Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 1 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 1 with Solutions

Time: 2 Hrs.

Max. Marks: 40

General Instructions :

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts. Part A and Part B.

- Part- A is compulsory for all candidates.

- Part- B has two option i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Question 1 to 16 and 27 to 30 carries 1 mark each.

- Questions 17 to 20. 31 and 32 carries 3 marks each.

- Questions 21, 22 and 33 carries 4 marks each.

- Questions 23 to 26 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, and 2 questions of three marks. 1 question of four marks and 2 questions of six marks.

Part – A

(Accounting for Partnership Firms and Companies)

Question 1.

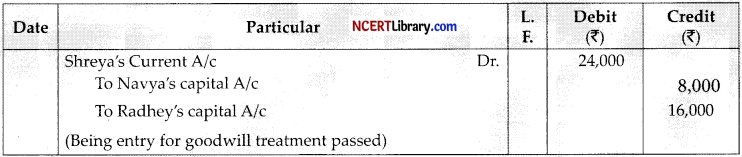

Navya and Radhey were partners sharing profits and losses in the ratio of 3: 1. Shreya was admitted for l/5th share in the profits. Shreya was unable to bring her share of goodwill premium in cash. The journal entry recorded for goodwill premium is given below: [1]

(a) 41: 7: 12

(b) 13: 12: 10

(c) 3: 1 :1

(d) 5 : 3: 2

Answer:

(c) 3 : 1: 1

Explanation:

Navya:Radhey = 3 : 1

Shreya’s share = \(\frac {1}{5}\)

Remaining share = 1 – \(\frac{1}{5}=\frac{4}{5}\)

Navya’s New share = Remaining share x Old share of Navya

= \(\frac{4}{5} \times \frac{3}{4}=\frac{12}{20}\)

Radhey’s New share = Remaining share × Old share

= \(\frac{4}{5} \times \frac{1}{4}=\frac{4}{20}\)

Shreya’s share = \(\frac{1}{5} \times \frac{4}{4}=\frac{4}{20}\)

New ratio = 12: 4 : 4 or 3: 1 : 1

![]()

Question 2.

Assertion (A): Commission provided to partner is shown in Profit and Loss A/c.

Reason: (R): Commission provided to partner is charge against profits and is to be provided at fixed rate. [1]

(a) (A) is correct but (R) is wrong

(b) Both (A) and (R) are correct, but (R) is not correct explanation of (A)

(c) Both (A) and (R) are incorrect.

(d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

Answer:

(c) Both (A) and (R) are incorrect.

Explanation:

Commission to payment is Appropriation of profit, Not change against profit.

Question 3.

A share of ₹10 each, issued at ₹4 premium out of which ₹7 (including ₹1 premium) was called up and paid up. The uncalled capital will be ………… [1]

(a) ₹7 per share

(b) ₹4 per share

(c) ₹8 per share

(d) ₹3 per share

Answer:

(b) 4 per share

OR

While issuing type of Debentures, company doesn’t give any undertaking for the repayment

of money borrowed by issuing such debentures.

(a) Zero Coupon Rate Debentures

(b) Non-Convertible Debentures

(c) Secured Debentures

(d) Non-Redeemable Debentures

Answer:

(d) Non-Redeemable Debentures

Explanation:

Only non-redeemable debentures are the debentures of which the company takes no undertaking for repayment of the sum borrowed.

Question 4.

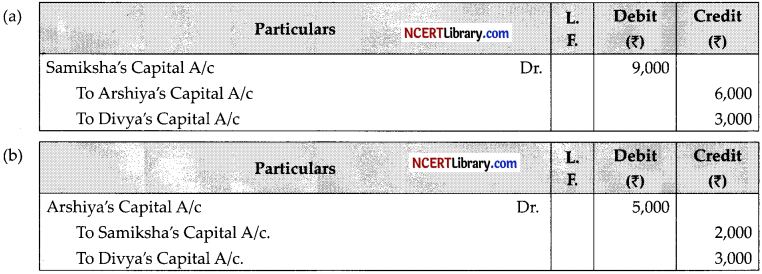

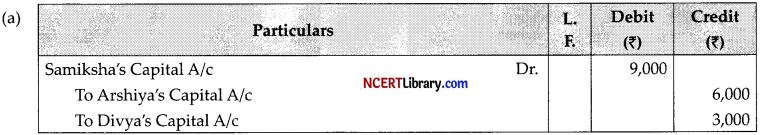

Saniiksha, Arshiya and Diva were parthers in a firm sharing profils and losses in the ratio of 5 : 3: 2. With effect from 1 April 2022, they agreed to share future profits and losses in the ratio of 2 : 5 :3. Their Balance Sheet showed a debit balance of 50,000 in the Profit and Loss Account and a balance of 40,000 in the Investment Fluctuation Fund. The market value of an investment is 30,000 against the book value of ‘50,000. Partners have decided, not to show revised valued in the balance sheet and to pass an adjusting entry for it. [1]

Which of the following is the correct treatment of the above?

Answer:

Explanation:

Explanation:

Old ratio = 5 : 3 : 2

New ratio = 2 : 5: 3

Sacrificing ratio = Old ratio – New ratio

Samiksha = \(\frac{5}{10}-\frac{2}{10}=\frac{3}{10}\) (sacrifice)

Arshiva = \(\frac{3}{10}-\frac{5}{10}=\frac{-2}{10}\) (gain)

Divya = \(\frac{2}{10}-\frac{3}{10}=\frac{-1}{10}\) (gain)

Net Effect:

The credit balance of Investment fluctuation Reserve (40,000-20,000) = 20,000

Debit Balance of Profit and Loss = (50,000) = 30,000

Samiksha’s share of loss = 30,000 × \(\frac {3}{10}\) = 9,000

Arshiya’s share = 30,000 × \(\frac {2}{10}\) = 6,000

Divya’s = 30,000 × \(\frac {1}{10}\) = 3,000

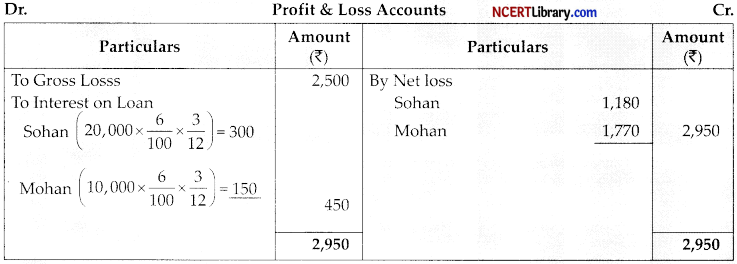

OR

Sohan and Mohan are partners sharing profits and losses in the ratio of 2: 3 with the capitals of ₹ 5,00000 and 6,00,000 respectively. On 1st January 2022, Sohan and Mohan granted loans of 20,000 and ₹ 10,000 respectively to the firm. Determine the amount of loss to be borne by each partner for the year ended 31 1st March 2022 if the loss before interest for the year amounted to ₹ 2,500.

(a) Share of Loss Sohan – ₹ 1,250 Mohan – ₹ 1,250

(b) Share of Loss Sohan – ₹ 1,000 Mohan -₹ 1,500

(c) Share of Loss Sohan – ₹ 820 Mohan – ₹ 1,230

(d) Share of Loss Sohan – ₹ 1,180 Mohan – ₹ 1,770

Answer:

(d) Share of Loss Sohan – ₹ 1,18O Mohan – ₹ 1,770

Explanation:

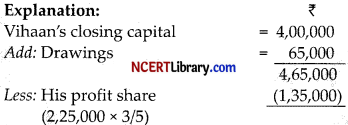

Question 5.

Vihaan and Mann are partners sharing profits and losses in the ratio of 3 : 2. The firm maintains fluctuating capital accounts and the balance of the same as on 3P March 2022 is ₹4,00,000 and ₹4,65,000 for Vihaan and Mann respectively. Drawings during the year were ₹65,000 each. As per the partnership deed, Interest on capital @ 10% p.a. on Opening Capital has been allowed to them. Calculate the Opening Capital of Vihaan given that the divisible profits during the year 2021-22 was 2,25,000. [1]

(a) ₹3,30,000

(b) ₹4,40,000

(C) ₹4,00,000

(d) ₹3,00,000

Answer:

(d) ₹3,00,000

Working Notes

Let Capital before interest = x

x + \(\frac {10x}{100}\) = 3,30,000

\(\frac {110}{100}\) = 3,30,000

x = \(\frac{30,000 \times 100}{10}\)

Interest on capital = \(\frac {10x}{100}\), x = ₹3,00,000

![]()

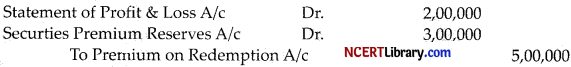

Question 6.

avitri Ltd. issued 50,000, 8% Debentures of ₹100 each at certain rate of premium and to be redeemed at 10% piemium. At the time of writing off Loss on Issue of Debentures, Statement of Profit and Loss was debited with ₹ 2,00,000. At what rate of premium, these debentures were issued? [1]

(a) 10%

(b) 16%

(c) 6%

(d) 4%

Answer:

(c) 6%

OR

Durga Ltd. issued 80,000, 10% Debentures of 100 each at certain rate of discount and were to be redeemed at 20% premium. Existing balance of Securities Premium before issuing of these debentures was ₹ 25,00,000 and after writing off Loss on Issue of Debentures, the balance in Securities Premium was ₹ 5,00,000. At what rate of discount, these debentures were issued?

(a) 10%

(b) 5%

(c) 25%

(d) 15%

Answer:

(b) 5%

Explanation:

Premium on redemption = 80,000 × 100 × \(\frac {20}{100}\) = ₹16,00,000

Loss on issue of debentures = ₹(25,00,000 – 5,00,000) = ₹20,00,000

Discount on issue of debentures = loss on issue – Premium on redemption

= 20,00,000 – 16,00,000 = ₹4,00,000

Rate of discount = \(\frac {4,00,000}{80,00,000}\) x 100 = 5%

Question 7.

Attire Ltd. issued a prospectus inviting applications for 12,000 shares of ₹ 10 each payable ₹ 3 on application, ₹ 5 on allotment and balance on call. Public had applied for certain number of shares and application money was received. Which of the following application money, if received restricts the company to proceed with the allotment of shares, as per SEBI guidelines? [1]

(a) ₹ 36,000

(b) ₹ 45,000

(c) ₹ 30,000

(d) ₹ 32,000

Answer:

(c) ₹ 30,000

Explanation:

As per SEBI guidelines, a company must receive at least 90% subscription of the issued share capital before making any allotment i.e. ₹30,000 is received on application it means people had applied for 10,000 shares only

\(\left(\frac{30,000}{3}=10,000\right)\) which is less than 90% of issued capital.

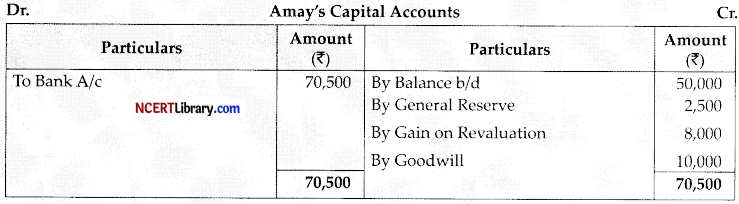

Question 8.

Amay, Bina and Chander are partners in a firm with capital balances of ₹50,000, ₹70,000 and ₹80,000 respectively on 31<sup>st</sup> March, 2022. Amay decides to retire from the firm on 31st March, 2022. With the help of the information provided, calculate the amount to be paid to Amay on his retirement. There existed a general reserve of ₹7,500 in the Balance Sheet on that date. [1]

The goodwill of the firm was valued at ₹30,000.

Gain on revaluation was ₹24,000.

(a) 88,500

(b) 90,500

(c) 5,375

(d) 70,500

Answer:

(d) 70,500

Explanation:

OR

A, B and C are partners. A’s capital is ₹3,00,000 and B’s capital is ₹1,00,000. C has not invested any amount as capital but he alone manages the whole business. C wants ₹30,000 p.a. as sa1ar though the deed is silent. Firm earned a profit of 1,50,000. How much will each partner receive as an appropriation of profits?

(a) A ₹60,000; ₹ 60,000; C ₹30,00

(b) A ₹90,000; B ₹30,000; C ₹30,000

(c) A ₹40,000; B ₹40,000 and C ₹70,000

(d) A ₹50,000; B ₹50,000 and C ₹50,000

Answer:

(d) A ₹50,000; B ₹50,000 and C ₹50,000

Explanation:

As the partnership deed is silent on salary and also partners had no agreed to it, the salary will not be provided to the individual. Thus A, B, C will get profit in the sharing ratio i.e. (1 : 1: 1).

![]()

Read the following hypothetical situation, Answer the Question no. 9 to 10.

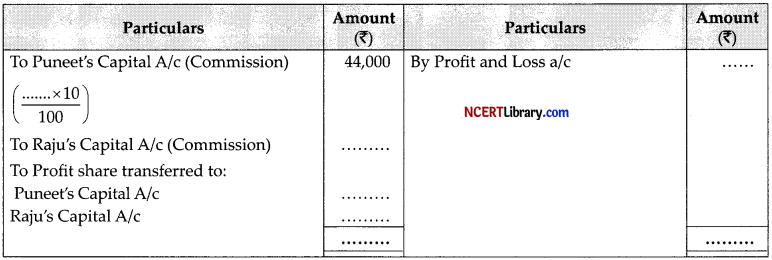

Puneet and Raju are partners in a clay toys-making firm. Their capitals were ₹5,00,000 and ₹10,00,000 respectively. The firm allowed Puneet to get a commission of 10% on the net profit before charging any commission and Raju to get a commission of 10% on the net profit after charging all commissions. Following is the Profit and Loss appropriation Account for the year ended 3Pt March 2022.

Dr. Profit and L.oss Appropriation Account Cr.

(for the year ended 31st March, 2022)

Question 9.

Raju’s commission will be: [1]

(a) ₹40,000

(b) ₹44,000

(c) ₹36,000

(d) ₹36,440

Answer:

(c) 36,000

Question 10.

Puneet’s share of profit will be: [1]

(a) ₹1,80,000

(b) ₹,44,000

(c) ₹2,16,000

(d) ₹1,60,000

Answer:

(a) ₹1,80,000

Explanation:

Divisible profit = 4,40,0000 – 44,000 – 36,000

Puneet’s share = 3,60,000 x \(\frac {1}{3}\) = 1,80,000

![]()

Question 11.

Choose the correct sequence of the following transactions in context of Division of Profits. [1]

(i) Guarantee by Firm to Partners

(ii) Guarantee by Partners to Firm

(iii) Transfer of Profits to Profit and Loss Appropriation Account

(iv) Guarantee by Partner to Partner

(a) (i); (iii); (iv); (ii)

(b) (iii); (i); (ii); (iv)

(c) (iii); (ii); (i); (iv)

(d) (ii); (iii); (iv); (i)

Answer:

(c) (iii); (ii); (i); (iv)

Question 12.

If 10,000 shares of 10 each were forfeited for non-payment of final call money of ₹3 per share and only 7000 shares were re-issued ₹11 per share as fully paid-up, then what is the amount of maximum possible discount that company can allow at the time of re-issue of the remaining 3,000 shares? [1]

(a) ₹28,000

(b) ₹21, 000

(c) ₹9,000

(d) ₹16,000

Answer:

(b) ₹21,000

Explanation:

Money received per share on first issue = 7

Maximum discount to be allowed on re-issue of shares 3000 x 7 = 21,000

Question 13.

As per Companies Act 2013, Securities Premium Balance can be untilised for which of the following purpose? [1]

(a) Issuing bonus to existing shareholders to convert partly paid-up into fully paid-up bonus shares.

(b) Providing for Premium payable on Redemption of Debentures.

(c) Writing off all Capitalised Expenditures.

(d) Buy Back of Debentures.

Answer:

(b) Providing for Premium payable on Redemption of Debentures.

![]()

Question 14.

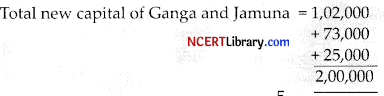

Ganga and Jamuna are partners sharing profits in the ratio of 2:1. They admit Saraswati for 1/5di share in future profits. On the date of admission, Ganga’s capital was ₹1,02,000 and Jamuna’s capital was ₹73,000. Saraswati brings ₹25,000 as her share of goodwill and she agrees to contribute proportionate capital of the new firm. How much capital will be brought by Saraswati? [1]

(a) ₹43,750

(b) ₹37,500

(c) ₹50,000

(d) ₹40,000

Answer:

(c) ₹50,000

Explanation:

Ganga : Jamuna = 2:1

Total new capital of Ganga and Jamuna

New capital of firm = 2,00,000 x \(\frac {5}{4}\)

Saraswati’s capital = 2,50,000 x \(\frac {1}{5}\) = 2,50,000

Question 15.

Green and Orange are partners. Green draws a fixed amount at the beginning of every month. Interest on drawings is charged @ 8% pa. At the end of the year interest on Green’s drawings amounts to ₹2,600. Monthly drawings of Green were: [1]

(a) ₹8,000

(b) ₹60,000

(c) ₹7,000

(d) ₹5,000

Answer:

(d) ₹5,000

Explanation:

Let total amount drawn by green ben x

2,600 = x × \(\frac{8}{100} \times \frac{6.5}{12}\)= x = ₹60,000

Monthly drawings = \(\frac {60,000}{12}\) = ₹25,000

OR

Girdhar, a partner withdrew ₹5,000 in the beginning of each quarter and interest on drawings was calculated as ₹1,500 at the end of accounting year 31 March 2022. What is the rate of interest on drawings charged?

(a) 6% pa.

(b) 8% pa.

(c) 10% p.a.

(d) 12% p.a.

Answer:

(d) 12% p.a.

![]()

Explanation:

Let Rate of interest be x

Average period = \(\frac{12+3}{2}=\frac{15}{2}\) = 7.5 months

1500 = (5000 × 4) × \(\frac{x}{100} \times \frac{7.5}{12}\) = 12%

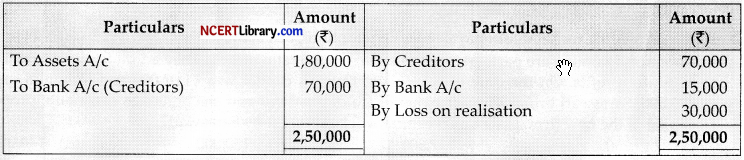

Question 16.

At the time of dissolution of a firm, Creditors are ₹70,000; Firm’s capital is ₹1,20,000; Cash Balance is ₹10,000. other assets realised ₹1,50,000. Gain/Loss in the realisation account will be: [1]

(a) ₹30,00 (Gain)

(c) ₹40,000 (Loss)

(b) ₹40,00 (Gain)

(d) ₹30,000 (Loss)

Answer:

(d) ₹30,00 (Loss)

Explanation:

Value of assets = (Capital + Creditor – Cash Balance)

= 70,000 + 12,000-10,000 = 72,000

Realization Account

Question 17.

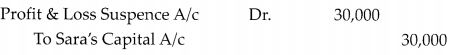

Nirmala, Divisha and Sara were partners in the firm sharing profits and losses in the 3: 4 : 3, Books were closed on 31St March every year. Sara died on 1S1 February 2022. As per the partnership deed Sara’s executors are entitled to her share of profit till the date of death on the basis of Sales turnover. Sales for the ‘ear ended 31st March 2021 was ₹10,00,000 and profit for the same year was ₹1,20,000. Sales show a positive trend of 20% and percentage of profit earning is reduced by 2%. [3]

Journalize the transaction along with the working notes.

Answer:

(Being Sara’s share of profit transferred to her capital A/c)

Working Note:

Last year sales turnover = 10,00,000

Profit for last ‘ear = 1,20,000

Profit % = \(\frac {Profit}{ Sales}\) × 100

= \(\frac{1,20,000}{10,00,000}\) × 100 = 12%

Current year sales increased by 20% = 10,00,000 × \(\frac {20}{100}\)

= 10,00,000 + 2,00,000 = ₹12,00,000

Current year profit reduced by 2% = 12 – 2% = 10%

Sara’s share of profit (till her death) = 12,00,000 × \(\frac{10}{100} \times \frac{10}{12} \times \frac{3}{10}\) = ₹30,000

![]()

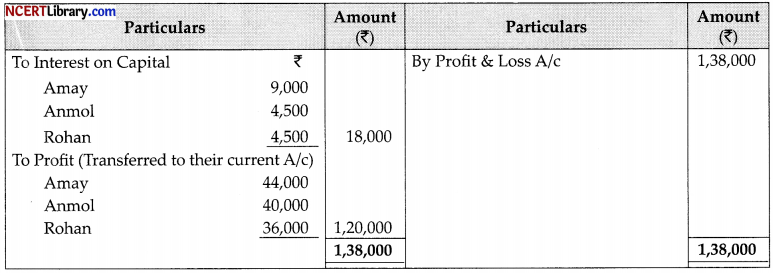

Question 18.

Ama Anmol and Rohan entered into a partnership on 1<sup>st</sup> July, 2021 to share profits and losses in the

ratio of 3 : 2: 1. Amay guaranteed that Rohan’s share of profit after charging interest on capital @ 6% p.a would not be less than ₹36,000 p.a. Their fixed capital balances are: ₹2,00,000, ₹1,00,000 and ₹1,00,000 respectively. Profit for the year ended 3l March, 2022 was 1,38,000. [3]

Prepare Profit and Loss Appropriation A/c.

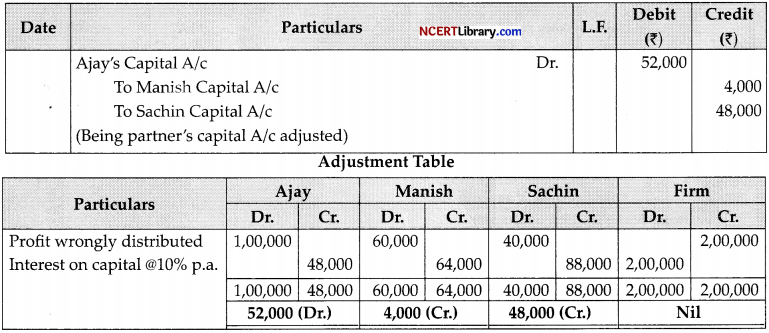

OR

Aja Manish and Sachin were partners sharing profits in the ratio 5 : 3: 2. Their capitals were ₹6,00,000; ₹8,00,000 and ₹11,00,000 as on April 01, 2021. As per partnership deed, Interest on Capitals were to be provided @ 10% p.a. For the year ended March ₹31, 2022, Profits of ₹2,00,000 were distributed without providing for Interest on Capitals. Pass an adjustment entry and show the workings clearly.

Woking Notes:

Interest on Capitals

Amay = ₹2,00,000 × 6% × \(\frac {9}{12}\) = ₹9,000

Anmol = ₹1,00,000 × 6% × \(\frac {9}{12}\) = ₹4,500

Rohan = ₹1,00,000 × 6% = \(\frac {9}{12}\) = ₹4,500

Guarantee = ₹36,000 × \(\frac {9}{12}\) = ₹27,000

Profit sharing

(i) Amay = 1,20,000 × \(\frac {3}{6}\) = ₹60,000

Less: Guarantee share = 16,000 = 44,000

(ii) Anmol = 1,20,000 × \(\frac {2}{6}\) = 40,000

(iii) Rohan = 1,20,000 × \(\frac {1}{6}\) = 20,000

Working Note:

Ajay’s Interest on capital = 60,000

Manish’s Interest on capital = 80,000

Sachin’s Interest on capital = 1,10,000

Total Interest on capital for the partners = 2,50,000

Available profit only ₹2,00,000 [as profit’s, less, then profit will be distributed in the ratio of interest on capital.]

So, New Adjustment ratio = 6 : 8 : 11

Ajay’s Interest = 2,00,000 × \(\frac {6}{25}\) = 48,000

Manish’s Interest = 2,00,000 × \(\frac {8}{25}\) = 64,000

Sachin’s Interest = 2,00,000 × \(\frac {11}{25}\) = 88,000

![]()

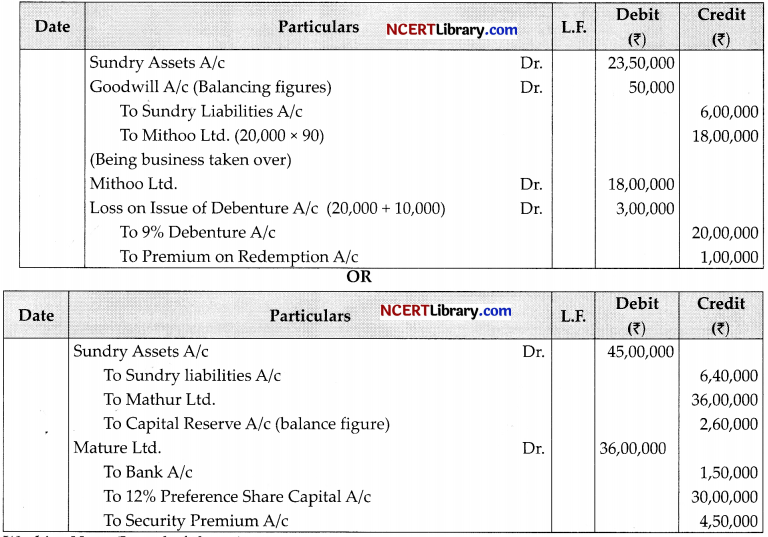

Question 19.

Anthony Ltd. issued 20,000, 9% Debentures of ₹100 each at 10% discount to Mithoo Ltd. from whom Assets of ₹23,50,000 and Liabilities of ₹6,00,000 were taken over. Pass entries in the books of Anthony Ltd. if these debentures were to be redeemed at 5% premium. [3]

OR

Random Ltd. took over running business of Mature Ltd. comprising of Assets of ₹45,00,000 and Liabilities of ₹6,40,000 for a purchase consideration of ₹36,00,000. The amount was settled by bank draft of ₹1,50,000 and balance by issuing 12% preference shares of f100 each at 15% premium. Pass entries in the books of Random Ltd.

Answer:

Workinç Note: (Issued of shares)

Security Premium = 36,00,000 – 1,50,000 = 34,50,000 × \(\frac {15}{115}\) = ₹4,50,000

Question 20.

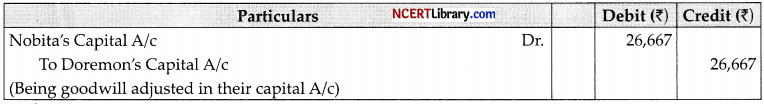

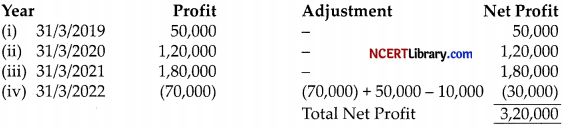

Doremon, Shinchan and Nobita are partners sharing profits and losses in the ratio of 3:2:1. With effect from 1st April 2022 they agree to share profits equally. For this purpose, goodwill is to be valued at two year’s purchase of the average profit of last four years which were as follows: [3]

Year ending on 31st March,2019 = ₹50,000 (Profit)

Year ending on 31st March,2020 = ₹1,20,000 (Profit)

Year ending on 31st March,2021 = ₹1,80,000 (Profit)

Year ending on 31st March,2022 = ₹70,00 (Loss)

On 1st April, 2021 a Motor Bike costing ₹50,00 was purchased and debited to the traveling expenses account, on which depreciation is to be charged @ 20% p.a by Straight Line Method. The firm also paid an annual insurance premium of ₹20,000 which had already been charged to Profit and Loss Account for all the years. Journalize the transaction along with the working notes.

Answer:

Working Note:

Calculate of Goodwill

Average Profit = 3,20,000/4 = ₹80,000

Goodwill = 80,000 x 2 = ₹1,60,000

A’s share = 1,60,000 x 1/6 = ₹26,667

Calculate sacrificing ratio

Old ratio = 3:2: 1

New ratio = 1: 1: 1

Sacrificing ratio = Old ratio – New ratio

Doremon= \(\frac{3}{6}-\frac{1}{3}=\frac{3-2}{6}=\frac{1}{6}\) (sac.)

Shinchari = \(\frac{2}{6}-\frac{1}{3}=\frac{2-2}{6}\) = 0

Nobita = \(\frac{1}{6}-\frac{1}{3}=\frac{1-2}{6}=\frac{-1}{6}\) (sain)

![]()

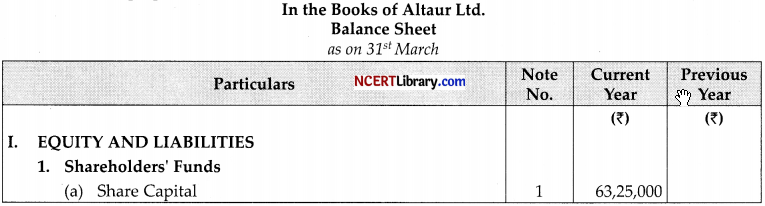

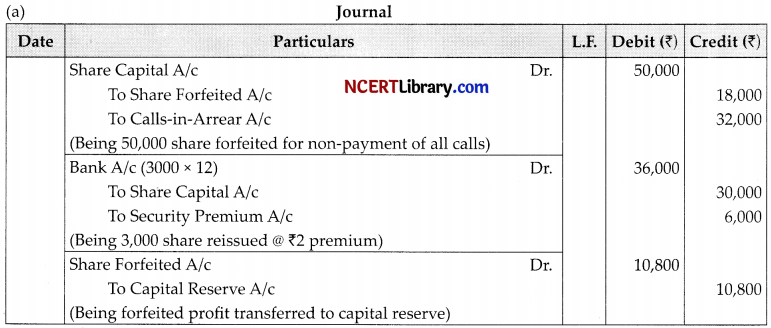

Question 21.

Altaur Ltd. was registered with an authorized capital of ₹4,00,00,000 divided in ₹25,00,000 Equity Shares of 10 each and ₹1,50,000, 9% Preference Shares of f100 each. The company issued ₹8,00,000 Equity Shares for public subscription at 20% premium, payable ₹3 on the application: ₹7 on the allotment (including premium) and balance on call. Public had applied for 10,00,00 shares. Excess Applications were sent letters of regret.

All the dues on allotment received except on 15,000 shares held by Sanju. Another shareholder Rocky paid his call dues along with allotment on his holding of 25,000 shares. You are required to prepare the Balance Sheet of the company as per Schedule III of Companies Act, 2013, showing Share Capital balance and also prepare Notes to Accounts. [4]

Answer:

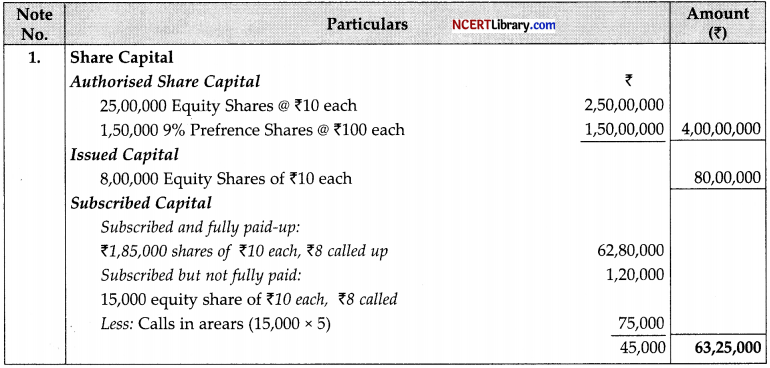

Question 22.

Charu, Dhwani, Iknoor and Paavni were partners in a firm. They had entered into partnership firm last year only, through a verbal agreement. They contributed capitals in the firm and to meet other financial requirements, few partners also provided loan to the firm. Within a year, their conflicts arisen due to certain disagreements and they decided to dissolve the firm. The firm had appointed Ms. Kavya, who is a financial advisor and legal consultant, to carry on the dissolution process. In the first instance, Ms. Kavya had transferred various assets and external liabilities to Realisation A/c. Due to her busy schedule; Ms. Kavya has delegated this assignment to you, being an intern in her firm. On the date of dissolution, you have observed the following transactions: [4]

(i) Dhwani’s Loan of ₹50,000 to the firm was settled by paying ₹42,000

(ii) Paavni’s Loan of ₹40,000 was settled by giving an unrecorded asset of ₹45,000

(iii) Loan to Charu of ₹60,000 was settled by payment to Charu’s brother loan of the same amount.

(iv) Iknoor ‘s Loan of ₹80,000 to the firm and she took over Machinery of ₹60,000 as part payment.

You are required to pass necessary entries for all the above mentioned transactions.

Answer:

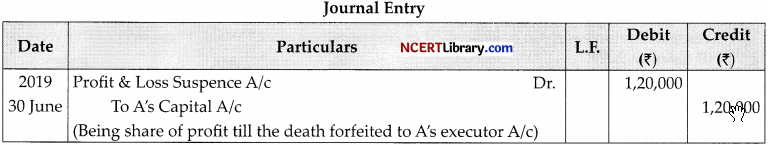

Question 23.

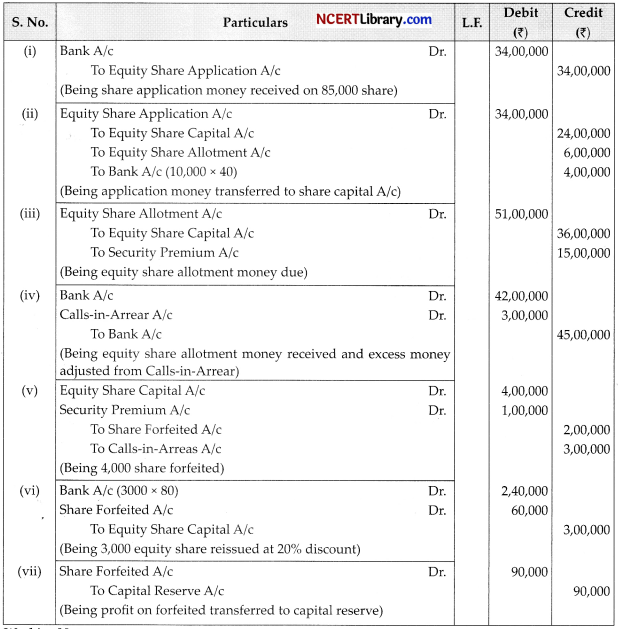

OTUA Ltd. was registered with an authorized capital of 2,00,000 equity shares of ₹100 each. The company offered 60,000 shares for public subscription at 25% premium. The share was payable as ₹40 on application and balance on allotment, with premium. Public had applied for 85,000 shares. Pro-rata allotment was made in the ratio of 5 : 4 and remaining applications were sent letters of regret. [6]

Mr. Anand holding 4,000 shares failed to pay allotment money and his shares were forfeited. Out of these 3,000 shares were re-issued at a discount of ₹20 per share. Pass necessary entries in the books of the OTUA Ltd.

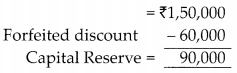

OR

Pass entries for torfeiture and re-issue in both the following cases.

(a) Vikram Ltd. forfeited 5,000 shares of Rahul, who had applied for 6,000 shares for non-payment of allotment money of ₹5 per share and first and final call of ₹2 per share. Only application money of ₹3 was paid by him. Out of these 3,000 shares were re-issued ₹l2 per share as fully paid.

![]()

(b) Ratan Ltd. forfeited 3,000 shares of ₹10 each (issued at ₹2 premium) for non-payment of first call of ₹2 per share. Final call of ₹3 per share was not yet made. Out of these 2,000 shares were re-issued at ₹10 per share as fully paid.

Answer:

Working Note:

Share Application Money Received = 85,000 × 40 = 34,00,000

Share Application Money Due = 60,000 × 40 = 24,00,000

Allotment was made on 5 : 4 basis that means = 80%

So for 60,000 Alloted share applications were = 60,000 x \(\frac {100 }{80}\) = 75,000 shares

Excess shares were rejected = 85,000 shares – 75,000 shares = 10,000 shares

Calls-in-Arrear

Shares applied by Mr. Anand = 4,000 × \(\frac {100 }{80}\) = 5,000 shares

Excess Application Money of Mr. Anand = 5,000 share – 4,000 share

= 1,000 share x ₹40 (application) = ₹40,000

Arrear Amount =4,000 x 85 = 3,40,000 – 40,000 = ₹3,00,000

Capital Reserve

Forfeited amount for 4,000 shares = ₹2,00,000

Working Note:

On 5,000 shares forfeited amount = 18,000

On 3,000 shares forfeited amount = \(\frac {18,000 }{5,000}\) x 3,000

Capital Reserve = 10,800

Working Note:

On 3,000 shares forfeited amount = 15,000

On 2,000 shares forfeited amount = \(\frac {15,000 }{3,000}\) x 2,000

Capital Reserve = 10,000

![]()

Question 24.

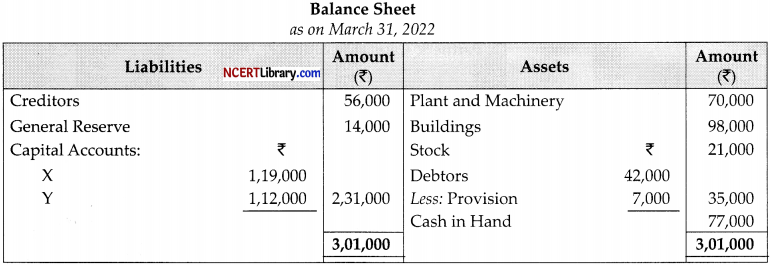

X and Y were parthers in the profit-sharing ratio of 3: 2. Their balance sheet as on March 31, 2022 was as

follows: [6]

Z was admitted for l/6th share on the following terms:

- Z will bring ₹56,000 as his share of capital, but was not able to bring any amount to compensate the

sacrificing partners. - Goodwill of the firm is valued at ₹84,000

- Plant and machinery were found to be undervalued by ₹14,000. Building was to brought up to ₹1,09,000.

- All debtors are good.

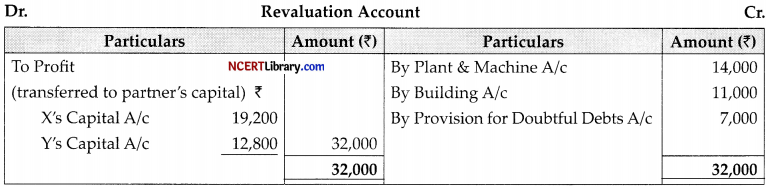

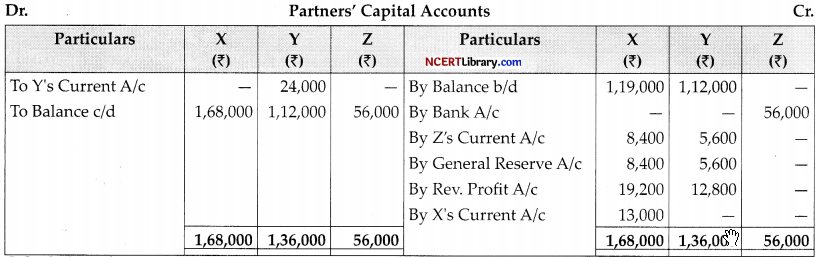

- Capitals of X and Y will be adjusted on the basis of Z’s share and adjustments will be done by opening necessary’ current accounts. You are required to prepare revaluation account and a partner’s capital account.

OR

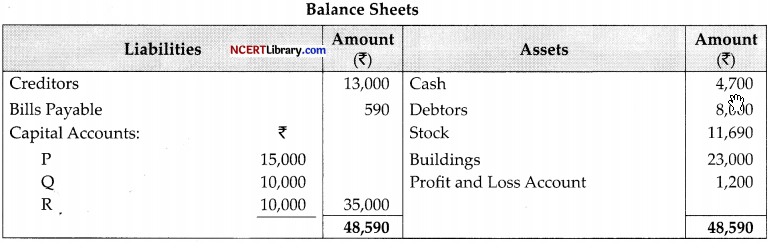

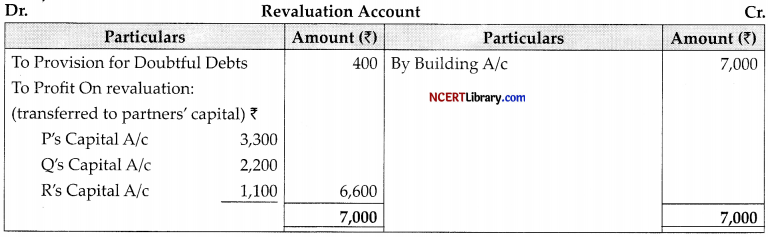

P, Q, and R were partners in a firm sharing profits in the ratio of 3; 2: 1 respectively. On March 31st, 2022,

the Balance Sheet of the firm stood as follows:

Answer:

Q retired on the abovementioned date on the following terms:

- Buildings to be appreciated by ₹7,000

- A provision for doubtful debts to be made at 5 % on debtors.

- Goodwill of the firm is valued at ₹8,000 and adjustment to be made by raising and writing off the goodwill.

- ₹2,800 was to be paid to Q immediately and the balance in his capital account to be transferred to his loan account carrying interest as per the agreement.

- Remaining partner decided to maintain equal capital balances, by opening current account. Prepare the revaluation account and partners’ capital accounts.

Calculation of New Ratio

Z’s share = 1/6

Remaining share = 1 – 1/6 = 5/6

X’s New share = Remaining share x Old share = \(\frac{5}{6} \times \frac{3}{5}=\frac{15}{30}\)

Y’s New share = \(\frac{5}{6} \times \frac{2}{5}=\frac{10}{30}\)

Z’sNews hare = \(\frac{1}{6} \times \frac{5}{5}=\frac{5}{30}\)

New ratio = 15 : 10: 5 = 3 : 2 : 1

Total capital = 56,000 × 6 = 3,36,000

X’s capital = 3,36,000 × \(\frac {3}{6}\) = ₹1,68,000

Y’scapital=3,36,000 × \(\frac {2}{6}\) = ₹1,12,000

Z’s capital = 3,36,000 × \(\frac {1}{6}\) = ₹56,O00

OR

Question 25.

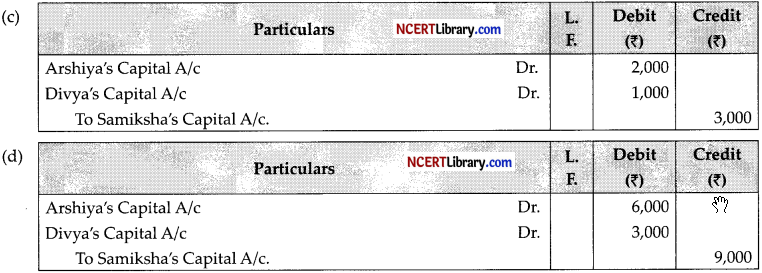

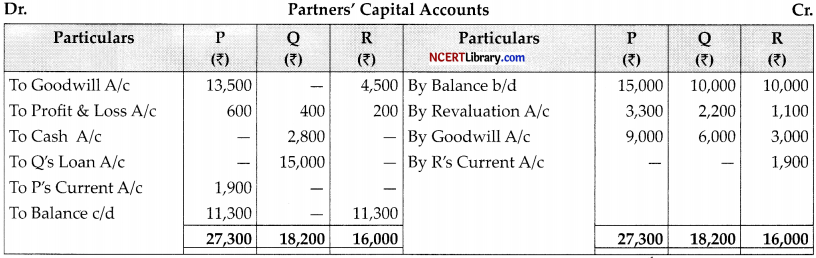

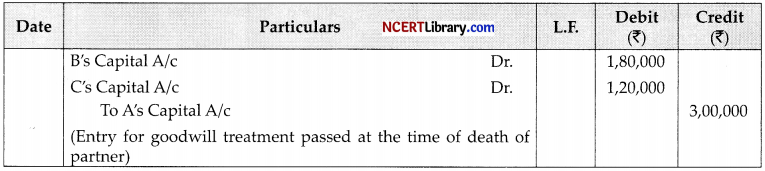

A, B and C were partners sharing Profit & Loss in the ratio 5: 3: 2. A died on 30th June, 2019. Entry for treatment of goodwill after his death was passed as follows: [6]

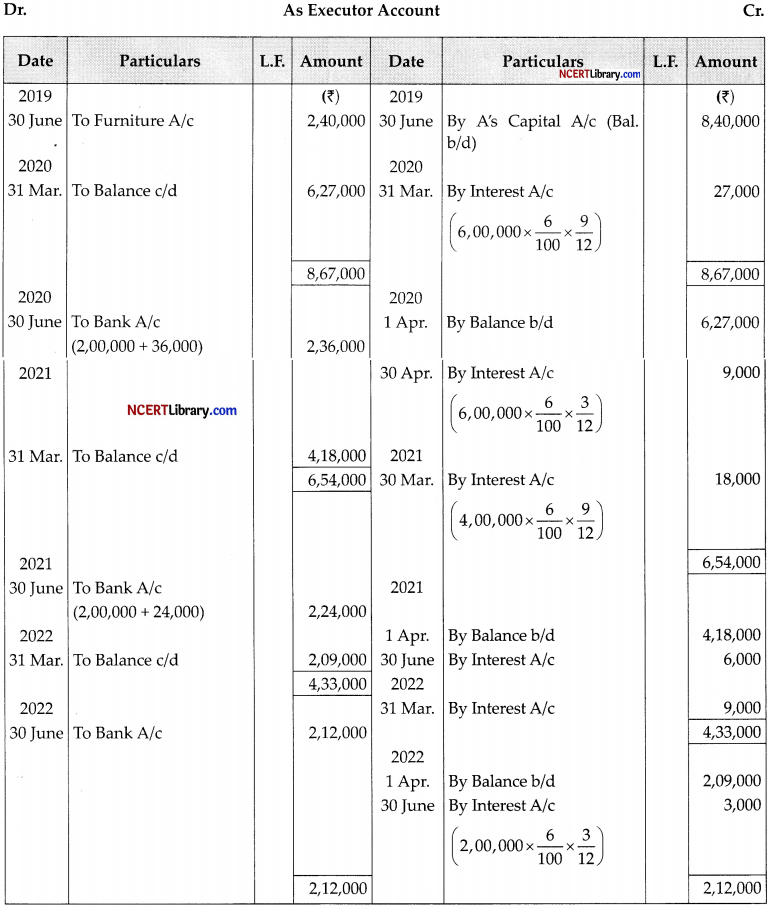

A’s profit till date of death was estimated as ₹1,20,000, based on the average profits of past three years. Final dues payable to A’s executors on the date of death was calculated as ₹8,40,000 out of which ₹2,40,000 was paid immediately by giving him Furniture valued for the same and balance was to be paid in three equal annual installments starting from 30 June, 2020, together with an interest rate as specified in Section 37 of Indian Partnership Act, 1932. Pass necessary entry for profit share to be credited to A’s Capital and also prepare A’s executor’s account till final settlement.

Answer:

Question 26.

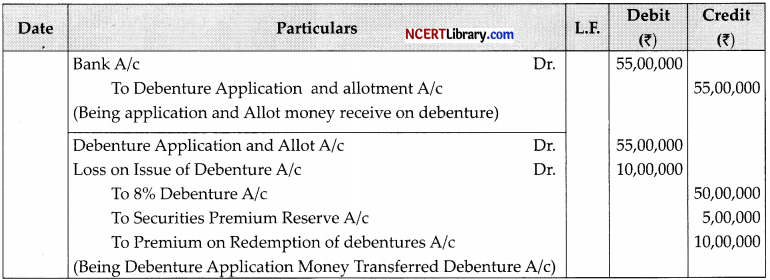

Health to Wealth Ltd. had share capital of ₹80,00,000 divided in shares of ₹100 each and 20,000, 8% Debentures of ₹100 each as part of capital employed. [6]

The company needs additional funds of ₹55,00,000 for which they decided to issue debentures in such a way that they got required funds after issuing debentures of the same class as earlier, at 10% premium. These debentures were to be redeemed at 20% premium after 4 years. These debentures were issued on 01 October, 2021. You are required to

(a) Pass entries for issue of Debentures.

(b) Prepare Loss on Issue of Debentures Account assuming there was existing balance of Securities Premium Account of ₹2,80,000.

(c) Pass entries for Interest on debentures on March 31, 2022, assuming interest is payable on 30

September and 31 March every year.

Answer:

Part-B

(Analysis of Financial Statement)

(Option – I)

Question 27.

Financial statements are prepared on certain basic assumptions (pre-requisites) known as . [1]

(a) Provision of Companies Act,2013

(b) Accounting Standards

(c) Postulates

(d) Basis of Accounting

Answer:

(c) Postulates

OR

Which one of the following is correct?

(i) Quick Ratio can be more than Current Ratio.

(ii) High Inventory Turnover ratio is good for the organization, except when goods are bought in small lots or sold quickly at low margins to realize cash.

(iii) Sum of Operating Ratio and Operating Profit ratio is always 100%.

(a) All are correct

(b) Only (i) and (iii) are correct.

(c) Only (ii) and (iii) are correct.

(d) Only (i) and (ii) are correct

Answer:

(c) Only (ii) and (iii) are correct.

![]()

Question 28.

From the following calculate Interest coverage ratio [1]

Net profit after tax ₹2,00,000; 10% debentures ₹1,00,00,000; Tax Rate 40%

(a) 1.2 times

(b) 3 times

(c) 2 times

(d) 5 times

Answer:

(b) times

Explanation:

Let Profit before tax be x

x – \(\frac{40 x}{100}\) = 12,00,000

\(\frac{40 x}{100}\) = 12,00,000

Net Profit before tax x = \(\frac{12,00,000 \times 100}{60}\) = 20,00,000

Fixed interest charges = 100,00,000 × 10% = 10,00,000

Net Profit before interest & tax, 20,00,000 + 10,00,000 = 30,00,000

![]()

Question 29.

Insurance Claim received by Albert Co. Ud. of 5,00,000 for Loss of Machinery due to theft will be

recorded in Cash Flow Statement in which of the following manner? [1]

(a) Added tinder Operating Activities as Extraordinary Item and Subtracted from Operating Activities also.

(b) Subtracted under Operating Activities as Extraordinary Item and Added to Operating Activities also.

(c) Added under Operating Activities as Extraordinary Item and Outflow tinder Investing Activity also.

(d) Subtracted under Operating Activities as Extraordinary Item and Inflow tinder Investing Activities also.

Answer:

(b) Subtracted tinder Operating Activities as Extraordinary Item and Added to Operating Activities also.

OR

A company issued 20,000; 9% Debentures of ₹100 each at 10% Discount. These debentures were to he redeemed at 15% Premium at the end of 5 years. The balance in Securities Premium Account as on the date of Issue was ₹3,70,O00. How this transaction will he reflected in Cash Flow Statement?

(a) Added ₹1,30,000 under Operating Activities as Loss on Issue of Debentures written off and Inflow of ₹20,00,000 under Financing Activities.

(b) Added ₹5,00,000 under Operating Activities as Loss on Issue of Debentures written off and Inflow of ₹18,00,000 tinder Financing Activities.

(c) Added ₹1,30,000 under Operating Activities as Loss on Issue of Debentures written off and Inflow of ₹18,00,000 under Financing Activities.

(d) Added ₹5,00,000 under Operating Activities as Loss on Issue of Debentures written off and Inflow of ₹20,00,000 under Financing Activities.

Answer:

(b) Added ₹5,00,000 under Operating Activities as Loss on Issue of Debentures written off and Inflow of ₹18,00,000 under Financing Activities.

![]()

Question 30.

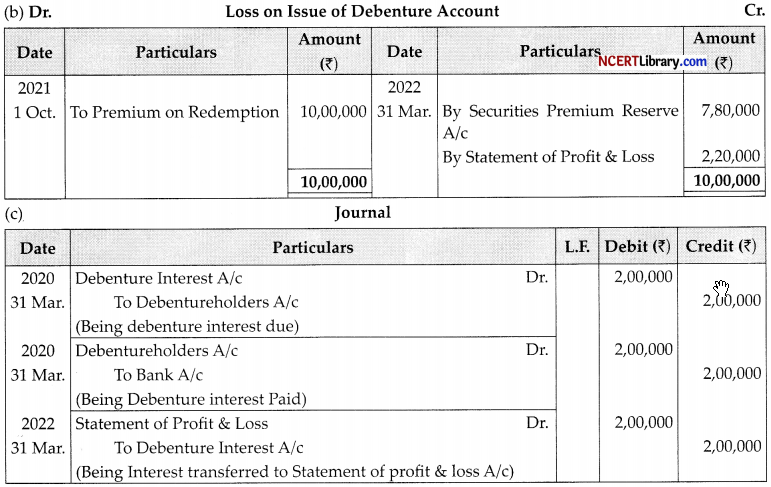

From the following information find out the inflow of Cash by sale of Office equipments. [1]

![]()

Office Equipment

Additional Information:

Depreciation for the year 2021 -22 was ₹40,000

Purchase of Office Equipment purchased during the year ₹30,000

Part of Office Equipment sold at a profit of ₹12,000

(a) ₹1,00,000

(b) ₹1,02,000

(c) ₹90,000

(d) ₹1,12,000

Answer:

(b) 1,02,000

Explanation:

Question 31.

Classify the following items under Major heads and Sub-head (if any) in the Balance Sheet of a Company as per schedule III of the Companies Act, 2013. [1]

(i) Current maturities of long-term debts

(ii) Furniture and Fixtures

(iii) Provision for Warranties

(iv) Income received in advance

(v) Capital Advances

(vi) Advances recoverable in cash within the operation cycle

Answer:

| Item | Head | Sub Head |

| (i) Current maturities of long-term debts | Current Liability | Short-from Borrowings |

| (ii) Furniture and Fixtures | Non-current Assets | Fixed Assets |

| (iii) Provision for Warranties | Non-current Liability | Long-Term Provision |

| (iv) Income received in advance | Current Liability | Other Current Liabilities |

| (v) Capital Advances | Non-current Assets | Long-term Loan and Advance |

| (vi) Advances recoverable in cash within the operation cycle | Current Assets | Short term Loan and Advance |

Question 32.

Lala Ltd. and Bala Ltd. use different accounting policies for inventory valuation. These variations leave a big question mark on the cross-sectional analysis and comparison of these two firms was not possible. Identify the limitation of Ratio Analysis highlighted in the above situation. Also explain any two other limitations of Ratio Analysis apart from the identified above. [3]

Answer:

As said in the question their accounting policies are different so it is the limitation.

Two other limitations are:

(a) It ignores price level change

(b) It ignores qualitative values

![]()

Question 33.

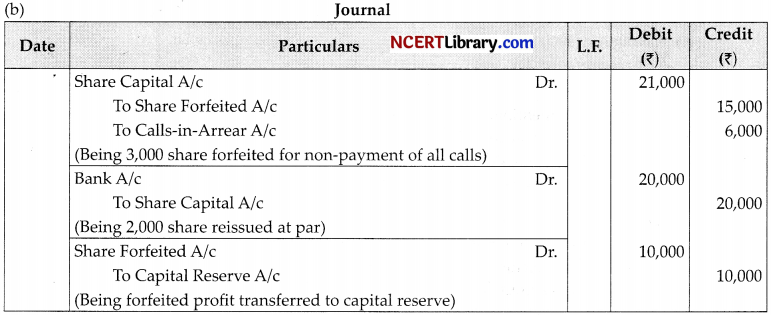

Determine Return on Investment and Net Assets Turnover ratio from the following information: [4]

Profits after Tax were ₹6,00,000; Tax rate was 40%; 15% Debentures were of ₹20,00,000; 10% Bank Loan was ₹20,0O,000; 12% Preference Share Capital ₹30,00,000; Equity Share Capital ₹40,O0.000; Reserves and Surplus were ₹10,0O,OO0; Sales ₹3,75,00,OO0 and Sales Return ₹15,00,0OO.

OR

Debt to Capital Employed ratio is 0.3: 1. State whether the following transactions, will improve, decline or will have no change on the Debt to Capital Employed Ratio. Also give reasons for the same.

(i) Sale of Equipments costing ₹10,00,000 for ₹9,00,000.

(ii) Purchased Goods on Credit for ₹1,00,000 for a credit of 15 months, assuming operating cycle is of 18 months.

(iii) Conversion of Debentures into Equity Shares of ₹2,00,000.

(iv) Tax Refund of ₹50,000 during the year.

Answer:

![]()

Fixed Interest charges = Interest on debentures + Interest on Bank loan

= 3,00,000 + 2,00,000 = 5,00,000

Capital employed = Debentures + Bank Loan + Prefence share capital + Equity share capital + Reserves & Surplus

= 20,00,000 + 20,00,000 + 30,00,000 + 40,00,000 + 10,00,000 = 1,20,00,000

Less Profit before tax = x –\(\frac {40x}{100}\) = 6,00,000

=\(\frac {60x}{100}\) = 6,00,000

x = \(\frac{6,00,000 \times 100}{60}\) = 10,00,000

Net Profit before interest + tax = 10,00,000+ fixed interest + charges (5,00,000) = 15,00,000

= \(\frac {15,00,000}{1,20,00,000}\) x 100 = 12.5%

EBIT = 6,00,000 + 4,00,000 + 5,00,000 = 15,00,000

![]()

Revenue from Operation = 3,15,00,000 – 15,00,000

= \(\frac{3,60,00,000}{1,20,00,000}\) = 3 times

OR

(1) Improve = Capital employed will decrease & debt constant

(ii) Same = No change in any one

(iii) Decline = Debt will decrease but capital employed same

(iv) Decline = Capital employed will increase but debt same

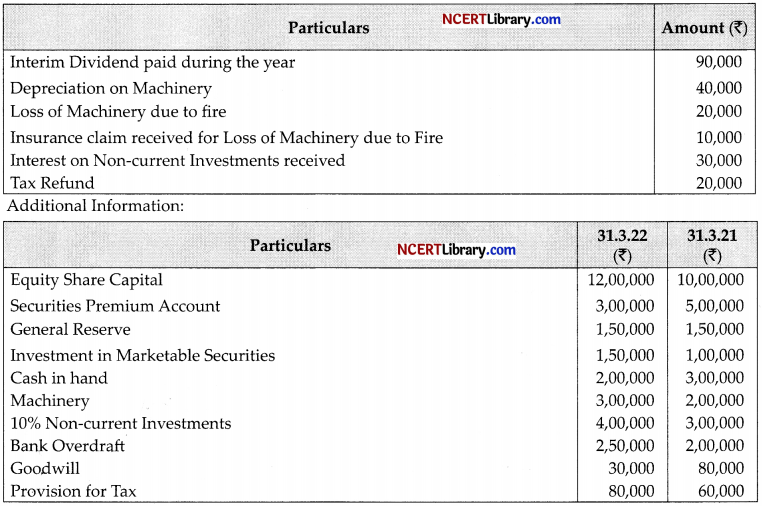

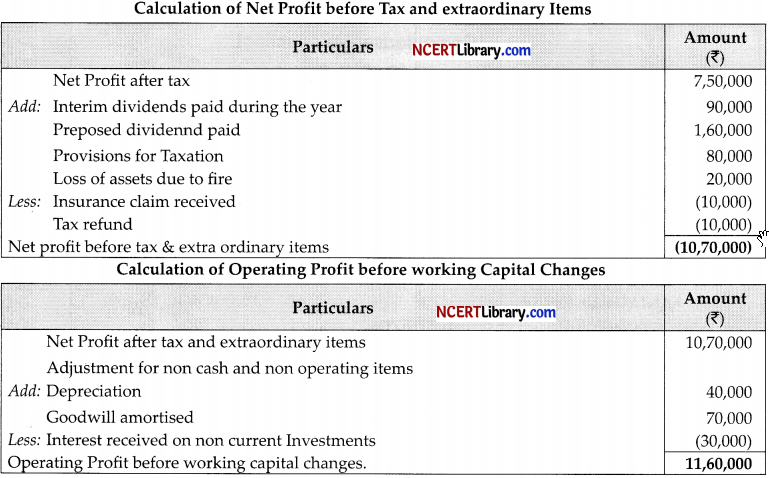

Question 34.

Read the following hypothetical text and answer the given questions on the basis of the same: [6]

Aashna, an alumnus of CI3SE School, initiated her start up Smartpay, in 2015. Smartpay is a service platform that processes payments via UN and POS, and provides credit or loans to their clients. During the year 2021-22, Smartpay issued bonus shares in the ratio of 5:1 by capitalising reserves. The profits of Smartpay in the year 2021-22 after all appropriations was 7,50,000. This profit was arrived after taking into consideration the following items:

(i) Goodwill purchased during the year was ₹20,000.

(ii) Proposed Dividend for the year ended March 31, 2021 was ₹1,60,000 and for the year ended March 31,2022 was ₹2,00,000.

![]()

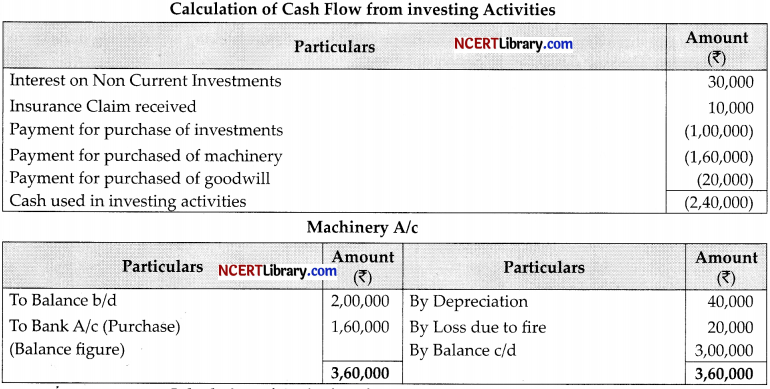

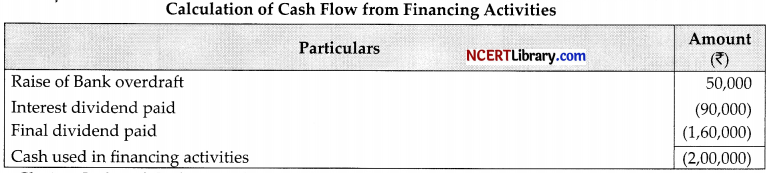

You are required to:

1. Calculate Net Profit before tax and extraordinary items.

2. Calculate Operating profit before working capital changes.

3. Calculate Cash flow from Investing activities.

4. Calculate Cash flow from Financing activities.

5. Calculate closing cash and cash equivalents.

Goodwill amortised = Opening goodwill + Purchased + Closing goodwill

= 20,000 + 20,000 + 30,000 = 70,000

Closing Cash and Cash equivalents = Closing Cash Balance + Closing Balance of Investment in Marketable securities

= 2,00,000 + 15,0000 = 3,50,000

Part-B

(Computerised Accounting)

(Option-II)

Question 27.

The syntax of PMT Function is ………..

(a) PMT (rate, pv, nper, [fv], [type])

(b) PMT (rate, nper, pv, [fyi, [type])

(c) PMT (rate, pv, nper, [type], [fv])

(d) PMT (rate, nper, pv, [type], [fv])

OR

In Excel, the chart tools provide three different options …………, …………. and ……….. Formatting

(a) Layout, Format, DataMaker

(b) Design, Layout, Format

(c) Format, Layout, Label

(d) Design, DataMaker, Layout

Question 28.

Which formulae would result in TRUE if C4 is less

(a) = AND(C4>10, D4>10)

(b) = AND(C4>10, C4<100).

(c) =AND(C4>10, D4<10).

(d) =AND (C4<10, D4,100)

![]()

Question 29.

Which function results can be displayed in Auto Calculate?

(a) SUM and AVERAGE

(b) MAX and LOOK

(c) LABEL and AVERAGE

(d) MIN and BLANK

OR

When navigating in a workbook, which command is used to move to the beginning of the current row?

(a) [Ctrl]+[Home]

(c) [Home]

(b) [Page Up]

(d) [Ctrl]+[Backspace]

Question 30.

What category of functions is used in this formula: = PMT (C10/12, C8, C9,1)

(a) Logical

(c) Payment

(b) Financial

(d) Statistical

Question 31.

State any three types of Accounting Vouchers used for entry in Tally software.

Question 32.

State any three requirements which should be considered before making an investing decision to choose

between ‘Desktop database’ or ‘Server database’.

Question 33.

State the features of the Computerized Accounting system.

OR

Explain the use of ‘Conditional Formatting.

Question 34.

Describe two basic methods of charging depredation. Differentiate between both of them.