Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 7 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 7 with Solutions

Time: 2 Hrs.

Max. Marks: 40

General Instructions :

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts. Part A and Part B.

- Part- A is compulsory for all candidates.

- Part- B has two option i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Question 1 to 16 and 27 to 30 carries 1 mark each.

- Questions 17 to 20. 31 and 32 carries 3 marks each.

- Questions 21, 22 and 33 carries 4 marks each.

- Questions 23 to 26 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, and 2 questions of three marks. 1 question of four marks and 2 questions of six marks.

Part – A

(Accounting for Partnership Firms and Companies)

Question 1.

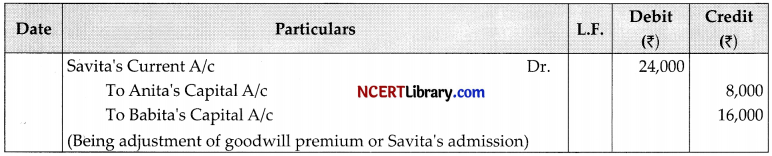

Anita and Babita were partners sharing profits and losses in the ratio of 3 :1. Savita was admitted for l/5th share in the profits. Savita was unable to bring her share of goodwill premium in cash.The journal entry recorded for goodwill premium is given below:

The new profit sharing ratio of Anita, Babita and Savita will be:

(a) 41 : 7 :12

(b) 13:12:10

(c) 3:1:1

(d) 5:3:2

Ans.

(a) 41 : 7 :12

Share = 3:1

Sacrificing Share = 1:2 (i.e.’ Ratio of 8,000 and 16,000)

Anita’s New Share =\(\frac{3}{4}-\left(\frac{1}{5} \times \frac{1}{3}\right)=\frac{41}{60}\)

Babita’s New Share = \(\frac{1}{4}-\left(\frac{1}{5} \times \frac{2}{3}\right)=\frac{7}{60}\)

Savita’s Share = \(\frac{1}{5} \text { or } \frac{12}{60}\)

So, new Ratio will be 41:7:12

![]()

Question 2.

Assertion (A): Commission paid to the partner is shown in Profit & Loss Appropriation Account.

Reason (R): Commission paid to the partner is a charge against profit and not the appropriation out of profit and hence it will be shown in Profit and Loss Account and not in Profit & Loss Appropriation Account.

(a) (A) is correct but (R) is wrong

(b) Bpth (A) and (R) are correct, but (R) is not correct explanation of (A)

(c) Both (A) and (R) are incorrect.

(d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

Answer:

(a) (A) is correct but (R) is wrong

Explanation:

Commission paid to partners, being an appropriation out of profit, is transferred to Profit and Loss Appropriation Account. It is not a charge against the profit and so it should not be shown in the Profit and Loss Account.

Question 3.

If a share of 10 issued at a premium of 3 on which the full amount has been called is forfeited then the share capital account should be debited with:

(a) ₹5

(b) ₹8

(c) ₹10

(d) ₹13

Answer:

(c) ₹10

Explanation:

In such case, the capital account is debited with ₹10 (Face value of share).

OR

Debenture premium carmot be used to ……………

(a) Write off the discount on issue of shares or debentures.

(b) Write off the premium on redemption of shares or debentures.

(c) Pay dividends.

(d) Write off capital loss.

Answer:

(c) Pay dividends.

Explanation:

Debentures premium cannot be used to pay dividends. It may be utilised for writing off premium allowed on redemption of shares or debentures, writing off preliminary expenses, writing off expenses or the commission paid or discount allowed on any issue of shares or debentures, etc.

Question 4.

A, B and C sharing profits in the ratio of 2: 2: 1 have fixed capitals of ₹3,00,000, ₹2,00,000 and ₹1,00,000 respectively. After closing the accounts for the year ending 31 March 2019 it was discovered that interest

on capitals was provided @ 12% instead of 10% p.a. In the adjusting entry:

(a) Cr. A ₹1,200; Dr. B ₹800 and Dr. C ₹400

(b) Dr, A₹1,200; Cr. B ₹800 and Cr. C ₹400

(c) Cr. A ₹800; Cr, B ₹400 and Dr. C ₹1,200

(d) Dr. A ₹800; Dr. B ₹400 and Cr. C ₹1,200

Answer:

(b) Dr. A ₹1,200; Cr. B ₹800 and Cr. C ₹400

OR

Raj and Ravi are partners from 1 April, 2020, without a Partnership Deed and they introduced capitals of 35,000 and 20,00O respectively. On lÑt October, 2020, Ra advanced loan of 8,000 to the firm without any agreement as to interest. The Profit and Loss Account for the ‘ear ended 3i March, 2021 shows a profit of 1 5,000 but the partners cannot agree on payment of interest and on the basis of division of profits. What amount of profit will be distributed between them?

(a) ₹7,500 to each.

(b) ₹7,380 to each.

(c) ₹7,260 to each.

(d) None of these.

Answer:

(b) ₹7,380 to each.

Explanation:

Interest on loan advanced by Raj = \(₹ 8,000 \times \frac{6}{100} \times \frac{6}{12}=₹ 240\)

Distributable Profits = ₹ 15,000-₹ 240=₹ 14,760

This profit will be Distributed Equally \(=\frac{14,760}{2}=₹ 7,380 \mathrm{each}\)

![]()

Question 5.

Virat and Anushka are partners in a firm sharing profit and losses in 2: 1 ratio. Their capital balance were ₹10,00,000 and ₹8,00,000 respectively. The firm made profits during the year amounting to 3,45,000. Both partners are allowed salary of ₹2,500 per month. Interest on capital is allowed @ 5% on capital balance.

Calculate closing balance of capital for Virat and Anushka.

(a) Virat = ₹12,10,000, Anushka = ₹9,35,000

(b) Virat = 12.35,000, Anushka = ₹9,10,000

(c) Virat = ₹13,10,000, Anushka = ₹9,85,000

(d) None of these

Answer:

(a) Virat = ₹12,10,000, Anushka = ₹9,35,000

Explanation:

Question 6.

‘inod Ltd. issued 2,000, 9% Debentures of ₹100 each at a premium of ₹10. These debentures are redeemable after 5 years at a premium of 20%. In the beginning 9% Debentures Account will be credited by:

(a) ₹2,00,000

(b) ₹2,40,000

(c) ₹2,60,000

(d) ₹2,20,000

Answer:

(d) ₹2,20,000

Explanation:

Total money received + Premium amount = (2,000 x 100) + (2,000 100) = 2,00,000+ 20,000 2,20,000

OR

9% Debentures were issued (face value ₹100) at a discount of 10% to a vendor of machinery for payment of ₹9,00,000. Amount of discount will be:

(a) ₹90,000

(b) ₹81,000

(c) ₹99,000

(d) ₹1,00,000

Answer:

(d) ₹1,00,000

Explanation:

No. of debentures issued =\(\frac{9,00,000}{90}=₹ 10,000\)

Discount = (10,00 × 10) = 1,00,000

Question 7.

vinod ltd. issued ₹20,000 shares of ₹10 each for public subscription at a premium of 10%. Full amount was payable on application. Applications were received for 30,000 shares and the Board decided to allot the shares on a pro rata basis. How much amount is refunded to the applicants?

(a) Nothing is refunded

(b) ₹1,00,000

(c) ₹1,30,000

(d) ₹1,10,000

Answer:

(d) ₹1,10,000

![]()

Question 8.

On retirement of a partner, debtors of ₹34,000 were shown in the Balance Sheet. Out of this ₹4,000 became bad. One debtor became insolvent. 70% were recovered from him out of U0,000. Full amount is expected from the balance debtors. On account of this item, loss in revaluation account will be:

(a) ₹10,200

(b) ₹3,000

(c) ₹7,000

(d) ₹4,000

Answer:

(c) ₹7,000

Explanation:

Loss on Revaluation = ₹4,000 + (30% of ₹10,000)

= ₹4,000 + ₹3,000 = ₹7,000

OR

According to Profit and Loss Account, the net profit for the year is U,50,000. The total interest on partner’s capital is 1 8,000 and interest on partner’s drawings is 2,000. The Divisible profit as per Profit and Loss Appropriation Account will be:

(a)₹1,66,000

(b) ₹1,70,000

(c) ₹1,30,000

(d) ₹1,34,000

Answer:

(d) 1,34,000

Explanation:

Divisible profit as per Profit and Loss Appropriation Account = ₹,50,000 + 2,000 – ₹ 8,000 = ₹ 34,000

Read the following hypothetical situation, Answer Question No. 9 to 10.

Arun and Barun are partners in a firm sharing profits and losses. Their capitals on 1” April, 2015 were ₹4,80,000 and ₹5,40,000. On 1 October, 2015, they decided that the total capital of the firm should be 10,00,000 to be contributed equally by both of them. According to the Partnership Deed, interest on capital is allowed to the partners @ 6% p.a.

Question 9.

You are required to compute interest on capital for the year ending 31q March, 2016, of Arun and Barun respectivily.

(a) ₹29,400; ₹31,200

(b) ₹4,400; ₹6,200

(c)₹ 15,000; ₹5,000

(d) None of these

Answer:

(a) ₹29,400; 3₹1,200

Explanation:

Computation of Interest on Capital for the year ending 31.3.2016 will be:

Arun = 4,80,000 × 6% 6/12 (+) 5,00,000 × 6% 6/12 = 29,400

Barun = 5,40,000 × 6% × 6/12 (+) 5,00,000 × 6% × 6/12 = Z31,200

Question 10.

What would be the interest on capital till 30th September, 2015, of Arun and Barun respectively?

(a) ₹29,400; ₹31,200

(b) ₹14,400; ₹16,200

(c) ₹15,000; ₹15,000

(d) None of these

Answer:

(b) ₹14,400; ₹16,200

Explanation:

Computation of Interest on Capital till 30.09.2015 will be:

Arun = ₹4,80,000 6% × 6/12 = ₹14,400

Barun = ₹5,40,000 × 6% × 6/12= ₹16200

![]()

Question 11.

Arrange the following in proper sequence as types of ‘Share Capital’:

(i) Paid-up Capital

(ii) Issued Capital

(iii) Subscribed Capital

(iv) Called up Capital

Choose the correct option:

(a) (ii) – (iii) – (iv) -(i)

(b) (i) – (ii) – (iii) – (iv)

(c) (iii) – (ii) -(i) – (iv)

(d) (iv) – (i) – (ii) – (iii)

Answer:

(a) (ii) – (iii) – (iv) -(i)

Explanation:

Suhcrihed share capital is that part of issued share capital which has been subscribed by investors. Issued share capital refers to the total of the share capital issued to shareholders for subscription. ‘Called-up capital’ means such part of the capital, which has been called for payment. Paid-up capital is that part of the called up share capital of the company which is actually paid-up by the shareholders.

Question 12.

Shubham, Shabnam and Jay are partners sharing profits in the ratio of 6 : 4 : 1. Jay is guaranteed a minimum profit of ₹20,000. The firm incurred a loss of ₹2,20,000 for the year ended 31st March, 2021. What amount of deficiency will be borne by Shubham and Shabnam?

(a) ₹10,000 each.

(b) ₹20,000 each.

(c) ₹24,000 by Shubbam & ₹l6,000 by Shabnam.

(d) ₹12,000 by Shubham & ₹8,000 by Shabnam.

Answer:

(c) ₹24,000 by Shubham & ₹16,000 by Shabnam.

Explanation:

Loss of Jay = \(₹ 2,20,000 \times \frac{1}{11}=₹ 20,000\)

Guaranteed Amount ₹20,000

Deficiency ₹20,000 + Loss ₹20,000 = ₹40,000

The Loss of ₹40,000 to be borne by Shola and Shabnam in 6: 4 i.e., 3: 2

Shola’s Share = \(₹ 40,000 \times \frac{3}{5}=₹ 24,000\)

Shabnam’s Share = \(₹ 40,000 \times \frac{2}{5}=₹ 16,000\)

Question 13.

Which of the following is not a purpose for which the Securities Premium amount can be used?

(a) Issuing fully paid bonus shares to shareholders.

(b) Issuing partly paid-up bonus shares to shareholders.

(c) Writing off preliminary expenses of the company.

(d) In purchasing its own shares (buy back)

Answer:

(b) Issuing partly paid-up bonus shares to shareholders.

Explanation:

As per section 52 of the Act, securities premium account can be used for the issue of fuiiy paid-up bonus shares.

Question 14.

A and B are partners in a firm having a capital of 54,000 and 36,000 respectively. They admitted C for 1/3rd share in the profits, C brought proportionate amount of capital. The Capital brought in by C would be:

(a) ₹90,000

(b) ₹45,000

(c) ₹5,4O0

(d) ₹36,000

Answer:

(b) 45,000 .

Explanation:

Let the total capital of the firm be ‘X’

Therefore, x = 54,000 + 36,000 + 1/3x

So, x 1,35,000 and C’s share = ₹45,000

![]()

Question 15.

A partner withdrew 4,000 per month from 1 July, 2016, on beginning of every month.

Accounts are closed at 31 March, 2017.

Calculate interest on drawings while rate of interest is 10% per annum.

(a) ₹1,600

(b) ₹1,8O0

(c) ₹1,500

(d) ₹2,200

Answer:

(c) ₹1,500

Explanation:

Rate Average Period

Interest on Drawings = Amount × Number of months of drawings \(\times \frac{\text { Rate }}{100} \times \frac{\text { Average Period }}{12}\)

Where

∴ Interest on Drawings = 4,000 × 9 ×\(\frac{10}{100} \times \frac{5}{12}=₹ 1,500\)

![]()

= \(\frac{9+1}{2}=5 \text { months }\)

OR

A partner withdrew 8,000 each on 1st April and 1st October. Interest on his drawings @ 6% p.a. on 31

March will be:

(a) ₹480

(b) ₹720

(c) ₹240

(d) ₹960

Answer:

(b) ₹720

Explanation:

Calculation of interest on drawings:

Total Drawings = 8,000 × 2 months = 16,000

Average period \(=\frac{\text { Time left after first drawing + time left after last drawing }}{2}\)

Hence, interest on drawings ? = 16,000 × 6% × \(\\frac{9}{12}=₹ 720=\frac{12+6}{2}=\frac{18}{2}=9 \text { months }\)

Question 16.

At the time of dissolution, total assets are worth ₹3,0,000 and external liabilities are worth ₹1,20,000. If assets realised 120% and realisation expenses paid were ₹4,000, then profit/loss on realisation will be:

(a) Profit ₹60,000

(b) Loss ₹60,000

(c) Loss ₹56,00

(d) Profit ₹56,000

Answer:

(d) Profit ₹56,000

Question 17.

X, Y and Z were partners in a firm sharing profits and losses in the ratio of 2 : 2: 1. The firm closes its books on 31st March every year. Y died on 24th June, 2018. On Vs death goodwill of the firm was valued at ₹1,20,000. Vs share in the profits of the firm till the date of death from the last Balance Sheet was to he calculated on the basis of sales. Sales during the ‘ear 2017-18 was ₹15,00,000 and profit earned during the year was ₹3,00,000 . Sales from P’ April, 2018 to 24th June, 2018 were ₹2,00,000. The total amount payable to Y’s executors on his death was ₹1,75,000. This amount was paid to them on 15.07.2018. Pass the necessary journal entries for the above transactions in the books of the firm.

Answer:

working Note:

1. Y’s share of Goodwill= \(1,20,000 \times \frac{2}{5}=₹ 48,000\)

X will compensate = \(48,000 \times \frac{2}{3}=₹ 32,000\)

Z will compensate = \(48,000 \times \frac{1}{3}=₹ 16,000\)

2. Profit % =\(\frac{3,00,000}{15,00,000} \times 100=20 \%\)

Profit till date of Vs death = \(2,00,000 \times \frac{20}{100}=₹ 40,000\)

Vs share In Profit = \(40,000 \times \frac{2}{5}=₹ 16,000\)

![]()

Question 18.

P and Q were partners in a firm sharing profits in the ratio of 5:3. On 1-4-2014 they admitted R as a new partner for 1/8th share in the profits with a guaranteed profit of 75,000. The new profit sharing ratio between P and Q will remain the same but they agreed to bear any deficiency on account of guarantee to R in the ratio 3: 2. The profit of the firm for the year ended 31-3-2015 was ₹4,00,000. Prepare Profit and Loss Appropriation Account of P, Q and R for the year ended 31-3-2015.

Answer:

working Note:

Let total share = 1

R’sshare = \(\frac {1}{8}\)

Remaining share = 1 – \(\frac{1}{8}=\frac{7}{8}\)

P’s new share = \(\frac{7}{8} \times \frac{5}{8}=\frac{35}{64}\)

Q’s new share = \(\frac{7}{8} \times \frac{3}{8}=\frac{21}{64}\)

New Ratio = 35:21:8

R’s share in profit = 4,00,000 × \(\frac {1}{8}\) = ₹50,000

Minimum guaranteed profit to R = ₹75,000

Deficiency = 75,000 – 50,000 = ₹25,000

Deficiency to be borne by P = 25,000 × \(\frac {3}{5}\) = ₹15,000

Deficiency to be borne by Q = 25,000 × \(\frac {2}{5}\) = ₹10,000

P’s share in profit = \(\left(4,00,000 \times \frac{35}{64}\right)-15,000=₹ 2,18,750-₹ 15,000=₹ 2,03,750\)

Q’s share in profit = \(\left(4,00,000 \times \frac{21}{64}\right)-10,000=₹ 1,31,250-₹ 10,000=₹ 1,21,250\)

OR

Prem, Param and Priya were partners in a firm. Their fixed capitals were Prem ₹2,00,000 Param ₹3,00,000 and Priya ₹5,00,000. They were sharing profits in the ratio of their capitals. The firm was engaged in the sale of ready-to-eat food packets at three different locations in the city, each being managed by Prem, Param and Pria. The outlet managed by Prem was doing more business than the outlets managed by Param and Priya. Prem requested Param and Priya for a higher share in the profits of the firm which Param and Priva accepted. It was decided that the new profit sharing ratio will be 2: 1: 2 and its effect will be introduced retrospectively for the last four years. The profits of the last four years were ₹2,00,000 ₹3,50,000; ₹4,75,000 and ₹5,25,000 respectively. Showing your calculations clearly, pass a necessary adjustment entry to give effect to the new agreement between Prem, Param and Priya.

Answer:

Working Notes:

1. Calculation of Profit Share in Capital Ratio (2: 3 : 5)

Total Profit of last 4 years (2,00,000 + 3,50,000 + 4,75,000 + 5,25,000) = ₹15,50,000

Prem’s Share = 15,50,000 × \(\frac {2}{10}\) = ₹3,10,000

Param’s Share = 15,50,000 × \(\frac {3}{10}\) = ₹4,65,000

Priya’s Share = 15,50,000 × \(\frac {5}{10}\) = ₹7,75,000

2. Calculation of Profit Share in New Ratio (2: 1: 2)

Prem’s Share = 15,50,000 × \(\frac {2}{5}\) = ₹6,20,000

Param’s Share = 15,50,000 × \(\frac {1}{5}\) = ₹3,10,000

Priya’s Share = 15,50,000 × \(\frac {2}{5}\) = ₹6,20,000

![]()

Question 19.

Amit holds 100 shares of 10 each on which he has paid l per share as application money. Bimal holds 200 shares of ₹10 each on which he has paid ₹1 and ₹2 per share as application and allotment money, respectively. Chetan holds 300 shares of l0 each and has paid ₹1 on application, ₹2 on allotment and ₹3 for the first call. They all fail to pay their arrears and the second call of ₹2 per share and the directors, therefore, forfeited their shares. The shares are re-issued subsequently for ₹11 per share as fully paid. Journalise the transactions.

Answer:

Working Notes:

1. Amount Transferred to Share Forfeiture Account:

Application money received from Amit (100 shares × ₹1) = ₹100

Application and allotment money received from Bimal (200 shares × ₹3) = ₹600

Application, allotment and first call money received from Chetan (300 shares ×₹ 6) = ₹1,800

Amount transferred to share forfeiture = ₹100 + ₹600 + ₹1,800 = ₹2,500

2. Calculation of Amount transferred to Capital Reserve:

As shares are re-issued at price higher than face value, hence full amount of share forfeiture will be transferred to capital reserve.

OR

Solvent Bank issued 20,000, 6% Debentures of ₹50 each at a premium of 8% on September 30, 2015 redeemable on September 30, 2020. The issue was fully subscribed. Record necessary entries for issue and redemption of debentures.

Answer:

Notes:

(i) As per section 71(4) of Companies Act, 2013 read with Rule 18(7) of Companies (Share Capital and Debentures) Rule, 2014, a Banking Company is not required to create Debentures Redemption Reserve.

(ii) A Company which is not required to create DRR is exempted from investing 15% amount also.

![]()

Question 20.

X,Y and Z are partners sharing profits and losses equally. They agree to admit ‘A’ for equal share. For this

purpose, goodwill is to be valued at four year’s purchase of average profit of last five years. Profits for the past five years.

| Year Ended | Profit/Loss (₹) |

| 31st March, 2016 | 60,000 |

| 31st March, 2017 | 1 ,40,000 |

| 31st March, 2018 | 2,00,000 |

| 31st March, 2019 | 2,80,000 |

| 31st March, 2020 | (2,40,000) |

On 1st April, 2019, 5 cycles costing ₹40,000 were purchased and were wrongly debited to Travelling

Expenses. Depreciation on cycles was to be charged @ 25% calculate value of goodwill.

Answer:

Calculation of Average Profit:

| 31st March, 2016 | Profit/Loss (₹) |

| 31st March, 2017 | 60,000 (Profit) |

| 31st March, 2018 | 1,40,000 (Profit) |

| 31st March, 2019 | 2,00,000 (Profit) |

| 31st March, 2020 | 2,80,000 (Profit) |

| 31st March, 2016 | (2,10,000) (Loss) (see note) |

| Total Profit | 4,70,000 |

Average Profit = \(\frac {₹4,70,000}{5}\) = ₹94,000

Goodwill = Average Profit x Number of Year’s Purchase

₹94,000 × 4 = ₹3,76,000

Note: Calculation of Adjusted loss for the year ended 31st March, 2020

Question 21.

Shanti Auto Ltd. is registered with an authorised capital of ₹3,50,00,000 divided into 3,50,000 equity shares of ₹100 each. The company issued 25,000 shares to the vendor for building purchased and 1,00,000 shares were issued to the public. The amount was payable as follows:

On Application and Allotment – ₹20 per share

On First call – ₹25 per share

On Second and Final call – ₹The balance

All calls were made and were duly received except on 50 shares held by Amit who failed to pay the second and final call. His shares were forfeited. Present the share capital in the Balance Sheet of the company as per Schedule Ill Part I of the Companies Act, 2013. Also prepare ‘Notes to Accounts’.

Answer:

Question 22.

Harbhajan and Monty were partners sharing profits and losses in the ratio of 3 : L They decided to

dissolve their firm on 31st March, 2019.

You are required to pass necessary journal entries to give effect to the following:

(ï) Profit and Loss A/c (Dr. balance) appeared in the books at ₹20,000.

(ii) Profit on realisation amounted to ₹12,000.

(iii) Harbhajan was to bear realisation expenses for which he was to get a commission of ₹2,000.

(iv) Equipments worth 3000 was taken over b’ Monty at ₹2,500.

Answer:

Question 23.

During the year 2014-15, A. B. C. Ltd. issued 10,000 Equity shares of ₹50 each at ₹55 per share, payable as follows:

On Application – ₹15

On Allotment – ₹20 (including premium ₹5)

On 1st and Final Call – ₹20

All the issued shares were subscribed for by the public.

![]()

One shareholder holding 500 shares did not pay the amount due on allotment and his shares were

immediately forfeited. Another shareholder holding 100 shares paid the amount of the P’ and Final Call with allotment.

After the company had made the 1st and Final Call, 200 of the forfeited shares were reissued as fully

called up at ₹45 per share. The share issue expenses were ₹7,000 which were written off at the end of the year.

You are required to pass journal entries in the books of the company for the year ending 31st March,

2015.

Answer:

Working Note:

Calculation of profit on reissue:

Forfeited shares amount on 200 shares 7,500/500 × 200 = ₹3,000

Therefore, profit on reissue of 200 shares = 3,000 – 1,000 = ₹2,000

OR

Journalise the following:

(j) The directors of a company forfeited 200 equity shares of ₹10 each on which ₹800 had been paid. The

shares were reissued upon payment of ₹1,500.

(ii) A holds 100 shares of ₹10 each on which he has paid ₹1 per share on application. B holds 200 shares of 10 each on which he has paid 1 on application, ₹2 on allotment. C holds 300 shares of 10 each on which he has paid ₹1 on application, ₹2 on allotment and ₹3 on first call. They all failed to pay their arrears and second and final call of ₹4 per share as well. All the shares of A, B and C were forfeited and subsequently reissued at ₹11 per share as fuily paid-up.

Answer:

Question 24.

Juliet and Rabani are partners in a firm, sharing profits and losses in the ratio of 3: 1. on 31st It March, 2016, their Balance Sheet was as under:

Mike was taken as a partner for 1/4th share, with effect from 1st April, 2016, subject to the following

![]()

adjustments:

(a) Plant and Machinery was found to be overvalued by ₹16,000. It was to be shown in the books at the

correct value.

(b) Provision for Doubtful Debts was to be reduced by ₹2,000.

(c) Creditors included an amount of ₹2,000 received as commission from Malini. The necessary

adjustment was required to be made.

(d) Gobdwill of the firm was valued at ₹60,000. Mike was to bring in cash his share of goodwill along

with his capital of ₹1,00,000.

(e) Capital Accounts of Julîet and Rabani were to be readjusted in the new profit sharing arrangement

on the basis of Mike’s capital, any surplus to be adjusted through current account and any deficiency

through cash.

You are required to prepare:

(i) Revaluation Account.

(ii) Partners’ Capital Accounts.

(iii) Balance Sheet of the reconstituted firm.

Answer:

Working Notes:

(i) Premium for Goodwill = 60,000 × \(\frac {1}{4}\) = ₹15,000

Premium for goodwill is distributed between Juliet and Rabani in the sacrificing ratio 3:1. As the new ratio is not mentioned, hence it is taken that the partners have sacrificed in their old ratio itself.

(ii) Readjustment of Capitals in the New Ratio:

Mike’s Capital for \(\frac {1}{4}\) th share = ₹1,00,000

Total Capital = 1,00,000 × 4 = ₹4,00,000

Hence, Juliet’s Capital = 4,00,000 × \(\frac {9}{16}\) = ₹2,25,000

Rabani’s Capital = 4,00,000 × \(\frac {3}{16}\) = ₹75,000

![]()

(iii) Calculation of New Profit Sharing Ratio:

Let total profit be 1 Mike’s share = \(\frac {1}{4}\)

Remaining Profit = 1 – \(\frac{1}{4}=\frac{3}{4}\)

Hence, Juliet’s share = \(\frac{3}{4} \times \frac{3}{4}=\frac{9}{16}\)

Rabani’s share = \(\frac{3}{4} \times \frac{1}{4}=\frac{3}{16}\)

Mike’s share = \(\frac {1}{4}\) or \(\frac {4}{16}\)

New ratio= 9:3:4

OR

X, Y and Z are partners in a firm sharing profits and losses in proportion of 1/2, 1/6 and 1/3 respectively. The Balance Sheet as on April 1, 2019 was as follows:

Z retired on the above date and the partners agreed that:

(i) Machinery is to be depreciated by 10%.

(ii) Provision for bad debts is to be increased to ₹1,500.

(iii) Furniture was taken over by Z for ₹14,000.

(iv) The continuing partners have decided to adjust their capitals in their new profit sharing ratio of 3: 1

after retirement of Z. Surplus or deficit if any, in their capital account will be adjusted through their

current Accounts.

Prepare Revaluation Account and Partners’ Capital Accounts.

Answer:

Question 25.

Karan, Ah and Dey are partners in a firm sharing profits and losses in the ratio of 3 : 2: 1. On 31st March, 2016, their Balance Sheet was as under:

Karan died on 1st July, 2016, An agreement was reached amongst Ali, Deb and Karan’s legal

representatives that:

(a) Building be revalued at ₹93,500.

(b) Furniture be appreciated by ₹10,000.

(c) To write off the provision for doubtful debts since all debtors were good.

(d) Investments be valued at ₹38,000.

(e) Goodwill of the firm be valued at ₹1,20,000.

(f) Karan’s share of profit to the date of his death, to be calculated on the basis of previous year’s profit which was 25,000.

(g) Interest on capital to be allowed on Karan’s capital @ 6% per annum.

(h) Amount payable to Karan’s legal representative to be transferred to his legal representative’s Loan Account.

![]()

You are required to:

(i) Pass Journal entries on the date of Karan’s death.

(ii) Prepare the Interim Balance Sheet of the reconstituted firm.

Answer:

Working Notes:

(i) Karan’s share of Profit up to the Date of Death = 25,000 ×\(\frac{3}{12} \times \frac{3}{6}\) = ₹3,125

(ii) Share of Goodwill = ₹1,20,000 × \(\frac{3}{6}\) = 60,000. It is shared by Ah and Dey in gaining ratio, i.e,2:1

Question 26.

On 1st April, 2013, Sunshine Ltd. issued ₹10,00,000, 15% Debentures of ₹100 each at 8% discount payable:

₹40 on application

The balance on allotment. These debentures were to be redeemed at a premium of 5%. All the debentures were subscribed for by the public.

Interest on these debentures was to be paid half-yearly which was duly paid by the company.

![]()

You are required to:

(i) Pass journal entries in the first year of debenture issue (including entries for debenture interest).

(ii) Prepare the 15% Debenture Account for the year ending 31st March, 2014.

Answer:

Part-B

(Analysis of Financial Statement)

(Option-l)

Question 27.

The basic Financial Statements include:

(a) Statement of Cash Flows (c) Balance Sheet and Income Statement

(b) Statement of Retained Earnings (d) None of these

Answer:

(c) Balance Sheet and Income Statement

Explanation:

Financial statements are a collection of summary-level reports about an organization’s financial

results, financial position, and cash flows. They include the income statement, balance sheet, and

statement of cash flows.

OR

Current ratio of Vidur Pvt. Ltd. is 3: 2. Accountant wants to maintain it at 2: 1. Following options are

available:

(i) He can repay Bills Payable (iii) He can take short-term loan

(ii) He can purchase goods on credit

Choose the correct option:

(a) Only (j) is correct (c) Only (î) and (iii) are correct

(b) Only (ii) is correct (d) Only (ii) and (iii) are correct

Answer:

(a) Only (i) is correct

Explanation:

Current ratio is used to assess the firm’s ability to meet its short-term liabilities on time. Repayment of bills payable will decrease both current assets and current liabilities equally which will result into change in current ratio to 2: 1.

Question 28.

Calculating Operating Ratio, if Cost of Revenue from operations is 50,000 Revenue from 0perations is

1,50,000 and Operating expenses 20,000.

(a) 45%

(b) 46.7%

(c) 48.1%

(d) 42.2%

Answer:

(b) 46.7%

Explanation:

![]()

= \(\frac{50,000+20,000}{1,50,000} \times 100=46.7 \%\)

![]()

Question 29.

A company acquired a plant for 5,00,000 paying 20% down payment and executing a bond for the

balance. Compute cash flow.

(a) ₹4,00,000 cash used in Investing Activities

(b) ₹1,00,000 cash used in Investing Activities

(c) ₹5,00,000 cash used in Investing Activities

(d) None of these

Answer:

(b) ₹1,00,000 cash used in Investing Activities

ExIanation:

Cash paid for acquiring a plant is a cash outflow from investing activities.

Cash Paid for Plant = ₹5,00,000 x \(\frac {20}{100}\) = ₹1,00,000

OR

If 12% Preference share capital ₹20,00,000 were redeemed at a premium of 5%, while preparing Cash Flow Statement, Cash Flow will be:

(a) Cash used is Financing Activities ₹22,40,000

(b) Cash used in Financing Activities ₹23,40,000

(c) Cash used in Financing Activities ₹20,00,000

(d) Cash used in Financing Activities ₹21,00,000

Answer:

(d) Cash used in Financing Activities 21,00,000

Explanation:

Issue and Redemption of Shares is a financing activity. Redemption of shares is outflow of cash from

finandng activity.

Cash used in Financing Activity = 12% Preference Share Capital + Premium on Redemption of

Debentures

= ₹20,00,O00 + (5% of 20,00,000)

= ₹20,00,00O + ₹1,00,000 = 21,00,000

Question 30.

From the following information, find out the inflow of cash:

![]()

Additional Information:

Depreciation for the year 2014-2015 is ₹80,000

During the year Machinery was purchased for ₹2,50,000 and a part of asset was sold at a profit of ₹40,000.

(a) ₹1,20,000

(b) ₹1,00,000

(c) ₹80,000

(d) ₹40,000

Answer:

(a) ₹1,20,000

Explanation:

Question 31.

Under which major headings and sub-headings will the following items be presented in the Balance Sheet of a company as per Schedule III, Part I of the Companies Act, 2013?

(i) Interest accrued and due on debentures

(ii) Loose tools

(iii) Accrued interest on calls in advance

(iv) Interest due on calls in arrears

(v) Trademarks

(vi) Premium on redemption of debentures

(vii) Plant and Machinery

(viii) Patents

Answer:

| Major-Head | Sub-Head |

| (i) Current Liabilities | Other Current Liabilities |

| (ii) Current Assets | Inventories |

| (iii) Current Liabilities | Other Current Liabilities |

| (iv) Current Assets | Other Current Assets |

| (v) Non-current Assets | Fixed Assets Intangible |

| (vi) Non-current Liabilities | Other Non-current Liabilities |

| (vii) Non-current Assets | Fixed Assets Tangible |

| (viii) Non-current Assets | Fixed Assets Intangible |

Question 32.

Anupam Ltd. had published its accounting ratios for the ýear 2021-22 along with the other financial statements for providing information regarding the performance of the company in the year 2021-22. On the analysis of these financial statements along with accounting ratios, it was found that the company was having very good profitability ratios i.e. company was occupying a good profitable position compared to previous year.

But from some secret sources on analyse of financial accounts got to know that in actual the closing stock of company is more than what company had disclosed, therefore showing more sales than actual. Find out the limitation of ratio analysis identified here. Also give two other limitations of accounting ratios.

Ans.

Identified here is of ‘window dressing. Wherein a company tried-to manipulate the actual facts and

present the better financial position thats what in actual is. The other two limitation of ratio analysis are

as follows:

1. Qualitative factors are not considered: Ratio analysis is a technique of quantitative analysis. If ignores qualitative factors, which may be important in decision making.

![]()

2. Price level changes are not considered: Change in price affects the comparability of the ratios. But

price level changes are not considered in accounting variables from which ratios are computed. This

limits the utility of accounting ratios.

Question 33.

From the following information, calculate Interest Coverage Ratio:

Profit after interest and tax – ₹6,00,000

10% Debentures – ₹8,00,000

Rate of Income Tax – 40%

Answer:

Profit after interest and tax = 6,00,000

Tax Rate = 40%

Profit before Tax = 6,00,000 × \(\frac{100}{60}\) = l0,00,000

Interest on Debentures = 8,00,000 × \(\frac{10}{100}\) = 80,000

Profit before Interest and tax = 10,00,000 + 80,000 = 10,80,000

![]()

= \(\frac{10,80,000}{80,000}\) = 13.5 times.

OR

The current ratio is 2 : 1. State giving reasons which of the following transactions would improve, reduce

and not change the current ratio:

(i) Payment of current liability.

(ii) Purchased goods on credit.

Answer:

The given current ratio is 2: 1. Let us assume that current assets are ₹50,000 and current liabilities are

₹25,000. Thus, the current ratio is 2: 1. Now we will analyse the effect of given transactions on current

ratio.

(i) Assume that ₹10,000 of creditors is paid by cheque. This will reduce the current assets to ₹40,000 and

current liabilities to ₹15,000. The new ratio will be 2.67: 1 (₹40,000/₹15,000). Hence, it has improved.

(ii) Assume that goods of ₹10,000 are purchased on credit. This will increase the current assets to ₹60,000 and

current liabilities to ₹35,000. The new ratio will be 1.7: 1 (₹60,000/ ₹35,000). Hence, it has reduced.

Question 34.

Given below is the information from the balance sheet of Himmat Ltd.

Notes to accounts:

Additional Information:

![]()

(ii) Income tax paid during the year includes ₹15,000 paid towards dividend distribution tax.

(iii) Land and Building of book value ₹1,50,000 was sold at a profit of 10%.

(iv) The rate of depreciation on plant and machinery is 10%.

![]()

Prepare:

(i) Net profit before tax and extra ordinary items.

(ii) Calculate operating profit before working capital change.

(iii) Cash flow from investing activities.

(iv) Cash flow from financing activities.

(v) Calculate closing cash and cash equivalents.

Answer:

Calculation of Net profit before tax and extra ordinary items.

Calculation Operating Profit Before Working Capital Change:

Calculation of cash flow from investing activities:

Calculation of Cash flow from financing activities:

Calculation of closing cash and cash equivalents:

Working Notes:

1. Calculation of Cash Flow from Operating Activities:

3. It is assumed that 10% debenture have been redeemed in the beginmg the year, therefore, interest is

not …………..