Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 5 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 5 with Solutions

Time: 2 Hrs.

Max. Marks: 40

General Instructions :

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts. Part A and Part B.

- Part- A is compulsory for all candidates.

- Part- B has two option i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Question 1 to 16 and 27 to 30 carries 1 mark each.

- Questions 17 to 20. 31 and 32 carries 3 marks each.

- Questions 21, 22 and 33 carries 4 marks each.

- Questions 23 to 26 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, and 2 questions of three marks. 1 question of four marks and 2 questions of six marks.

Part – A

(Accounting for Partnership Firms and Companies)

Question 1.

‘A’ and ‘B’ are partners sharing profits and losses in the ratio of 5 : 3. On admission, ‘C’ brings ₹70,000 cash and ₹48,000 against goodwill. New profit sharing ratio between A’, ‘B’ and ‘C’ is 7 : 5 : 4. The sacrificing ratio between

(a) 4:1

(b)4:7

(c) 5:4

(d) 3:1

Answer:

(c) 3:1

Explanation:

Sacrificing Ratio = Old Ratio – New Ratio

‘A’S Sacrifice = \(\frac{5}{8}-\frac{7}{16}=\frac{10-7}{16}=\frac{3}{16} \text { and }\)

‘B’s Sacrifice = \(\frac{3}{8}-\frac{5}{16}=\frac{6-5}{16}=\frac{1}{16}\)

Sacrificing Ratio = 3:1

Question 2.

Assertion (A): In case of losses interest on capital will not be provided.

Reason (R): If interest on capital is treated as an appropriation of profit then it will not be provided in case of loss. However, if it is treated as a charge, it can be provided.

(a) (A) is correct but (R) is wrong

(b) Both (A) and (R) are correct, but (R) is not correct explanation of (A)

(c) Both (A) and (R) are incorrect.

(d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

Answer:

(d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

Explanation:

In the case if interest on capital is treated as an appropriation of profit, then it will not be provided in case the firm incurs a loss. However, if it is treated as a charge ,then in such case it can be provided.

![]()

Question 3.

Vinod Ltd. forfeited a share of ₹50 issued at a premium of 20% for non-payment of first call of ₹15 per share and final call of ₹5 per share. At what minimum price it can be reissued?

(a) ₹50

(b) ₹30

(c) ₹40

(d) ₹20

Answer:

(d) ₹20

Explanation:

It can be issued at a price of ₹20, which is ₹50 – ₹30 = no.

(as ₹30 per share has already been received on first issue, thus ₹30 is the maximum discount that can be provide on re-issue.)

OR

Which of the following statement is true with regard to 10% Debentures issued at a discount of 20%?

(a) The carrying amount of debentures gets reduced each year at a rate of 20%.

(b) Issue price and the carrying amount of debentures are equal.

(c) At the time of redemption, the debentureholder will be paid at the issue price.

(d) The face value and the carrying amount of debentures are equal.

Answer:

(d) The face value and the carrying amount of debentures are equal.

Explanation:

The face value and the carrying amount of 10% debentures issued at a discount of 20% are equal.

Question 4.

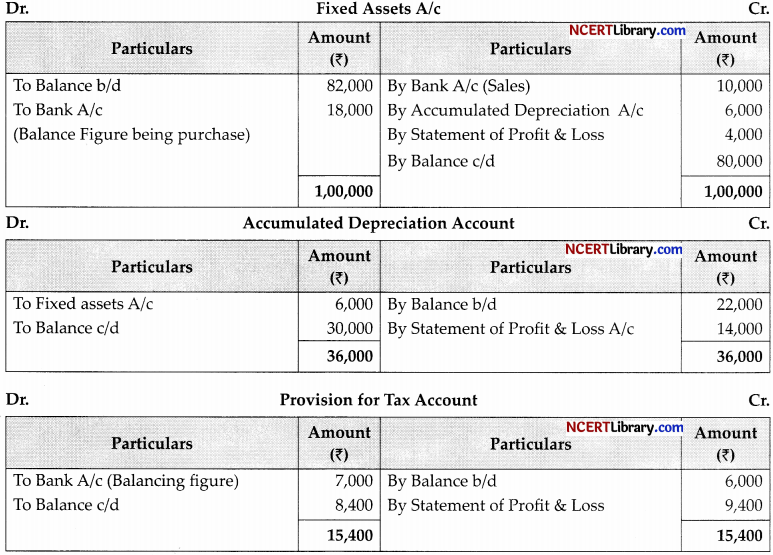

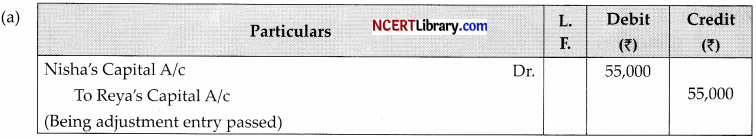

Reya, Mona and Nisha shared profits Mosses in the ratio of 3 : 2 : 1. The profits for the last three year’s were ₹1,40,000; ₹84,000 and ₹1,06,000 respectively. These profits were by mistake shared equally to all. Journal entry for the same will be.

Answer:

Explanation:

Aman and Bobby are partners with a profit-sharing ratio of 2 : 1 and capitals of ₹3,00,000 and ₹2,00,000 respectively. They are allowed 6% p.a. interest on their capitals and are charged 10% p.a. interest on their drawings. Their drawings during the year were Aman ₹60,000 and Bobby ?40,000. Bobby’s share of net profit as per Profit and Loss Appropriation Account amounted to ? 40,000. Net Profit of the firm before any appropriations was:

(a) ₹1,22,000

(b) ₹1,13,000

(c) ₹1,17,000

(d) ₹1,45,000

Answer:

(d) ₹1,45,000

Explanation:

Calculation of Net Profit of the firm before any appropriation :

Aman’s Share of Profit = \(₹ 40,000 \times \frac{2}{1}=₹ 80,000\)

Total Net Profit of the Firm = 80,000 ÷ 40,000 = 1,20,000 (Divisible profit)

Interest on capitals =6% x (3,00,000+2,00,000) = 30,000

Interest on drawings = 10% x (60,000 + 40,000) ×\(\frac{6}{12}=₹ 5,000\)

Net Profit of Firm before Appropriations = (1,20,000 + 30,000) – 5,000 = ₹ 1,45,000

![]()

Question 5.

Calculate Closing Capital:

Opening Capital ₹90,000; Profit for the year ₹25,000; Drawings ₹17,000. During the year proprietor sold ornaments of his wife for ₹40,000 and invested the same in business.

(a) ₹2,40,000

(b) ₹1,40,000

(c) ₹2,38,000

(d) ₹1,38,000

Answer:

(d) ₹1,38,000

Explanation:

Closing Capital = Opening Capital + Additional Capital + Profits – Drawings Closing Capital = 90,000 + 40,000 + 25,000 – 17,000 Closing Capital = ₹1,38,000

Question 6.

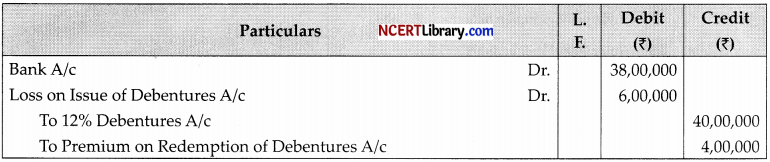

The following journal entry appeared in the books of Ajay Ltd.:

What is the percentage of discount on issue of debentures in the above transaction?

(a) 15%

(b) 5%

(c) 10%

(d) 8%

Answer:

(b) 5%

Explanation:

% of discount on issue of debentures = 2,00,000/40,00,000 × 100 = 5%.

OR

Teena Ltd. purchased asset of Divya Ltd. as under:

Plant & Machinery ₹10,00,000

Land & Building ₹50,00,000

The purchased consideration was ₹60,00,000. ₹15,00,000 were paid through bank and the remaining by issue of 12% Debentures of ₹100 each at a premium of 20%.

What is the face value of issued debentures for purchased consideration?

(a) ₹60,00,000

(c) ₹37,50,000

(b) ₹45,00,000

(d) None of these

Answer:

(c) ₹37,50,000

Explanation:

No. of debentures issue = 45,00,000/120 = 37,500

Face Value of issue share = 37,500 x 100 = 37,50,000

Question 7.

ABC Ltd. purchased Furniture of ₹10,00,000 from KK Ltd. and paid 20% of the amount by accepting a bill of exchange in favour of KK Ltd. The remaining amount was paid by issuing Equity Shares of ₹100 each at a premium of 25% to KK Ltd. What number of Equity Shares to be issued to KK Ltd.?

(a) 6,000

(b) 6,400

(c) 10,000

(d) 7,000

Answer:

(b) 6,400

Explanation:

Amount paid through Issuing Equity Shares = 80% of ₹10,00,000 = ₹78,00,000

Number of Equity Shares to be issued = \(\frac{₹ 8,00,000}{₹ 125}=6,400 \text { shares }\)

![]()

Question 8.

Anil, Bimal and Chetan are partners sharing their profits and losses in the ratio of 4 : 3 : 2. On 1.7.2019, Chetan retired and on that date the capitals of Anil, Bimal and Chetan after all necessary adjustments stood at 775,000, 765,000 and 745,000 respectively. Anil and Bimal continued to carry the business for 6 months without settling Chetan’s account. During the period of six months ending 31st December, 2019, a profit of 750,000 is earned by the firm. Keeping Chetan’s interest in mind, the amount payable to Chetan will be:

(a) ₹1,350

(b) ₹13,362

(c) ₹12,162

(d) ₹1,362

Answer:

(c) ₹12,162

Explanation:

Chetan’s Capital = ₹45,000

Total Capital of Firm = ₹5,000 + ₹65,000 + ₹45,000 = ₹1,85,000

Chetan’s share in Profit = \(₹ 50,000 \times \frac{₹ 45,000}{₹ 1,85,000}\)

= ₹12,162 (approx)

OR

A and B have capitals of ₹2,00,000 and ₹1,00,000 respectively. Interest on capital is to be allowed as per partnership deed at 6% per annum. Their profit-sharing ratio is 2 :1. The profit for the year was 715,000. Actual distribution of profit & loss will be:

(a) A ₹12,000 and B ₹6,000

(b) A ₹1,875 and B ₹1,125

(c) A ₹12,000 and B ₹ 3,000

(d) A ₹10,000 and B ₹5,000

Answer:

(d) A 710,000 and B ₹5,000

Explanation:

Interest on capital A = \(2,00,000 \times \frac{6}{100}=₹ 12,000\)

Total Interest = 12.000 + 6,000 = 18,000

Interest on Capital B = \(1,00,000 \times \frac{6}{100}=6,000\)

The profit 715,000 will be distributed among the partners A and Bin their profit sharing ratio, which is 2 :1.

Because if the appropriations are more than profits then profit is distributed among the partners in the .ratio of appropriations.

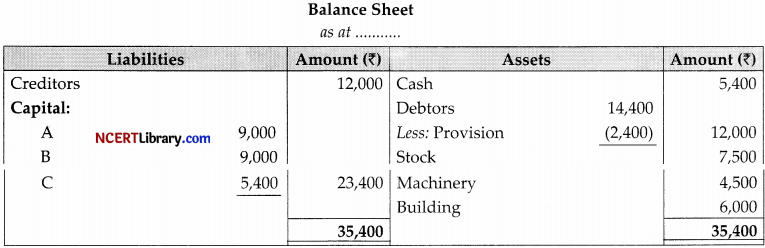

Read the following hypothetical situation, answer the question no. 9 and 10. A, B and C are partners sharing profits equally. They decided that in future C will get 1/5th share in profits. On the day of change, following is their balance sheet.

On this date, building have been valued at ₹9,000, stock to be reduced by ₹300 and provision for doubtful debts to be reduced by ₹900.

Question 9.

What was the profit of revaluation account?

(a) ₹2,100

(b) ₹2,400

(c) ₹3,600

(d) ₹4,200

Answer:

(c) ₹3,600

Explanation:

Question 10.

What was profit amount transferred to C’s account?

(a) ₹1,200

(b) ₹720

(c) ₹1,440

(d) None of these

Answer:

(a) ₹1,200

Explanation:

In the above revaluation account shows the profit amount transferred to C’s capital account is 1,200.

Question 11.

What will be the correct sequence of events?

(i) Forfeiture of shares

(ii) Default on calls

(iii) Re-issue of shares

(iv) Amount transferred to capital reserve.

(a) (i), (iv), (ii), (iii)

(b) (ii), (iv), (i), (iii)

(c) (ii), (i), (iii), (iv)

(d) (iii), (iv), (i), (ii)

Answer:

(c) (ii), (i), (iii), (iv)

Question 12.

Shivank, Tanveer and Karthik are partners in a firm sharing profits and losses in the ratio of 12 : 8 : 5. Partner Karthik is guaranteed a minimum profit of ₹5,000 p.a. by the firm. The losses for the year were ₹20,000. What will be the amount of deficiency for Karthik.

(a) ₹9,000

(b) ₹1,000

(c) ₹5,000

(d) ₹4,000

Answer:

(a) ₹9,000

Explanation:

Loss of Karthik = \(₹ 20,000 \times \frac{5}{25}=₹ 4,000\)

Guaranteed Amount = ₹5,000 + Loss ₹4,000 = ₹9,000

![]()

Question 13.

As per Companies Act, 2013 which company can issue debentures for more than 10-years maturity period?

(a) Manufacturing Companies

(b) Infrastructure Companies

(c) Service Companies

(d) None of these

Answer:

(b) Infrastructure Companies

Explanation:

As per Companies Act, 2013 only Infrastructure companies can issue debentures for more than 10 years but less than 30 years.

Question 14.

A and B are partners in a firm sharing profits in the ratio of 3: 2. They admit C into partnership for 1/5th share. C brings ₹30,000 as capital and ₹10,000 as premium for goodwill. New profit sharing ratio will be 5:3:2. How much amount of premium is to debited/credited in B’s Capital Account?

(a) Debit ₹3,000

(b) Credit ₹3,000

(c) Debit ₹5,000

(d) Credit ₹5,000

Answer:

(d) Credit ₹5,000

Sacrifice Ratio = Old Ratio – New Ratio

A’s Share =\(\frac{3}{5}-\frac{5}{10}=\frac{1}{10}\)

B’s Share = \(\frac{2}{5}-\frac{3}{10}=\frac{1}{10}\)

Therefore, B’s Capital Account is to be credited by \(\left(₹ 10,000 \times \frac{1}{2}\right)\) = ₹5,000.

Question 15.

Anil and Arjun are partners sharing profits equally. Anil drew regularly ₹4,000 at the end of every month for six months ended 30th September, 2020. Calculate interest on drawings @ 5% p.a. for a period of six months.

(a) ₹250

(b) ₹41.67

(c) ₹1,200

(d) None of these

Answer:

(a) ₹250

Explanation:

Average Period = \(\frac{5}{2}=2.5\)

Anil’s Drawings = ₹4,000 × 6 = ₹24,000

Interest on Anil’s Drawings = \(₹ 24,000 \times \frac{5}{100} \times \frac{2.5}{12}=₹ 250\)

In the absence of Partnership Deed, interest on loan of a partner is allowed:

(a) at 8% per annum.

(b) at 6% per annum.

(c) no interest is allowed.

(d) at 12% per annum.

Answer:

(b) at 6% per annum.

Explanation:

As per the legal provisions of the Indian Partnership Act, 1932 in the absence of Partnership Deed, interest on loan of a partner is allowed at 6% per annum.

Question 16.

On dissolution of a firm, Balance Sheet reveals Total Debtors at ₹50,000, Total Creditors at ₹25,000, ₹5,000 of the creditors are not to be paid and the remaining creditors agreed to accept 5% less amount. Provision for Doubtful Debts appear at n,500. Bad debts amount to HO,000 and remaining debtors are realised at a discount of 5%.

How.much amount will be paid to Creditors?

(a) ₹18,750

(b) ₹19,000

(c) ₹19,750

(d) ₹20,000

Answer:

(b) ₹19,000

Explanation:

Amount will be paid to creditors = {(₹25,000 – ₹5,000) – [₹25,000 – ₹5,000 (unclaimed creditor)] × 5%) = ₹20,000 – ₹1,000 = ₹19,000,

![]()

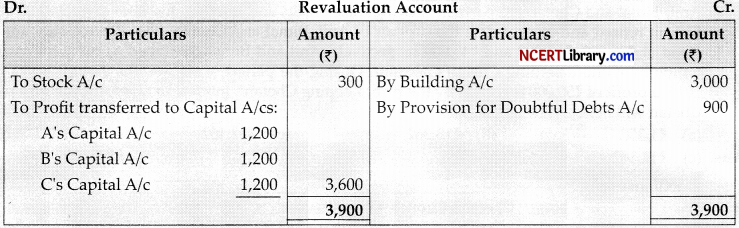

Question 17.

Satnam, Harnam and Gurunam were partners in a firm sharing profits and losses in the ratio of 5:2:3. The firm closes its books on 31st March every year. On 1-7-2019 Harnam died. On his death goodwill of the firm was valued on the basis of average profits of last four years. The profits of the last four years were as follows

| (₹) | |

| 2016-16 | 50,000 |

| 2017-17 | 80,00 |

| 2018-18 | 40,000 |

| 2015-19 | I ,70,000 |

His share in the profits of the firm till the date of his death were ₹57,000. The total amount payable to Harnam’s executors was ₹3,40,000. It was paid on 15-7-2019. Pass necessary journal entries for the above transactions in the books of the firm.

Answer:

Working Note:

Calculation of Goodwill:

Firm’s Goodwill = \(\frac{50,000+80,000+40,000+1,70,00}{4}\) = 85,000

Harnam’s share of goodwill = \(85,000 \times \frac{2}{10}=₹ 17,000\)

Question 18.

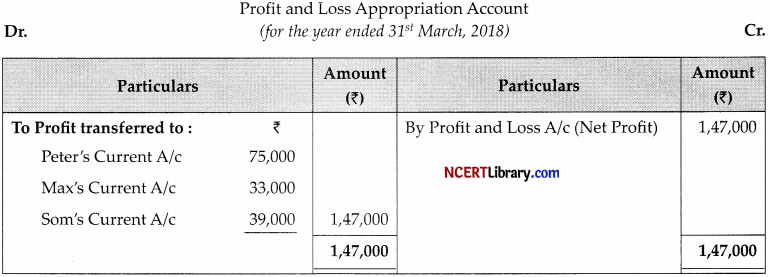

Peter, Max and Som were partners in a firm sharing profits and losses in the ratio of 4 : 2 :1. Their fixed capitals were ₹40,000, ₹30,000 and ₹30,000, respectively. Som was guaranteed a profit of ₹39,000 by the firm. It was decided that any loss arising because of the guarantee would be shared by Peter and Max equally. The trading profit of the firm for the year ended 31st March, 2018, was ^1,47,000. You are required to prepare the Profit and Loss Appropriation Account for the year 2017-18, showing the distribution of profits.

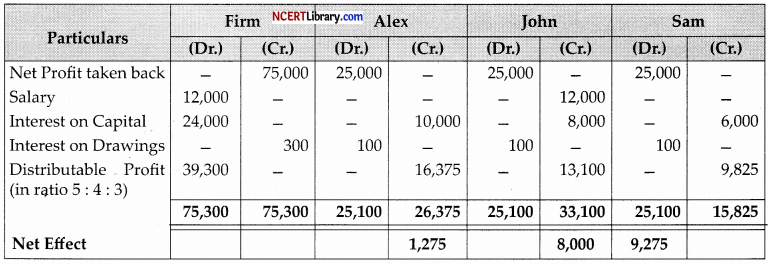

OR

Alex, John and Sam are partners in a firm. Their capital accounts on 1st April, 2011, stood at ₹1,00,000, ₹80,000 and ₹60,000 respectively.

Each partner withdrew ₹5,000 during the financial year 2011-12.

As per the provisions of their partnership deed:

(i) John was entitled to a salary of ₹1,000 per month.

(ii) Interest on capital was to be allowed @ 10% per annum.

(iii) Interest on drawings was to be charged @ 4% per annum.

(iv) Profits and losses were to be shared in the ratio of their capitals.

The net profit of ₹75,000 for the year ended 31st March, 2012, was divided equally amongst the partners without providing for the terms of the deed. You are required to pass a Single Adjusting Journal Entry to rectify the error.

Answer:

Working Notes:

Som’s guaranteed amount of profit = ₹39,000

Som’s actual share in profit = \(1,47,000 \times \frac{1}{7}\)=₹ 21,000

Deficiency in the share = =39,000-21,000=₹ 18,000

Amount to be borne by Peter and Max = \(\frac{18,000}{2}=₹ 9,000 \text { each }\)

⇒ Peter’s share of profit = \(\left(\frac{4}{7} \times 1,47,000\right)-9,000\) = 84,000 – 9,000 = ₹75,000

⇒ Max’s share of profit = \(\left(\frac{2}{7} \times 1,47,000\right)-9,000\) = 42,000-9,000=₹ 33,000

OR

Question 19.

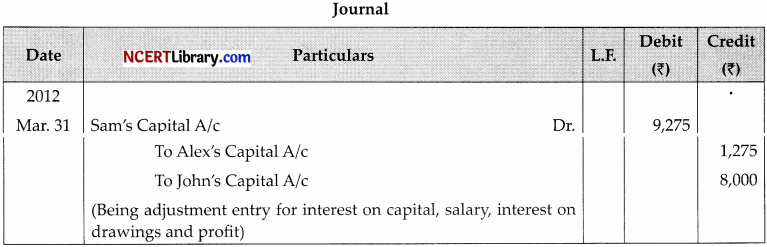

Fill in the missing figures in the following journal entry:

OR

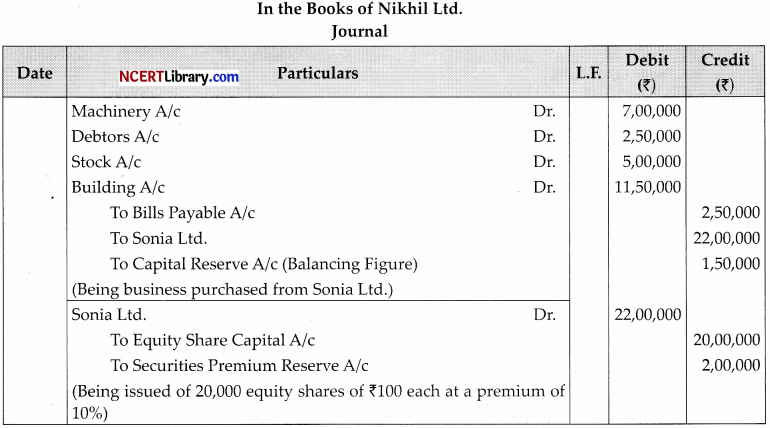

Nikhil Ltd. purchased a running business from Sonia Ltd. for a sum of ₹22,00,000 by issuing ₹20,000 fully paid equity shares of ?100 each at a premium of 10%. The assets and liabilities consisted of the following:

Machinery ₹7,00,000, Debtors ₹2,50,000, Stock ₹5,00,000, Building ₹11,50,000 and Bills Payable ₹2,50,000. Pass necessary Journal entries in the books of Nikhil Ltd. for above transactions.

Answer:

OR

Working Note:

No. of shares to be issued = ₹22,00,000 + ₹110 = 20,000 shares

Question 20.

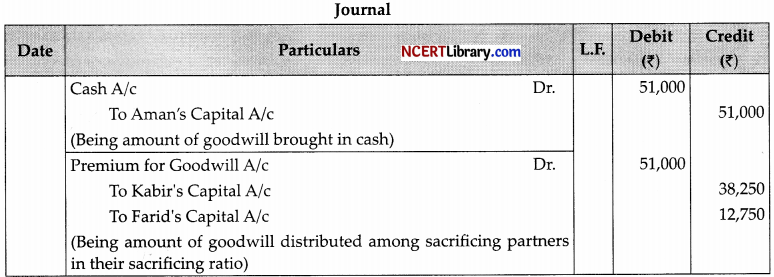

Kabir and Farid are partners in a firm sharing profits in the ratio of 3 : 1 on 1-4-2019 they admitted Manik into partnership for 1/4th share in the profits of the firm. Manik brought his share of goodwill premium in cash. Goodwill of the firm was valued on the basis of 2 years purchase of last three years average profits. The profits of last three years were :

| (₹) | |

| 2016-17 | 90,000 |

| 2017-18 | 1,30,000 |

| 2018-19 | 86,000 |

![]()

During the year 2018-19 there was a loss of ₹20,000 due to fire which was not accounted for while calculating the profit. Calculate the value of goodwill and pass the necessary journal entries for the treatment of goodwill.

Answer:

Old Ratio of Kabir and Farid = 3:1

New Partner Manik’s Share = \(\frac { 1 }{ 2 }\)

Average Profit of last 3 years = \(\frac { 1 }{ 2 }\)

Goodwill at 2 year’s purchase = Average Profit × No. of years’ purchase

= ₹1,02,000 × 2

= ₹2,04,000

New Partner Manik’s Share of Goodwill = \(₹ 2,04,000 \times \frac{1}{4}=₹ 51,000\)

Note: Less of ₹ 20,000 will not be accounted because it is accidental which are not considered in goodwill calculation.

Question 21.

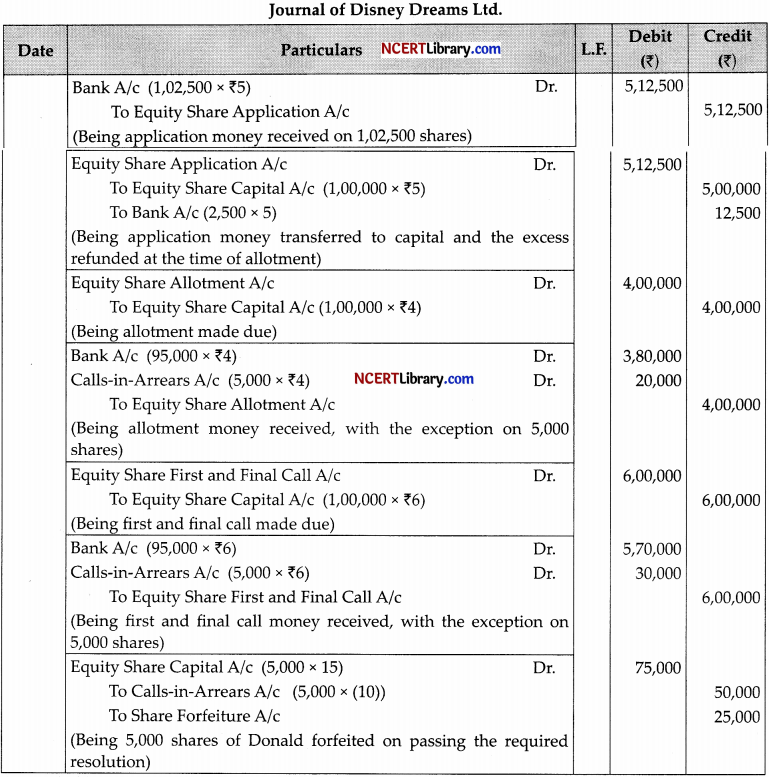

Disney Dreams Ltd. issued ₹1,00,000 equity shares of ₹15 each at par. The money was payable as follows: on application ₹5 per share, On allotment ₹4 per share, On first and final call ₹6 per share. Applications were received for ₹1,02,500 shares. Excess applications were rejected and full allotment was made. Donald, who held ₹5,000 shares failed to pay the allotment and call money. Flis shares were forfeited after the final call. Journalise these transactions when Calls-in-Arrears Account is opened by the company.

Answer:

Question 22.

Arun, Shobha and Yuvraj were partners in a firm. On 1st April, 2018 their fixed capitals stood at ₹1,00,000, ₹50,000 and ₹50,000 respectively.

As per the provisions of partnership deed,

(i) Partners were entitled to an annual salary of ₹20,000 each.

(ii) Interest on Capital @ 10% p.a. was to be provided.

(iii) Profits were to be shared in the ratio 3:1:1. Net profit for the year ended 31st March, 2019 was ₹90,000. Pass Journal entries for the above in the books of the firm.

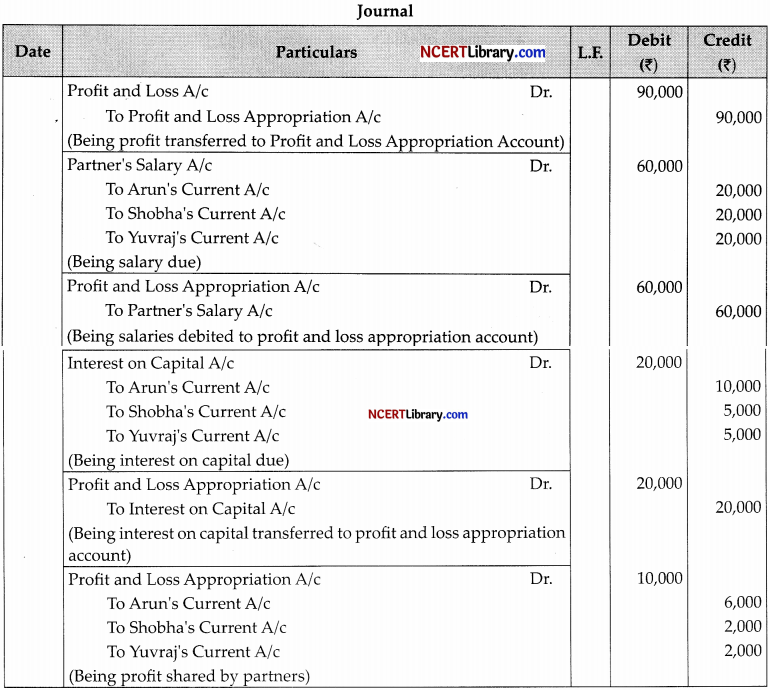

Answer:

Question 23.

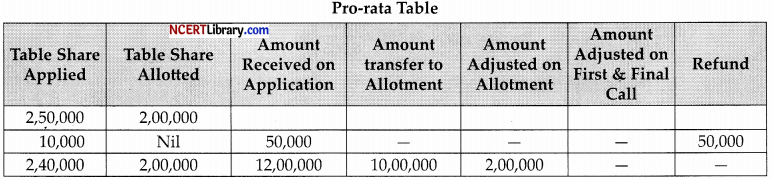

Premier Tools Ltd. invited applications for issuing ₹2,00,000 equity shares of ₹10 each at a premium of ₹2 per share. The amount was payable as follows:

On application ₹5 per share (including premium)

On allotment ₹3 per share

On first & final call balance

Applications were received for 2,50,000 shares. Applications for 10,000 shares were rejected and pro-rata allotment was made to the remaining applicants. Over payments received on application were adjusted towards sums due on allotment.

All calls were made and duly received except allotment and first and final call from Naveen who applied for ₹7,200 shares. His shares were forfeited. Half of the forfeited shares were reissued for ₹48,000 as fully paid. Pass the necessary journal entries for the above transactions in the books of Premier Tools Ltd. Open calls-in-arrears account wherever required.

OR

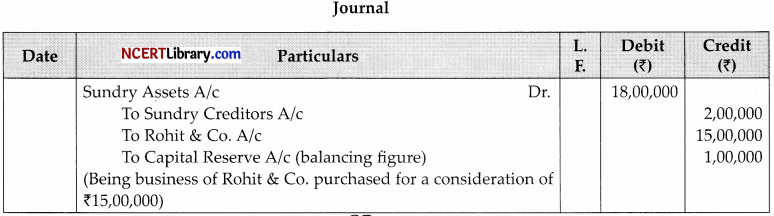

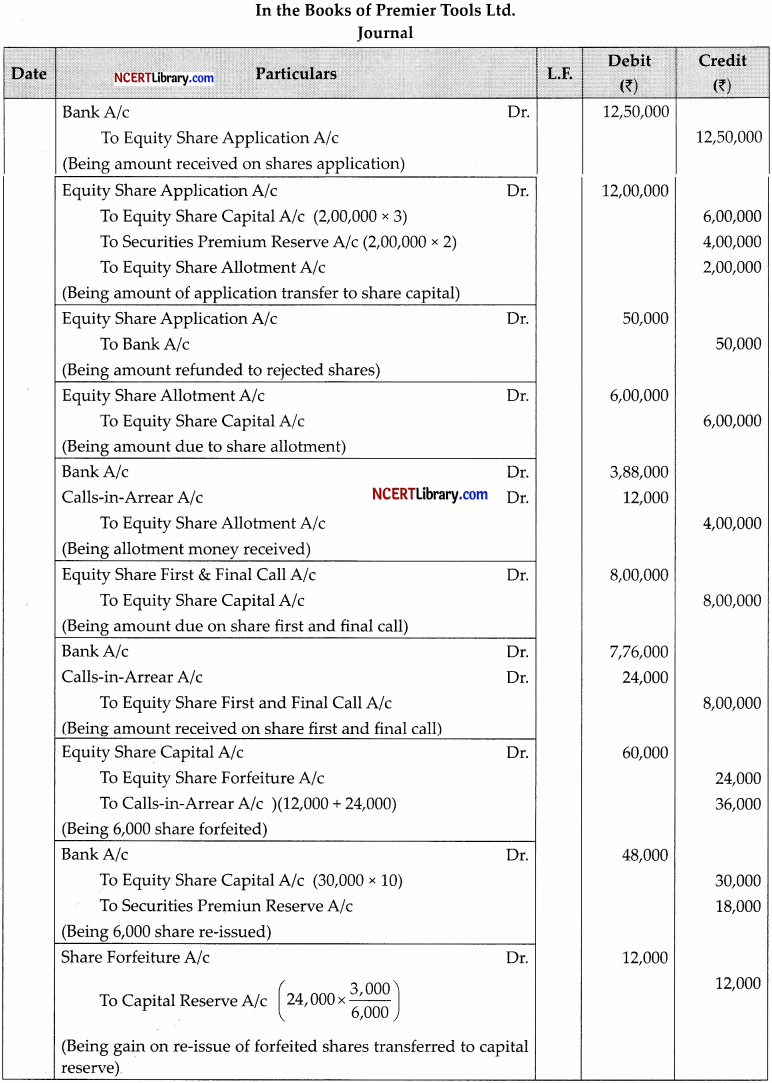

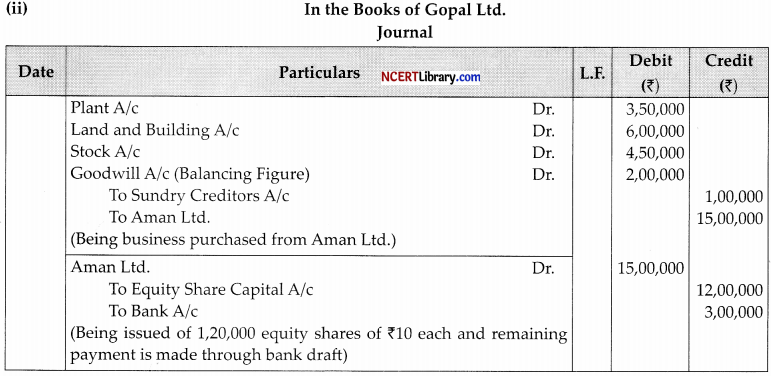

Pass necessary journal entries for the following transactions in the books of Gopal Ltd:

(i) Purchased furniture for ₹2,50,000 from M/s Furniture Mart. The payment to M/s Furniture Mart was made by issuing equity shares of ₹10 each at a premium of 25%.

(ii) Purchased a running business from Aman Ltd. for a sum of ₹15,00,000. The payment of ₹2,00,000 was made by issue of fully paid equity shares of ₹10 each and balance by a bank draft. The assets and liabilities consisted of the following:

Plant ₹3,50,000; Stock ₹4,50,000; Land and Building ₹6,00,000; Sundry Creditors ₹1,00,000.

Answer:

Working Notes:

Calculation of Actual Calls-in-Arrear

Total Share Allotted

![]()

= 7,200 × \(\frac{2,00,000}{2,40,000}\) = 6,000 Shares

(ii) Excess amount received on:

Application form Naveeb = Value of Application (Applied Shares – Allofted Shares)

= 5 (7,200 – 6,000) = 5 x 1,200 = ₹6,000

![]()

(iii) Amount due on allotment from Naveen = Value of allotment x No. of Shares allotted

= 3 x 6,000 = ₹18,000

(iv) Actual Calls-in-Arrear = (iii) – (ii)

= 18,000 – 6,000 = ₹12,000.

OR

Answer:

Working Note:

Calculation of Number of Shares to be issued (at premium of 25%)

No. of Shares = \(\frac{\text { Purchase Price }}{\text { Issue Price }}=\frac{2,50,000}{(10+2.5)}\) = 20,000 shares

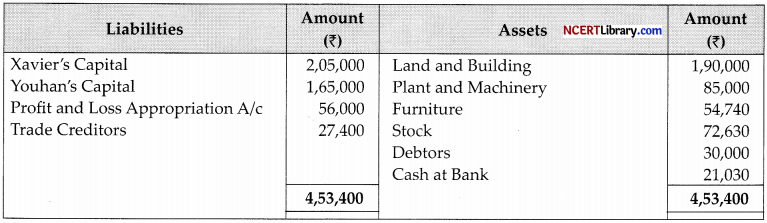

Question 24.

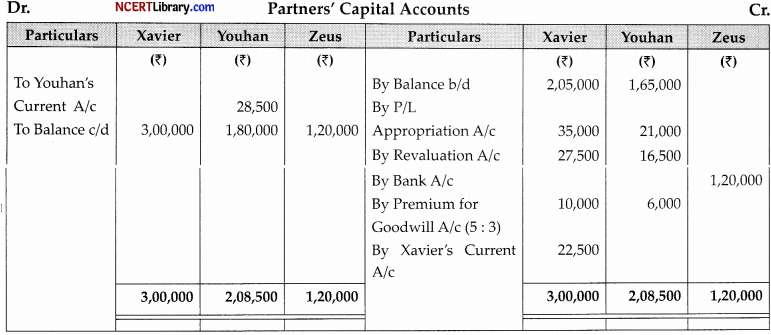

The Balance Sheet of a partnership firm of Xavier and Youhan, who were sharing profits in the ratio of 5 : 3 respectively, as on 31st March, 2020 was as follows:

On the above date, Zeus was admitted on the following terms:

(i) Zeus would get 1/5th share in the profits.

(ii) Zeus would pay ₹1,20,000 as his capital and ₹16,000 for his share of goodwill.

(iii) Machinery would be depreciated by 10% and building would to he appreciated by 30%. A provision for bad debts @ 5% on debtors would be created. An unrecorded liability amounting to ₹3,000 for repairs to building would be recorded in the books of account.

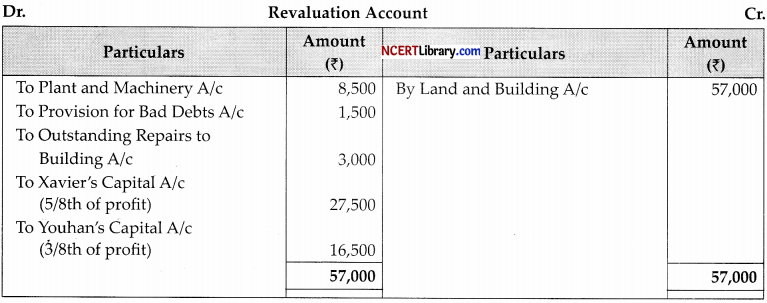

(iv) The capital accounts of the old partners would be adjusted through the necessary current accounts in such a manner that the capital accounts of all the partners would be in their profit sharing ratio. Prepare Revaluation Account, Partners’ Capital Account and the initial Balance Sheet of the new firm.

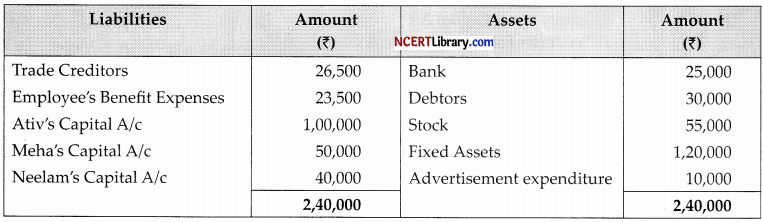

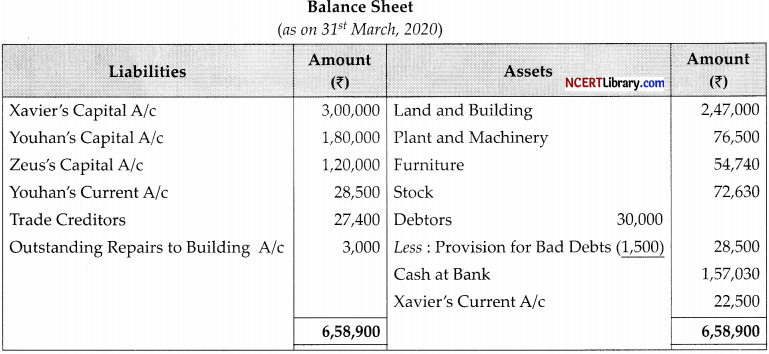

OR

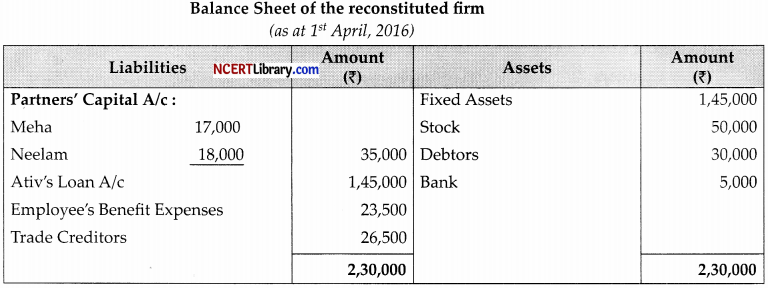

Ativ, Meha and Neelarn were partners sharing profits and losses in the ratio of 5 : 3 : 2. On 31-03-2016, their Balance Sheet was as under:

Ativ retired on 01-04-2016. For this purpose, the following adjustments were agreed upon:

(i) Goodwill of the firm, was to be value at 2 years’ purchase of the average profits of three completed years of preceding the date of retirement. The profits were as follows – ₹55,000, ₹65,000 and ₹60,000.

(ii) Fixed assets were to be increased by ₹25,000.

(iii) Stock was overvalued by ₹5,000.

(iv) 20,000 were immediately paid to Ativ and the balance was transferred to his Loan Account. Prepare Revaluation Account, Capital Accounts of partners and Balance Sheet of the reconstituted firm.

Answer:

Working Note:

New Profit sharing Ratio – Zeus’s Share = \(\frac {1}{5}\)

Remaining share = 1 – \(\frac{1}{5}=\frac{4}{5}\)

Xavier s Share = \(\frac{5}{8} \times \frac{4}{5}=\frac{20}{40}=\frac{1}{2}\)

Youhans Share = \(\frac{3}{8} \times \frac{4}{5}=\frac{12}{40}=\frac{3}{10}\)

Required balances of capital A/c \(\frac{1}{2}: \frac{3}{10}: \frac{1}{5}=\frac{5: 3: 2}{10}\) = 5 : 3 : 2

Zeus’s Capital = ₹1,20,000

Zeus’s share of profit = 1/5

Hence total capital of the firm = 1,20,000 x 5 = ₹6,00,000

Xavier’s New Capital = ₹6,00,000 x \(\frac {5}{10}\) = ₹3,00,000

Youhan’s New Capital = ₹ 6,00,000 \(\frac {3}{10}\) = ₹1,80,000

OR

Question 25.

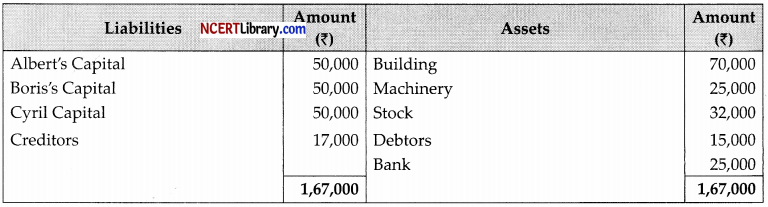

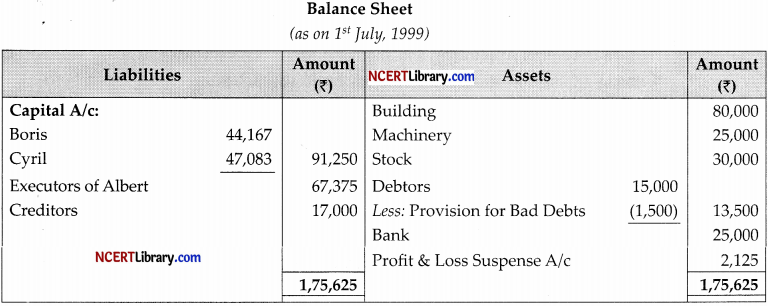

Albert, Boris and Cyril are partners sharing profits and losses in the ratio of 3 : 2: 1 and their balance sheet as on 31st March, 1999 stood as under:

Albert died on 1st July 1999 and the following decisions were taken by the surviving partners. According to the partnership deed his executors were entitled to:

(i) The deceased partner’s capital as appearing in the last balance sheet and interest thereon at 6% per annum upto the date of death.

(ii) His share of profit for the period he was alive based on the figure of 31st March, 1999.

(iii) Goodwill according to his share of profit to be calculated by taking twice the amount of the average profit of the last three years.

The profits of the previous years were:

31st March, 1999 – ₹11,000

31st March, 1998 – ₹15,000 and

31st March 1997 – ₹10,000

![]()

(iv) Assets were to be revalued:

Building – 80,000

Stock – 30,000, and

Provision for bad debts @ 10%

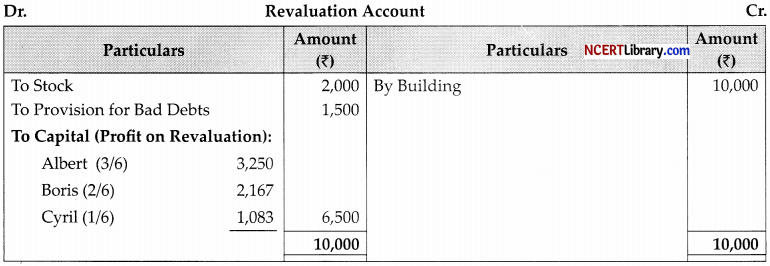

Assuming that all the above changes are to be incorporated in the new firm and are not to be written off (except goodwill) prepare the Revaluation Account, Partners’ Capital Accounts and Balance Sheet as on 1st July, 1999. (All calculations are to be made to the nearest rupee)

Working Notes:

(i) Albert’s share of Goodwill:

Average profits of last 3 years : \(\frac {1}{3}\) x ₹ (11,000 + 15,000 + 10,000) = ₹12,000

Albert’s share of average profits: \(\frac {3}{6}\) x ₹12,000 = ₹6,000

Value of his share of goodwiLl : 2 x ₹6,000 = ₹12,000

(ii) Due to lack of adequate information current assets and current liabilities on 1.7.99 have been assumed to have remained the same as they were on 31-3-99. In actual practice, however these will be different.

![]()

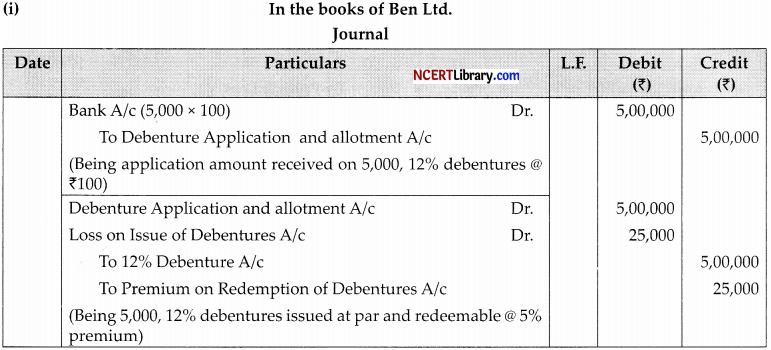

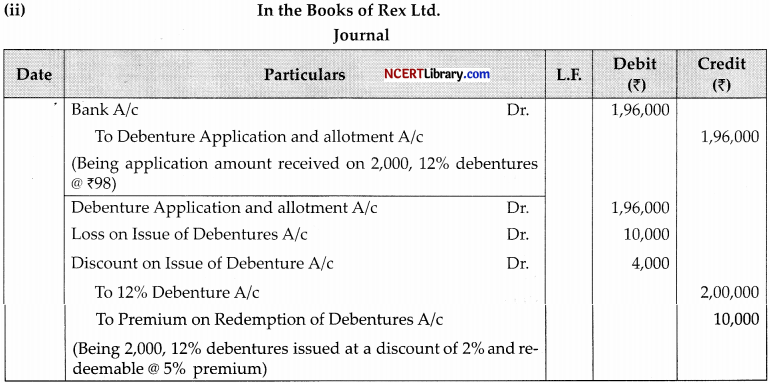

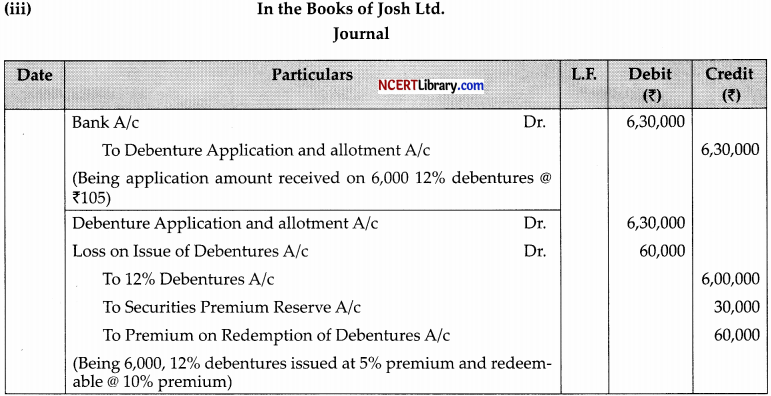

Question 26.

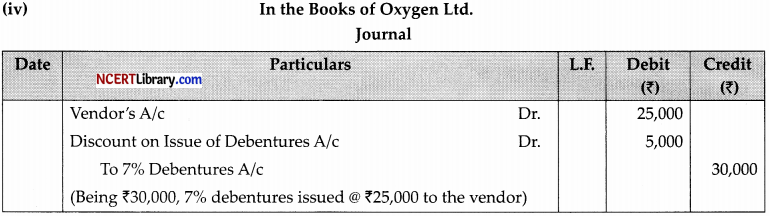

You are required to pass journal entries for the issue of debentures in the following conditions:

(i) Ben Ltd. issued 5,000, 12% Debentures of ₹100 each at par, redeemable at 5% premium.

(ii) Rex Ltd. issued ₹2,00,000, 12% Debentures of ₹100 each at a discount of 2%, redeemable at a premium of 5%.

(iii) Josh Ltd. issued 6,000, 12% Debentures of ₹100 each at a premium of 5%, redeemable at a premium of 10%.

(iv) Oxygen Ltd. issued ₹30,000, 7% debentures of ₹100 each to a Creditor for ₹25,000 in full satisfaction of his claim.

Answer:

Part-B

(Analysis of Financial Statement) (Option-l)

Question 27.

Which of the following is correct example of capital work-in-progress?

(a) Purchase of current assets

(b) Conversion of raw material into final goods

(c) Office building under construction

(d) Increase in patents

Answer:

(c) Office building under construction

Explanation:

Capital work-in-progress represents costs incurred to date on a fixed asset that is still under construction at the Balance Sheet date. The costs being incurred on such assets cannot be recognised as an operating asset until they qualify as a ready-to-use asset.

OR

Which one of the following is correct?

(i) A ratio is an arithmetical relationship of one number to another number.

(ii) Quick ratio is also known as acid test ratio.

(iii) Rule of thumb for current ratio is 2:1.

(iv) Debt equity ratio is the relationship between outside fund and shareholders fund.

(a) All (1), (ii), (iii) and (iv) are correct.

(b) Only (j), (ii) and (iii) are correct.

(c) Only (ii), (iii) and (iv) are correct.

(d) Only (ii) and (iii) are correct.

Answer:

(a) All (î), (ii), (iii) and (iv) are correct,

Explanation:

1. A ratio is an arithmetical relationship of one number to another number. In terms of accountancy an accountancy ratio would be the relationship between two figures obtained from the account statement. For example, Net profit ratio is the ratio of net profit to the net sales made.

2. Quick ratio is also known as acid test ratio because it measures the ability of the company to meet unexpected liabilities without having to depend on the sale of inventories.

![]()

3. The rule of thumb for current ratio is 2: 1, this is not a constant rule hut rather relative. Whether or not the current ratio is satisfactory completely depends on the nature of business, current assets and current liabilities.

4. Debt equity ratio is calculated as Total outside liabilities/shareholders equity and so it can be said that it is the relationship between outsiders fund shareholders funds.

Question 28.

The credit sale of M/s. Dinesh & Sons is ₹ 21,00,000. It’s debtors and bills receivables at the end of the accounting period amounted to ₹2,00,000 and ₹1 ,50,000 respectiveh What will he the Trade receivable Turnover Ratio?

(a) 4 times

(b) 5 times

(c) 6 times

(d) 7 times

Answer:

(c) 6 times

Question 29.

A company receives a dividend of 3,00,000 on its investment in other company’s shares. If this company is a Finance Company, it will be classified as?

(a) Cash Flow from Operating Activities

(b) Cash Flow from Investing Activities

(c) Cash Flow from Financing Activities

(d) None of these

Answer:

(a) Cash Flow from Operating Activities

Explanation:

Dividend received by finance company on its investment in other company’s share is operating activities as the main business of a finance company is to borrow lend or invest money

OR

Sheetal Ltd. company received a refund of 50,000 from income tax department. This refund of tax is treated as …………. activity while preparing cash flow statement.

(a) outflow of cash

(c) no change in cash

(b) inflow of cash

(d) none of these

Answer:

(b) inflow of cash

Explanation:

Refund of tax is treated as inflow of cash. It is added in operating activities in cash flow statement.

Question 30.

Provision for taxation opening and closing balances are 3,50,000 aid 4,60,000 respectively. 2,10,000 tax paid during the ear. What is amount of provision for tax made during the year?

(a) ₹3,50,000

(b) ₹4,60,000

(c) ₹2,10,000

(d) ₹3,20,000

Answer:

(d) ₹3,20,000

Explanation:

Provision for tax made during the year = 4,60,000 + 2,10,000 – 3,50,000 = ₹3,20,000

![]()

Question 31.

Under which heads and sub-heads will the following items appear in the Balance Sheet of a company as per Schedule III of the Companies Act, 2013:

(i) Public Deposits

(ii) Calls-in-Advance

(iii) Building under construction

Answer:

| Item | Head | Sub-Head |

| Public Deposits | Non-current Liabilities | Long-term Borrowings |

| Calls in Advance | Current Liabilities | Other Current Liabilities |

| Building under construction | Non-current Assets | Property Plant and Equipment and Intangible Assets – Capital Work-in Progress |

Question 32.

A Ltd. and B Ltd. tries to compare their financial statements but was having problem in comparing because A Ltd. was using the policy of charging as depreciaton on straight line basis while B Ltd. was using the policy of charging depreciation of written down value method. Identify the limitation observed here. Also state the other two limitations of ratio analysis.

Answer:

The limitation identified here is that the comparision is not possible different firms adopt different accounting policies. Such differences make the accounting ratio incomparable.

Other two limitations of ratio analysis are:

(i) False Result: Accounting ratios are calculated from the financial statements, therefore, the reliability of ratio and its analysis is dependent upon the correctness of the financial statements. If the financial statements are not true and fair, the analysis will give a false picture of the affair.

(ii) Lack of Standard Ratios: There is no single standard ratio against which accounting ratio can be compared.

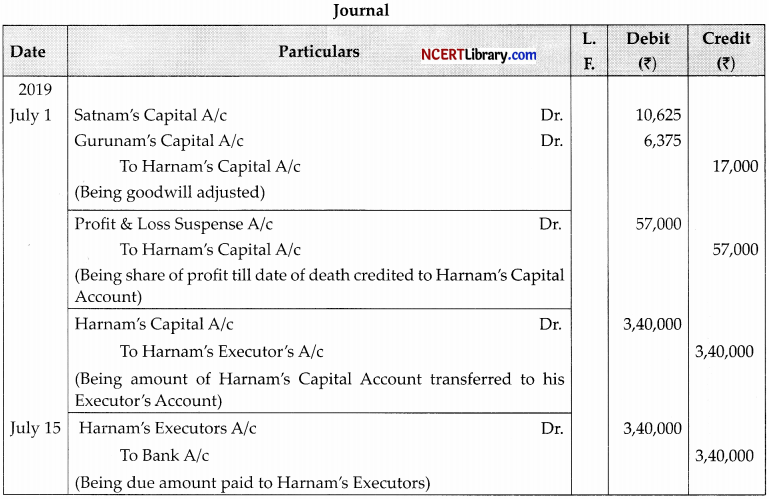

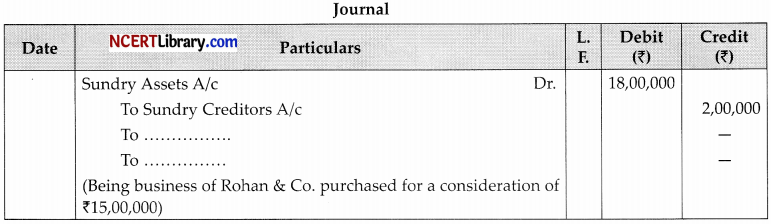

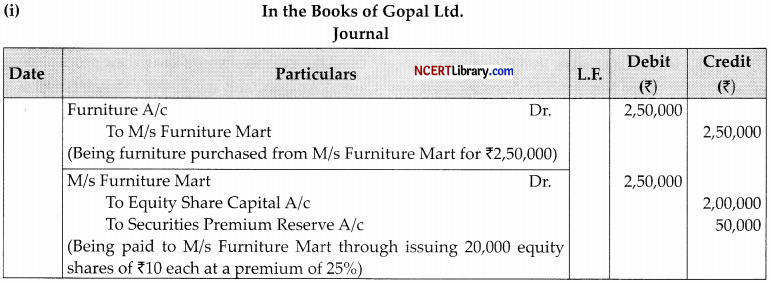

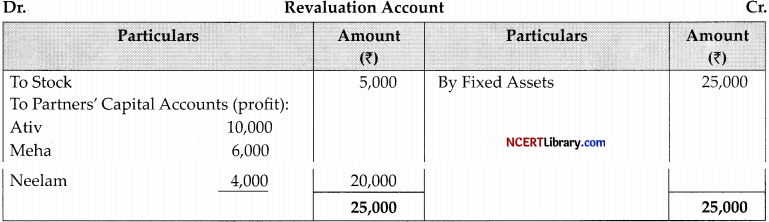

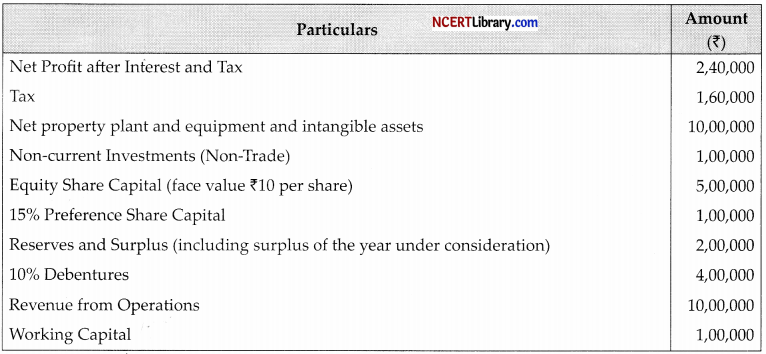

Question 33.

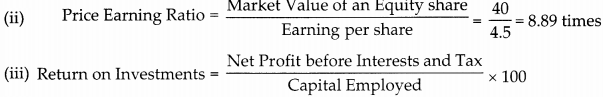

From the following information calculate the following ratios (up to two decimal places):

(i) Earning per Share

(ii) Price Earning Ratio

(iii) Return on Investments

(iv) Working Capital Turnover Ratio

Note : The market value of an equity share is ₹40.

OR

The Current Ratio of a company is 2.1 : 1.2. Stale with reasons which of the following transactions will increase, decrease or not change the ratio:

(i) Redeemed 9% debentures of ₹1,00,000 at a premium of 10%.

(ii) Received from debtors ₹17,000.

(iii) Issued ₹2,00,000 equity shares to the vendors of machinery.

(iv) Accepted bills of exchange drawn by the creditors ₹7,000

Answer:

![]()

Net Profit after interest and tax = ₹2,40,000

Preference share dividend = 1,00,000 x \(\frac {15}{100}\) = ₹15,000

Net Profit after interest, tax and preference dividend = 2,40,000 – 15,000 = ₹2,25,000

No. of Equity Shares = \(\frac {5,00,000}{10}\) = 50,000

∴ Earning per share = \(\frac{2,25,000}{50,000}\) = ₹4.50 per share

Net Profit before Interests and Tax = 2,40,000 + 40,000 + 1,60,000 = ₹4,40,000

Interest on Debentures = 10% of 4,00,000 = ₹40,000

Capital Employed = Non-current Assets (excluding Non-Trade Investments) + Working Capital

= 10,00,000 + 1,00,000 = ₹11,00,000

Return on Investments = \(\frac{4,40,000}{11,00,000}\) x 100 = 40%

OR

| Items | Effect | Explanation |

| (i) Redeemed 9% debentures of 1,00,000 at a premium of 10% | Decrease | Current liabilities remain unchanged but current assets will decrease because of the outflow of cash. |

| (ii) Received from debtors 17,000 | No Change | Both debtors and cash/bank are current assets, so increase and decrease in current assets by same amount results in current ratio being unaffected. |

| (iii) Issued 2,00,000 equity shares to the vendors of machinery | No Change | Since non-current assets and non-current liabilities are increased by the same amount and have no effect on current assets and current liabilities, therefore, current ratio remains the same i.e., 2.1: 1.2. |

| (iv) Accepted bills of exchange drawn by the creditors 7,000 | No Change | Here, only one current liability is converting into another current liability (i.e., creditors into bills payable), thus, current ratio remains unaffected. |

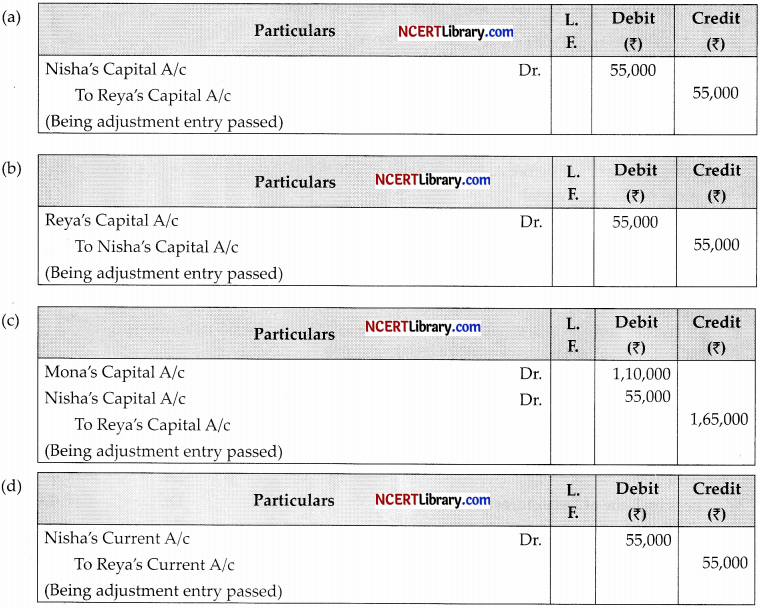

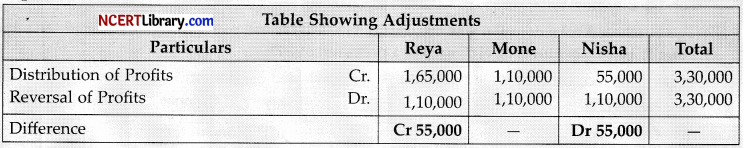

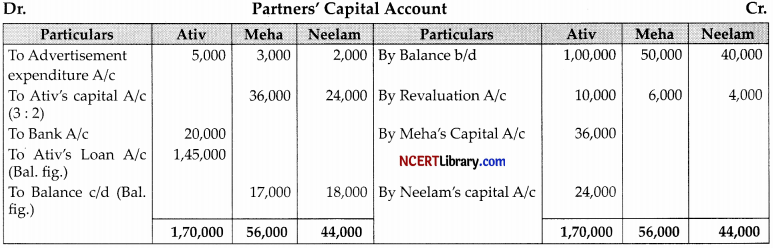

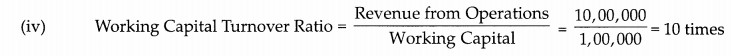

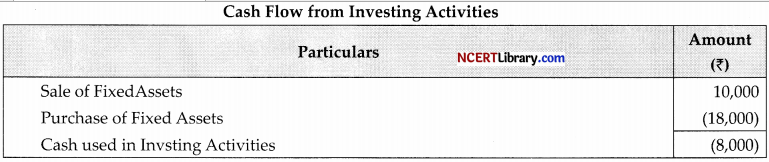

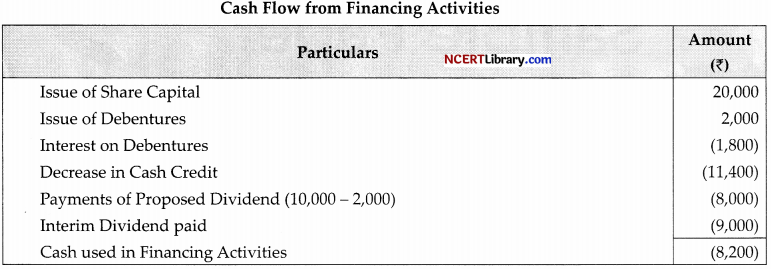

Question 34.

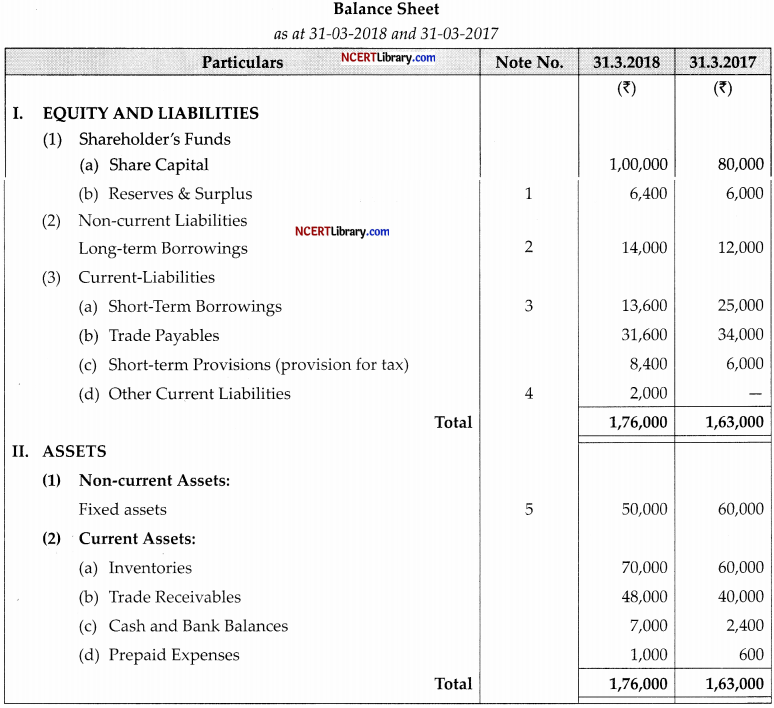

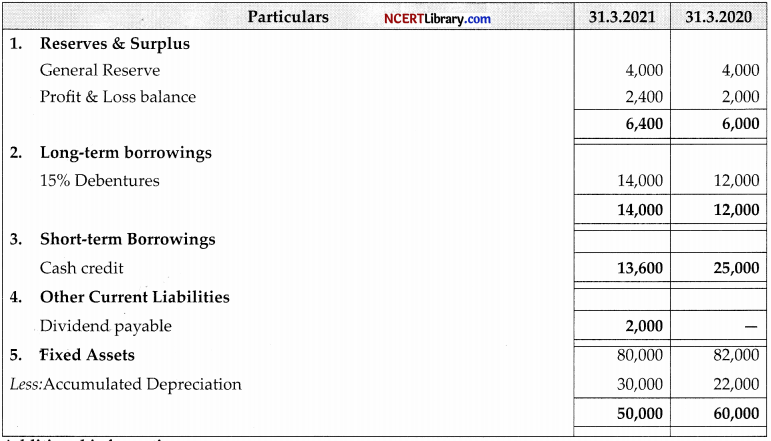

The following is the extract of Ramesh Ltd. Balance Sheet.

Notes to Accounts:

Additional information:

![]()

(b) Provision for tax made ₹9,400

(c) Fixed assets sold for ₹10,000, their cost ₹20,000 and accumulated depreciation till date of sale is ₹6000.

(d) An interim dividend paid during the year ₹ 9,000.

![]()

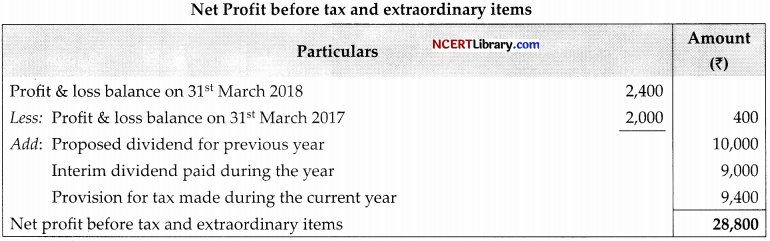

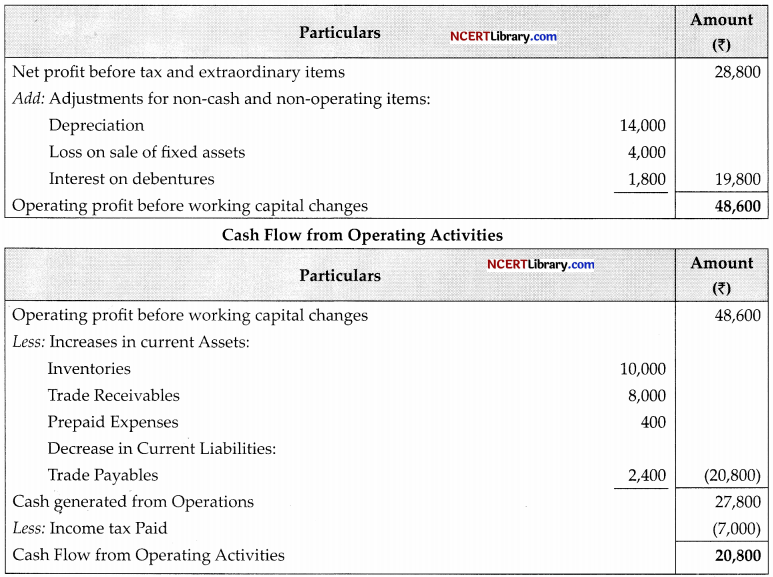

You are required to calculate:

1. Net Profit before tax and extraordinary items.

2. Operating profit before working capital changes.

3. Cash flow from operating activities.

4. Cash flow from investing activities.

5. Cash flow from financing activities.

Operating profit before working capital changes.

working notes