the year. But it does not indicate that the people were better off during the year. In other words, a higher GDP may not necessarily mean higher welfare of the people.

(b) Steps of Income Method:

(i) All the producing enterprises employing various factors of production are identified and classified into primary, secondary and tertiary sectors.

(ii) The factor incomes paid by each sector are classified under compensation of employees, operating surplus and mixed income.

(iii) When factor incomes of all the 3 sectors are summed up, we get domestic income or NDPfC.

(iv) In the final step NFIA is added to domestic income to arrive at National Income (NNPFC).

Question 17.

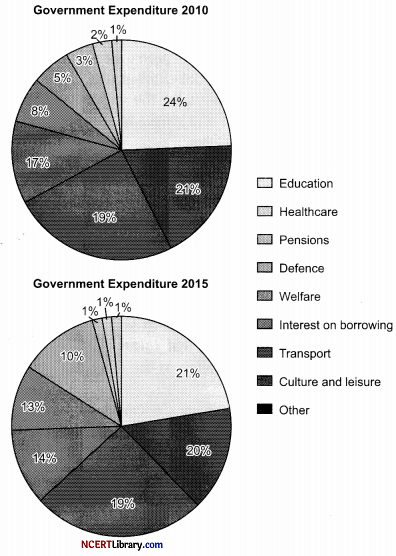

(a) Compare the government expenditure for the years 2010 and 2015.

(b) How can the government make use of its budget to reduce the problem of income inequality?

OR

(a) Briefly explain Surplus budget and Deficit Budget.

(b) Is the following revenue expenditure or capital expenditure in the context of government budget? Give reasons.

(i) Expenditure on collection of taxes.

(ii) Expenditure on purchasing computers.

Answer:

(a) (i) The pie chart shows the allocation of money between 2010 and 2015 in various sectors.

(ii) In the year 2010, maximum expenditure was incurred on education, which remained at the peak in the year 2015 also, even though it reduced by 3% compared to the year 2010.

(iii) The money spend on welfare was increased by 4% within half a decade. On the other hand, money spent on defence and healthcare was reduced by 3% and 1%, respectively.

(iv) Money utilised for interest on borrowing was raised by 5% in the year 2015. Similarly, money spend on transportation, culture and leisure activities was reduced by 2% and 1%, respectively. In contrast, the ratio of money spent on pensions and activities remains the same.

(v) Overall the decrease was noticed in the spending ratio of education and defence. In comparison, the maximum increased in spending ratio was seen on the interest rate.

(b) The government uses its budget to solve various problems in the economy. One of the objectives of government budget is to increase equality in the income and wealth of the nation. Therefore, the government uses its tools of tax and subsidy in the budget to create equality. To achieve this objective government imposes a tax on the richer section of the society and provides subsidies to the poor section of the society. This allocation of income from richer to the poorer helps in reducing income inequality.

OR

(a) Surplus Budget : The budget is a surplus budget when the estimated revenues of the year are greater than anticipated expenditures. Government Expected Revenue > Government Proposed Expenditure. Surplus budget shows the financial soundness of the government. When there is too much inflation, the government can adopt the policy of surplus budget as it will reduce aggregate demand. Increase in revenue by levying taxes on people reduces their disposable incomes, which otherwise could have been spend on consumption or saved and devoted to capital formation. Since government spending will be less than its income, aggregate demand will decrease and help to reduce the price level.

Deficit Budget: Deficit budget is one where the estimated government expenditure is more than the expected revenue. Government’s Estimated Revenue < Government’s Proposed Expenditure. According to Prof. Hugh Dalton,”If over a period of time expenditure exceeds revenue, the budget is said to be unbalanced”. Such deficit amount is generally covered through public borrowings or withdrawing resources from the accumulated reserve surplus. In a way a deficit budget is a liability of the government as it creates a burden of debt or it reduces the stock of reserves of the government.

(b) (i) Expenditure on collection of taxes is a revenue expenditure. This type of expenditure includes the government expenditure which does not cause any reduction in government liabilities and also does not create assets for the government.

(ii) Expenditure on purchasing computers is a capital expenditure. This expenditure includes that government expenditure, which creates assets for the government.

![]()

Section-B (Indian Economic Development)

Question 18.

During the British rule, livelihood of the majority population of the country was dependent on:

(a) agriculture sector

(b) industrial sector

(c) service sector

(d) none of these

Answer:

(a) agriculture sector

Explanation: During the british rule,India was directly or indirectly dependent on the agriculture sector thus, it was an agrarian economy.

Question 19.

_________was introduced to increase productivity and self-sufficiency in food.

(a) White revolution

(b) Green revolution

(c) Blue revolution

(d) Black revolution

OR

________describes the status of industrial sector during the British rule.

(a) Modern industry

(b) Handicraft industry

(c) Systematic de-industrialisation

(d) Jute and Textile Industry

Answer:

(b) Green revolution

Explanation: The use of new technology increased agricultural productivity to enable the country to be self-sufficient in food grains are the features of Green Revolution.

OR

(c) Systematic de-industrialisation

Explanation: In other words it means any change caused by the removal or reduction of industrial capacity or any activity in a country or region, especially heavy industry or manufacturing industry. Britishers followed the policy of systematically de-industrialising India.

Question 20.

“GLF” with respect to the people’s Republic of China referred to as .

(a) Giant Leap Forward

(b) Great Lead Forum

(c) Great Leap Forward

(d) Giant Lead Forum

OR

China is moving ahead of both_______and________in terms of indicators of human development.

I. India

II. Pakistan

III. Myanmar

IV. Sri Lanka

Alternatives:

(a) I or II

(b) II or III

(c) III or IV

(d) I or IV

Answer:

(c) Great Leap Forward

Explanation: The Great Leap Forward (GLF) was a campaign initiated in 1958 in China by Mao’s, which was aimed to modernise the China’s economy. The campaign was initiated towards the large scale industrialisation in the country not concentrated only in the urban areas.

OR

(a) I or II

Explanation: China is moving ahead of both India and Pakistan in terms of indicators of human development.

Question 21.

NABARD is________source of rural credit.

(a) institutional

(b) non-institutional

(c) cooperative society

(d) regional

Answer:

(a) institutional

Explanation: Sources of agricultural credit can be broadly classified into institutional and noninstitutional sources. Non-institutional sources include moneylenders, traders and commission agents, relatives and landlords, but institutional sources include cooperatives, commercial banks including the SBI Group, RBI and NABARD.

Question 22.

From the set given in column-I and corresponding facts given in column-II choose the correct pair of statement.

| Column-I | Column-II | ||

| I. | New Economic Policy in India | (A) | 1991 |

| II. | The Great Leap forward campaign in China | (B) | Service Sector |

| III. | Reforms initiated in Pakistan | (C) | 1958 |

| IV. | Contributes a Major share of India’s GDP | (D) | Primary sector |

Alternatives:

(a) I-(A)

(b) II-(B)

(c) III-(C)

(d) IV-(D)

Answer:

(a) I-(A)

![]()

Question 23.

Read the following statements carefully:

Statement1: Human capital refers to the stock of skills, ability, expenditure, education and knowledge in a nation at a point of time.

Statement 2: Human capital formation contributes towards economic growth of the country. In the light of the given statements, choose the correct alternative from the following:

Alternatives:

(a) Statement1 is true and statement 2 is false.

(b) Statement1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements 1 and 2 are true.

Explanation: Human capital refers to the stock of skills, ability, expenditure, education and knowledge in a nation at a point of time. Human capital formation contributes towards economic growth of the country by stimulating innovations and inventions in the country. It enable human resources to understand changes in scientific advancement so that they are able to adapt themselves to new technology.

Question 24.

Read the following statements carefully:

Statement 1: Commune system was started in the rural areas of China, under which people collectively cultivated lands.

Statement 2: The commune system resulted in more equitable distribution of food grains in ChinaIn the light of the given statements, choose the correct alternative from the following:

Alternatives:

(a) Statement 1 is true and statement 2 is false.

(b) Statement 1 is false and statement 2 is true.

(c) Both statements 1 and 2 are true.

(d) Both statements 1 and 2 are false.

Answer:

(c) Both statements1 and 2 are true.

Explanation: Commune system was started in the rural areas of China to revolutionised agriculture in rural areas. Under which people collectively cultivated lands. The commune system resulted in more equitable distribution of food grains in China. Nearly 26000 communes covered almost entire population engaged in agriculture.

Question 25.

An establishment with four hired workers is known as__________sector establishment.

(a) formal

(b) informal

(c) both (a) and (b)

(d) none of these

OR

Which of the following is not a benefit of organic farming ?

(a) Cheaper inputs

(b) Attractive returns on investment

(c) Greater import possibilities

(d) Higher nutritional value

Answer:

(b) informal

Explanation: An establishment with four hired workers is known as informal sector establishment. An informal sector is an unorganised sector of the economy. It includes all enterprises that hire less than 10 workers, excepts farming and self-employed enterprises. Therefore an establishment with four hired workers is known as informal sector establishment.

OR

(c) Greater import possibilities

Explanation: Organic farming have cheaper inputs. It generate good returns on investment and income through exports. Organically grown food has more nutritional value.

Question 26.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): We need good human capital to produce other human capital (say, doctors, engineers etc.). It means that we need investment in human capital to produce more human capital out of human resources

Reason (R): Investments in education, in health, on-job training, migration and information are the sources of human capital formation as this expenditure increases efficiency of human resources.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion(A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion(A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

Explanation: Sources of human capital formation are expenditure in education, health, migration, on-job training, information. It assists in further capital formation.

![]()

Question 27.

Read the following statement -Assertion (A) and Reason (R). Choose one of the correct alternatives given below:

Assertion (A): China is moving ahead of India and Pakistan.

Reason (R): Pakistan is ahead of India in reducing the proportion of people below the poverty line.

Alternatives:

(a) Both Assertion (A) and Reason (R) are true and Reason (R) is the correct explanation of Assertion (A).

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

(c) Assertion (A) is true, but Reason (R) is false.

(d) Assertion (A) is false, but Reason (R) is true.

Answer:

(b) Both Assertion (A) and Reason (R) are true and Reason (R) is not the correct explanation of Assertion (A).

Explanation: China is moving ahead of Pakistan and India. This is accurate for many indicators income indicators such as GDP, per capita or population proportion under the poverty line or health pointers such as mortality rates, access sanitation, literacy, life expectancy or malnourishment. Pakistan is ahead of India in reducing the proportion of people below the poverty line. Its performance in both China and Pakistan are in a similar position concerning the proportion of people below the international poverty rate of $1 a day. In contrast, the proportion is almost two times higher for India.

Question 28.

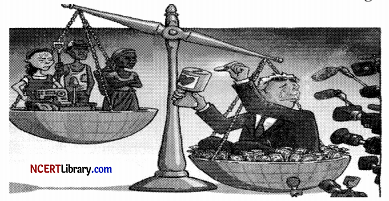

Interpret the given picture on account of current environmental challenges.

Answer:

The picture given indicates the following aspects:

(i) Income inequalities: In India, an essential cause of poverty is the presence of large inequalities in the income distribution and concentration of economic power.

(ii) Underdevelopment of the economy: The root cause of poverty is the underdevelopment of the economy. The underdevelopment is triggered by the relative backwardness of the agriculture and industrial sector.

(iii) High unemployment: Poverty is affected by unemployment or low wages.

Question 29.

Defend or refute the following statement with the valid explanation:

Is environmental crisis a recent phenomenon?

OR

What is meant by sustainable development? Discuss briefly any two strategies of sustainable development.

Answer:

Yes, environmental crisis is a recent phenomenon. Environment was able to perform its functions without any interruption till the resource extraction was not above the rate of regeneration of the resource and the wastes generated were within the assimilating capacity of the environment. But today, environment fails to perform its vital function of life sustenance resulting in an environmental crisis. The rising population of the developing countries and the affluent consumption and production standards of the developed world have placed a hug stress on the environment. Many resources have become extinct and the wastes generated are beyond the absorptive capacity of the environment. As a result, we are today at the threshold of environmental crisis.

OR

Sustainable development: It refers to the development which will allow all future generation to have an average quality of life; the aim of it is to ensure that present generation should leave quality of life for next generation. The term sustainable development has its origin in IUCN (International Union for the Conservation of Natural Resources).

Strategies of sustainable development:

1. Use of environment friendly fuels: In urban areas, use of CNG is being promoted to be used as fuel. In Delhi, use of CNG in public transport has significantly lowered air pollution. In rural areas, households generally use wood, dung cake or other biomass as fuel. These fuels have several adverse implications like deforestation, reduction in green cover, wastage of cattle dung and air pollution. To overcome this problem, use of LPG and global gas is being promoted as they are cleaner fuels.

2. Establishment of Mini-Hydel Plants: In mountain regions, perpetual streams can be found almost everywhere. These streams can be used to generate electricity through mini-hydel plants. These power plants are more or less environmentally friendly and generate enough power to meet local demands. Moreover, large-scale transmission towers and cables are also not required in such plants.

Question 30.

Compare and analyse the ‘Annual growth of GDP’ based on the following information:

Annual Growth of Gross Domestic Product (%), 1980-2017

| Country | 1980-90 | 2015-17 |

| India | 5.7 | 7.3 |

| China | 10.3 | 6.8 |

| Pakistan | 6.3 | 5.3 |

Source: Key indicators for Asia and Pacific 2016, Asian Development Bank, Philippines: World Development Indicators 2018.

Answer:

1. The above table depicts the annual growth of gross domestic product among various countries between 1980-1990 and 2015-2017.

2. When several developed countries were finding it complex to maintain a growth rate of even 5%, China sustained near double-digit growth during the 1980s, as displayed in the table.

3. In the 1980s, Pakistan was ahead of India; China had double-digit growth and India was at the bottom.

4. From 2015-2017, there was a decline in Pakistan and China’s growth rates, whereas India met with a moderate increase in growth rates.

5. Also, notice that, in 2015, India stood first and Pakistan stood at the bottom.

Question 31.

The year 1921 was considered as the year of Great Division. Support the given statement with valid explanation.

OR

What was the immediate crisis, which led India to change its economic policies after 1991?

Answer:

The year 1921 is regarded as the dividing year or the ‘Year of Great Divide’ because prior to 1921, population growth in India was never consistent. During a decade from 1911 1921 India faced negative population growth rate. India was in the first phase of demographic transition till 1921 that was characterised by high birth rate and high death rate. After 1921, India’s population growth never declined and showed a consistent upward trend so, 1921 is called Year of Great Division.

OR

The immediate crisis, which led India to change its economic policies after 1991 were:

(i) A serious shortage of foreign exchange had arisen because import exceeded exports. We lost our exports to gulf countries due to war.

(ii) Government was forced to borrow from foreign and domestic markets because expenditure incurred on subsidies and welfare schemes were huge and revenue from taxes was insufficient.

(iii) Performance of Public Sector Companies was much below the desired level with many of them running at a loss.

(iv) There was a severe liquidity crisis. Foreign exchange reserves dropped to levels, which were not sufficient for a fortnight. International Banks refused to extend credit unless change in policies took place.

![]()

Question 32.

State weather the following statements are true or false with valid arguments.

(a) Organic farming promote sustainable development.

(b) “Human Capital Formation gives birth to innovation, invention and technological improvements.”

Answer:

(a) Organic farming refers to a system of farming that sustains and enhances the ecological balance. In other words, this system of farming relies upon the use of organic inputs for cultivation. The traditional farming involves the use of chemical fertilisers, toxic pesticides, etc. that harms the ecosystem drastically so, this type of farming is practiced to produce toxic-free food for the consumers while simultaneously maintaining the fertility of the soil and contributing to ecological balance. This type of farming enables eco-friendly sustainable economic development.

(b) The statement is true that “Human Capital Formation gives birth to innovation, invention and technological improvements” by:

(i) Expenditure of Education: It is the most effective way of raising a productive workforce in the country. Labour skill of an educated person is more than that of an uneducated person. Individuals invest in education to increase their future income and raise the living standard.

(ii) Expenditure in Health: It is also an important expenditure to build and maintain productive labour force and to improve quality of life of people in the society. It makes a man more efficient and therefore more productive. Their contribution to the production process tends to rise and adds more to GDP than a sick person.

(iii) Expenditure on the Job-training: It helps the workers to sharper their specialised skills. It increases the skill, efficiency and capacity of the workers. It also make workers more creative and innovative which result in increase in production and productivity.

Question 33.

(a) How will you know whether a worker is working in the informal sector?

(b) Define disguised unemployment.

(c) Raj is going to school. When he is not in school, you will find him working in his firm. Can you consider hiin a worker? Why?

OR

(a) ‘India has failed to implement the recommendations of Education Commission 1964-66 to spent least 6% of GDP on education ‘Give valid arguments in support of the given statement.

(b) Health care is suffering from the urban-rural and rich-poor divide in India. Do you agree with the given statement? Give the reason by stating some statistical facts in light of the above statement.

Answer:

(a) From the following points, we can know whether a worker is working in the informal sector:

(i) The number of workers employed is less than 10.

(ii) The workers are not entitled to social security schemes.

(iii) The workers are not allowed to form trade unions and are not protected by labour laws.

(b) Disguised unemployment refers to that unemployment in which more people are engaged in the same activity or work than actually required.

(c) Raj is not a worker because he is not actively engaged in production activity. Workers include all those who are fit for work and are willing and available to work. Workers do not include children, old people, handicapped, etc.

OR

(a) Investment in education system in India has been a woeful failure. The fact of the matter is that, in 1952 we were spending a meagre 0.6% of our GDP an education that rose to only 4% in 2014. This has fallen well short at 6% target as proposed by the Education Commission, 1964. Moreover, throughout this period the increase in education expenditure has not been uniform and there has been irregular rise and fall. This shows the apathy of the government towards investment in the education system. One can imagine, if the recommended 6% p.a. of the GDP would have been spent properly the present education system would have reached unforeseen heights.

(b) It is rightly said that health care in India suffers from an urban-rural and rich-poor divide.

(i) 71% population lives in rural regions, while 21% of the hospitals are located in rural regions. It means 79% of hospitals serve 29% population. Of 7.5 lakh beds, only 19% are in rural regions.

(ii) There are only 0.37 hospitals for 1 lakh people in rural regions. In contrast, it is 3.3 hospitals per 1 lakh population in urban regions, i.e., various hospitals in urban regions are 10 times the number of hospitals in rural regions.

(iii) Specialised medical care is missing in village regions, such as obstetrics, paediatrics, anesthesia, and gynecology. PHCs in rural regions do not even have a blood test and X-ray facility.

Question 34.

Read the following text carefully and answer the given questions on the basis of the same and common understanding:

The economy of India had undergone significant policy shifts in the beginning of thel990s. This new model of economic reforms is commonly known as the LPG or Liberalisation, Privatisation and Globalisation model. The primary objective of this model was to make the economy of India the fastest developing economy in the globe with capabilities that help it match up with the biggest economies of the world. The concepts of liberalization, globalization and privatization are actually closely related to one another.

This LPG phenomenon was first initiated in the Indian Economy in 1990 when the Indian Economy experienced a severe crisis. At that time the government decided to introduce the New Industrial Policy (NIP) in 1991 to start liberalizing the Indian economy. The chain of reforms that took place with regards to business, manufacturing, and financial services industries targeted at lifting the economy of the country to a more proficient level.

These economic reforms had influenced the overall economic growth of the country in a significant manner. LPG model of reforms consists of Liberalisation, Privatisation and Globalisation. Liberalisation resulted in several economic reforms which reduced the tariffs and made policies less constraining. Privatisation refers to transferring business from a government to a privately owned entity, while globalisation refers to expanding commercial activities globally.

This policy aimed to build foreign reserves and move towards a higher economic growth rate. Also, it proposed to convert the Indian economy into a market economy, free of restrictions. Lastly, the motivation was to increase private players in all sectors of the economy.

(a) What is globalisation?

(b) What was the immediate crisis, which led India to change its economic policies after 1991?

Answer:

(a) Globalisation means the opening of nationalistic and local outlooks to a broader perspective of an interlinked and interdependent world with free transfer of goods, capital, and services across the national borders.

(b) The immediate crisis, which led India to change its economic policies after 1991 were:

(i) A serious shortage of foreign exchange had arisen because import exceeded exports. We lost our exports to gulf countries due to war.

(ii) Government was forced to borrow from foreign and domestic markets because expenditure incurred on subsidies and welfare schemes were huge and revenue from taxes was insufficient.

(iii) Performance of Public Sector Companies was much below the desired level with many of them running at a loss.

(iv) There was a severe liquidity crisis. Foreign exchange reserves dropped to levels, which were not sufficient for a fortnight. International Banks refused to extend credit unless change in policies took place.

![]()