Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 4 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 4 with Solutions

Time: 2 Hrs.

Max. Marks: 40

General Instructions :

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts. Part A and Part B.

- Part- A is compulsory for all candidates.

- Part- B has two option i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Question 1 to 16 and 27 to 30 carries 1 mark each.

- Questions 17 to 20. 31 and 32 carries 3 marks each.

- Questions 21, 22 and 33 carries 4 marks each.

- Questions 23 to 26 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, and 2 questions of three marks. 1 question of four marks and 2 questions of six marks.

Part – A

(Accounting for Partnership Firms and Companies)

Question 1.

X and Y shares profits and losses in the ratio of 2 :1. They take Z as a partner and the new profit-sharing ratio becomes 3: 2 :1. Z brings ₹9,000 as a premium for goodwill. The full value of goodwill will be:

(a) ₹60,000

(b) ₹36,000

(c) ₹54,000

(d) ₹27,000

Answer:

(c) ₹54,000

![]()

Explanation:

Total value of goodwill = 9,000 × \(\frac{6}{1}=₹ 54,000\)

Question 2.

Assertion (A): Partners distribute profits and losses in their profit-sharing ratio and not in the ratio of their capitals.

Reason (R): The amount of appropriation, as per partnership deed are more than the amount of profit available for distribution, profit is distributed in the ratio of appropriations.

In the context of above the statements which of the following is correct?

(a) (A) is correct but (R) is wrong

(b) Both (A) and (R) are correct, but (R) is not the correct explanation of (A)

(c) Both (A) and (R) are incorrect.

(d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

(b) Both (A) and (R) are correct, but (R) is not the correct explanation of (A)

Question 3.

Blue Berry Ltd. had issued 50,000 equity shares of ₹20 each and had called up ₹16 but received only ₹10 per share, equity share capital account will be credited by:

(a) ₹20 per share

(b) ₹16 per share

(c) ₹14 per share

(d) ₹2 per share

Answer:

(b) ₹16 per share

(Explanation:

It will be debited with ₹16 per share because only ₹16 per share has been called up.

OR

Which of the following statements is correct?

(a) A debenture holder is an owner of the company

(b) A debenture holder can get his money back only on the liquidation of the company

(c) A debenture issued at a discount can be redeemed at a premium

(d) A debenture holder receives interest only in the event of profits

Answer:

(c) A debenture issued at a discount can be redeemed at a premium

Question 4.

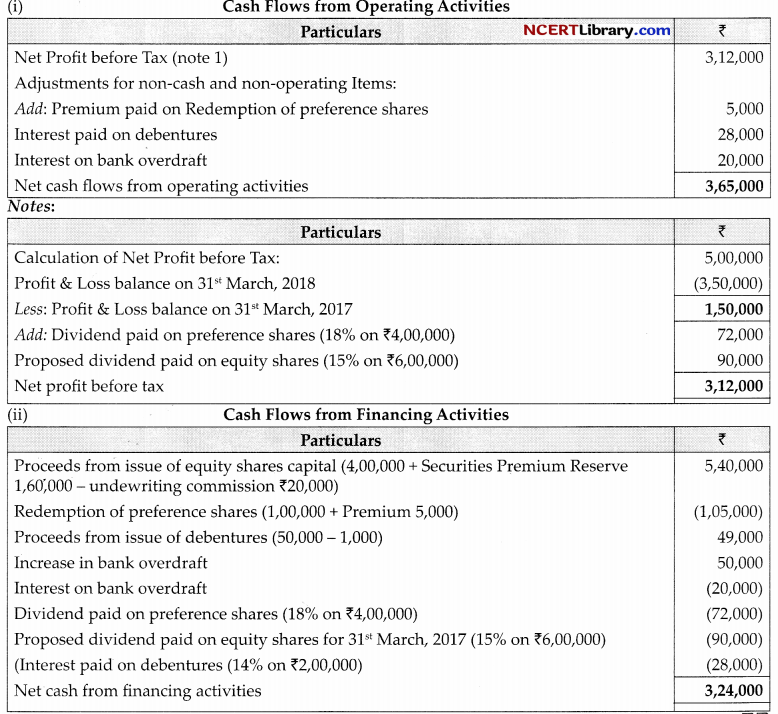

Preeti, Mona and Nisha shared profits in the ratio of 3:2:1. Profits of the last 3 years were ₹1,40,000, ₹ 84,000,₹ 1,06,000 respectively. These profits were by mistake shared equally in all the three years. Which of the following entry is necessary to correct the error?

| (a) Nisha’s Capital A/c To Preeti’s Capital A/c |

Dr. | 55,000 | 55,000 |

| (b) Preeti’s Capital A/c To Nisha’s Capital A/c |

Dr. | 55,000 | 55,000 |

| (c) Mona’s Capital A/c To Preeti’s Capital A/c |

Dr. | 55,000 | 55,000 |

| (d) Preeti’s Capital A/c To Mona’s Capital A/c |

Dr. | 55,000 | 55,000 |

OR

A, B and C are partners sharing profits in the ratio of 5: 4 :1. C is given a guarantee that his share in a year will not be less than ₹5,000. Profit for the year ended 31.3.2022 is ₹40,000. Deficiency in the guaranteed profit of C is to be borne by B. Deficiency to be borne by B is:

(a) Deficiency of C ₹1,500 met by B

(b) Deficiency of C ₹1,000 met by B

(c) Deficiency of C ₹4,000 met by B

(d) None of these

Answer:

(b) Deficiency of C ₹1,000 met by B

Explanation:

Share of Profits:

A = 40,000 × \(\frac{5}{10}=₹ 20,000\)

B = 40,000 × \(\frac{4}{10}=₹ 16,000\)

C = 40,000 × \(\frac{1}{10}=₹ 4000\)

The deficiency of C is ₹1,000 while will be met by B.

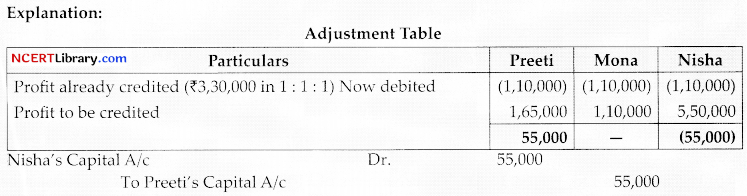

Question 5.

A and B are partners sharing profits and losses in the ratio of 3: 1. Their capitals at the end of the financial year 2021-22 were ₹6,00,000 and ₹3,00,000. During the year, A’s drawings were ₹80,000 and B’s drawings were ₹40,000, which had been duly debited to partner’s capital accounts. Profit before charging interest on capital for the year was ₹80,000. The same had also been credited in Iheir profit sharing ratio B had brought additional capital of ₹70,000 on October 1, 2021. Calculate opening capital of B:

(a) 2,00,000

(b) 2,50,000

(c) 3,40,000

(d) 3,20,000

Answer:

(b) 2,50,000

Question 6.

Pavitra Ltd. issue 60,000, 10% debentures of ₹100 each at a certain rate of premium and to be redeemed at 10% premium. At the time of writing off loss on issue of debentures, Statement of Profit & Loss was debited by ₹7,20,000. At what rate of premium, these debentures were issued?

(a) 2%

(b) 3%

(c) 5%

(d) 8%

Answer:

(a) 2%

Premium to be paid on debentures redemption = \(\frac{60,000 \times 100 \times 10}{100}\)

= ₹ 6,00,000

Discount = 7,20,000-6,00,000

=₹ 1,20,000

Rateof discount = \(\frac{1,20,000}{60,00,000} \times 100=2 \%\)

![]()

OR

William Pens Ltd. issued 10,000, 7% debentures of ₹100 each at a discount of ₹4. It has a balance in securities premium reserve of ₹25,000, It will write off discount on issue of debentures:

(a) ₹40, 000 from Securities Premium Reserve.

(b) ₹40,000 from Statement of Profit & Loss.

(c) ₹25,000 from Securities Premium Reserve and ₹15,000 from Statement of Profit & Loss.

(d) ₹15,000 from Securities Premium Reserve and ₹25,000 from Statement of Profit & Loss.

(c) ₹25,000 from Securities Premium Reserve and ₹15,000 from statement of Profit & Loss.

Explanation:

Reason: Because first discount will be written off from Securities Premium Reserve A/c and if still any discount amount is left to be adjusted, it will be adjusted from statement of profit & loss.

Question 7.

Reserve Capital is not a part of:

(a) Authorised Capital

(b) Subscribed Capital

(c) Unsubscribed Capital

(d) Issued Capital

Answer:

(c) Unsubscribed Capital

Explanation:

Reason: Reserve capital is the capital that a company decides to call from the shareholder at the time of its winding up. It means that the shareholder will pay the amount of unpaid capital when the company calls it to be paid. It also means that the company cannot call the capital that is unsubscribed capital.

Question 8.

X and Y are partners sharing profits equally. Z was manager who received the salary of ₹8,000 p.m. in addition to commission of 5% on net profit after charging such commission profit for the year is ₹13,56,000 before charging salary. Find the total remuneration of Z.

(a) ₹1,56,000

(b) ₹1,76,000

(c) ₹1,52,000

(d) ₹1,74,000

Answer:

(a) ₹1,56,000

The total remuneration of Z = salary + commission

= 96,000 + \(\frac{5}{105} \times(13,56,000-96,000)\)

= 96,000 + 60,000

= ₹1,56,000

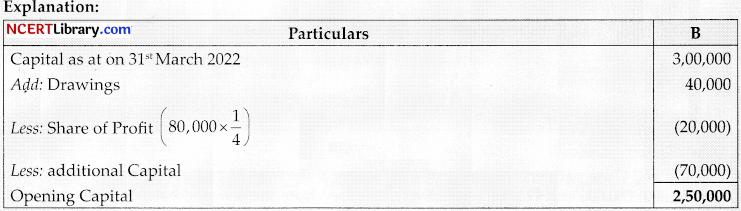

OR

A, B and C are partners sharing profit and losses in the ratio of 2 : 2 : 1. Their capital Accounts stand as ₹50,000; ₹50,000 and ₹25,000 respectively. B retired from the firm and balance in the general reserve on that date was ₹15,000. If goodwill of the firm’s ₹30,000 and profit on revaluation is ₹7,050, what amount will be transferred to B’s Loan A/c?

(a) ₹50,820

(b) ₹70,820

(c) ₹8,820

(d) None of these

Answer:

(b) ₹70,820

Read the following hypothetical situation, Answer Question No. 9 and 10.

Amar, Binod and Chaman are in trading Business of Jute. They have been sharing profits equally up to the year ended 31st March, 2020. The’ reconstituted the firm and profit sharing ratio was changed to 3 : 2: 1. Chaman being a working partner demanded that he should be paid annual salary of ₹75,000. The partners did not agree to the salary demanded by Chaman but agreed to give him minimum guaranteed profit of ₹60,000. Their capitals as on 1st April, 2020 were ₹5,00,000, ₹4,00,000 and ₹3,00,000 respectively. Profit for the year ended on 3Pt March 2021 was ₹3,00,000.

Question 9.

What will he the partners’ profit share if deficiency Chaman’s share is to be borne by Amar and Binod in the ratio of4 :1?

(a) ₹1,50,000, ₹90,000; ₹60,000

(b) ₹1,42,000, ₹98,000, ₹60,000

(c) ₹1,44,000, ₹96,000, ₹60,000

(d) ₹1,20,000, ₹1,20,000, ₹60,000

Answer:

(b) ₹1,42,000, ₹98,000, ₹60,000

Explanation:

Chaman’s share of profit will be 50,000 \(\left[3,00,000 \times \frac{1}{6}\right]\)

Deficiency = 60,000 – 50,000 = ₹10,000

To be borne by Amar and Binod in 4 :1.

Hence Amar will get = 1,50,000 – 8,000 = ₹1,42,000

Binod will get = 1,00,000 – 2,000 = ₹98,000

Question 10.

What will be partners profit shares, if Chaman’s share of profit is guaranteed after allowing interest on capital @ 6% p.a.

(a) ₹1,09,600; ₹56,400; ₹60,000

(b) ₹89,600; ₹76,400; ₹60,000

(c) ₹99,600; ₹66,400; ₹60,000

(d) ₹1,00,800; ₹67,200; ₹60,000

Answer:

(d) ₹1,00,800; ₹67,200; ₹60,000

Explanation:

Profit after interest on capital = ₹3,00,000 – 72,000 (interest) = ₹2,28,000

Chaman’s share of profit = ₹2,28,000 × \(\frac{1}{6}\) =₹38,000 [Thus it is less than guaranteed profit]

Profit after guaranteed profit = 2,28,000 – 60,000 = ₹1,68,000

[it will be distributed between Amar and Binod in 3 : 2]

Amar’s share = 1,68,000 \(\times \frac{3}{5}=₹ 1,00,800\)

Binod’s share = 1,68,000 \(\times \frac{2}{5}=₹ 67,200\)

Chaman’s share = 60,000

![]()

Question 11.

Relationship between the partners is of:

(a) Close relatives

(b) Agent and principal

(c) Junior & Senior

(d) Senior-subordinate relationship

Answer:

(b) Agent and principal

Question 12.

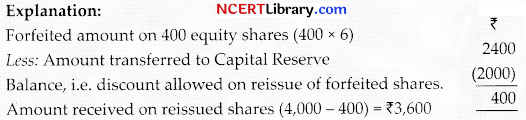

Apple Tree Ltd. had forfeited 1,000 equity shares of ₹10 each for non-payment of first and final call of ₹4 per share. It reissued 400 of these shares and transferred ?2,000 to capital reserve. Forfeited shares were reissued for:

(a) ₹800

(b) ₹3,200

(c) ₹3,600

(d) ₹2,400

Answer:

(c) ₹3,600

Question 13.

The excess value of net assets over purchase consideration at the time of purchase of a business is:

(a) Credited to the Capital Reserve

(b) Debited to the Goodwill Account

(d) Credited to the Vendor’s A/c

Answer:

(a) Credited to the Capital Reserve

Question 14.

X and Y are partners with capitals of ₹18,000 and 02,000 respectively. A new partner Z is admitted with \(\frac{1}{5}\) th share in profits. He brings ₹14,000 for his capital. Profit and Loss A/c has a credit balance of 10,000

on the date of Z’s admission. Value of Hidden goodwill will be:

(a) ₹16,000

(b) ₹25,000

(c) ₹20,000

(d) None of these

Answer:

(a) ₹16,000

Explanation:

Capital of firm on basis of Z’s share = 14,000 × \(\frac{5}{1}=₹ 70,000 \)

Existing Capital = [18,000 + 5,000 profit] + [12,000 + 5,000 (profit)] + 14,000

= ₹54,000

Hidden Goodwill = 70,000- 54,000 = ₹16,000

Question 15.

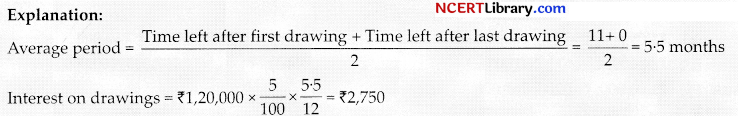

4ohan draws ₹10,000 p.m. on last day of every month for his personal use. If interest is to be charged @ 5% p.a. interest chargeable from him in accounting year will be:

(a) ₹3,250

(b) ₹2,750

(c) ₹3,000

(d) ₹3,500

Answer:

(b) ₹2,750

OR

Partner’s drawing account is closed:

(a) by transfer to credit side of the capital A/c

(b) by transfer to credit of current A/c

(c) Either (a) or (b)

(d) by transfer to debit side of capital or current A/c

Answer:

(d) by transfer to debit side of capital or current A/c

Question 16.

On the basis of following data, what final payment to a partner on firm’s dissolution will be made: debit balance of capital A/c 04,000. Share of his profit on realisation 03,000; Firms assets taken by him for 07,000.

(a) ₹31,000

(b) ₹29,000

(c) ₹12,000

(d) ₹60,000

Answer:

(c) ₹12,000

Explanation:

Payment to a partner = share of profit – debit balance of capital – value of firms assets taken by him.

= 43,000 -14,000 -17,000 = ₹12,000

Question 17.

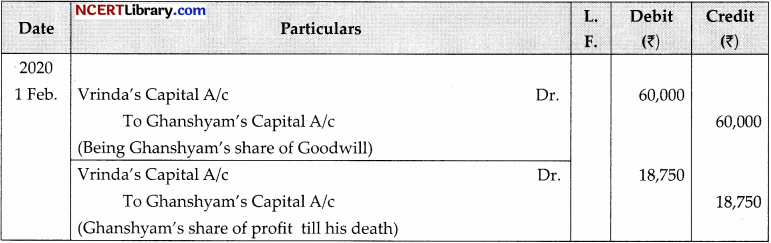

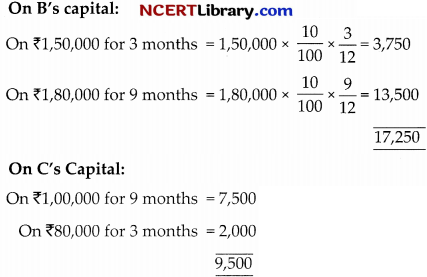

Ram, Ghanshyam and Vrinda were partner in a firm sharing profits in the ratio of 4 : 3 : 1. The firm loses its books on 31st March every year. On 1st Feb., 2020, Ghanshyam died and it was decided that the new profit-sharing ratio between Ram and Vrinda will be equal. The partnership deed provided for the following on the death of a partner:

(a) His share of goodwill be calculated on the basis of half of the profits credited to his account during the previous for completed years.

The firms profits for the last four years were:

| ₹ | |

| 2015-16 | 1,20,000 |

| 2016-17 | 80,000 |

| 2017-18 | 40,000 |

| 2018-19 | 80,000 |

(b) His share of profit in the year of his death was to be computed on the basis of the average profit of part two years. Pass necessary journal entries relating to goodwill and profit to be transferred to Ghanshyam’s Capital Account. Also show your working clearly.

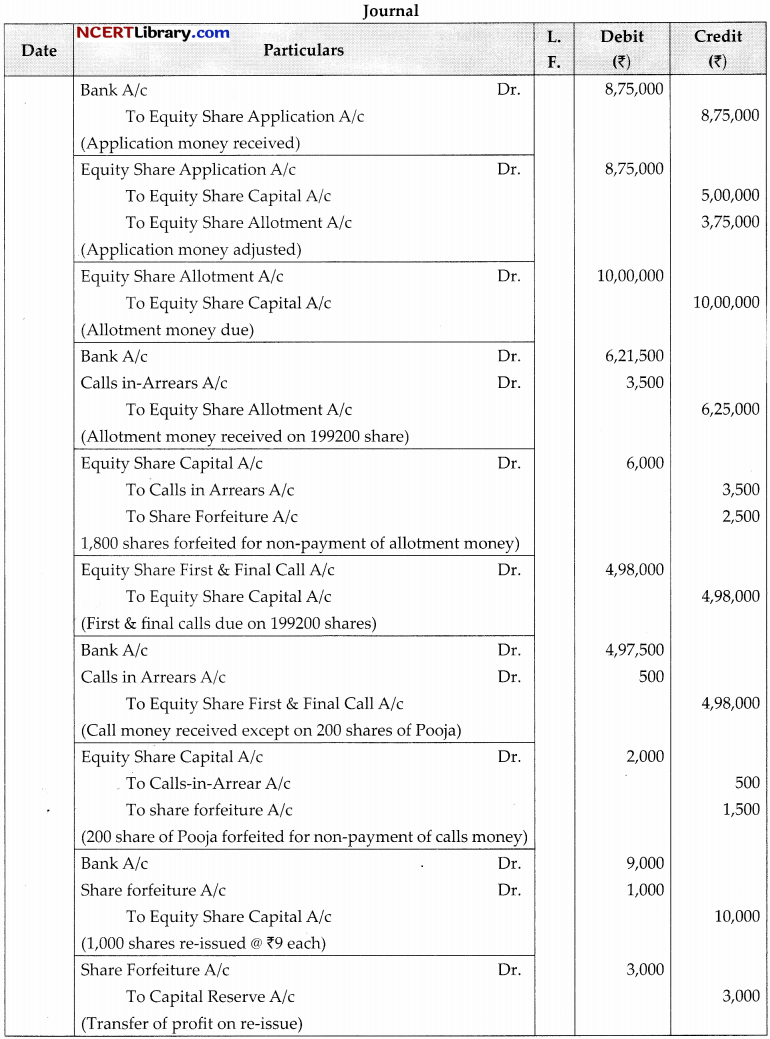

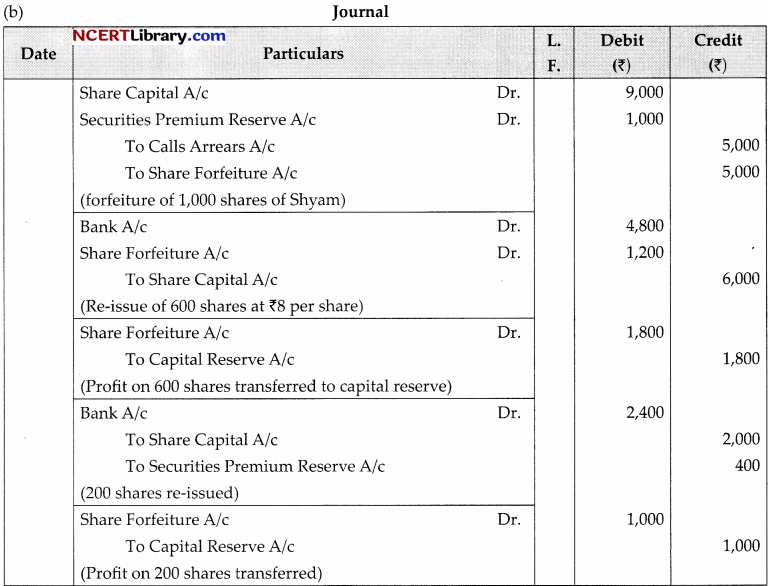

Answer:

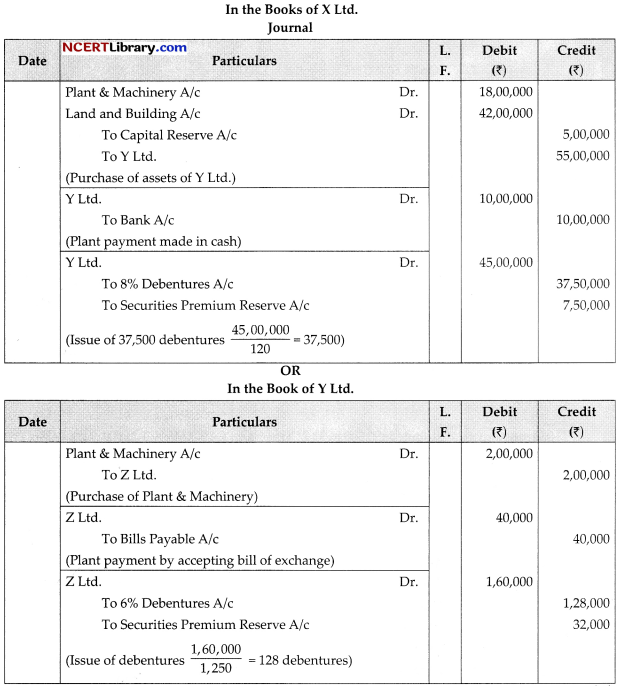

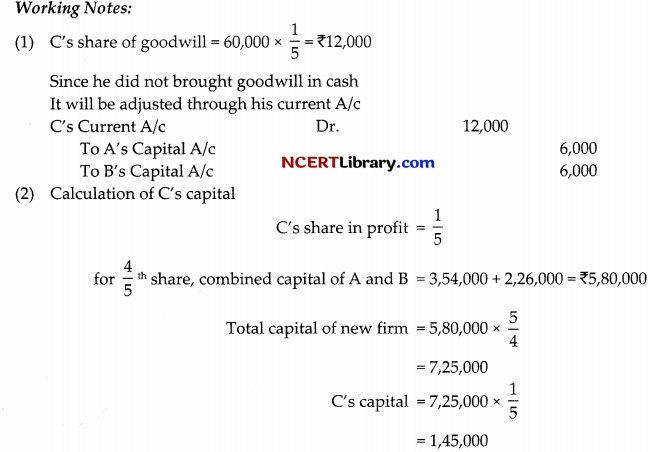

![]()

Working Note:

1. Calculation of Ghanshyam’s share of goodwill of total of 4 year’s profits

= 1,20,000 + 80,000 + 40,000 + 80,000 = ₹3,20,000

Ghanshyam’s share = 3,20,000 × \(\frac{3}{8}\) =₹1,20,000

His share of goodwill = 1,20,000 × \(\frac {3}{8}\) = ₹60,000

2. Calculation of Gaining ratio:

Ram’s Gain = \(\frac{1}{2}-\frac{4}{8}\) =0

Vrinda’s Gain = \(\frac{1}{2}-\frac{1}{8}=\frac{4-1}{8}=\frac{3}{8}\)

Only Vrinda gains

3. Ghanshyam’s share of profit’s till death

Average profit of part 2 years = \(\frac{40,000+80,000}{2}\) = ₹60,000

Profit for 10 months = (1st April 2019 to 1 Feb. 2020)

=60,000 × \(\frac{10}{12}\) = ₹50,000

Ghanshyam’s share = 50,000 × \(\frac{3}{8}\) = ₹18,750

Question 18.

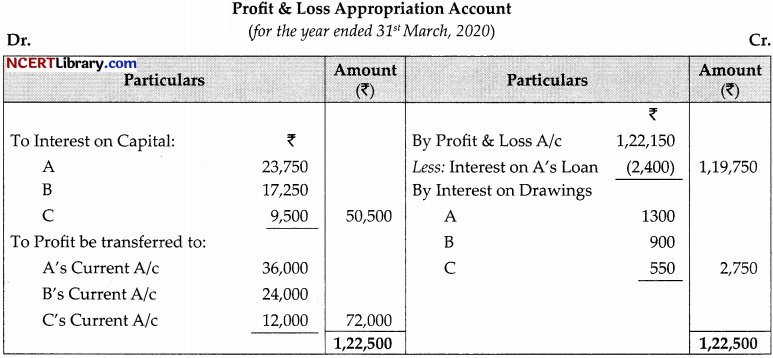

A,B,C are partners sharing profits and loss in the ratio of 3 : 2 :1. A withdraws ₹20,000 at the beginning of every month B withdraws ₹1500 in the middle of every month whereas ₹1,000 at the end of every month. Interest on capitals and drawings is to be charged @ 10% p.a. (is also to be allowed a salary of ₹800 per month. After deducting salary but before allowing any type of interest the profit for the year ending 31st March, 2020 was ₹1,22,150. Prepare Profit & Loss appropriation A/c from the information given below:

OR

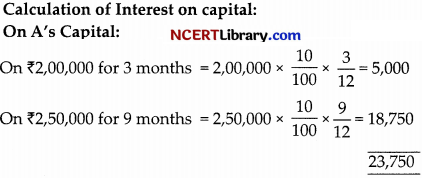

The partners of a firm distributed profits for the year ended 31st March, 2021, ₹90,000 in the ratio of 3:2:1 without providing for the following adjustments:

(i) A and B were entitled to a salary of ₹1,500 each per annum.

(ii) B was entitled to a commission of ₹4,500.

(iii) B and C had guaranteed a minimum profit of ₹35,000 p.a. to A.

(iv) Profits were to be shared in the ratio of 3 : 3 : 2.

Pass necessary journal entry.

Answer:

Working Notes:

Calculation of Interest on Drawings:

A= 24,000 × \(\frac{10}{100} \times \frac{6.5}{12}=₹ 1,300\)

B= 18,000 × \(\frac{10}{100} \times \frac{6}{12}=₹ 900\)

C= 12,000 × \(\frac{10}{100} \times \frac{5 \cdot 5}{12}=₹ 550\)

OR

Working Notes:

Profit after salary and commission = 90,000 – 3,000 – 4,500 = ₹82,500

A’s share = 82,500 × \(\frac{3}{8}\) = ₹30,938

Since A’s share is less than 35,000 he will be given minimum guaranteed amount of ₹35,000.

![]()

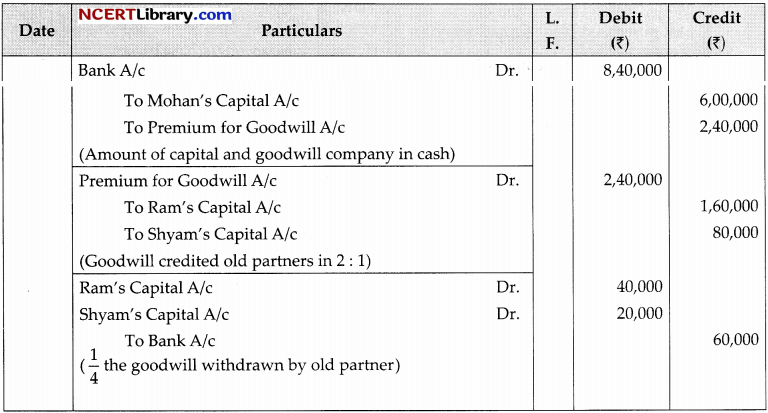

Question 19.

X Ltd. purchased assets of Y Ltd. as under plant and machinery of ₹20,00,000 at ₹18,00,000; Land and Buildings of ₹30,00,000 at ₹42,00,000 for purchase consideration of ₹55,00,000 and paid ₹10,00,000 in cash and remaining by issue of 8% debentures of ₹100 each at a premium of 20%. Record necessary entries in the books of X Ltd.

OR

Y Ltd. purchased plant & machinery for ₹2,00,000 from Z Ltd. 20% of amount was paid by Y Ltd. by accepting a bill of exchange in favour of Z Ltd. and the balance was paid by issuing 6% debentures of ₹1,000 each at a premium of 25% journalise the above transactions.

Answer:

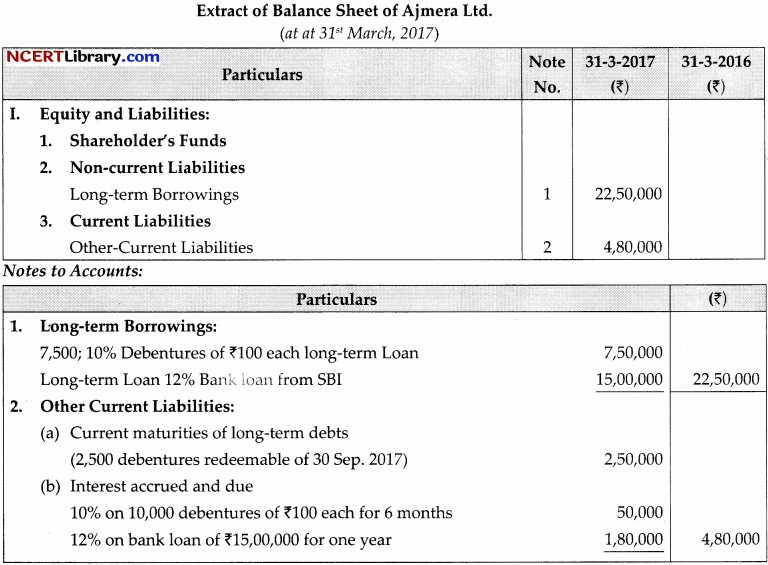

Question 20.

Ram and Shyam are partners. Their profit sharing ratio of is 3 : 2. Mohan joins the partnership for \(\frac{1}{4}\)th share’of profit is (of which he acquires \(\frac{2}{3}\) from Ram and \(\frac {1}{3}\) from Shyam). Mohan brings in ?6,00,000 for 1 capital and ₹2,40,000 for goodwill. \(\frac{1}{4}\)th of the amount of goodwill is withdrawn by old partners.

Answer:

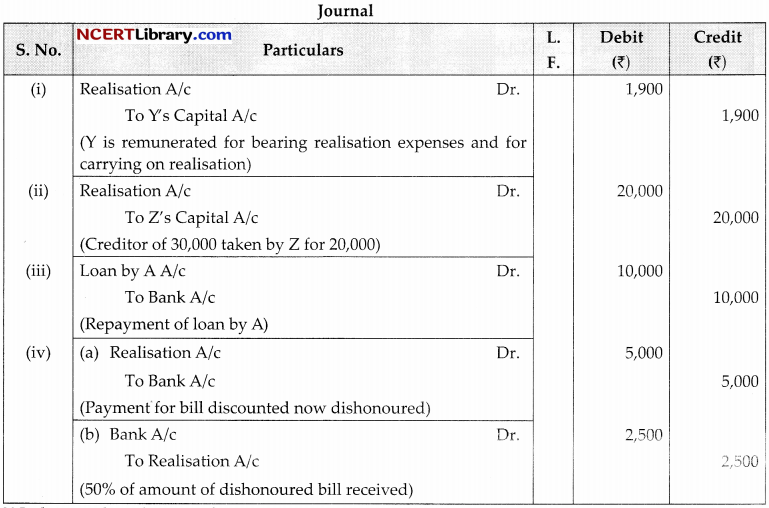

Question 21.

Ajmera Ltd. raised the following loans in the year 2016-17:

12% bank loan from SBI on 1st April 2016 : ₹15,00,000 10,000; 10% debentures of ₹100 each, redeemable at par in 4 equal yearly instalments on 1st October 2016: ₹10,00,000

The terms of the loans were:

(i) The redemption of debentures to begin from 30th September, 2017.

(ii) Interest on Bank loan to be paid annully but interest on debentures to be paid half yearly. The company had not paid the interest, both on the bank loan and on the debentures till the date of Balance Sheet. You are required to show the above items under equity and liabilities of the Balance Sheet of the company as at 31st March, 2017.

Answer:

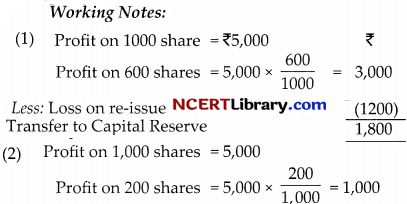

Question 22.

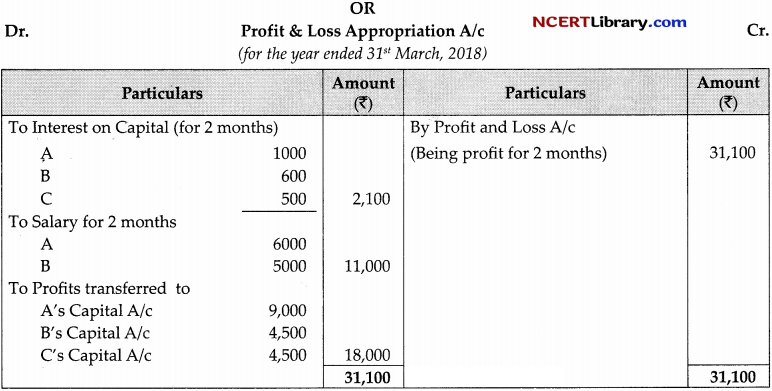

Pass the journal entries for the following transactions in the books of X,Y and Z sharing profits in the ratio of 3 : 2 :1 at the time of dissolution of the firm:

(i) Y a partner to bear realisation expenses agreed at ₹1,900. Actual expenses paid by Y were ₹1,500.

(ii) Z a partner agreed to pay a creditor of ₹30,000 for ₹20,000.

(iii) A partner had given loan to the firm of ₹10,000. It was repaid to him.

(iv) There was contingent liability of ₹37,000 in respect of bills discounted but not matured all the discounted bills were honoured but an acceptor of a bill of ₹5,000 became insolvent and 50 paise in a rupee was received. The liability of the firm on account of this bill discounted and dishonoured has not so for then recorded.

Answer:

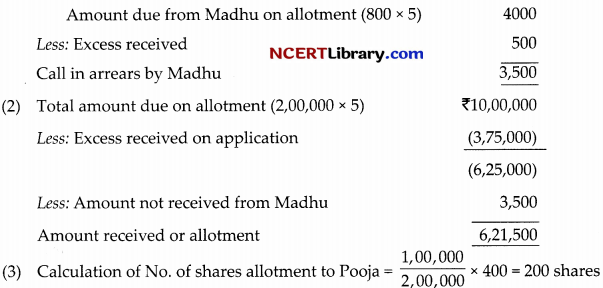

![]()

Question 23.

X Ltd. invited applications for issuing 2,00,000 equity shares of ₹10 each. The amount was payabl follows:

| ₹ | |

| On application | 2.50 |

| On allotment | 5.00 |

| On first & final call | 2.50 |

Applications for 3,50,000 shares were received and the allotment was made as follows:

| Category | Shares applied for | Shares allotted |

| I | 50,000 | 40,000 |

| II | 1,00,000 | 60,000 |

| III | 2,00,000 | 1,00,000 |

All the shares were allotted or a pro-rata basis and excess application money was adjusted towards sum due on allotment. Madhu, who belonged to category I and to whom 800 shares were allotted failed to pay the allotment money. Her shares were forfeited immediately after allotment was not received. Pooja who belonged to category III and who had applied for 400 shares, failed to pay the final call money. Here shares were forfeited after the final call. The forfeited shares were reissued @ ₹9 per share fully paid-up pass necessary journal entries in the books of X Ltd.

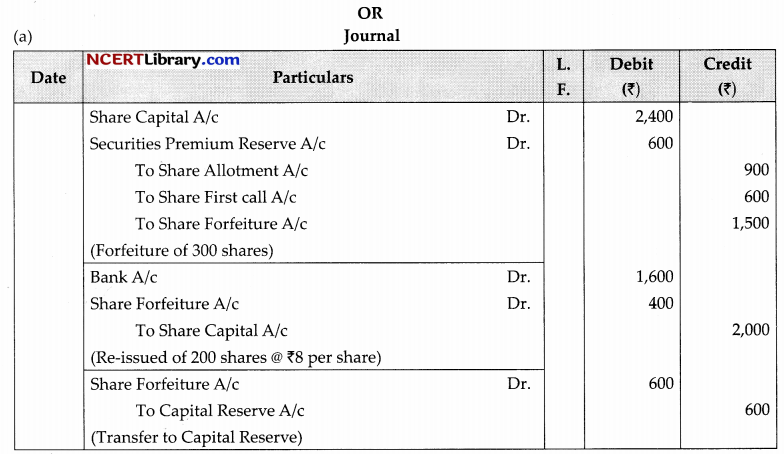

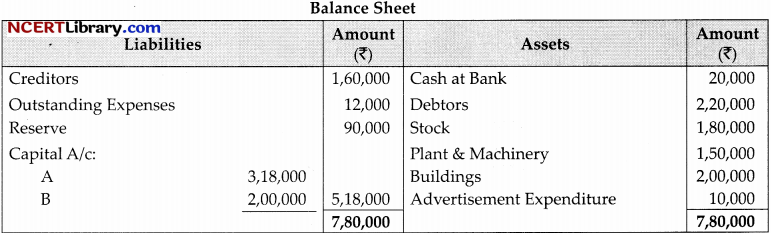

OR

Pass entries for forfeiture and reissue.

(a) A limited company forfeited 300 shares after. X who had applied for 500 shares on account of nonpayment of allotment money ₹3 + 2 (premium) and first call ₹2. Only ₹3 per share was received with application. Out of these, 200 shares were reissued to Mr. Y as fully paid in such a way that ₹600 were transferred to capital reserve.

(b) X Ltd. forfeited 1,000 shares of ₹10 each issued at 10% premium to Shyam (₹9 called up) on where he did not pay ₹3 of allotment (including premium) and first call of ₹2. Out of these, 600 shares were reissued to Ram as fully paid-up for ₹8 per share and 200 shares to Sham as fully paid up @ ₹12 at different intervals of time.

Answer:

Working Notes:

(i) Share applied for by Madhu = \(\frac{50,000}{40,000}\) × 800 on = 1000 shares.

Excess amount received from Madhu application = (1,000 – 800) shares

= 200 × 2.5 = ₹500

![]()

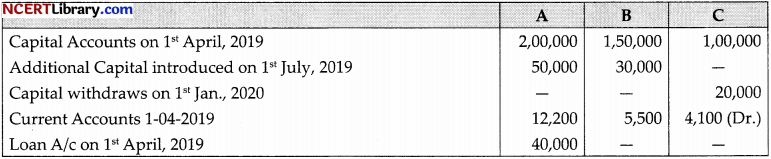

Question 24.

A and B are partners sharing profits and losses in the ratio of \(\frac {1}{2}\) and \(\frac {1}{3}\) and \(\frac {1}{6}\) carried to reserve A/c. They admit C as a partner on 1st April 2018 at which date the balancesheet of firm was as under:

Following terms were agreed upon:

(i) Stock is undervalued by 10%.

(ii) Depreciation of ₹30,000 has been omitted on plant and machinery for the year ended 31st March, 2018.

(iii) Creditors include a contingent liability of ₹50,000 which has been decided by the count at ₹43,000.

(iv) In respect of debtors, the following debts provide bad or doubtful:

₹15,000 due from Ram – bad to the full extent;

₹20,000 due from Shyam – insolvent, estate expected to pay only 40%.

(v) Goodwill of the firm is valued at ₹60,000. However (is unable to bring his share of goodwill in cash.

(vi) C is given \(\frac {1}{5}\) th share of profits which he acquires equally from A and B. C is to bring in capital proportionate to his share of profits in the firm. You are required to prepare Revaluation A/c, Partners Capital Account and new Balance Sheet.

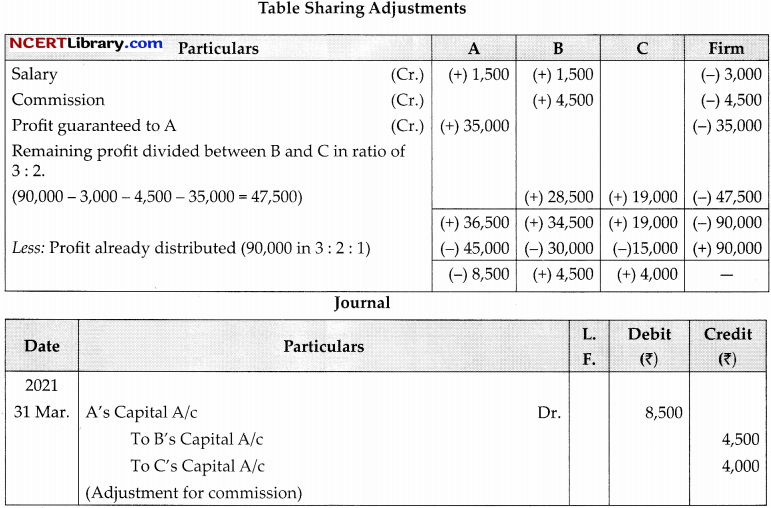

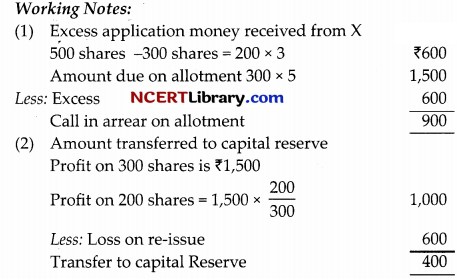

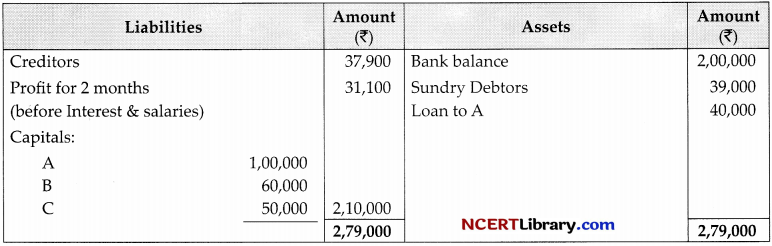

OR

A, B and C are partners sharing profits of 2: 1: 1. They closed their books on 31st March every year. A died on 31st May, 2018. B and C decided to share future profits in 3 : 2. On this date their Balance sheet was as follows:

According to the partnership deed:

(a) Interest on capital is allowed @ 6% p.a. A and B are entilled to salaries at ₹3,000 and ₹2,500 p.m.

(b) In the event of death of a partner goodwill was to be valued at 2 years purchase of average net profits of 3 completed years preceding death. The net profits for the years ending 31st March, 2016, 2017 and 2018 were ₹55,000, ₹48,000 and ₹65,000 respectively. A’s share was paid to his executors, B and C continued the firm.

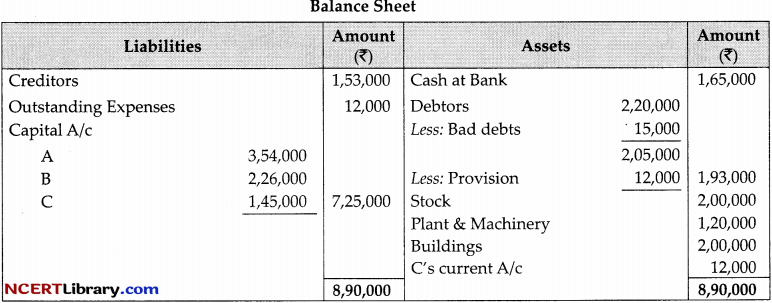

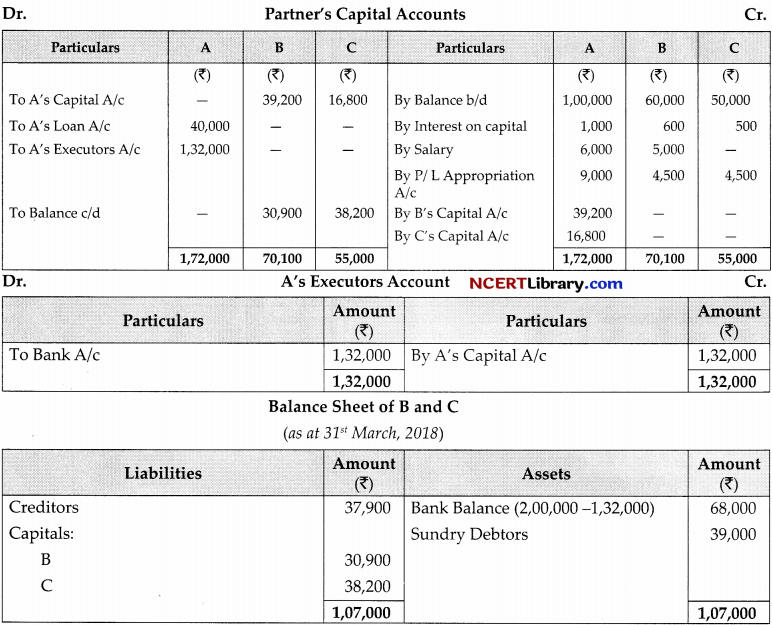

Prepare Profit & Loss A/c, Partners Capital A/c and Balance Sheet of B and C.

Answer:

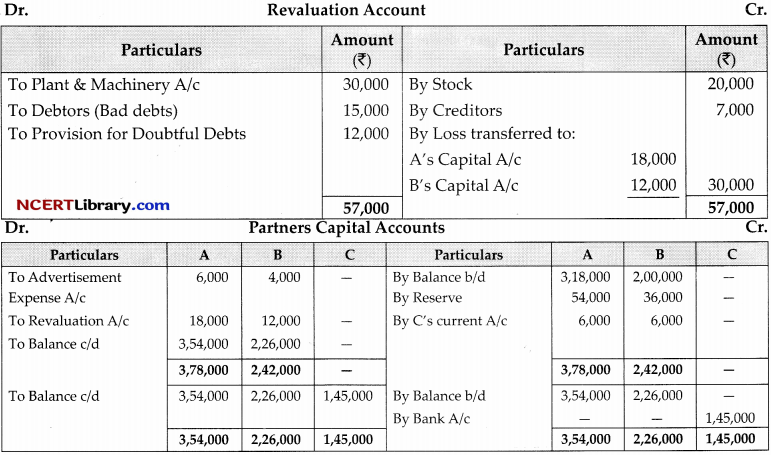

![]()

Working Notes:

Average Profit = \(\frac{55,000+48,000+65,000}{3}\) = ₹56,000

Goodwill at 2 years purchase = 56,000 × 2 = ₹1,12,000

A’s share of goodwill = 1,12,000 × \(\frac{2}{4}\) = ₹56,000

Question 25.

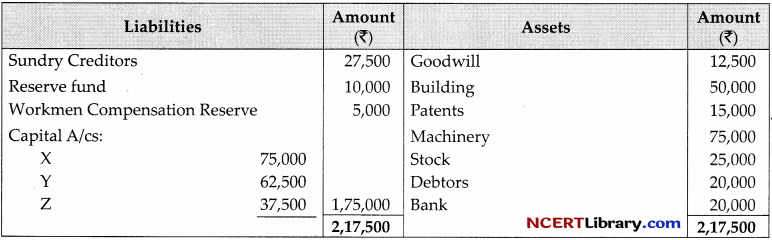

X, Y and Z were partners sharing profits and losses in the ratio of 5 : 3 : 2 respectively. On 31st March 2018 their balance sheet stood as under:

(a) Z died on 1st August 2018, it was agreed that goodwill be valued at \(2 \frac{1}{2}\) years purchase of average profits of last four years which were 2014-15 ₹32,500; 2015-16, ₹30,000; 2016-17 ₹40,000 and 2017-18 ₹37,500.

(b) Machinery be valued at ₹70,000; Patents; ₹20,000 and Buildings at ₹62,500.

(c) For the purpose of calculating Z’s share in profits upto the date of his death, the profits of 2018-19 should be taken to have been earned on the some scale as in 2017-18.

(d) As sum of ₹10,500 is to be paid immediately to the executor’s of Z and the balance to be paid in four equal half yearly instalments together with interest @ 10% p.a. Prepare Z’s capitals A/c and Z’s executor’s A/c for 2018-19.

Answer:

Z’s Capital Account

Working Notes:

Valuation of goodwill:

Total Profit = 32,500 + 30,000 + 40,000 + 37,500 = 71,40,000

Average Profit = \(\frac{1,40,000}{4}\)

= 35,000

Hence goodwill = 35,000 × \(\frac{5}{2}\) = 87,500

Z’s share of goodwill = 87,500 × \(\frac{2}{10}\) =17,500

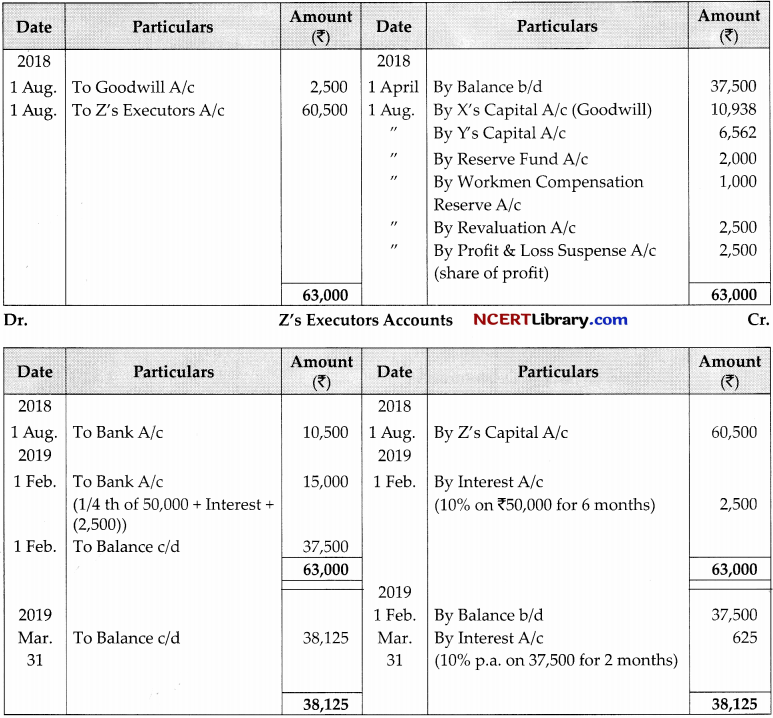

Question 26.

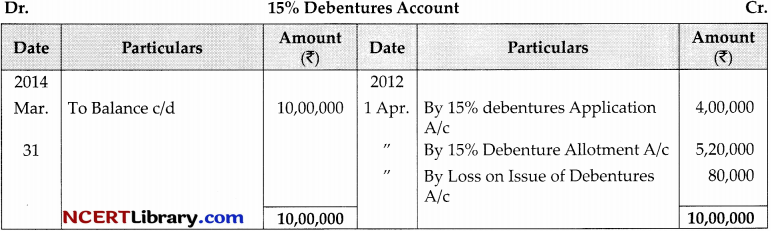

On 1st April 2013, Sunshine Ltd. issued, ₹10,00,000,15% debentures of ₹100 each at 8% discount payable: ₹4 on application The balance on allotment These debentures were to be redeemed at a premium of 5% after 5 years. All the debentures were subscribed for by the public. Interest on these debentures was to be paid half yearly which was duly paid by the company.

You are required to:

(i) Pass the journal enteries in the first year of debentures issue (including enteries for debentures interest)

(ii) Prepare the 15% debenture A/c for the year ending 31st March, 2014.

Answer:

Part – B

(Analysis of Financial Statement)

(Option-1)

Question 27.

Share application money (refundable) is shown as:

(a) Other Long-Term Liabilities

(b) Other Current Liabilities

(c) Short-term Provisions

(d) Short-term Borrowings

Answer:

(b) Other Current Liabilities

![]()

OR

Current Ratio of Vidur Pvt. Ltd. is 3 : 2. Accountant wants to maintain it at 2 : 1. Following options are available here:

(i) He can repay bills payable.

(ii) He can purchase goods on credit

(iii) He can take Short-term-loan

Choose the correct option:

(a) Only (i) is correct

(b) Only (ii) is correct

(c) Only (i) and (iii) are correct

(d) Only (ii) and (iii) are correct

Answer:

(a) Only (i) is correct

Question 28.

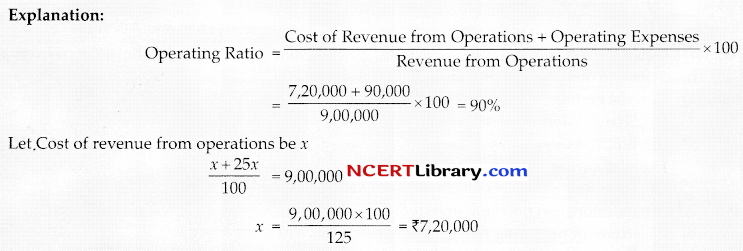

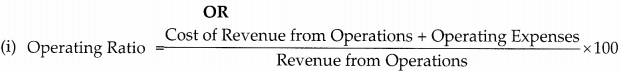

Revenue from Operation ₹9,00,000, Gross profit 25% on cost, Operating expenses ₹90,000, operating ratio will be:

(a) 100%

(b) 50%

(c) 90%

(d) 10%

Answer: (c) 90%

Question 29.

Exe. Ltd. has balance in Provision for Tax A/c of ?50,000 and ₹75,000 as on 31st March 2019 and 2020 respectively. It made a provision for tax during the year of ₹65,000. The amount of tax paid during the year was:

(a) ₹50,000

(b) ₹60,000

(c) ₹40,000

(d) ₹75,000

Answer:

(c) ₹40,000

Which of the following transactions will not result into flow of cash?

(a) Issue of equity shares of ₹1,00,000

(b) Purchase of machinery of ₹1,75,000

(c) Redemption of 9% debentures of ₹3,50,000

(d) Cash deposited into bank ₹15,000

Answer:

(d) Cash deposited into bank ₹15,000

Question 30.

GSC Ltd. purchased machinery of ₹10,00,000 issuing a cheque of ₹2,50,000 and 10% debentures of ₹7,50,000. In the cash flow statement, the transaction will be shown as:

(a) Outflow under Investing activity ₹10,00,000 inflow under financing activity as receipt for debentures ₹7,50,000 ‘

(b) Outflow under investing activity ₹2,50,000

(c) In flow of ₹7,50,000 as financing activity

(d) None of the above

Answer:

(b) Outflow under investing activity ₹2,50,000

Question 31.

Classify the following items under major heads and sub-heads (if any) in the balance sheet of a company as per schedule III of the, companies Act, 2013.

(i) Advances received from customers

(ii) Capital work in progress

(iii) Capital Reserve

(iv) Interest due on calls in arrears

(v) Loose tools

(vi) Deposit with customs authorities

| Item | Major head | Subhead |

| (i) | Current Liabilities | Other Current Liabilities |

| (ii) | Non-Current Assets | Property, Plant & Equipment (Fixed assets) Capital work on progress) |

| (iii) | Shareholders Fund | Reserves & Surplus |

| (iv) | Current Assets | Other Current Assets |

| (v) | Current Assets | Inventories |

| (vi) | Non-Current Assets | Long-term Loan and Advances |

Question 32.

(a) Name the two internal and two external parties interested in financial statement of a company.

(b) State two objectives of preparing financial statements.

Answer:

(a) Internal Parties.

(i) Shareholders

(ii) Employees

External Parties

(i) Creditors

(ii) Investors and potential investors

(b) Objectives of preparing financial statements are:

(i) To provide sufficient and reliable information to various parties interested in financial statements.

(ii) To assets effectiveness of management towards utilization of resources of business.

![]()

Question 33.

Calculate Trade Payables Turnover Ratio and Average Payables period (in days):

| Total purchases | ₹8,50,000 |

| Cash purchases | ₹1,00,000 |

| Purchases return | ₹50,000 |

| Creditors at the end of year | ₹1,60,000 |

| Creditors in beginning | ₹1,20,000 |

Answer:

Trade Payable Turnover Ratio = \(\frac{\text { Net Credit Purchases }}{\text { Average Trade Payables }}=\frac{7,00,000}{1,40,000}=5 \text { times. }\)

Average Payable Period = \(\frac{365}{\text { Trade Payable Turnover Ratio }}=\frac{365}{5}=73 \text { days. }\)

Working Notes:

Net Credit Purchases = Total Purchases – Cash Purchases – Purchases Return = 8,50,000 – 1,00,000 – 50,000 = ₹7,00,000

Average Trade Payables \(=\frac{\text { Opening Trade Payables }+\text { Closing Trade Payables }}{2}\)

= \(\frac{₹ 1,20,000+1,60,000}{2}=₹ 1,40,000\)

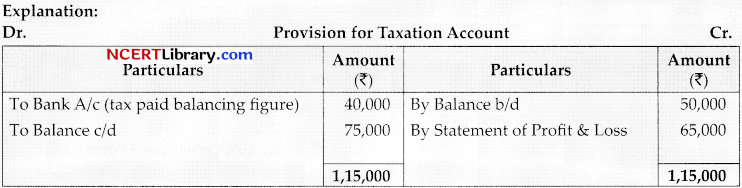

= \(\frac{13,20,000+2,20,000}{22,00,000} \times 100=\frac{15,40,000}{22,00,000} \times 100=70 \%\)

Working Notes:

Cash Revenue = 10,00,000

Credit Revenue = ₹12,00,000

Total revenue from operation = ₹22,00,000

Operating expenses = 10% of 22,00,000 = ₹2,20,000

Gross profit = 40% of 22,00,000 = ₹8,80,000

Cost of Revenue from operations = 22,00,000 – 8,80,000 = ₹13,20,000

(ii) Calculation of Inventory Turnover Ratio:

inventory Turnover Ratio \(=\frac{\text { Cost of Revenue from Operations }}{\text { Average Inventory }}\)

\(=\frac{13,20,000}{1,60,000}=8.25 \text { times }\)

Working Notes:

Average inventory \(=\frac{\text { Opening Inventory }+\text { Closing Inventory }}{2} \)

\(=\frac{1,50,000+1,70,000}{2}=1,60,000\)

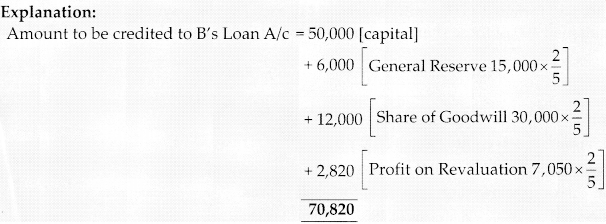

Question 34.

From the following particulars from Rajeshwar Ltd. calculate of:

(i) Cash flows from operating activities and

(ii) Cash flows from financing activities.

| Particulars | 31-3-2017 (₹) |

| Equity share capital | 6,00,000 |

| 18% Preference share capital | 4,00,000 |

| Securities premium reserve | 1,00,000 |

| 14% debentures | 2,00,000 |

| Discount on debentures | 5,000 |

| Underwriting commission on the issue of shares | – |

| Bank Overdraft | 1,00,000 |

| Interest on Bank Overdraft | 15,000 |

| Profit and loss balance | 3,50,000 |

Additional Information:

(i) Preference shares were redeemed on 31st March, 2018 at a premium of 5%. Such premium has been provided out of profit.

(ii) New shares and debentures were issued on March 31, 2018.

(iii) Dividend on preference shares was paid.

(iv) Proposed dividend on equity shares capital was: for 31st March 2018 @ 20% for 31st March 2017 @ 15%

Answer: