Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 6 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 6 with Solutions

Time: 2 Hrs.

Max. Marks: 40

General Instructions :

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts. Part A and Part B.

- Part- A is compulsory for all candidates.

- Part- B has two option i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Question 1 to 16 and 27 to 30 carries 1 mark each.

- Questions 17 to 20. 31 and 32 carries 3 marks each.

- Questions 21, 22 and 33 carries 4 marks each.

- Questions 23 to 26 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, and 2 questions of three marks. 1 question of four marks and 2 questions of six marks.

Part – A

(Accounting for Partnership Firms and Companies)

Question 1.

Ram and Sita are partners sharing profits in the ratio of 5 : 4. They admit Lakshman as a partner for l/10th share of profits which he acquires in equal proportion from Ram and Sita. The new ratio of the partners will be:

(a) 5:4:1

(b) 31:30:8

(c) 91:18:71

(d) 91:71:18

Explanation:

Ram’s New share = \(\frac{5}{9}-\left(\frac{1}{10} \times \frac{1}{2}\right)=\frac{91}{180}\)

Sita’s New share = \(\frac{4}{9}-\left(\frac{1}{10} \times \frac{1}{2}\right)=\frac{71}{180}\)

Laxman’s New share = \(\frac{1}{10} \times \frac{18}{18}=\frac{18}{180}\)

Thus , the New Profit ratio will be = 91:71: 18

![]()

Question 2.

Assertion (A): It is important to compute sacrificing and gaining ratio at the time of change in profit sharing ratio.

Reason (R): Sacrificing partner compensates the gaining partner by paying him proportion amount of goodwill.

Options:

(a) (A) is correct but (R) is wrong

(b) Both (A) and (R) are correct, but (R) is not correct explanation of (A)

(c) Both (A) and (R) are incorrect.

(d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

Answer:

(a) (A) is correct but (R) is wrong

Explanation:

Gaining partner compensates the sacrificing partner by paying him proportion amount of goodwill.

Question 3.

If a share of ₹10 issued at a premium of ₹3 on which the full amount has been called is forfeited then the share capital account should be debited with:

(a) ₹5

(b) ₹8

(c) ₹10

(d) ₹13

Answer:

(c) ₹10

Explanation:

in such case, the capital account is debited with 10 (Face value of share).

OR

Debentures that do not carry any charge or security on assets of the company are known as:

(a) Secured Debentures

(b) Unsecured Debentures

(c) Convertible Debentures

(d) Registered Debentures

Answer:

(b) Unsecured Debentures

Explanation:

Unsecured debentures are debentures that do not carry any charge or security on assets of the company. They are also known as Naked debentures.

Question 4.

A, B and C are partners sharing profits in the ratio of 4 : 3: 2 decided to share profits equally. Goodwill of the firm is valued at ₹10,800. In adjusting entry for goodwill:

(a) A’s Capital A/c Cr. by ₹4,800; B’s Capital A/c Cr. by ₹3,600; C’s Capital A/c Cr. by ₹2,400

(b) A’s Capital A/c Cr. by ₹3,600; B’s Capital A/c Cr. by ₹3,600; C’s Capital A/c Cr. by ₹3,600

(c) A’s Capital A/c Dr. by ₹1,200; C’s Capital A/c Cr. by ₹1,200;

(d) A’s Capital A/c Cr. by ₹1,200; C’s Capital A/c Dr. by ₹1,200

Answer:

(d) A’s Capital A/c Cr. by ₹1,200; C’s Capital A/c L)r. by fl,200

Explanation:

Change in A’s share =\(\frac{1}{3}-\frac{4}{9}=\frac{3-4}{9}=\frac{-1}{9} \text { (sacrifice) }\)

\(=10,800 \times \frac{1}{9}=₹ 1,200\)

Change in B’s share =\(\frac{1}{3}-\frac{3}{9}=0\)

Change in C’s share =\(\frac{2}{3}-\frac{2}{9}=\frac{3-2}{9}=\frac{1}{9}(\text { Gain })\)

C’s share of goodwill =\(10,800 \times \frac{1}{9}=₹ 1,200\)

OR

Arun & Vijay are partners in a firm. Arun is to get commission of 10% of net profit before charging any commission. Vijay is to get a commission of 10% on net profit after charging all commissions. Net Profit for the year ended 31 March, 2021 was 55,000. What will be the amount of Profit to be distributed to each?

(a) 5,500 to Arun and 4,500 to Vijay.

(b) 27,500 each.

(c) 22,500 each.

(d) None of these.

Answer:

(c) 22,500 each.

Explanation:

Commission of Arun =\(₹ 55,000 \times \frac{10}{100}=₹ 5,500\)

Profit after charging Arun’s Commission = \(₹ 55,000-₹ 5,500=₹ 49,500\)

Commission of Vijay = \(₹ 49,500 \times \frac{10}{110}=₹ 4,500\)

Distributable Profits = ₹ 55,000-(₹ 5,500+₹ 4,500) = ₹45,000

As the Ratio is not given it will be distributed equally, i.e.,=\(\frac{45,000}{2}\) = 22.500 each

Question 5.

arthik and Ajay are partners in a firm. Karthik is to get commission of 10% of net profit before charging any commission. Ajay is to get a commission of 10% on net profit after charging all commissions. Net profit for the year ended 31st March, 2021 was ₹55,000. What will be amount of profit to be distributed to each?

(a) ₹5,500 to Karthik & ₹4,500 to Ajay

(b) ₹27,500 each

(c) ₹22,500 each

(d) None of these

Answer:

(c) ₹22, 500 each

Explanation:

Commission of Karthik = \(₹ 55,000 \times \frac{10}{100}=₹ 5,500\)

Commission of Ajay = ₹55,000 – ₹5,500 = ₹49,500

=\(₹ 49,500 \times \frac{10}{110}=₹ 4,500\)

Net Profits =55,000 – (5,500 + 4,500) = 45,000

As the Ratio is not given it will be = \(\frac{45,000}{2}=₹ 22,500 \mathrm{each}\)

Question 6.

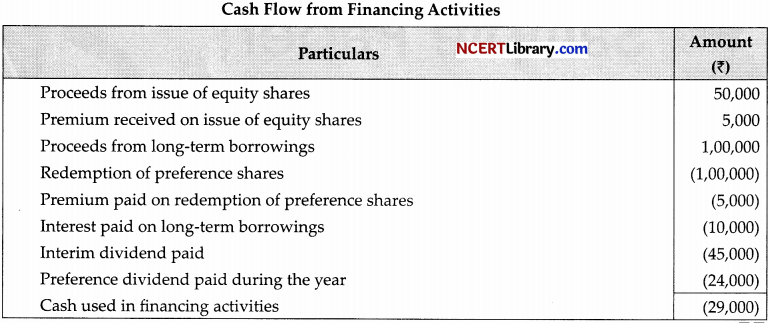

The following journal entry appeared in the books of KN Ltd.:

What is the percentage of discount on issue of debentures in the above transaction₹

(a) 15 %

(b) 5 %

(c) 10 %

(d) 8 %

Answer:

(b) 5 %

Explanation:

Discount on Issue of Debentures = Loss on issue of debentures – Premium on redemption of debentures

= 3,00,000-2,00,000 = ₹ 1,00,000

% of discount on issue of debentures = \(\frac{1,00,000}{20,00,000} \times 100=5 \%\)

OR

A Ltd. took over the assets of ₹6,60,000 and liabilities of ₹80,000 of B Ltd. for an agreed purchase consideration of ₹6,00,000 payable 10% in cash and the balance by issue of 15% debentures of f100 each at 10% discount. The number of debentures to be issued is:

(a) ₹6,600

(b) ₹5,400

(c) ₹6,000

(d) ₹4,500

Answer:

(c) ₹6,000

![]()

Explanation:

Purchase Consideration = ₹6,00,000

Amount paid in cash = 10% of ₹6,00,000 = ₹60,000

Amount of Debentures Issued – ₹6,00,000 – ₹60,000 = 5,44),000

Issue Price of Debenture = ₹100 – (10% of ₹100) = ₹100 – ₹10 = ₹90

Number of Debentures Issued \(\frac{₹ 5,40,000}{₹ 90}=6,000\)

Question 7.

A company invited applications for 1,00,000 shares and it received applications for 1,50,000 shares. Applications for 30,000 shares were rejected and the remaining shares were allotted on a pro-rata basis. How many shares an applicant for 3,000 shares will be allotted?

(a) 2,500 Shares

(b) 3,600 Shares

(c) 4,500 Shares

(d) 2,000 Shares

Answer:

(a) 2,500 Shares

Explanation:

Number of shares that is to be allotted to an applicant for 3,000 shares = \(\frac{3,000 \text { shares } \times 1,00,000 \text { shares }}{1,20,000 \text { shares }}\)

= 2,500 Shares

Question 8.

A, B and C are partners in a firm sharing profits and losses in the ratio 3 : 4 : 2. B wants to retire from the firm. The profit on revaluation on that date was 45,000. New ratio of A and C is 5: 3. Profit on revaluation will be distributed as:

(a) A ₹16,000; B ₹12,000; C ₹8,000

(b) A ₹15,000; B ₹20,000; C ₹10,000

(c) A ₹22,500; C ₹13,500

(d) A ₹23,625; C ₹12,375

Answer:

(b) A 15,000; B 2,000; C 10,000

Explanation:

At the time of retirement of a partner, profit or loss on revaluation of assets and liabilities is distributed to all partners in old profit sharing ratio.

OR

A, B, C, and D are partners in a firm sharing profits as 4 : 3:2: 1 respectively. It earned a profit of 1,80,000 for the year ended 3V’ March, 2021. As per the Partnership Deed, they are to charge a commission @ 20% of the profit after charging such commission, which they will share as 2 : 3 : 2 : 3. What will be the amount of commission to be paid to the partners.

(a) ₹7,500 each

(b) ₹6,000; ₹r9,000; ₹6,000; ₹9,000

(c) ₹12,000; ₹9,000; ₹6,000; ₹3,000

(d) None of these

Answer:

(b) ₹6,000; ₹9,000; ₹6,000; ₹9,000

Explanation:

Commission = \(₹ 1,80,000 \times \frac{20}{120}=₹ 30,000\)

A’s Commission = \(₹ 30,000 \times \frac{2}{10}=₹ 6,000\)

B’s Commission = \(₹ 30,000 \times \frac{3}{10}=₹ 9,000\)

C’s Commission \(₹ 30,000 \times \frac{2}{10}=₹ 6,000\)

D’s Commission = \(₹ 30,000 \times \frac{3}{10}=₹ 9,000\)

Read the following hypothetical situation, answer the question no. 9 to lo.

The average net profits expected in the future by ABC Firm are ₹36,000 per year. The average capital employed in the business by the firm is ₹2,00,000. The rate of return expected from capital invested in this class of business is 10%. The remuneration of the partuers is estimated to be ₹6,000 per annum.

Question 9.

What will be the Actual Average Profit?

(a) ₹36,000

(b) ₹35,000

(c) ₹30,000

(d) ₹6,000

Answer:

(c) ₹30,000

Explanation:

Actual Average Profit = ₹36,000 -₹6,000 = ₹30,000

Question 10.

What will be the Normal Profit?

(a) ₹10,000

(b) ₹20,000

(c) ₹30,000

(d) ₹15,000

Answer:

(b) ₹20,000

Explanation:

Normal Profit = ₹2,00,000 x 10% = ₹20,000

Question 11.

What will be the correct sequence of arrangement of items in the Notes to Accounts?

(i) Subscribed but not fully paid-up capital

(ii) Authorised Capital

(iii) Subscribed and fuily paid-up capital

(iv) Issued capital

Options:

(a) (ii) (iv),(iii), (i)

(b) (i) ,(ii),(iii), (iv)

(c) (iii),(i),(iv), (iii)

(d) (iv),(ii),(i), (iii)

Answer:

(a) (ii),(iv),(iii), (i)

Explanation:

As per Companies Act 2013, while preparing notes to accounts for share capital. It is the authorised capital which is shown of first. After that comes issued capital and then subscribe and fully paid up capital at the end at subscribed but not fully paid up capital.

Question 12.

The Directors of Vinod Ltd. forfeited ₹70,000 Equity Shares of ₹10 each ₹10 called up, for non-payment of final call of ₹1 per share. Half of the forfeited shares were reissued at ₹20 per share fully paid-up. On reissue of forfeited shares, the following amount will be transferred to the Capital Reserve Account:

(a) ₹70,000

(b) ₹1,40,000

(c) ₹4,20,000

(d) ₹3,15,000

Answer:

(d) ₹3,15,000

Explanation:

Amount to be transferred to the Capital Reserve = ₹35,000 Shares x ₹9 = ₹3,15,000

![]()

Question 13.

In case of admission of a partner, the entry for Unrecorded Investments is:

(a) Debit Partners’ Capital A/c and Credit Investments A/c.

(b) Debit Revaluation A/c and Credit Investments A/c.

(c) Debit Investments A/c and Credit Revaluation A/c.

(d) None of the above.

Answer:

(c) Debit Investments A/c and Credit Revaluation A/c.

Explanation:

In case of admission of a partner the unrecorded assets is debited because in this case the value of assets is increased and as per the rule increase in value of asset is debit.

Question 14.

Disha and Abha were partners in a firm. Farad was admitted as a new partner for 1/5th share in the profits of the firm. Farad brought proportionate capital. Capitals of Disha and Abha after all adjustments were ₹64,000 and

(a) ₹22,000

(b) ₹27,500

(c) ₹55,000

(d) ₹28,000

Answer:

(b) ₹27,500

Explanation:

Old ratio of Disha and Abha =1:1

New Partner Farad’s share Total Adjusted Capital of =1/5

Total Adjusted Capital of Disha and Abha ₹64,000 + ₹46,000 – ₹1,10,000

Let total share be 1

Remaining share of Disha and Abha = \(1-\frac{1}{5}=\frac{4}{5}\)

Total Capital of the firm = \(1,10,000 \times \frac{5}{4}=₹ 1,37,500\)

New Partner Farad share of Capital = \(₹ 1,37,500 \times \frac{1}{5}=₹ 27,500\)

Question 15.

If a partner withdraws ₹10,000 in the beginning of every month and as per the partnership deed interest on drawings is to be charged @ 10% p.a. Interest on his drawings will be:

(a) ₹6,500

(b) ₹12,000

(c) ₹6,000

(d) ₹7,500

Answer:

(a) ₹6,500

Explanation:

The calculation of interest on drawings is as given below:

Total Drawings = ₹ 10,000 × 12 = ₹ 1,20,000

Interest on Drawings = \(\frac{₹ 1,20,000 \times 10}{100} \times \frac{6.5}{12}=₹ 6,500\)

Z is a partner in a firm. He withdrew regularly ₹2,000 every month for the six months ending 31st March, 2019. If interest on drawings is charged @ 8% p.a. the interest charged will be:

(a) ₹480

(b) ₹280

(c) ₹200

(d) ₹240

Answer:

(d) ₹240

Explanation:

The calculation of interest on drawings will be as follows:

Average period = \(\frac{5 \cdot 5+0 \cdot 5}{2}=\frac{6}{2}\) = 3 months

\(\mathrm{₹} 2,000 \times 6 \times 8 \% \times \frac{3}{12}=₹ 240\)

Question 16.

In case of dissolution, total creditors of the firm were ₹40,000; creditors worth ₹10,000 were given a piece of furniture costing ₹8,000 in full and final settlement. Remaining creditors allowed a discount of 10%. What will be the amount with which cash will be credited in the Realisation Account for payment to creditors?

(a) ₹28,000

(b) ₹27,000

(c) ₹20,000

(d) ₹25,000

Answer:

(b) ₹27,000

Explanation:

Cash paid to creditors = 90% of (₹40,000 – ₹10,000) = \(\frac{90}{100} \times ₹ 30,000=₹ 27,000\)

Question 17.

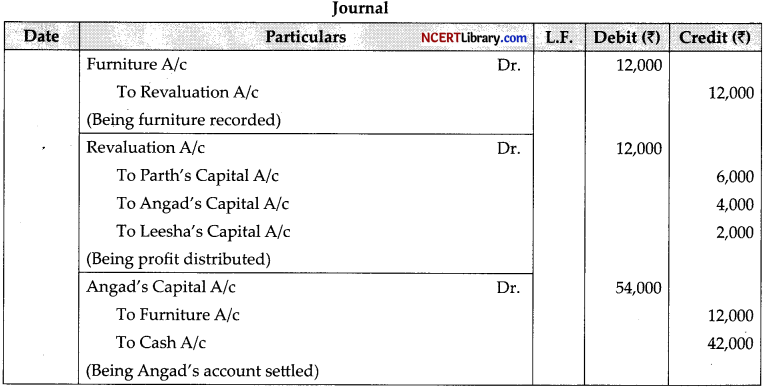

Parth, Angad and Leesha are partners in a firm sharing profits and losses in the ratio of 3:2:1 respectively. Angad retires and his claim, including his capital and entitlements from the firm including his share of Goodwill of the firm, is ₹50,000. After this amount was determined, it was found that there was an unrecorded piece of furniture valued at ₹12,000 which had to be recorded. Upon recording this piece of furniture, the revised amount due to Angad was determined and settled by giving him this piece of furniture and the balance in cash. You are required to give the journal entries for recording the payment to Angad in the books of the firm.

Answer:

Working Note:

Calculation of amount due to Angad:

Profit on recording the piece of Furniture = ₹12,000

Angad’s share of profit = \(₹ 12,000 \times \frac{2}{6}=₹ 4,000\)

Total Amount due to Angad = ₹50,000 + ₹4,000 = ₹54,000

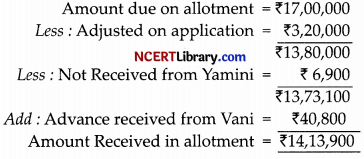

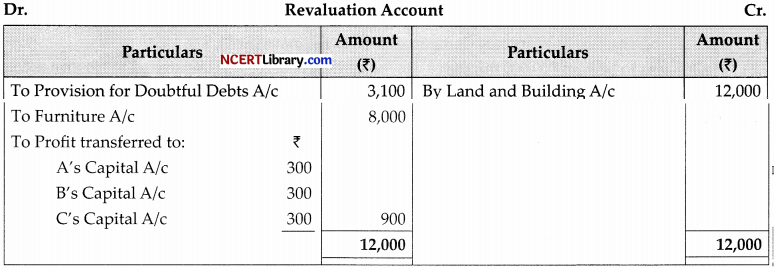

Question 18.

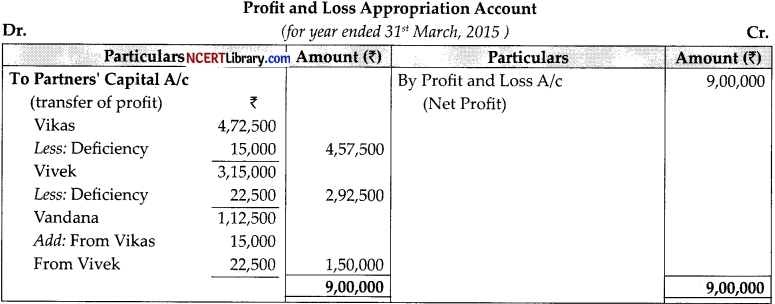

Vikas and Vivek were partners in a firm sharing profits in the ratio of 3 : 2. On 1.4.2014 they admitted Vandana as a new partner for 1/8th share in the profits with a guaranteed profit of ₹1,50,000. The new profit sharing ratio between Vivek and Vikas will remain the same but they decided to bear any deficiency on account of guarantee to Vandana in the ratio 2 :3. The profit of the firm for the year ended 31.3.2015 was ₹9,00,000, Prepare Profit and Loss Appropriation Account of Vikas, Vivek and Vandana for the year ended 31.3.2015.

![]()

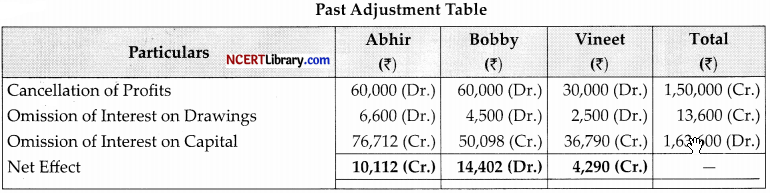

OR

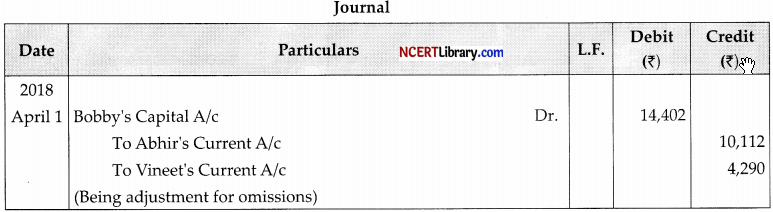

On 31st March, 2018 the balance in the Capital Accounts of Abhir, Bobby and Vineet, after making adjustments for profits and drawings were ₹8,00,000, ₹6,00,000 and ₹4,00,000 respectively. Subsequently, it was discovered that interest on capital and interest on drawings had been omitted. The partners were entitled to interest on capital @ 10°/o p.a. and were to be charged interest on drawings @ 6% p.a. The drawings during the year were:

Ahhir – ₹20,000 drawn at the end of each month, Bobby – ₹50,000 drawn at the beginning of every half year and Vineet – ₹1,020,000 withdrawn on 31 October, 2017. The net profit for the year ended 3Pt March, 2018 was ₹1,50,000. The profit sharing ratio was 2 : 2: 1. Pass necessary adjusting entry for the above adjustments in the books of the firm. Also, show your workings clearly.

Answer:

Working Notes:

Vandana’s share = \(\frac{1}{8}\)

Remaining share = \(1-\frac{1}{8}=\frac{7}{8}\)

Vikas’s new share= \(=\frac{3}{5} \times \frac{7}{8}=\frac{21}{40}\)

Vivek’s new share = \(\frac{2}{5} \times \frac{7}{8}=\frac{14}{40}\)

New profit Sharing Ratio = Vikash Vivek and Vandana

\(\frac{21}{40}: \frac{14}{14}: \frac{1}{8} \times \frac{5}{5}\)

\(\frac{21}{40}: \frac{14}{40}: \frac{5}{40}=21: 14: 5\)

OR

Working Notes:

1. Calculation of Interest on Drawings:

Abhir = \((₹ 20,000 \times 12) \times \frac{5.5}{12} \times \frac{6}{100}=₹ 6,600\)

Bobby = \((₹ 50,000 \times 2) \times \frac{9}{12} \times \frac{6}{100}=₹ 4,500\)

Vineet = \(₹ 1,00,000 \times \frac{5}{12} \times \frac{6}{100}=₹ 2,500\)

2. Calculation of Opening Capital:

3. Total Interest on Capital = ₹98,000 + ₹64,000 + ₹47,000 = ₹2,09,000

Profits available = ₹1,50,000 + ₹13,600 = ₹1,63,600

∴ Interest on capital is given as ₹1,63,600 divided in the ratio of opening capitals, i.e., 98 : 64 : 47.

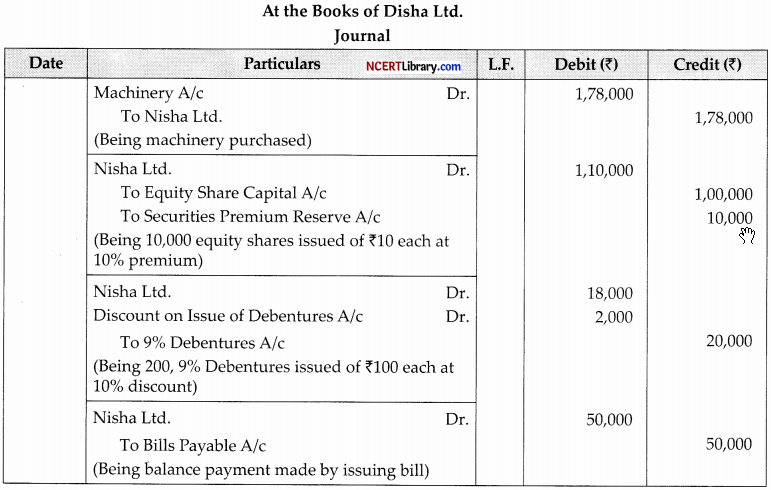

Question 19.

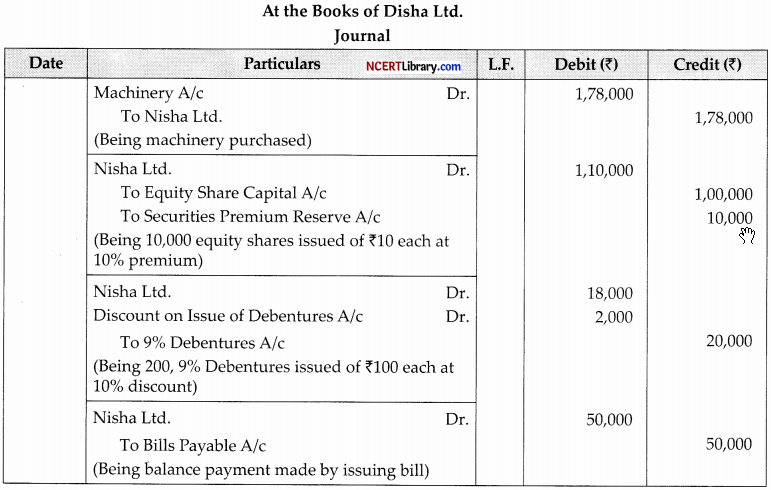

Disha Ltd. purchased machinery from Nisha Ltd. and paid to Nisha Ltd. as follows:

(i) By issuing ₹10,000, equity shares of ₹10 each at a premium of 10%.

(ii) By issuing 200, 9% debentures of ₹100 each at a discount of 10%.

(iii) Balance by accepting a bill of exchange of ₹50,000 payable after one month.

Pass necessary journal entries in the books of Disha Ltd. for the purchase of machinery and making payment to Nisha Ltd.

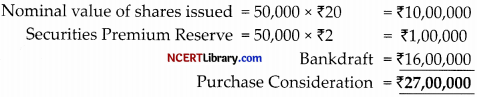

OR

X Ltd. took over the following assets and liabilities of Y Ltd.: Land and Building ₹20,00,000; Stock ₹5,00,000; Sundry Debtors ₹2,50,000 and Sundry Creditors ₹2,00,000. X Ltd. paid the purchase consideration by issuing bankdraft of ₹16,00,000 and 50,000 equity shares of ₹20 each at a premium of 10%. Calculate purchase consideration and pass journal entries in the books of X Ltd.

Answer:

OR

![]()

Question 20.

Asha and Aditi are partners in a firm sharing profits and losses in the ratio of 3 : 2. They admit Raghav as a partner for 1/4th share in the profits of the firm. Raghav brings ₹6,00,000 as his capital and his share of goodwill in cash. Goodwill of the firm is to be valued at two year’s purchase of average profits of the last four years.

The profits of the firm during the last four years are given below:

| Year | Profit ₹) |

| 2013-14 | 3,50,000 |

| 2014-15 | 4,75,000 |

| 2015-16 | 6,70,000 |

| 2016-17 | 7,45,000 |

The following additional information is given:

(i) To cover management cost an annual charge of ₹56,250 should be made for the purpose of valuation of goodwill.

(ii) The closing stock for the year ended 31.3.2017 was overvalued by ₹15,000. Pass necessary journal entries on Raghav’s admission showing the working flotes clearly.

Answer:

Old Ratio =3 : 2= Asha : Aditi

Raghav’s share = \(\frac{1}{4}\)

Sacrifice ratio = 3 : 2

Goodwill of Firm = No. of years purthase × Average profits

Average Profit = \(\frac{3,50,000+4,75,000+6,70,000+7,45,000-15,000}{4}\)

[(15,000) for over valuation goodwill

= 5,56,250 – 56,250

= ₹5,00,000

Firm’s goodwill = 2 × 5,00,000

= ₹10,00,000

Raghav’s share of goodwill = \(\frac { 1 }{ 2 }\)

= ₹2,50,000

Question 21.

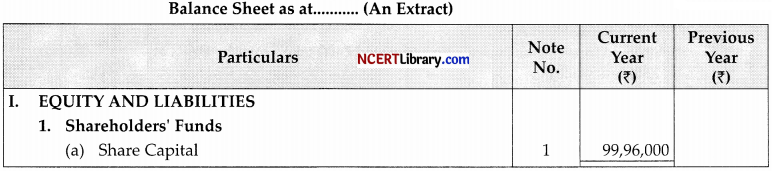

‘JN Ltd.’ were registered with an authorised capital of 2,00,000 equity shares of ₹100 each. The company offered to the public for subscription 1,00,000 shares. Applications for 1,50,000 shares were received and allotment was made to all the applicants on pro-rata basis. All calls were made and were duly received except the second and final call of ₹4,000. The amount payable on second and final call was ₹20 per share.

Present the Share Capital in the Balance Sheet of the company as per Schedule III, Part I of the Companies Act, 2013.

Answer:

Note to Accounts

Question 22.

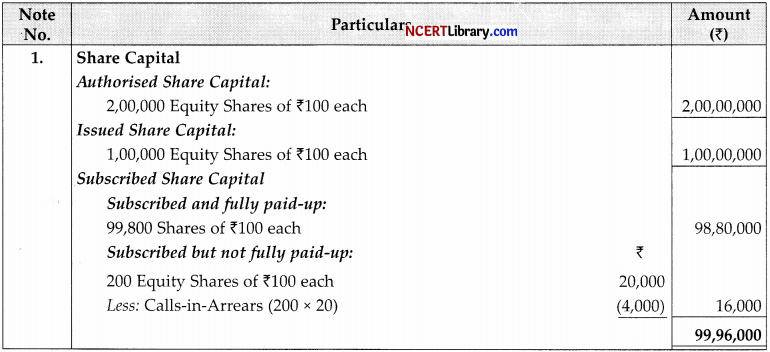

Record necessary journal entries to record the following unrecorded assets and liabilities in the books of

Paras and Priya:

(i) There was an old furniture in the firm which had been written off completely in the books. This was sold for ₹3,000.

(ii) Ashish, an old customer whose account for ₹1,000 was written off as bad in the previous year, paid 60% of the amount.

(iii) Paras agreed to take over the firm’s goodwill (not recorded in the books of the firm) at a valuation of ?30,000.

(iv) There was an old typewriter which had been written off completely from the books. It was estimated to realise ₹400. It was taken away by Priya at an estimated price less 25%.

(v) There were 100 shares of ₹10 each in Star Limited acquired at the cost of ₹2,000, which had been written off completely from the books. These shares are valued @ ?6 each and divided among the partners in their profit sharing ratio.

Answer:

![]()

Question 23.

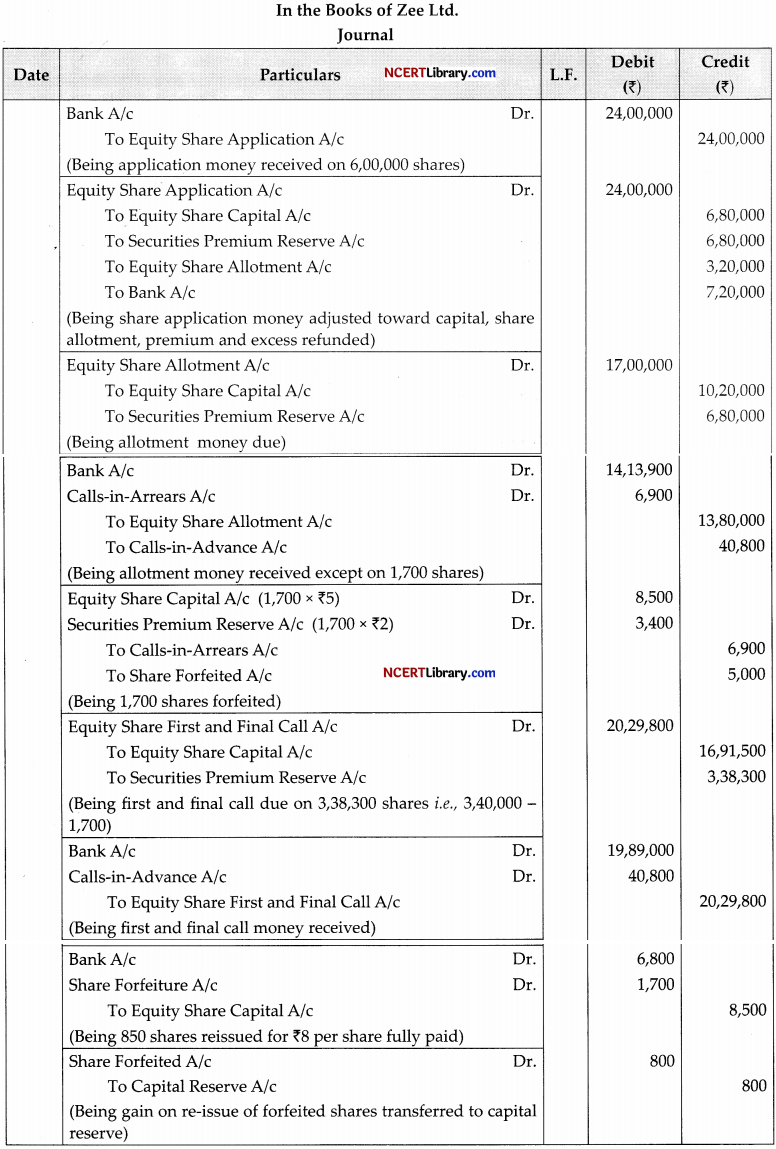

Zee Ltd. invited applications for issuing 3,40,000 equity shares of ₹10 each at a premium of ₹5 per share. The amount was payable as follows :

On application ₹4 per share (including ₹2 premium)

On allotment ₹5 per share (including ₹2 premium)

On First and Final call – Balance.

Applications for 6,00,000 shares were received. Applications for 1,80,000 shares were rejected and application money was refunded. Shares were allotted on prorata basis to the remaining applicants. Excess money received with applications was adjusted towards sum due on allotment. Yamini who had applied for 2,100 shares failed to pay allotment money and her shares were forfeited immediately.

Vani to whom 6,800 shares were allotted paid her entire share money due on allotment. Afterwards First and Final call was made and was duly received. Out of the forfeited shares 850 shares were reissued to Vansh at ?8 per share fully paid-up. Pass necessary journal entries for the above transactions in the books of the company by opening calls-in-arrears and calls-in-advance accounts.

OR

Pass journal entries for forfeiture and reissue of shares:

(i) X Ltd. forfeited 30 shares of ₹10 each, ₹7 called-up, on which Mahesh has paid application and allotment money of ₹5 per share. Of these, 25 shares were reissued to Naresh as fully paid-up for ₹6 per share.

(ii) Z Ltd. forfeited 10 shares of ₹10 each issued at 10% premium to Shyam (₹9 called-up) on which he did not pay ₹3 of allotment (including premium) and first call of ₹2. Out of these, 6 shares were reissued to Ram as fully paid-up for ₹8 per share and 2 shares to Suraj as fully paid-up @ ₹12 per share at different intervals of time.

Answer:

Working Notes:

2. Vani has paid on allotment = 6,800 x ₹6 (Call) = ₹40,800

3. Amount Received on Allotment:

4. Amount to be transferred to Capital Reserve :

\(\left(\frac{850}{1,700} \times 5,000\right)-1,700=₹ 800\)

OR

![]()

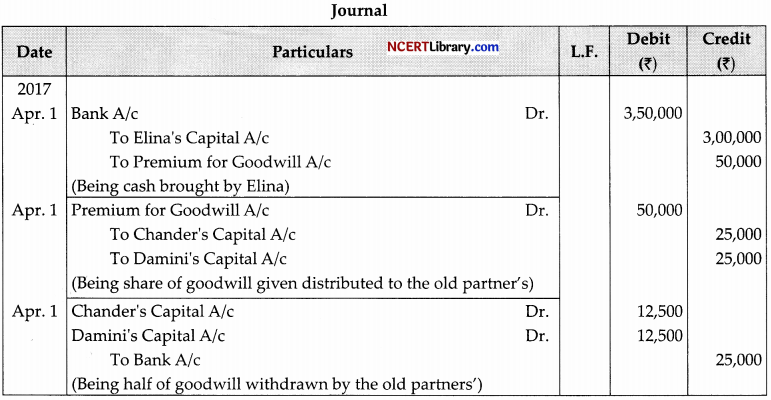

Question 24.

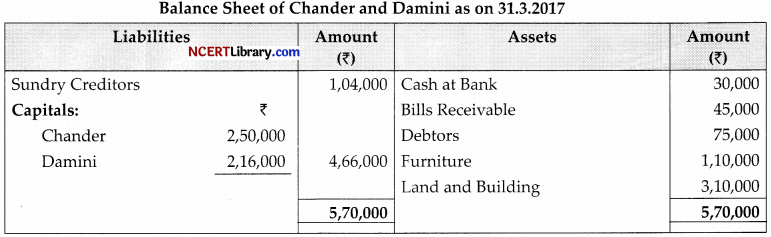

Chander and Damini were partners in a firm sharing profits and losses equally. On 31st March, 2017 their Balance Sheet was as follows :

Balance Sheet of Chander and Damini as on 31.3.2017

On 1.4.2017, they admitted Elina as a new partner for 1/3rd share in profits on the following conditions:

(i) Elina will bring ₹3,00,000 as her capital and ₹50,000 as her share of goodwill premium, half of which will be withdrawn by Chander and Damini.

(ii) Debtors to the extent of ₹5,000 were unrecorded.

(iii) Furniture will be reduced by 10% and 5% provision for bad and doubtful debts will be created on bills receivable and debtors.

(iv) Value of land and building will be appreciated by 20%.

(v) There being a claim against the firm for damages, a liability to the extent of ₹8,000 will be created for the same.

Prepare Revaluation Account and Partners’ Capital Accounts.

OR

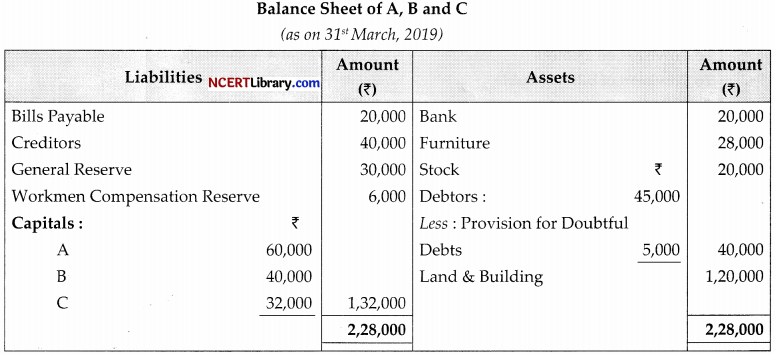

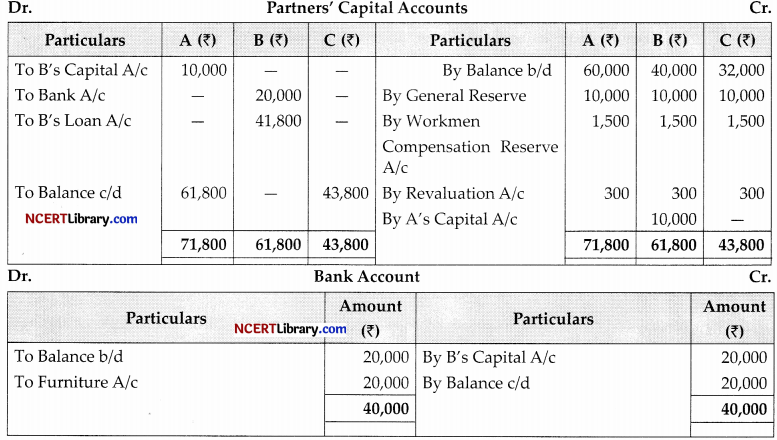

A, B and C were partners in a firm. Their Balance Sheet as at 31st March, 2019 was as follows:

B retired on 1st April, 2019. A and C decided to share profits in the ratio of 2 :1. The following terms were agreed upon:

(i) Goodwill of the firm was valued at ₹30,000.

(ii) Bad debts ₹4,000 were written off. The provision for doubtful debts was to be maintained @ 10% on debtors.

(iii) Land and Building was to be increased to ₹1,32,000.

(iv) Furniture was sold for ₹20,000 and the payment was received by cheque.

(v) Liability towards Workmen Compensation was estimated at ₹1,500.

(vi) B was to be paid ₹20,000 through a cheque and the balance was transferred to his loan account. Prepare Revaluation Account, Partners’ Capital Accounts and Bank Account.

Answer:

Old ratio = 1:1 = Chander :Damini

Elina’s share = 1/3

Sacrifice ratio = 1:1

![]()

Working Notes:

Bad Debts = ₹4,000

Provision for Doubtful Debts (45,000 -4,000) x \(\frac{10}{100}\) = 41,000 x\(\frac{10}{100}\) = ₹4,100

Old Provision = ₹8,100 – ₹5,000 = ₹3,100

Old Share = 1:1:1

New Share = 2: 1

Gain ofA = \(\frac{2}{3}-\frac{1}{3}=\frac{1}{3}\)

Gain ofC = \(\frac{1}{3}-\frac{1}{3}\) = Nill

Question 25.

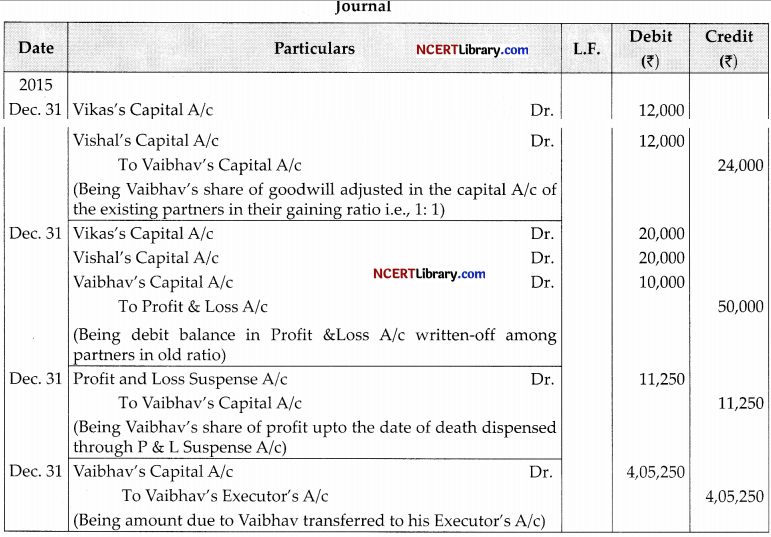

Vikas, Vishal and Vaibhav were partners in a firm sharing profits in the ratio of 2 : 2 : 1. The firm closes its books on 31st March every year. On 31-12-2015 Vaibhav died. On that date his Capital account showed a credit balance of ₹3,80,000 and Goodwill of the firm was valued at ₹1,20,000. There was a debit balance of ?50,000 in the profit and loss account. Vaibhav’s share of profit in the year of his death was to be calculated on the basis of the average profit of last five years. The average profit of last five years was ₹75,000. ‘ Pass necessary journal entries in the books of the firm on Vaibhav’s death.

Answer:

Working Note:

Vaibhavs share in profit = \(75,000 \times \frac{1}{5} \times \frac{9}{12}=₹ 11,250\)

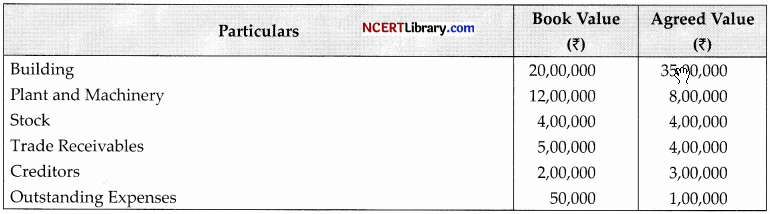

Question 26.

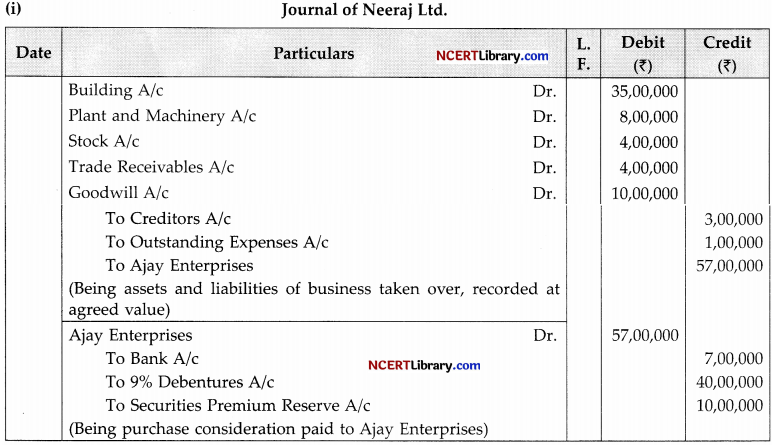

(i) Neeraj Ltd. took over business of Ajay enterprises on 1-04-2020. The details of the agreement regarding the assets and liabilities to be taken over are:

It was decided to pay for purchase consideration as ?7,00,000 through cheque and balance by issue of 2,00,000, 9% Debentures of ?20 each at a premium of 25%. Journalise.

(ii) On April 1, 2019, Z Ltd. issued, 10,000, 8% Debentures of ?100 each at premium of 5%, to be redeemable at a premium of 10%, after 5 years. The entire amount was payable on application. The issue was over subscribed to the extent of 10,000 debentures and the allotment was made proportionately to all the applicants. The securities premium amount has not been utilised for any other purpose during the year. Give journal entries for the issue of debentures and writing off loss on issue of debentures.

Answer:

Working Note:

Working Note:

Goodwill = Total Liabilities + Purchase Consideration – Total Assets

Total Assets = ₹35,00,000 + ?8,00,000 + ₹4,00,000 + ₹4,00,000 = ₹51,00,000

Total Liabilities = ₹3,00,000 + ₹1,00,000 = ₹4,00,000

Purchase Consideration = \(₹ 7,00,000+\left[2,00,000 \times\left(₹ 20+₹ 20 \times \frac{25}{100}\right)\right]latex]

=₹ 7,00,000+(2,00,000 × ₹25)= ₹7,00,000+ ₹50,00,000= ₹ 57,00,000

Goodwill = ₹57,00,000 + ₹4,00,000 – ₹51,00,000 = ₹10,00,000

Part – B

(Analysis of Financial Statement) (Option-1)

Question 27.

Balance Sheet of a company is required to be prepared in the format given in .

(a) Schedule III Part II

(b) Schedule III Part I

(c) Schedule III Part III

(d) Table A

Answer:

(b) Schedule III Part I

Explanation:

Schedule III Part I of the Companies Act, 2013 deals with the form of Balance Sheet and Profit and Loss Account and classified disclosure to be made therein and it applies to all the companies registered under the Companies Act, 1956.

![]()

If the Current Ratio of a company is 3 : 2, identify which combination is correct.

(a) Current Assets ₹50,000 and Current Liabilities ₹50,000

(b) Current Assets ₹60,000 and Current Liabilities ₹50,000

(c) Current Assets ₹90,000 and Current Liabilities ₹70,000

(d) Current Assets ₹90,000 and Current Liabilities ₹60,000

Answer:

(d) Current Assets ₹90,000 and Current Liabilities ₹60,000

Explanation:

The Current ratio explains the relationship between current assets and current liabilities. Current assets are the assets which are likely to be converted into cash or cash equivalents within 12 months from the date of Balance Sheet or within the period of operating cycle. Current liabilities are the liabilities payable within 12 months from the date of Balance Sheet or within the period of operating cycle.

Question 28.

Opening Inventory of a firm is ₹80,000. Cost of revenue from operations is ₹6,00,000. Ixrventory Turnover Ratio is 5 times. Its closing Inventory will be:

(a) ₹1,60,000

(b) ₹1,20,000

(c) ₹80,000

(d) ₹2,00,000

Answer:

(a) ₹1,60,000

Explanation:

Inventory Turnover Ratio [latex]=\frac{\text { Cost of Revenue from Operation }{ Average Inventory }}\)

5 \(=\frac{₹ 6,00,000}{\text { Average Inventory }}\)

Average Inventory = \(\frac{₹ 6,00,000}{5}=₹ 1,20,000\)

Average Inventory \(=\frac{\text { Opening Inventory }+\text { Closing Inventory }}{2}\)

= \(=\left(\frac{80,000+\text { Closing Inventory }}{2}\right)\)

Closing Inventory =2,4 0,000 – 80,000 = 1,60,000

Question 29.

Which of the following transactions will not result into flow of cash?

(a) Issue of equity shares of ₹1,00,000

(b) Purchase of machinery of ₹1,75,000

(c) Redemption of 9% debentures ₹3,50,000

(d) Cash deposited into bank ₹15,000

Answer:

(d) Cash deposited into bank ₹15,000

Explanation:

Cash deposited into bank will not result into flow of cash, as bank balance is also included into cash and cash equivalents.

OR

Amongst the following ‘Payment of bonus to the employees’ by an insurance company is which type of activity?

(a) Operating Activity

(b) Investing Activity

(c) Financing Activity

(d) Both Operating and Financing Activity

Answer:

(a) Operating Activity

Explanation:

Payment of bonus to the employees by an insurance company will be considered under operating activities.

Question 30.

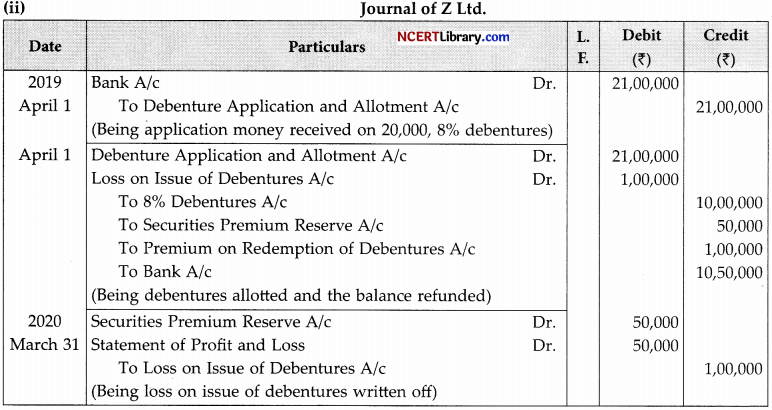

From the following information, find out Cash Outflow from Financing Activities.

Additional Information:

Additional Debentures were issued at the end of year.

Interim Dividend paid ₹50,000 Preference Share Capital Issued ₹2,00,000

(a) ₹82,000

(b) ₹2,08,000

(c) ₹2,38,000

(d) ₹2,48,000

Answer:

(a) ₹82,000

Explanation:

Question 31.

Under which major heads and sub-heads will the following items appear in the Balance Sheet of a company as per Schedule III Part-I of the Companies Act, 2013:

(i) Trade Debtors

(ii) Marketable Securities

(iii) Finished Goods

(iv) Patents

Answer:

| Particulars | Main Head | Sub-Head |

| (i) Trade Debtors | Current Assets | Trade Receivables |

| (ii) Marketable Securities | Current Assets | Current Investments |

| (iii) Finished Goods | Current Assets | Inventories |

| (iv) Patents | Non-current Assets | Fixed Assets Intangible |

Question 32.

A Ltd. and B Ltd. tries to compare their financial statements but was having problem in computing because A Ltd. was using the policy charging depreciation on straight line basis while B Ltd. was using the policy of changing depreciation of written down value method. Identify the limitation identified here. Also state the other two limitations of ratio analysis.

Answer:

The limitation identified here is that the comparision is not possible different firms adopt different accounting policies. Such differential make the accounting ratio incomparable other two limitations of ratio analysis are:

1. False Result: Accounting ratios are calculated firm the financial statements, therefore, the reliability of ratio and its analysis is dependent upon the correctness of the financial statements. If the financial statements are not true and fair, the analysis will give a false picture of the affair.

2. tack of Standard Ratios: There is no single standard ratio against which accounting ratio can be compared.

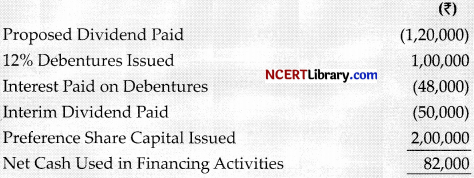

Question 33.

From the following information obtained from the books of Kamal Ltd., Calculate (i) Gross Profit Ratio and (ii) Net Profit Ratio.

OR

The quick ratio of a company is 1.5 : 1. State with reason which of the following transactions would:

(i) increase;

(ii) decrease or

(iii) not change the ratio.

(a) Paid rent 3,000 in advance.

(b) Trade receivable included a debtor Shri Ashok who paid his entire amount due 9,7OO.

Answer:

(i) Gross Profit Ratio \(=\frac{\text { Gross Profit }}{\text { Revenue from Operations }} \times 100\)

\(=\frac{1,13,000}{2,50,000} \times 100=45.2 \%\)

Revenue from Operations = ₹2,50,000

Net Purchases = ₹1,05,000 – ₹5,000 = ₹1,00,000

Cost of Revenue from Operations = Net Purchases + Decrease in Stock + Direct Expenses + Wages

= ₹1,00,000 + ₹15,000 ÷ ₹4,000 + ₹18,000

= ₹37,000

Gross Profit = ₹2,50,000 – ₹1,37,000 = ₹1,13,000

(ii) Net Profit Ratio \(=\frac{\text { Net Profit }}{\text { Revenue from Operations }} \times 100\)

= \(\frac{83,000}{2,50,000} \times 100=33.2 \%\)

Net Profit = Gross Profit – Salaries 1,13.000-30,000 = ₹83,000.

OR

Answer:

(ii) Decrease the ratio.

Reason: Payment of advance rent of ?3,000, will reduce the value of quick assets. Hence, the quick ratio is decreased.

(iii) Not change the ratio

Reason: As there is a simultaneous increase and decrease in quick asset, i.e. cash and debtor, therefore, it will not affect the value of current asset.

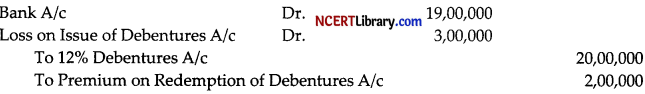

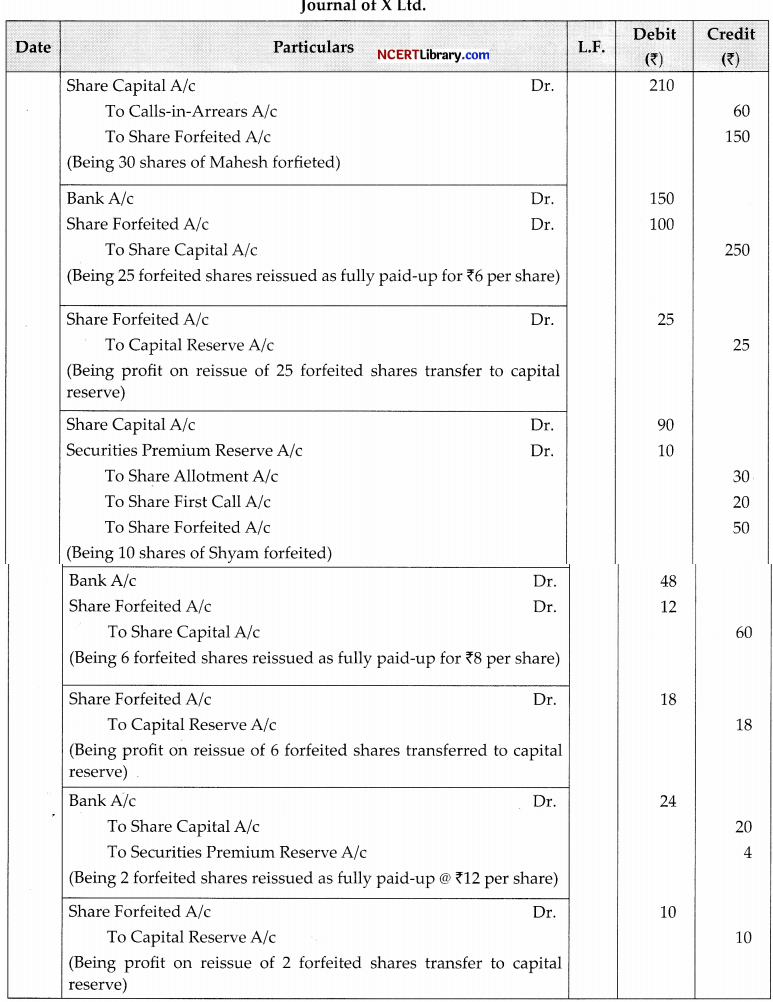

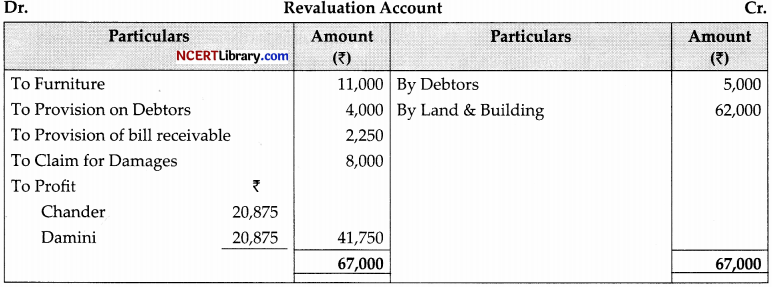

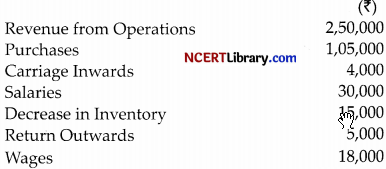

Question 34.

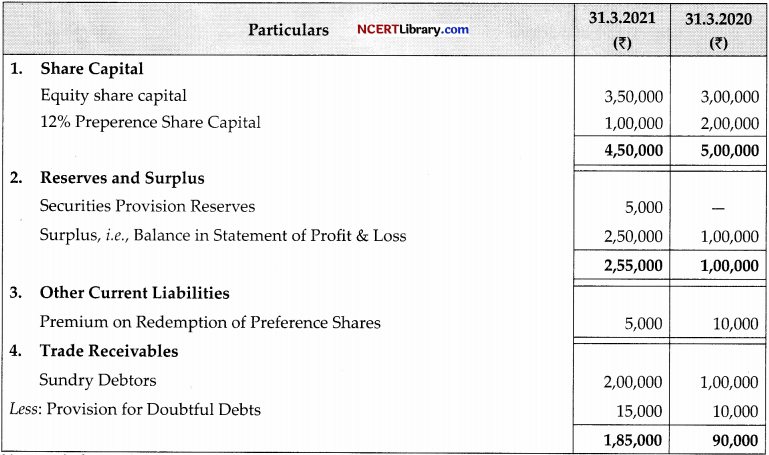

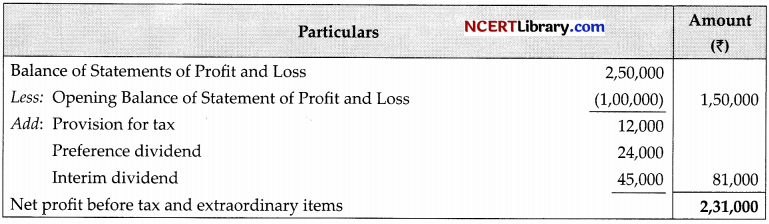

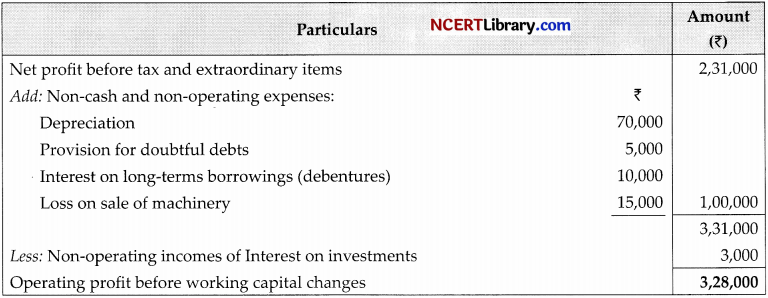

The following is the balance sheet and information of light ltd.

Notes to Accounts:

![]()

You are informed that during the year:

(i) A machine with a book value of ₹40,000 was sold for ₹25,000.

(ii) Depreciation changed during the year was ₹70,000.

(iii) Preference shares were redeemed on 31st December, 2020 at a premium of 5%.

(iv) An interim divided @ 15% was paid on equity shares on 31st January 2021.

(v) Dividend @ 12% was proposed on preference shares for the year ended 31st March,2020 on ₹2,00,000.

(vi) Fresh equity shares were issued at a premium of 10% on 31st March, 2021.

Prepare:

1. Net Profit before tax and extraordinary items.

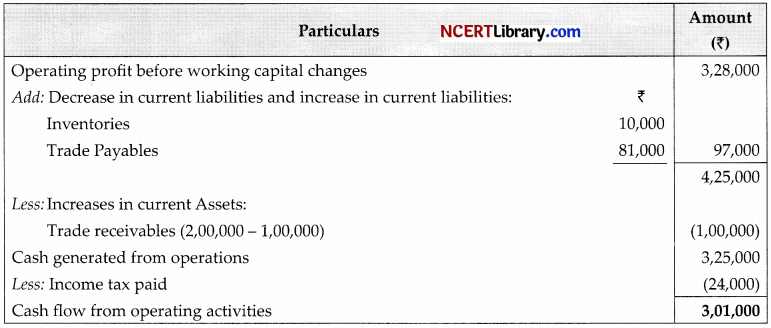

2. Operating profit before working capital change.

3. Cash flow from operating activities.

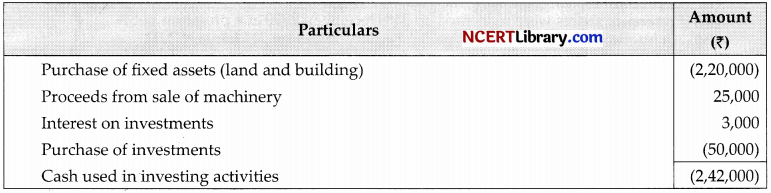

4. Cash flow from investing activities.

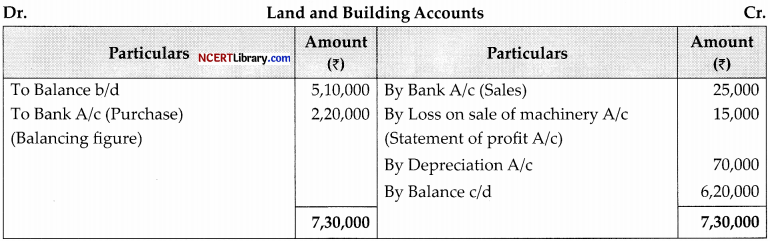

5. Cash flow from financing activities.

Sol.

Net Profit before tax anti extraordinary items.

Operating profit before working capital changes.

Cash Flow from Operating Activities:

Cash Flow from Financing Activities: