NCERT Solutions for Class 12 Accountancy Chapter 5 Dissolution of Partnership Firm

NCERT Solutions CBSE Sample Papers AccountancyClass 12 Accountancy

TEST YOUR UNDERSTANDING -I

Question 1. Dissolution of a partnership is different from dissolution of a firm.

Answer True

In dissolution of partnership, business continues whereas in dissolution of firm, the business is closed.

Question 2. A partnership is dissolved when there is a death of a partner.

Answer True

As a new partnership deed is to be made.

Question 3. A firm is dissolved when all partners give consent to it.

Answer True

As all partners agree to it.

Question 4: A firm is compulsorily dissolved when a partner decide to retire.

Answer False

The remaining partners may continue the business hence, it not necessary to dissolve the firm.

Question 5. Dissolution of a firm necessarily involves dissolution of partnership.

Answer True

When firm does not exist then partners have no business to do.

Question 6. A firm is compulsorily dissolved when all partners or when all except one partner become involvent.

Answer True

As the partner becomes incompetent to sign the contract.

Question 7. Court can order a firm to be dissolved when a partner becomes insane.

Answer True

The court can order for dissolution when any partner files a suit for it.

Question 8. Dissolution of partnership can not take place without intervention of the court.

Answer False

Partnership can be dissolved with the consent of the partners also.

TEST YOUR UNDERSTANDING -II

• Tick the correct answer

Question 1. On dissolution of a firm, bank overdraft is transferred to

(a) cash account (b) bank account

(c) realisation account (d) partner’s capital account

Answer (c) Realisation account

Question 2. On dissolution of a firm, partner’s loan account is transferred to

(a) realisation account (b) partner’s capital account (c) partner’s current account (d) None of these

Answer (d) None of these

Question 3. After transferring liabilities like creditors and bills payables in the realisation account, in the absence of any information regarding then payment, such liabilities are treated as

(a) never paid (b) fully paid (c) partly paid (d) None of these

Answer (b) Fully paid

Question 5. Unrecorded assets when taken over by a partner are shown in

(a) debit of realisation account

(b) debit of bank account

(c) credit of realisation account

(d) dredit of bank account

Answer (c) Credit of realisation account

Question 6. Unrecorded liabilities when paid are shown in

(a) debit of realisation account

(b) debit of bank account

(c) credit of realisation account

(d) credit of bank account

Answer (a) Debit of realisation account

Question 7. The accumulated profits reserves are transferred to

(a) realisation account (b) partners’ capital account

(c) bank account (d) None of these

Answer (b) Partners’ capital account

Question 8. On dissolution of the firm, partner’s capital accounts are closed through

(a) realisation account (b) drawings account

(c) bank account (d) loan account

Answer (c) Bank account

TEST YOUR UNDERSTANDING – III

• Fill in the correct word(s)

1. All assets (except cash/bank and fictitious assets) are transferred to the ————— (Debit/Credit) side of ——————— Account (Realisation/Capital).

Answer:Answer Debit, Realisation

2. All ————— (internal/external) liabilities are transferred to the ————— (Debit/Credit) side of ——————acccount (Bank/Realisation).

Answer External, Credit, Realisation

3. Accumulated losses are transferred to ————— (Current/Capital Accounts) in —————— (equal ratio/profit sharing ratio).

Answer Capital account, Profit sharing ratio

4. If a liability is assumed by a partner, such Partner’s Capital Account is ––––––– ——— (debited/credited)..

Answer Credited

5. If a partner takes over an asset, such (Partner’s Capital Account) is ———————— (debited/credited).

Answer Debited

6. No entry is required when a ——————— (partner/creditor) accepts a fixed asset in payment of his dues.

Answer Creditor

7. When creditor accepts an asset whose value is more than the amount due to him, he will ———————— (pay/not pay) the excess amount which will be credited ———————— Account.

Answer Pay, Realisation

8. When the firm has agreed to pay the partner a fixed amount for realisation work irrespective of the actual amount spent, such fixed amount is debited to (Realisation/Capital) Account and Credited to (Capital/Bank) Account.

Answer Realisation, Capital

9. Partner’s loan is —————— (recorded/not recorded) in the (Realisation Account).

Answer Not recorded

10. Partner’s current accounts are transferred to respective ———————— Partners’ (Loan/Capital) Accounts.

Answer Capital

DO IT YOURSELF

Question 1. For closure of assets accounts.

Answer

Realisation A/c Dr

To Assets A/c

Question 2. For closure of liabilities accounts.

Answer

Liabilities A/c Dr

To Realisation A/c

Question 3. For sale of assets.

Answer

Bank A/c Dr

To Realisation A/c

Question 4. For settlement of a creditor by transfer of fixed assets to him.

Answer No entry

Question 5. For expenses of realisation when actual expenses are paid by the partner on behalf of the firm.

Answer

Realisation A/c Dr

To Partner’s Capital A/c

Question 6. When a partner discharges the liability of the firm.

Answer

Realisation A/c Dr

To Partner’s Capital A/c

Question 7. For payment of partner’s loan.

Answer Partner’s Loan A/c Dr

To Bank A/c

Question 8. For settlement of capital accounts.

Answer

Partner’s Capital A/c Dr

To Bank A/c

SHORT ANSWER TYPE QUESTIONS

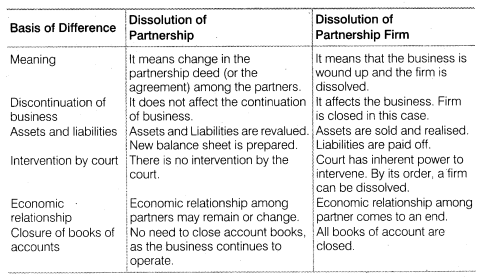

Question 1. State the difference between dissolution of Partnership and Dissolution of Partnership firm.

Answer The difference between the Dissolution’ of Partnership and Dissolution of Partnership Firm is as follows.

Question 2. State the accounting treatment for

(i) Unrecorded assets (ii) Unrecorded liabilities.

Answer (i) Accounting Treatment for Unrecorded Assets Unrecorded asset is an asset, which have not been shown in the books of account or which has been written off in the books of accounts, but the asset is still available in physical condition. Sometimes it is sold outside for cash and sometimes it is taken away by the partner. The accounting treatment for unrecorded asset will be there according to the situation.

(a) When the unrecorded asset is sold for cash the following Journal Entry will be there

(b) When the unrecorded asset is taken over by any partner the following Journal Entry will be there

(ii) Accounting Treatment for Unrecorded Liabilities Unrecorded liabilities are those liabilities, which have not been shown in the books of account. But at the time of dissolution they are required to be paid off. The following Journal Entry will be there as per situation.

(a) When the unrecorded liability is paid off the following Journal Entry will be there

(b) When the unrecorded liability is taken over by a partner. The following Journal Entry will be there

Question 3. On dissolution, how will you deal with partner’s loan if it appears on the

(a) assets side of the balance sheet,

(b) liabilities side of balance sheet.

Answer (a) When loan amount is shown in the assets side of the balance sheet, it indicate that the loan has been granted by the firm to the partner. In that case, at the time of dissolution the amount of loan will be transferred to the concerned partner’s capital account. The following Journal Entry will be passed

(b) When the amount of loan appears in the liabilities side of the balance sheet, it indicate that the respective partner or partners have given loan to the firm. In this case, partner’s loan will be paid off after paying all the external liabilities first. Here, it is worth mentioning that the partner’s loan will not be transferred to the realisation account, in fact, it will be paid in cash. The following accounting entry will be passed in this regard

Question 4. Distinguish between Firm’s Debts and Partner’s Private Debts.

Answer The difference between Firm’s Debts and Partner’s Private Debts is as follows

Question 5. State the order of settlement of accounts on dissolution.

Answer In case of dissolution of a firm, the firm ceases to conduct business and has to settle its accounts. For this purpose, it disposes off all its assets for satisfying all the claims against it. In this context, it should be noted that, subject to agreement among the partners, the following rules as provided in Section 48 of the Partnership Act, 1932 shall apply. As per those rules, the following order of settlement will be followed.

(i) Treatment of Losses

Note Losses, including deficiencies of capital, shall be paid

(a) First out of profits,

(b) Next out of capital of partners, and

(c) Lastly, if necessary, by the partners individually in their profits sharing ratio.

(ii) Application of Assets The assets of the firm, including any sum contributed by the partners to make up deficiencies of capital, shall be applied in the following manner and order

(a) In paying the debts of the firm to the third parties;

(b) In paying each partner proportionately what is due to him/her from the firm for advances as distinguished from capital (i.e., partner’s loan);

(c) In paying to each partner proportionately what is due to him on account of capital; and

(d) The residue, if any, shall be divided among the partners in their profit sharing ratio.

Question 6. On what account Realisation Account differs from Revaluation Account?

Answer There is the following difference between Realisation Account and Revaluation Account

LONG ANSWER TYPE QUESTIONS

Question 1. Explain the process of dissolution of partnership firm.

Answer Dissolution means breaking of relationship among the partners. As per Section 39 of the Indian Partnership Act 1932, the dissolution of firm implies that not only partnership is dissolved but the firm losses its existence, i.e., after dissolution the firm does not remain in business.

Dissolution of partnership firm implies discontinuation of the business of the partnership firm. Dissolution involves winding up of business, disposal of assets and paying off the liabilities and distribution of any surplus or borne of loss by the partners of the firm. As per the Partnership Act 1932, a partnership firm may be dissolved in the following manners.

(i) Dissolution by Agreement As a firm is formed with the consent of all partners with a mutual agreement. Dissolution can also be there with

the help of agreement. It happens in following two ways.

A firm may be dissolved

(a) When all the partners agree to dissolve the firm.

(b) When there is any term related to dissolution of firm in the partnership agreement.

(ii) Compulsory Dissolution A firm may be dissolved compulsorily in the following condition

(a) In case, all the partners or all except one partner become insolvent or insane.

(b) If the business becomes illegal.

(c) Where all the partners except one decide to retire from the firm.

(d) Where all the partners except one die.

(iii) Dissolution by Notice When partnership is at will then the partnership firm may be dissolved, if any partner give notice in writing to all the other partners expressing his/her intention to dissolve the firm.

(iv) Dissolution by Court A court may order for dissolution if a suit is filed by a partner, as per Section 44 of Indian Partnership Act, 1932. The court may order to dissolve a partnership in following conditions

(a) A partner becomes insane.

(b) A partner commits breach of agreement wilfully.

(c) When a partner’s conduct affects the business.

(d) When a partner transfers his interest to a third party.

(e) If business cannot be continued.

(f) If a partner becomes incapable of doing business.

(g) If court thinks dissolution to be just and equitable on any ground.

Besides these, above mentioned circumstances, a partnership firm may be dissolved if the court at any stage finds dissolution of the firm to be justified and inevitable.

Question 2. What is a Realisation Account?

Answer On dissolution of a firm, all the books of account are closed, all assets are sold and all liabilities are paid off. In order to record the sale of assets and discharge of liabilities, a nominal account is opened named realisation account. The main purpose to open realisation account is to ascertain the profit or loss due to the realisation of assets and liabilities. Realisation profit (if credit side > debit side) or realisation loss (if debit side > credit side) are transferred to the partner’s capital account in their profit sharing ratio.

Concisely, following are the important objectives of preparing realisation account

(i) To close all the books of account.

(ii) To record transactions relating to the sale of assets and discharge of liabilities.

(iii) To determine profit or loss due to the realisation of assets and liabilities.

Features of Realisation Account

(i) In realisation account, sale of assets is recorded at their realised value.

(ii) Payment to liabilities (creditors) is recorded at their settlement value.

(iii) After all the transactions have been recorded, there will be balance, which may be profit or loss.

(iv) Profit arises in two situations

(a) When assets are realised at more than their book value.

(b) When liabilities are settled at less than their book value.

(v) If the two conditions are vice versa, the net result will be loss.

(vi) The net profit or loss on realisation is to be transferred to the partner’s capital accounts in their profit sharing ratio.

The format for realisation account is as follows

Question 3. Reproduce the format of Realisation Account.

Answer

Question 4. How deficiency of creditors is paid off?

Answer When a firm gets into the situation of dissolution, first of all the amount received from the sale of firm’s assets are utilised to pay the creditors. After that, if the sale receipts of assets fall short, then partners’ private assets are used for settling the dues of the firm’s creditors. Even if some portion of the amount due to creditors is left unpaid, then there arises deficiency of

creditors. This deficiency is handled in the following two ways

(i) In first case, deficiency is transferred to the Deficiency Account.

(ii) In second case, the deficiency is transferred to the partner’s capital account.

In first case, a separate account is prepared for the firm’s creditors. Then in ‘ order to ascertain the firm’s cash balance accruing from the sale of the firm’s

assets and partners’ private assets, cash account is prepared. After ascertaining the cash availability with the firm, the creditors and the external liabilities are paid proportionately (partially). The remaining unpaid creditors or the deficiency is transferred to the Deficiency Account.

In the second case, the creditors are paid by the cash available with the firm

including the partners’ individual contribution. The deficiency or unpaid creditors amount .is transferred to the partner’s capital account. Thus, the deficiency of the creditors is borne by all the partners in their profit sharing ratio. If any partner becomes insolvent and is unable to bear the deficiency, then this will be regarded as a capital loss to the firm.

‘ If the partnership deed is silent, about such capital loss in the fact of insolvency of a partner, the deficiency on the insolvent partner’s capital ’ account must be borne by the other solvent partners, in proportion to their capital. In that case, we should apply Garner vs Murray decision in solving problems in partnership.

NUMERICAL QUESTIONS

1. Journalise the following transactions regarding realisation expenses :

[a] Realisation expenses amounted to Rs.2,500.

[b] Realisation expenses amounting to Rs.3,000 were paid by Ashok, one of the partners.

[c] Realisation expenses Rs.2,300 borne by Tarun, personally.

[d] Amit, a partner was appointed to realise the assets, at a cost of Rs.4,000. The actual amount of realisation amounted to Rs.3,000.

2. Record necessary journal entries in the following cases:

[a] Creditors worth Rs.85,000 accepted Rs.40,000 as cash and Investment worth Rs.43,000, in full settlement of their claim.

[b] Creditors were Rs.16,000. They accepted Machinery valued at Rs.18,000 in settlement of their claim.

[c] Creditors were Rs.90,000. They accepted Buildings valued Rs.1,20,000 and paid cash to the firm Rs.30,000.

3. There was an old computer which was written-off in the books of accounts in the pervious year. The same has been taken over by a partner Nitin for Rs.3,000.

Journalise the transaction, supposing. That the firm has been dissolved.

4. What journal entries will be recorded for the following transactions on the dissolution of a firm:

[a] Payment of unrecorded liabilities of Rs.3,200.

[b] Stock worth Rs.7,500 is taken by a partner Rohit.

[c] Profit on Realisation amounting to Rs.18,000 is to be distributed between the partners Ashish and Tarun in the ratio of 5:7.

[d] An unrecorded asset realised Rs.5,500.

5. Give journal entries for the following transactions :

1. To record the realisation of various assets and liabilities,

2. A Firm has a Stock of Rs. 1,60,000. Aziz, a partner took over 50% of the Stock at a discount of 20%,

3. Remaining Stock was sold at a profit of 30% on cost,

4. Land and Buildging (book value Rs. 1,60,000) sold for Rs. 3,00,000 through a broker who charged 2%, commission on the deal,

5. Plant and Machinery (book value Rs. 60,000) was handed over to a Creditor at an agreed valuation of 10% less than the book value,

6. Investment whose face value was Rs. 4,000 was realised at 50%

6. How will you deal with the realisation expenses of the firm of Rashim and Bindiya in the following cases:

1. Realisation expenses amounts to Rs. 1,00,000,

2. Realisation expenses amounting to Rs. 30,000 are paid by Rashim, a partner.

3. Realisation expenses are to be borne by Rashim for which he will be paid Rs. 70,000 as remuneration for completing the dissolution process. The

actual expenses incurred by Rashim were Rs. 1,20,000.

7. The book value of assets (other than cash and bank) transferred to Realisation Account is Rs. 1,00,000. 50% of the assets are taken over by a partner Atul, at a discount of 20%; 40% of the remaining assets are sold at a profit of 30% on cost; 5% of the balance being obsolete, realised nothing and remaining assets

are handed over to a Creditor, in full settlement of his claim. You are required to record the journal entries for realisation of assets.

8. Record necessary journal entries to record the following unrecorded assets and liabilities in the books of Paras and Priya:

1. There was an old furniture in the firm which had been written-off completely in the books. This was sold for Rs. 3,000,

2. Ashish, an old customer whose account for Rs. 1,000 was written-off as bad in the previous year, paid 60%, of the amount,

3. Paras agreed to takeover the firm’s goodwill (not recorded in the books of the firm), at a valuation of Rs. 30,000,

4. There was an old typewriter which had been written-off completely from the books. It was estimated to realize Rs. 400. It was taken away by Priya at an estimated price less 25%,

5. There were 100 shares of Rs. 10 each in Star Limited acquired at a cost of Rs. 2,000 which had been written-off completely from the books. These shares are valued @ Rs. 6 each and divided among the partners in their

profit sharing ratio.

9. All partners wishes to dissolve the firm. Yastin, a partner wants that her loan of Rs. 2,00,000 must be paid off before the payment of capitals to the partners. But, Amart, another partner wants that the capitals must be paid before the payment of Yastin’s loan. You are required to settle the conflict giving reasons.

Answer According to Section 48 of Partnership Act 1932, their is a sequence of preferences given which tells the priority of payment at time of dissolution. In the above condition, the loans and advances of partner’s i.e., Rs.2,00,000 will be paid before and payment of capital is always done at last

10. What journal entries would be recorded for the following transactions on the dissolution of a firm after various assets (other than cash) on the third party liabilities have been transferred to Reliasation account.

1. Arti took over the Stock worth Rs. 80,000 at Rs. 68,000.

2. There was unrecorded Bike of Rs. 40,000 which was taken over By Mr. Karim.

3. The firm paid Rs. 40,000 as compensation to employees.

4. Sundry creditors amounting to Rs. 36,000 were settled at a discount of 15%.

5. Loss on realisation Rs. 42,000 was to be distributed between Arti and Karim in the ratio of 3:4.

11. Rose and Lily shared profits in the ratio of 2:3. Their Balance Sheet on March 31, 2006 was as follows:

Rose and Lily decided to dissolve the firm on the above date. Assets (except bills receivables) realised Rs. 4,84,000. Bills receivable were taken over by Rose at X 30,000. Creditors agreed to take Rs 38,000. Cost of realisation was Rs 2400. There was a Motor Cycle in the firm which was brought out of the firm’s money, was not shown in the books of the firm. It was now sold for Rs 10,000. There was a continigent liability in respect of outstanding electric bill of Rs 5,000. Bill receivable taken over by Rose at Rs 33,000.

Show realisation account, partners’ capital account, loan account and cash account.

12. Shilpa, Meena and Nanda decided to dissolve their partnership on March 31,2006. Their profit sharing ratio was 3:2:1 and their Balance Sheet was as under:

The stock of value of Rs. 41,660 are taken over by Shilpa for Rs. 35,000 and she agreed to discharge bank loan. The remaining stock was sold at Rs. 14,000 and debtors amounting to Rs. 10,000 realised Rs. 8,000. land is sold for Rs. 1,10,000. The

remaining debtors realised 50% at their book value. Cost of realisation amounted to Rs. 1,200. There was a typewriter not recorded in the books worth Rs. 6,000 which were taken over by one of the Creditors at this value. Prepare Realisation Account

13. Surjit and Rahi were sharing profits (losses) in the ratio of 3:2, their Balance Sheet as on March 31, 2004 is as follows:

The firm was dissolved on March 31, 2006 on the following terms:

1. Surjit agreed to take the investments at Rs. 8,000 and to pay Mrs. Surojit’s loan.

2. Other assets were realised as follows:

Stock Rs.5,000

Debtors Rs. 18,500

Furniture Rs. 4,500

Plant Rs. 25,000

3. Expenses on realisation amounted to Rs. 1,600.

4. Creditors agreed to accept Rs. 37,000 as a final settlement. You are required to prepare Realisation account, Partner’s Capital account and Bank account

14.Rita, Geeta and Ashish were partners in a firm sharing profits/losses in the ratio of 3:2:1. On March 31, 2006 their balance sheet was as follows:

On the date of above mentioned date the firm was dissolved:

1. Rita was appointed to realise the assets. Rita was to receive 5% commission

on the rate of assets (except cash) and was to bear all expenses of realisation,

2. Assets were realised as follows:

Rs.

Debtors 30,000

Stock 26,000

Plant 42,750

3. Investments were realised at 85% of the book value,

4. Expenses of realisation amounted to Rs. 4,100,

5. Firm had to pay Rs. 7,200 for outstanding salary not provided for earlier,

6. Contingent liability in respect of bills discounted with the bank was also materialised and paid off Rs. 9,800, Prepare Realisation account, Capital Accounts of Partner’s and Cash Account.

15. Anup and Sumit are equal partners in a firm. They decided to dissolve the parntership on December 31, 2006. When the balance sheet is as under :

The Assets were realised as follows :

Rs.

Lease hold land 72,000

Furniture 22,500

Stock 40,500

Plant 48,000

Sundry Debtors 10,5000

The Creditors were paid Rs. 25,500 in full settlement. Expenses of realisation amount to Rs. 2,500. Prepare Realisation Account, Bank Account, Partners Capital Accounts to close the books of the firm.

16. Ashu and Harish are partners sharing profit and losses as 3:2. They decided to dissolve the firm on December 31, 2006. Their balance sheet on the above date was:

Ashu is to take over the building at Rs. 95,000 and Machinery and Furniture is take over by Harish at value of Rs. 80,000. Ashu agreed to pay Creditor and Harish agreed to meet Bank overdraft. Stock and Investments are taken by both partner in profit sharing ratio. Debtors realised for Rs. 46,000, expenses

of realisation amounted to Rs. 3,000. Prepare necessary ledger account.

More Resources for CBSE Class 12

RD Sharma class 12 Solutions

NCERT Solutions for Class 12th English Flamingo

NCERT Solutions for Class 12th English Vistas

CBSE Class 12 Accountancy

NCERT Solutions for Class 12th Maths

CBSE Class 12 Biology

CBSE Class 12 Physics

CBSE Class 12 Chemistry

CBSE Sample Papers For Class 12

NCERT SolutionsAccountancyBusiness StudiesMacro EconomicsCommerce