Students must start practicing the questions from CBSE Sample Papers for Class 12 Accountancy with Solutions Set 3 are designed as per the revised syllabus.

CBSE Sample Papers for Class 12 Accountancy Set 3 with Solutions

Time: 2 Hrs.

Max. Marks: 40

General Instructions :

- This question paper contains 34 questions. All questions are compulsory.

- This question paper is divided into two parts. Part A and Part B.

- Part- A is compulsory for all candidates.

- Part- B has two option i.e. (i) Analysis of Financial Statements and (ii) Computerised Accounting. Students must attempt only one of the given options.

- Question 1 to 16 and 27 to 30 carries 1 mark each.

- Questions 17 to 20. 31 and 32 carries 3 marks each.

- Questions 21, 22 and 33 carries 4 marks each.

- Questions 23 to 26 and 34 carries 6 marks each.

- There is no overall choice. However, an internal choice has been provided in 7 questions of one mark, and 2 questions of three marks. 1 question of four marks and 2 questions of six marks.

Part – A

(Accounting for Partnership Firms and Companies)

Question 1.

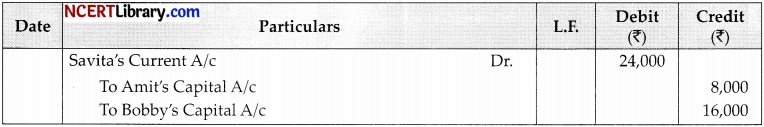

Amit and Bobby are partners sharing profits & losses in the ratio of 3:1. Savita was admitted for l/5th share in the profits. Savita was unable to bring her share of goodwill for premium in cash. The journal entry recorded for the premium for goodwill is as below:

The new profit sharing ratio of Amit, Bobby and Savita will be:

(a) 41:7:12

(b) 13:12:10

(c) 3:1:1

(d) 5:3:2

Answer:

(a) 41:7:12

![]()

Explanation:

Sacrificing Ratio = Amit = \(\frac{8,000}{24,000}=\frac{1}{3} \text { Bobby }=\frac{16,000}{24,000}=\frac{2}{3}\)

New Profit Share = Old profit share – Sacrificed share

Amit’s new share = \(\frac{3}{4}-\left(\frac{1}{5} \times \frac{1}{3}\right)=\frac{3}{4}-\frac{1}{15}=\frac{45-4}{60}=\frac{41}{60}\)

Bobby’s new share = \(\frac{1}{4}-\left(\frac{1}{5} \times \frac{2}{3}\right)=\frac{1}{4}-\frac{2}{15}=\frac{15-8}{60}=\frac{7}{60}\)

Savita’s share = \(\frac {1}{5}\)

New profit sharing ratio = \(\frac{41}{60}: \frac{7}{60}: \frac{1}{5}=41: 7: 12\)

Question 2.

Assertion (A): Interest on loan by partner is allowed at the agreed rate of interest and in the absence of agreement it is allowed @ 8%.

Reason (R): In the absence of partnership deed, interest on loan by partner is not allowed.

(a) (A) is correct but (R) is wrong

(b) Both (A) and (R) are correct, but (R) is not correct explanation of (A)

(c) Both (A) and (R) are incorrect.

(d) Both (A) and (R) are correct, and (R) is the correct explanation of (A)

Answer:

(c) Both (A) and (R) are incorrect.

Explanation:

Interest on loan by partner is allowed @ 6% p.a.

Question 3.

Fortune Ltd. forfeited 2,000 shares of ₹10 each (which were issued at par) held by Navesh for non payment by allotment money of ₹4 per share.

The called up value per share was ₹9. On forfeiture, Share Capital Account will be debited by:

(a) ₹10,000

(b) ₹8,000

(c) ₹2,000

(d) ₹18,000

Answer:

(b) ₹18,000

Explanation:

As called up value is ₹9, thus share capital a/c will be debited bv (2,000 × 9) = ₹18,000.

OR

In case debentures of ₹2,00,000 are issued at par but payable at a premium of 5%, the premium payable will be debited to:

(a) Securities Premium Reserve A/c (c) Loss on Issue of Debentures A/c

(b) Premium on Redemption of Debentures A/c (d) Statement of Profit & Loss A/c

Answer:

(c) Loss on Issue of Debentures A/c

Question 4.

L and M share profits of a business in the ratio of 5 : 3. They admit N as a partner in the firm for l/4th share in the profits. For the purpose of admission of N, goodwill of the firm is to be valued at 4 year’s purchase of average super profit of the last 3 years. Average Profit of the last 3 years is ₹20,000. Normal Profit is ₹12,000.

For adjustment of goodwill, the entry will be:

Answer:

Explanation:

Goodwill = Super profit × Number of year purchase

Super Profit = Average Profit – NormaI Profit

Value of firm’s goodwill = (₹20,000 – ₹12,000) × 4

= ₹32,000

N’s share of goodwill = ₹32,000 × \(\frac{1}{4}=₹ 8,000\)

N’s share of goodwill is credited of L and M in their sacrificing ratio i.e., 5 : 3.

OR

X, Y, Z are partners in a firm sharing profits & losses in the ratio of 6 : 4 :1. X guaranteed profit of ₹15,000 to Z. Net profit for the year ending 31st March 2019 was ₹99,000. X’s share in the profit of the firm will be:

(a) ₹30,000

(b) ₹15,000

(c) ₹48,000

(d) ₹45,000

Answer:

(c) ₹48,000

Explanation:

Z’s actual share of profit = \(\frac { 1 }{ 2 }\)

Deficiency = Guaranteed profit – ₹9,000

= 15,000- 9,000 = ₹6,000

X’s share in profit = \(\frac { 1 }{ 2 }\)

= 54,000 – 6,000

= ₹48,000

Question 5.

Reema and Seema were partners in a firm sharing profits & losses in the ratio of 3 : 2. Their capitals were ₹1,20,000 and ₹2,40,000 respectively. They were entitled to interest on capital @10%. The firm earned profit of ₹18,000 during the year. The interest on Reema’s Capital A/c will be:

(a) ₹12,000

(b) HO,800

(c) ₹7,200

(d) ₹6,000

Answer:

(d) ₹6,000

![]()

Explanation:

Total interest on capital = ₹12,000 (Reema) + ₹24,000 (Seema) = ₹36,000.

However, total distributable profits are ₹18,000.

Therefore, total profits of ₹18,000 will be distributed between Reema and Seema in ratio of their interest on capital, i.e., in the ratio of 1 : 2.

Interest on Reema’s capital = 18,000 × \(\frac{1}{3}=₹ 6,000\)

Question 6.

Discount on issue of debentures is restricted to:

(a) 10%

(b) 20%

(c) 25%

(d) None of these

Answer:

(d) None of these

OR

Mahesh Ltd. issues 50,000, 10% debentures of ₹100 each at certain rate of discount and were to be redeemed at 20% premium. Existing balance of securities premium before issuing of these debentures was ₹25,00,000 and after writing off loss on issue debentures, the balance in securities premium was ₹10,00,000. At what rate of discount, these debentures were issued?

(a) 10%

(b) 5%

(c) 25%

(d) 15%

Answer:

(a) 10%

Explanation:

Loss on Issue of Debentures = 50,000 x 100 x 20% = ₹10,00,000

Amount written off from Securities Premium

Reserve A/c = 25,00,000 – 10,00,000 = ₹15,00,000

Discount on issue of debentures ₹15,00,000 – Loss on Issued Debenture

= 15,00,000 – 10,00,000 = ₹5,00,000

Rate of Discount = \(\frac{5,00,000}{50,00,000} \times 100=10 \%\)

Question 7.

Brawn Ltd. had allotted 10,000 shares to the applicants of 14,000 shares on pro-rata basis. The amount payable on application was ₹2 per share. Mohan had applied for 420 shares. The number of shares allotted and the amount carried forward for adjustment against allotment money due from Mohan are:

(a) 60 shares, ₹120

(b) 320 shares, ₹200

(c) 340 shares, ₹100

(d) 300 shares, ₹240

Answer:

(d) 300 shares, ₹240

Explanation:

Shares allotted to Mohan = \(\frac{10,000}{14,000} \times 420\) = 300 shares

Application money paid by him = 420 × 2 = 840

Less: Application money should be paid by

![]()

Question 8.

A, B, C, D were partners sharing profits in the ratio of 1: 2 : 3 : 4. D retired and his share was acquired by A and B equally. Goodwill was valued at 3 years purchase of average profits of last 4 years, which were ₹40,000. General reserve showed a balance of ₹1,30,000 and D’s capital in the balance sheet was ₹3,00,000 at the time of D’s retirement. The amount due to D will be:

(a) ₹3,50,000

(b) ₹4,00,000

(c) ₹4,20,000

(d) ₹3,76,000

Answer:

(b) ₹4,00,000

OR

X and Y are partners sharing profit equally. Z was a manager who received the salary of 8,000 p.m. in addition to commission of 5% on net profit alter charging such commission. Profit for the year is 1 3,56,000 before charging salary. Find the total remuneration of Z.

(a) ₹1,56,000

(b) ₹1,76,000

(c) ₹1,52,000

(d) ₹1,74,000

Answer:

(a) ₹ c 1,56,000

Explanation:

Total remuneration of Z = Salary + Commission

= ₹96,O00 + \(\frac{5}{105} \times(13,56,000-96,000)\) = 96,000 + 60,000 = ₹1,56,000

Read the following hypothetical situation, Answer Question No. 9 and 10.

Amrish and Yogesh are partners since 1st October 2017 sharing profits & losses in the ratio of 3 : 2. Their capitals as on 1st April 2020 were of ₹5,00,000 and ₹3,00,000 respectively. They did not have a partnership deed but had agreed to allow interest on capital @ 5% p.a. and salary to Yogesh is to be allowed of ₹25,000 per annum. The accountant was preparing the annual accounts of the year and identified that during the year interest on capital was not allowed but Yogesh’s salary was allowed. Profit after Yogesh’s salary was ₹1,49,300. Also provision was not made for manager’s commission @ 5% of the net profit.

Answer the following questions on the basis of the above information.

Question 9.

Profit before Yogesh’s salary will be:

(a) ₹1,41,000

(b)₹1,66,000

(c) ₹1,57,300

(d) ₹1,74,300

Answer:

(d) ₹1,74,300

![]()

Explanation:

Calculation: ₹149,300 + 25,000 (salary)

Profit before Yogesh’s is salary = ₹1,74,300

Question 10.

Manager’s commission will be:

(a) ₹3,800

(b) ₹3,080

(c) ₹8,030

(d) ₹8,300

Answer:

(d) ₹8,300

Explanation:

Manager’s Commission = 1,74,300 × \(\frac{5}{105}=₹ 8,300\)

Question 11.

Which of the following is not an essential feature of partnership?

(a) An agreement oral or written, should exist among the partners.

(b) Agreement should be to carry on lawful business.

(c) All the partners should contribute capital in the firm.

(d) There should be at least two partners.

Answer:

(c) All the partners should contribute capital in the firm.

Question 12.

Sal Tree Ltd. had forfeited 5,000 equity shares of ₹10 each that were issued at a premium of C5 per share for non-payment of first & final call of ?4 per share. The forfeited shares were reissued for ₹8 per share as fully paid-up. The amount that will be transferred to capital reserve will be:

(a) ₹10,000

(b) ₹20,000

(c) ₹30,000

(d) Nil

Answer:

(b) ₹20,000

Explanation:

Question 13.

According to Table ‘F’ of schedule I interest on calls in advance may be paid at a rate not exceeding ……… p.a.

(a) 10%

(b) 12%

(c) 6%

(d) 15%

Answer:

(b) 12%

Question 14.

Ramesh and Suresh are partners sharing profits & losses in the ratio 2 : 1 respectively. Ramesh’s capital is ₹1,02,000 and Suresh is capital is ₹73,000. They admit Mahesh and agreed to give him l/5th share in future profits. Mahesh brings ₹14,000 as his share of goodwill. He agrees to contribute capital in the new profit sharing ratio. How much capital will be brought by Mahesh?

(a) ₹43,750

(b) ₹45,000

(c) ₹47,250

(d) ₹48,000

Answer:

(c) ₹47,250

Explanation:

Ramesh’s new capital = \(1,02,000+\left(14,000 \times \frac{2}{3}\right)\)

=1,02,000+9,333=₹ 1,11,333

Suresh’s new capital = \(73,000+\left(14,000 \times \frac{1}{3}\right)\)

= 73,000+4,667=₹ 77,667

Total capital of Ramesh & Suresh = 1,11,333+77,667=₹ 1,89,000

Total capital of new firm = \(1,89,000 \times \frac{5}{4}=₹ 2,36,250\)

Mahesh share of capital = \(2,36,250 \times \frac{1}{5}=₹ 47,250\)

Question 15.

if the date of drawings is not given, interest on total drawings is calculated for:

(a) 4 months

(b) 5 months

(c) 6 months

(d) 1 year

Answer:

(c) 6 months

OR

If equal amounts are withdrawn in the beginning of each month throughout the year, interest on drawings in calculated as:

(a) Total drawings × \(\frac{\text { Rate }}{100} \times \frac{5.5}{12}\)

(b) Total drawings × \(\frac{\text { Rate }}{100} \times \frac{6.5}{12}\)

(c) Total drawings × \(\frac{\text { Rate }}{100} \times \frac{6}{12}\)

(d) Total drawings × \(\frac{\text { Rate }}{100} \times \frac{5}{12}\)

Answer:

(b) Total drawings × \(\frac{\text { Rate }}{100} \times \frac{6.5}{12}\)

Explanation:

Average period \(=\frac{\text { Time left after first drawing + Time left after last drawing }}{2}\)

= \(\frac{12+1}{2}\) = 6.5 months.

Question 16.

Due to change in profit sharing ratio X’s sacrifice his 3/10 share while Z’s gain his 3/10 share. They decide to record the effect of the following without affecting the book figures, by passing an adjusting entry:

General Reserve ₹35,000

Profit & Loss (Cr.) ₹15,000

Advertisement

Suspense A/c (Dr.) ₹20,000

The necessary adjustment entry will be:

(a) Dr. Z and Cr. X by ₹18,000

(b) Dr. X and Cr. Z by ₹9,000

(c) Dr. X and Cr. Z by ₹18,000

(d) Dr. Z and Cr. X by ₹9,000

Answer:

(d) Dr. Z and Cr. X by ₹9,000

![]()

Question 17.

Sita, Reeta and Geeta are partners in a firm sharing profits and losses in the ratio of 4 : 3 : 1. As per the terms of agreement of partnership deed on the death of any partner. Goodwill of deceased partner was to be valued at 50% of the Net profit credited to that Partner’s Capital A/c during the last three completed year before her death. Sita died on 28th february 2018. The profits for the last 5 years were: 2013 – ₹60,000; 2014 – ₹97,000; 2015 – ₹1,05,000; 2016 – ₹30,000; 2017 – ₹84,000 On the date of Sita’s death, building was found undervalued by ₹80,000 which was to be considered. Calculate the amount of Sita’s share of goodwill in the firm and record the adjustment journal entries of goodwill and revaluation of building. The new profit sharing ratio between Reeta and Geeta will be equal:

Answer:

Working Note:

Calculation of Sita’s share goodwill:

Total of last 3 years profit = 1,05,000 + 30,000 + 84,000 = 2,19,000

Sita’s share in last three years profit = \(2,19,000 \times \frac{4}{8}=₹ 1,09,500\)

Sita’s share of goodwill = \(1,09,500 \times \frac{50}{100}=₹54,750\)

Calculation of gaining ratio:

Recta = \(\frac{1}{2}-\frac{3}{8}=\frac{4-3}{8}=\frac{1}{8}\)

Geeta = \(\frac{1}{2}-\frac{1}{8}=\frac{4-1}{8}=\frac{3}{8}\)

Gaining Ratio = \(\frac{1}{8}: \frac{3}{8}=1: 3\)

Sita’s share of goodwill will be contributed by Recta and Geeta in their gaining ratio:

Reeta = \(54,750 \times \frac{1}{4}=13,688\)

Ceeta = \(54,750 \times \frac{3}{4}=41,062\)

Question 18.

Anmay and Lavina are partners with capitals of ₹5,00,000 and ₹4,00,000 respectively, on which they are entiled to interest @10% p.a. They divide profits in the ratio 2:1. They take Sudha into partnership with l/4th share of profits and guaranteed that her share of profits will not be less than ₹2,00,000. Sudha brought ?3,00,000 as per capital. Any deficiency of profits received by Sudha oven in her 1/4th share of profit will be borne by Anmay and Lavina in the ratio of 4 : 1. Profit at the end of the year before allowing interest on capital amounted to ₹7,20,000. Distribute the profits for the year ended 31st March

OR

A, B, C were partners in a firms sharing profits & losses in the ratio of 4 : 3 : 3. Their fixed capitals were ₹1,00,000, ₹2,00,000 and ₹3,00,000 respectively. For the year 2021-22, interest on capital was credited to them @10% p.a. instead of 9% p.a. Pass the entry for rectifying the error.

Answer:

Working Note:

Since, Sudha share amount to ₹1,50,000; whereas minimum guaranteed amount is ₹2,00,000, the deficiency of ₹50,000 will be borne by Anmay and Lavina in 4: 1.

Deficiency borne by Anmay = \(50,000 \times \frac{4}{5}=₹ 40,000\)

Deficiency borne by Lavina = \(50,000 \times \frac{1}{5}=₹ 10,000\)

OR

Question 19.

Litmus Ltd. took over assets of ₹10,00,000 and liabilities of ₹1,80,000 of Cayns Ltd. for ₹7,60,000. Litmus Ltd. issued 9% debentures of ₹100 each at a discount of 5% in full satisfaction of the purchase consideration in favour of Cayns Ltd. Pass the necessary journal entries in the books of Litmus Ltd.

![]()

OR

Rockey Ltd. purchased building for ₹22,00,000. Half the payment was made by cheque and the balance half by issue of 9% debentures of ₹100 each at a premium of 10% pass the journal entries.

Answer:

Question 20.

Ram and Mohan were partners in a firm sharing profits in the ratio of 4: 1. On 01-03-2021 they admitted Sohan as a new partner for 1/3d share of profits of the firm. They fixed the new profit sharing ratio as 4 : 2 : 3. The Profit & Loss A/c on the date of admission showed a balance of ₹32,000 (Dr.). The firm also had reserve of ₹1,00,000. Sohan is to bring ₹60,000 as premium for his share of goodwill. Pass necessary journal entries.

Answer:

Question 21.

Maple Ltd. was formed on 1st November 2021, with a capital of ₹12,00,000 divided into equity shares of ₹10 each at a premium of ₹2 per share. It offered 10,00,000 shares to the public.

The issue price was payable as follows:

₹4 with application

₹6 with allotment (including premium)

The balance as and when required.

The balance was not called till the date of the Balance Sheet. All the shares offered by the company were subscribed for one shareholder holding 1,000 shares paid the balance with allotment. Another shareholder holding 800 shares did not pay the allotment money when due. You are required to share the items under equity and liabilities head in the balance sheet of the company (Prepared as per schedule III of the Companies Act, 2013) at the end of the financial year with Notes to Accounts.

Answer:

![]()

Question 22.

P and Q were partners in a firm. Pass journal entries for the following transaction on dissolution of the firm after various assets and external liabilities have been transferred to Realisation A/c.

(i) X, an unrecorded creditor of ₹10,000 was paid by partner P at a discount of 20%.

(ii) Y, an unrecorded creditor of ₹25,000 took over computer at ₹30,000. Balance was paid by him in cash.

(iii) There was an unrecorded asset of ₹20,000 half of which was handed over to settle half of the unrecorded liability of ₹28,000 and the balance of unrecorded liability was paid at 80% in full settlement. The remaining half of the unrecorded asset was sold in the market at a discount of 10%.

(iv) P’s loan was appearing on the liabilities side of the balance sheet at ₹50,000. He accepted unrecorded amount of ₹40,000 at ₹35,000 and the balance was paid to him in cash.

Answer:

Question 23.

XY Ltd. invited applications for issuing 50,000 shares of ?10 each. The amount was payable as follows:

On Application – ₹3 per share

On Allotment – ₹4 per share

On First & Final call – ₹3 per share

Applications were received for 75,000 shares and pro-rata allotment was made as follows:

1. Applications for 40,000 shares were allotted 30,000 shares on pro-rata basis.

2. Applicants for 35,000 shares were alloted 20,000 shares on pro-rata basis.

3. Ramy to whom 1,200 shares were allotted out of the group applying for 40,000 shares failed to pay the allotment money. His shares were forfeited immediately after allotment.

4. Shamu, who had applied for 700 shares out of the group applying for 35,000 shares failed to pay the first final call. His shares were also forfeited. Out of the forfeited shares 1,000 shares were re-issued @?8 per share fully paid-up. The re-issued shares included all the forfeited shares of Shamu.

5. Pass the necessary journal entries to record the above transactions.

OR

Pass the necessary journal entries in both the following cases:

(a) Hari applied for 2,000 shares of HO each at a premium of ₹3 per share. He was allotted 1,000 shares. After having paid ₹3 per share on application, he did not pay the allotment money of per share (including premium) and on his subsequent failure to pay the first call of per share, his shares were forfeited. These shares were re-issued @?8 per share credited as fully paid-up. Pass journal entries.

(b) L Ltd. forfeited 470 shares of ₹10 each issued at a premium of ₹5 per share for non payment of allotment money of ₹8 per share (including share) premium ₹5 per share and the first and final call of ₹5 per share. Out of these 60 shares were subsequently re-issued at ₹14 per share.

Answer:

Working Notes:

Working Notes:

(1) (A) Ramu must have applied for = \(\frac{40,000}{30,000} \times 1,200=1,600 \text { shares }\)

Excess amount received form Rarnu on application = (1,600 – 1,200) shares = 400 × 3=₹1,200

OR

Working Notes:

Calculation of the amount due but not paid on allotment

(a) Total no. of shares applied – 2,000

(b) Total money paid on application (2,000 × 3) – ₹6,000

Excess application money [6,000-(1,000 × 3)] – ₹3,000

(c) Total amount due on allotment (1,000 × 5) – ₹5,000

(d) Amount due but not paid (5,000-3000) – ₹2,000

![]()

Out of ₹5,000 due on allotment, ₹2,000 due for share capital and ₹3,000 due for securities premium reserve. Out of excess application money of ₹3,000; ₹2,000 are adjusted towards allotment as share capital and ₹1,000 are adjusted towards securities premium reserve. Therefore SPR of ₹2,000 (3,000 – 1,000) is not received. Hence, Securities Premium Reserve is debited by ₹2,000.

Working Notes:

Profit on 470 shares = ₹940

Profit on 60 shares = \(940 \times \frac{60}{470}=₹ 120\)

Question 24.

X and Y are in partnership sharing profit and losses in the ratio of 3 : 2. Their balance sheet as at 31st March 2021, were as under:

They admit Z on 1 April 2021 on the following terms:

(i) A provision of 5% is to be created on debtors.

(ii) Accrued income of ₹1,500 does not appears in the books and ?5,000 are outstanding for salaries.

(iii) Present market value of Investments is ₹6,000. X takes over the investments at this value.

(iv) New profit sharing ratio of partners will be 4 : 3 : 2. will bring in ?20,000 as his capital.

(v) Z is to pay in cash an amount equal to his share in firm’s goodwill valued at twice the average profits of the last 3 years which were ₹30,000; ₹26,000 and ₹25,000 respectively.

(vi) Half the amount of goodwill is withdrawn by old partnes.

You are required to prepare Revaluation A/c, Capital A/c, Current A/c and the opening balance sheet of the new firm.

OR

Mahesh, Vishesh and Naresh were partners in a firm sharing profits & losses in the proportion of

\(\frac{1}{2}: \frac{1}{3}: \frac{1}{6}\)respectively. On 31st March 2021, their Balance Sheet was as follows:

Mahesh retired on the above date and it was agreed that:

(i) Plant and Machinery will be depreciation by 5%.

(ii) An old computer previously written off was sold for ₹4,000.

(iii) Bad debts amounting to ₹3,000 will be written off and a provision of 5% on debtor for bad and doubtful debts will be maintained.

(iv) Goodwill of the firm was valued at ₹1,80,000 and Mahesh’s share of the same was credited in his account by debiting Vishesh’s and Naresh’s accounts.

(v) The capital of the new firm was to be fixed at ₹90,000 and necessary adjustments were to be made by bringing in or paying off cash as the case may be

(vi) Vishesh and Naresh will share future profits in the ratio of 3 : 2.

Prepare Revaluation A/c, Partner’s Capital A/c and the Balance Sheet of the re-constituted firm.

Answer:

Working Notes:

Calculation of Gaining Ratio:

Vishesh’s Gain = \(\frac{3}{5}-\frac{1}{3}=\frac{9-5}{15}=\frac{4}{15}\)

Naresh’s Gain = \(\frac{2}{5}-\frac{1}{6}=\frac{12-5}{30}=\frac{7}{30}\)

Gaining Ratio of Vishesh and Naresh = \(\frac{4}{15}: \frac{7}{30}=8: 7\)

![]()

(2) Mahesh’s share of goodwill = \(1,80,000 \times \frac{1}{2}=₹ 90,000\)

Which is contribution by Vishesh and Naresh in their gaining ratio i.e., 8 : 7. Thus

Vishesh’s contribution = \(90,000 \times \frac{8}{15}=₹ 48,000\)

Naresh’s contribution = \(90,000 \times \frac{7}{15}=₹ 42,000\)

(3) Calculation of Vishesh’s capital and Naresh capital in new firm:

Total capital of new firm = ₹90,000

Vishesh’s new capital = \(90,000 \times \frac{3}{5}=₹ 54,000\)

Naresh’s new capital = \(90,000 \times \frac{2}{5}=₹ 36,000\)

Question 25.

Following is the Balance Sheet of A, B and C as at 31st March 2020:

B died on 30th June 2020, under the partnership agreement the executor of B was entitled to:

(i) Amount standing to the credit of his capital A/c

(ii) Interest on capital which amounted to ₹375

(iii) His share of goodwill ₹21,000

(iv) His share of profit from the closing of the last financial year to the date of death which amounted to ₹2,625.

B’s executor was paid ₹20,400 on 1st July 2015 and the balance in four equal yearly instalments starting from 30th June 2016 with interest @ 6% p.a.

Prepare B’s account and B’s executor’s account till it is finally paid

Answer:

![]()

Question 26.

Mift Marketing Ltd. a listed company issued 15,000; 10% debentures of ₹100 each at par on 1st April 2017, redeemable at 5% premium in three yearly instalments by draw of lots as follows:

On 31st March 2019 3,000; 10% debentures

On 31st March 2020 6,000; 10% debentures

On 31st March 2021 6,000; 10% debentures

The company complied with the legal requirements with respect to redemption of debentures.

Pass the journal entries for issue and redemption of debentures. Prepare premium on redemption of debentures A/c and debentures redemption investment A/c.

Answer:

Part – B

(Analysis of Financial Statement)

(Option-I)

Question 27.

A transaction that increases both Current ratio and Quick ratio is:

(a) Purchase of stock in trade on credit

(b) Sale of stock at loss

(c) Cash payment of non-current liability

(d) Sale of non-current asset for cash

Answer:

(d) Sale of non-current asset for cash

OR

In a company’s Balance Sheet, provision for employees benefits to be settled within 12 months is shown under:

(a) Non-current Liabilities

(b) Current Liabilities

(c) Non-current Assets

(d) Current Assets

Answer:

(b) Current Liabilities

Question 28.

From the following information, calculate proprietary ratio:

Share Capital ₹5,00,000, Non-current Assets ₹22,00,000, Reserves and Surplus ₹3,00,000, Current Assets 1o,oo,ooo.

(a) 100%

(b) 70%

(c) 40%

(d) 25%

Answer:

(d) 25%

![]()

Explanation:

Proprietary Ratio \(=\frac{\text { Shareholder’s Funds }}{\text { Total Assets }} \times 100\)

Shareholder’s Funds = Share Capital + Reserve & Surplus

= 5,00,000 + 3,00,000

= 8,0O,000

Total Assets = Non-current Assets + Current Assets

= 22,00,000 + 10,00,000 = 32,00,000 8,00,000

Proprietary Ratio = \(\frac{8,00,000}{32,00,000} \times 100=25 \%\)

Question 29.

Adjustment for proposed dividend is:

(a) Add previous year’s proposed dividend under net profit before tax and extra-ordinary items and deduct it under financing activity.

(b) Add current year’s proposed dividend under net profit before tax and extra-ordinary items and deduct previous year’s proposed dividend under financing activity.

(c) Add current year’s proposed dividend under net profit before tax and extra-ordinary items and deduct current year’s proposed dividend under financing activity.

(d) None of the above

Answer:

(a) Add previous year’s proposed dividend under net profit before tax and extra-ordinary items and deduct it under financing activity.

OR

Rashmi Ltd. a financing company took deposit of ?5,00,000 during the year @12% p.a. It will be included

in which of the following activities while preparing the cash flow statements:

(a) Investing activities

(b) Financing activities

(c) Both (a) and (b)

(d) Operating activities

Answer:

(d) Operating activities

Question 30.

In the extract of Balance Sheet of Ram Ltd. 12% debentures shows a balance of ₹2,00,000 on 3Pt March 2021 and ₹1,60,000 on 31st March 2022. Interest on debentures is paid on half yearly basis on September and 3151 March every year. Debentures were redeemed on 30tI September 2021.

How much amount will be shown in financing activity for cash flow statement prepared on 3V March 2022?

(a) Outflow of ₹40,000

(b) Inflow of ₹42,600

(c) Outflow of ₹61,600

(d) Outflow of ₹64,000

Answer:

(c) Outflow of ₹61 ,600

Explanation:

Question 31.

Classify the following items under major heads and sub head (if any) in the balance sheet of a company as per schedule III of the Companies Act, 2013.

(i) Arrears of fixed cumulative dividends

(ii) Work in progress

(iii) Interest accrued and due on securred loan

(iv) Computer software

(v) Shares in SBI

(vi) Money received against share warrants.

Answer:

| Items | Major Heads | Sub-Head |

| 1. Arrears of fixed cumulative dividend | Contingent liabilities and commitments (to be shown in notes to accounts) | Commitments |

| 2. Work-in-Progress | Current Assets | Inventories |

| 3. interest accrued and due on secured loan | Current Liabilities | Other Current Liabilities |

| 4. Computer Softwere | Non-current Assets | Fixed Assets— Intangible Assets |

| 5. Shares in SB! | Non-current Assets | Non-current Investments |

| 6. Money received against share warrants | Shareholders Funds | – |

Question 32.

I. State whether the following transactions will result in

(i) improve

(ii) reduce or

(iii) not alter the current ratio. Assuming the current ratio to be 2 :1. Also give the reasons.

(a) Purchase of inventories for cash

(b) Bills receivable endrosed to trade payables.

II. Give any limitations of accounting ratios.

Answer:

I. (a) Not alter [as there is only a conversion of one current amount to another]

(b) Improve [as both the current assets and current liabilities are decreased by the some amount]

II. 1. False accounting data gives false ratios.

2. Comparision is not possible if different firms adopt different accounting policies.

Question 33.

Calculate Return on Investment Ratio and Inventory Turnover Ratio from the figures given below:

![]()

OR

Calculate the following ratios from the details given below:

(i) Current ratio

(ii) Liquid ratio

(iii) Operating ratio

(iv) Gross profit ratio Details:

Current assets = ₹770,000

Net working capital = ₹730,000

Inventories = 730,000

Revenue from Operations = ₹71,40,000

Cost of Revenue from Operations = ₹768,000

Answer:

(i) Return of Investment = \(\frac{\text { Net Profit before Interest and Tax }}{\text { Capital Employed }} \times 100\)

Net profit before interest = Gross profit Indirect expenses

Gross profit = Revenue from operation – Cost of revenue from operations

Cost of revenue from operations = operations inventory + Purchases + Carriage inwards Closing inventory

=30,000+1,00,000+10,000-40,000=₹ 1,00,000

Gross profit =2,00,000-1,00,000=₹ 1,00,000

Net profit before interest = Gross profit -Indirect Expenses =1,00,000-15,000 = ₹ 85,000

Capital employed = Non current assets + Current assets – Current liabilities = 80,000+50,000-20,000 = ₹ 1,10,000

Return on Investment (ROI) = \(\frac{85,000}{1,10,000} \times 100\) = 77.27%

(ii) Inventory turnover ratio \(=\frac{\text { Cost of Revenue from Operations }}{\text { Average Inventory }}\)

Average inventory = \(\frac{30,000+40,000}{2}=₹ 35,000\)

Inventory turnover ratio = \(\frac{1,00,000}{35,000}=2.86 \text { times }\)

OR

(i) Current Ratio \(=\frac{\text { Current Assets }}{\text { Current Liabilities }}\)

Current Liabilities = Current Assets – Net Working Capital

= 70,000-30,000

= 40,000

Current Ratio = \(\frac{70,000}{40,000}=1.75: 1\)

(ii) Liquid Ratio \(=\frac{\text { Liquid Assets }}{\text { Current Liabilities }}\)

Liquid Assets = Current Assets – Inventories

= 70,000-30,000

= 40,000

Liquid Ratio = \(\frac{40,000}{40,000}=1: 1\)

(iii) Operating Ratio = \(=\frac{\text { Cost of Revenue from Operations }+\text { Operating Expenses }}{\text { Revenue from Operations }} \times 100\)

= \(\frac{68,000}{1,40,000} \times 100=48.57 \%\)

(iv) Gross Profit Ratio \(=\frac{\text { Gross Profit }}{\text { Revenue from Operations }} \times 100\)

Gross Profit = Revenue from Operations – Cost of Revenue from Operations

=1,40,000-68,000=₹ 72,000

Gross Profit Ratio = \(\frac{72,000}{1,40,000} \times 100=51.43 \%\)

Question 34.

Following are the Balance Sheets of Sewak Ltd. as at 31-03-2022 and 31-03-2021:

Additional Information:

1. Included in the fixed assets was a piece of machinery costing ₹70,000 on which depreciation charged was ₹40,000 and it was sold for ₹30,000. During the year ₹1,40,000 depreciation was charged on fixed assets.

2. Share issue expenses of ₹15,000 were incurred and written off from the statement of profit & loss in 2021-22.

Prepare a Cash Flow Statement.

Answer:

2. It has been assumed that new debenture amounting to ₹2,00,000 have been issued at the end of the

accounting year i.e., on 31st March 2022.