CBSE Previous Year Question Papers Class 12 Economics 2017 Outside Delhi

Time allowed : 3 hours

Maximum marks: 100

** Answer is not given due to change in the present syllabus

CBSE Previous Year Question Papers Class 12 Economics 2017 Outside Delhi Set – I

Section – A

Question 1.

Any statement about demand for a good is considered complete only when the following is/are mentioned in it (Choose the correct alternative): [1]

(a) Price of the good

(b) Quantity of the good

(c) Period of time

(d) All of the above

Answer:

(a) Price of the good.

Question 2.

Demand for a good is termed inelastic through the expenditure approach when (Choose the correct alternative) [1]

(a) Price of the good falls, expenditure on it rises

(b) Price of the good falls, expenditure on it falls

(c) Price of the good falls, expenditure on it remains unchanged

(d) Price of the good rises, expenditure on it falls.

Answer:

(c) Price of the good falls, expenditure on it remains unchanged.

Question 3.

Define indifference curve. [1]

Answer:

Indifference curve is a diagrammatic presentation of an indifference set of a consumer. It is a locus of all such points which show different combinations of two commodities offering the same level of satisfaction to the consumer.

Question 4.

A seller cannot influence the market price under (Choose the correct alternative) [1]

(a) Perfect competition

(b) Monopoly

(c) Monopolistic competition

(d) All of the above

Answer:

(a) Perfect competition.

Question 5.

State any one feature of monopolistic competition. [1]

Answer:

Product differentiation is one of the main features of monopolistic competition.

Question 6.

Give the meaning and characteristics of production possibility frontier. [3]

Answer:

PPF is a curve showing different possible combinations of two goods which can be produced with the available resources.

The main characteristics of PPF are :

(a) PPF always slopes downward from left to right: PPF has a negative slope which implies that more than one good can be produced only by loss of another good.

(b) PPF is concave to the origin: The PPF is concave to origin and shows the tendency of increasing MRT.

Question 7.

Explain the problem of “how to produce”. [3]

Answer:

‘How to produce’ refers to the choice of technique of production. It has two categories:

(1) Labour-intensive technique: It implies greater use of labour than capital. It promotes employment.

(2) Capital-intensive technique: It implies greater use of capital than labour. It promotes efficiency and accelerates the pace of growth. The choice of technique depends on the type of product manufactured by a company. For e.g.-A food and beverage company can use hundreds of workers with little application of capital (machinery) or can use more machines with few workers in order to produce the desired quantity of biscuits and soft drinks.

Question 8.

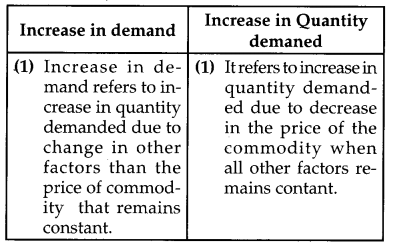

Distinguish between ‘increase in demand’ and ‘increase in quantity demanded’ of a good.

OR

Explain the meaning of ‘Budget set’ and ‘Budget line’. [3]

OR

Answer:

Difference between ‘increase in demand’ and ‘increase in quantity demanded’ of a good is:

‘Budget set’ refers to attainable combinations of a set of two goods, given prices of goods and income of the consumer. The budget set equation is:

P1X1 + P2 X2 ≤ Y

Where P1 = Price of good 1; X1 Quantity of good 1; P1 Price of good 2 ; X1 = Quantity of good 2

‘Budget line’ is a line showing different possible combinations of good 1 and good 2, which a consumer can buy, given his budget and the prices of good-1 and good-2. Anywhere on the budget line, a consumer is spending his entire income either on good 1 or on good 2 or on both good 1 and good 2.

Question 9.

Explain with the help of a numerical example, the meaning of diminishing marginal rate of substitution. [4]

Answer:

Suppose a consumer consumes two goods – X and Y. He wants one more unit of X in exchange for some amount of Y. It is explained in the following schedule:

| Combination of goods XandY | Marginal rate of substitution (MRS) |

| 8X + 20Y

9X + 16Y 10X + 13Y |

_____

4Y: IX 3Y: IX |

Since marginal utility of good X goes on falling with every increase in units of X, therefore, consumer will be willing to sacrifice lesser quantity of good Y for obtaining additional units of X.

Initially for getting an additional emit of X, consumer is willing to sacrifice (20 – 16) = 4 units of Y. So MRS is 4Y : IX. When one more unit of X in acquired then (16 – 13) = 3 units of Y are sacrificed. MRS has fallen to 3Y : IX. The reason is, as more units of X are consumed, marginal utility from each successive unit of X goes on falling, this makes the consumer to sacrifice less units of Y to get additional unit of X.

Hence, we can say that marginal rate of substitution is always diminishing.

Question 10.

Define market supply. Explain the factor ‘input prices’ that can cause a change in supply.

OR

Give the behaviour of marginal product and total product as more and more units of only one input are employed while keeping other inputs as constant. [4]

Answer:

Market supply is the total amount of a commodity that all the firms/producers in the industry are willing to sell at different possible prices of that commodity.

For example: The table is showing market supply. It is based on the assumption that there are only two firms (A and B) supplying Good-X in the market

Market Supply Schedule

|

Px (Price of Good-x) (₹) |

Qx (firm ‘A’) (Units) | Qx (firm’B) (units) |

Market supply (Units) |

| 5 | 0 | 0 | 0 |

| 10 | 10 | 5 | 10 + 5 = 15 |

| 15 | 20 | 10 | 20 + 10 = 30 |

| 20 | 30 | 15 | 30 + 15 = 45 |

The above table shows the total market supply assuming only two firms in the market.

Effect of ‘input prices’ causing change in supply: Input price may increase or decrease. In case of increase in input price, cost of production tends to rise hence, producers will supply less of the commodity at its existing price. It will cause the backward shifting of the supply curve. Opposite will happen in case of decrease in input price as cost of production tends to decline hence, more supply of the commodity will be given at the existing price of the commodity. In such case forward shifting of supply curve will take place.

OR

Consider a situation when land is a fixed factor, labour is a variable factor and the farmer is producing wheat. Since land is a fixed factor, he can produce more of wheat only by using more of labour. As more labour is applied on a fixed piece of land, total productivity increases but at a diminishing rate. It occurs due to the operation of law of variable proportion. It can be understood by the following table :

Law of variable proportions

The above figure shows :

(1) MP tends to rise till OL units of labour are used. This corresponds to point E on the MP curve. It shows increasing returns to a factor.

(2) When MP is rising TP tends to rise at an in¬creasing rate. This occurs till point K on the TP curve. This corresponds to the situation of increasing returns to a factor.

(3) Beyond OL units of labour. MP tends to decline and TP increases only at diminshing rate. It occurs between E and S on MP curve and between K and T on TP curve. This is a situation of diminish-ing returns to a factor.

(4) When employment of labour exceeds OS units, MP becomes negative. Accordingly, TP starts declining. This is a situation of negative returns to a factor, occured beyond point T on TP curve and beyond S on MP curve.

Question 11.

Explain “perfect knowledge about the markets” feature of perfect competition. [4]

Answer:

Perfect knowledge means that both the buyers and sellers have full knowledge about the prices and costs prevailing in the different parts of the market. All firms have equal access to technology and inputs. This ensures the same per unit cost of production by all the firms in the industry.

Implication of perfect knowledge: No firm is in a position to charge a different price and no buyer will pay a higher price for the same product. As a result, uniform price prevails. Since, there is uniform price and uniform cost, all firms earn uniform profits because profit equals price-cost.

Question 12.

When the price of a good rises from ₹ 10 per unit to ₹ 12 per unit, its quantity demanded falls by 20 percent. Calculate its price elasticity of demand. How much would be the percentage change in its quantity demanded, if the price rises from ₹ 10 per unit ₹ 13 per unit ? [6]

Answer:

Original Price (P) = ₹ 10 per unit

New price (PI) = ₹ 12 per unit

Change in Quantity demanded (ΔQ) = 20%

Price elasticity of demand (Ed) = ?

Change in prices (ΔP) = New price – Original price

₹ (12 – 10) = ₹ 2

Now, further taking this elasticity of demand in another situation when price changes from ₹ 10 to ₹ 13 per unit

Percentage change in price

Question 13.

Complete the following table: [6]

| Output (units) | Average Fixed Cost (₹) | Marginal Cost (₹) | Average Variable Cost (₹) | Average Cost (₹) |

| 1 | 60 | 20 | — | — |

| 2 | — | — | 19 | — |

| 3 | 20 | — | 18 | — |

| 4 | — | 18 | — | — |

| 5 | 12 | — | — | 31 |

Answer:

| Output (units) | AFC (₹) | MC (₹) | AVC (₹) | AC (₹) |

| 1 | 60 | 20 | 20 | 80 |

| 2 | 30 | 18 | 19 | 49 |

| 3 | 20 | 16 | 18 | 38 |

| 4 | 15 | 18 | 18 | 33 |

| 5 | 12 | 23 | 19 | 31 |

Question 14.

From the following total cost and total revenue schedule of a firm, find out the level of output, using marginal cost and marginal revenue approach, at which the firm would be in equilibrium. Give reasons for your answer.

| Output (units) | Total Revenue (₹) | Total Cost (₹) |

| 1 | 10 | 8 |

| 2 | 18 | 15 |

| 3 | 24 | 21 |

| 4 | 28 | 25 |

| 5 | 30 | 33 |

Answer:

The firm will be in equilibrium at output unit 4, where MC = MR i.e. 4.

At this point, the two conditions of MC= MR approach fulfills. These conditions are :

(i) MC should be equal to MR.

(ii) At the point of equilibrium, MC should be rising i.e. MC should rise just after the equilibrium unit.

Both these conditions are fulfilled at output unit 4. Where MC = MR and MC is rising on the next unit than revenue. Hence, firm will be in equilibrium at output unit 4.

Question 15.

Distinguish between perfect oligopoly and Imperfect oligopoly. Also explain the “interdependence between the firms” feature of oligopoly.

OR

Explain the meaning of excess demand and excess supply with the help of a schedule. Explain their effect on equilibrium price. [6]

Answer:

Difference between perfect oligopoly and imperfect oligopoly: In an oligopoly market, when firms produce homogenous products, it is called perfect oligopoly whereas when firms produce differentiated products, it is called imperfect oligopoly.

It is rare to find perfect oligopaoy type of situation. Examples: cement, steel, aluminium and chemical producing industries. While examples of imperfect oligopoly are: passenger cars, cigarettes and soft drinks.

Interdependence between the firms : There is an interdependence of firms for taking decision about price and output. Since there are a few firms, a change in price and output of a product by any firm is likely to influence the output and profit of rival firms whose reaction may prove counter productive.This makes the firms mutually dependent on each other, in case of decisions about price and output. For example, there is an interdependence of decision about price between pepsi and cola. If pepsi reduces price, cola-cola may do the same substantially.

OR

When there is excess demand : Excess demand refers to a situation where at a given price, quantity demanded exceeds quantity supplied. The situation of excess demand can be explained with the help of following graph and schedule :

In the given figure, OP is the equilibrium price and OP1 is the market price. At OP1 price quantity demanded is OQ and quantity supplied is Q2. Thus there is an excess demand equal to AB = (OQ1 – OQ2). This will result in a competition among buyers. Price will rise leading to rise in supply and fall in demand as shown by arrows along DD and SS curves. This change will contiune till price rises to OP which is the equilibrium price.

When there is excess supply: Excess supply refers to a situation where quantity supplied exceeds quantity demanded. The situation of excess supply can be explained with help of the following graph:

In the above figure, OP is the equilibrium price and OP1 is the market price. At OP1 quantity supplied is OQ2 and quantity demanded is Q1. Thus there is an excess supply equal to AB = (OQ2 – OQ1). This will lead to competition among sellers. Price will fall leading to fall in supply and rise in demand as shown by arrows along DD and SS curves. Process of this change will contiune till price falls to OP which is the equilibrium price.

Section — B

Question 16.

Demand deposits include (Choose the correct alternative) [1]

(a) Saving account deposits and fixed deposits

(b) Saving account deposits and current account deposits

(c) Current account deposits and fixed deposits

(d) All types of deposits

Answer:

(b) Saving account deposits and current account deposits.

Question 17.

Define marginal propensity to consume. [1]

Answer:

MPC is the ratio of change in consumption to change in income. Symbolically,

MPC = \(\frac{\Delta C}{\Delta Y}\)

Where, ΔC = change in consumption

ΔY = change in income

MPC = Marginal propensity to consume.

Question 18.

If the marginal propensity to consume is greater than marginal propensity to save, the value of the multiplier will be (Choose the correct alternative) [1]

(a) greater than 2

(b) less than 2

(c) equal to 2

(d) equal to 5

Answer:

(d) equal to 5

Question 19.

Define Government budget. [1]

Answer:

Government budget is a detailed statement of the estimates of government receipts and government expenditure during a financial year.

Question 20.

What is meant by depreciation of domestic currency? [1]

Answer:

Depreciation of domestic currency means fall in the value of domestic currency in relation to foreign currency i.e., a situation where exchange rate is determined by the market forces of supply and demand for foreign exchange in the international money market.

Question 21.

Explain with the help of an example, the basis of classifying goods into final goods and intermediate goods. [3]

Answer:

The basis of classifying goods into final goods and intermediate goods is that whether the good is purchased for final use or for the use in further production.

(i) Final goods: All goods which are meant either for consumption by consumers or for investment by firms are called final goods. They are meant for final use and the final use of a product is only for consumption or investment. In other words, final goods are acquired for own use i.e. by consumers for satisfaction of their wants and by producers for capital formation. For examples, biscuits, flour, clothes are final goods when purchased by a consumer for their personal use or for satisfaction of their wants. Machine bought by a household is final good but machine bought by a firm for its use in production is not a final good.

(ii) Intermediate goods : All goods which are used as raw material for further production of other goods, or for re-sale in the same year are known as intermediate goods. For example flour, milk, sugar, salt, fuel, etc., when purchased by a firm in order to prepare biscuits are intermediate goods. The cloth if purchased by a dress maker is also an intermediate good. Machine if purchased by a firm for resale in the same year is an intermediate good.

Question 22.

Explain “difficulty in storing wealth” problem faced in the barter system of exchange.

OR

Explain the “medium of exchange” function of money. ** [3]

Answer:

In the barter system of exchange, it was difficult for the people to store wealth or generalise purchasing power for future use in the form of goods like cattle, wheat, potatoes and other perishable items, etc. Holding of stocks of such goods involved costly storage and deterioration.

Question 23.

Distinguish between direct taxes and indirect taxes. Give an example of each. [3]

Answer:

Difference between direct and indirect taxes :

| Direct Tax | Indirect Tax |

| (1) When liability of paying a tax and the burden of that tax fall on the same person, the tax is called a direct tax. | (1) When liability of paying tax is on one person but the burden of that tax falls on other person. The tax is called an indirect tax. |

| (2) The burden of direct tax cannot be shifted on to the others. | (2) The burden of indirect tax can be shifted on to the others. |

| (3) Examples are-in-come tax, corporate tax, gift tax, etc. | (3) Examples are- sales tax, custom duty, service tax, etc. |

Question 24.

Explain the “bankers’ bank” function of the central bank. [4]

OR

Explain the process of credit creation by commercial banks.

Answer:

As a banker’s bank, central bank works in a similar way as commercial banks deals with its customers. It accepts deposits from the commercial banks and offers them loans. The central bank also provides ‘clearing house’ facility to the commercial banks. It is a cheque clearing facility provided at one centre to all the banks. Central bank is the custodian of their cash reserves. Banks of the country are required to keep a certain percentage of their deposits with the central bank and in this way the central bank is the ultimate holder of the cash reserves of commercial banks.

OR

The process of credit creation by commercial bank can be easily understood by taking an example. Suppose a person, say X, deposits ₹ 2000, with a bank and the LRR is 10% which means the bank keeps only the minimum required ₹ 200 as cash reserve. The bank can use remaining amount ₹ 1800 (= 2000-200) for giving loan to someone. The bank lends ₹ 1800 to, say F, for this purpose and an account is opened in the name of Y and the amount is credited in his account. This is the first round of credit creation in the form of secondary deposit (₹ 1800) which equals 90% of the initial deposit.

Now again from the deposit of Y, bank keeps 10% or LRR i.e. 180 and remaining ₹ 1620 is advanced to, say Z. The bank get, new demand deposit. This is the second round of credit creation till secondary deposit becomes zero. In the end, volume of total credit created it becomes multiple of initial deposit. The quantitative outcome is called money multiplier. In short, money (or credit) creation by commercial banks depends on two factors (i) amount of initial deposit and (ii) LRR. Symbolically:

Total credit creation = Initial deposit × \(\frac{1}{\mathrm{LRR}}\)

Question 25.

An economy is in equilibrium. From the following data, calculate the marginal propensity to save : [4]

(a) Income = 10,000

(b) Autonomous consumption = 500

(c) Consumption expenditure = 8,000

Answer:

Applying the equation :

c = \(\overline{c}\) + by

Where, c = Consumption expenditure (8, 000)

\(\overline{c}\) = Autonomous consumption (500)

b = MPC (marginal propensity to consume)

y = Income (10,000)

8,000 = 500 + b × 10, 000

8000 = 500 + 10, 000b .

8000 – 500 = 10,000b

7,500 = 10,000b

b = \(\frac{7,500}{10,000}\)

b = 0.75, MPC = 0.75

Now,

MPS + MPC = 1

MPS = 1 – MPC

= 1 – 0.75

= 0.25

Hence, the value of MPS = 0.25

Question 26.

Explain how government budget can be helpful in bringing economic stabilization in the economy. [4]

Answer:

Government budget can be helpful in bringing economic stabilization in the economy. Economic instability occurs when there is frequent price fluctuations in the economy. Such price fluctuations can be controlled through budget by taxes, subsidies and expenditure. For instance, if there is the condition of inflation (continuous rise in prices), government can reduce its own expenditure, tax rates can be increased or subsidies can be withdrawn or reduced to control the expenditure on the part of consumer and producer both. While in the condition of depression characterised by falling output and prices, government can reduce taxes and grant subsidies to encourage spending by people.

Question 27.

Distinguish (a) between current account and capital account, and (b) between autonomous transactions and accommodating transactions of balance of payments account. [6]

Answer:

(a)

(b)

| Autonomous transactions (BOP) | Accommodating transactions (BOP) |

| (1) Autonomous transactions refer to such BOP transactions which are undertaken for consideration of profit. | (1) Accommodating transactions are free from the considerations of profit. |

| (2) Autonomous items are the cause of BOP imbalance (BOP surplus or BOP deficit) | (2) Accomodating items are meant to restore BOP • balance. |

| (3) Autonomous items may involve the movement of goods across the borders (like export and import of consumer goods or capital goods). | (3) Accommodating items do not involve the movement of goods across the borders. These items only involve the movement of official reserves with the RBI. |

| (4) Autonomous items are classified as ‘above the line’ items of BOP. | (4) Accomodatingitems are classified as ‘below the line’ items of BOP. |

Question 28.

Explain the precautions that should be taken while estimating national income by expenditure method. [6]

OR

Will the following be included in the domestic product of India ? Give reasons for your answer.

(a) Profits earned by foreign companies in India.

(b) Salaries of Indians working in the Russian Embassy in India.

(c) Profits earned by a branch of State Bank of India in Japan.

Answer:

The following precautions need to taken for correct estimation of national income by expenditure method :

- To avoid double counting, expenditure on all intermediate goods and services is excluded. For example, purchase of vegetables by a restaurant, expenses on electricity by a fac¬tory.

- Government expenditure on all transfer pay¬ments such as scholarship, unemployment allowance, pension, etc.

- Expenditure on purchase of second-hand goods is excluded from national income because this type of expenditure is not on currently produced goods.

- Expenditure on purchase of old shares/ bonds or new shares/bonds, etc., is excluded because it is not the payment done for goods and services currently produced. It shows mere transfer of property from one person to another.

- Imputed expenditure on own account output (e.g.-owner occupying his house, self- consumed output by a farmer) should not be included.

OR

(a) Profit earned by foreign companies in India : Yes, it is included in domestic income of India because profits are earned by the company within India’s domestic territory irrespective of ownership of the company.

(b) Salaries of Indians working in Russian embassy in India : No, it is not included in domestic product of India because Russian embassy in India is not a part of domestic teritory of India (but a part of domestic territory of Russia).

(c) Profits earned by a branch of State Bank of India in Japan : No, it is not included in domestic income of India because it is not earned in Indian domestic territory.

Question 29.

Calculate (a) National Income, and (b) Net National Disposable Income : ** [6]

Answer:

(a)

NI = NDPfc + NFLA (Net factor income from abroad)

NDPfc = COE + Mixed income + operating surplus

= COE + MI + (Rent + Royalty + Interest + Profit)

= 2,000 + 7,000 + 400 + 500 + 900

= ₹ 10,800 crores

NNPfc or NI = NDPfc – Net factor income to abroad

= 10,800 – 50 = 10,750 crore.

Question 30.

Given a consumption curve, outline the steps required to be taken in deriving a saving curve from it. Use diagram. [6]

Answer:

In the above diagram :

CC = Consumption function

OI = 45° degree line showing income drawn from the origin O.

B = Breakeven point where consumption = income, i.e, a point where there is no saving.

Following are the steps used in drawing saving

curve from consumption function:

(1) Take a point B on consumption curve and from it draw a perpendicular on X-axis intersecting it on point B1.

(2) Take OS on Y-axis of lower part as equal to OC (OS = OC). This gives point S from where saving curve will start.

(3) Join points S and B1 and extend the straight line upward and thus we get saving curve SS1.

In this way, saving curve is diagrammatically drawn from consumption curve.

CBSE Previous Year Question Papers Class 12 Economics 2017 Outside Delhi Set – II

Note: Except for the following questions, all the remaining questions have been asked in previous sets.

Question 7.

Explain the problem of “for whom to produce.”[3]

Answer:

The problem of Tor whom to produce’ focuses on the distribution of the final goods and services produced. The distribution of the final goods and services is equal to the distribution of National Income among the factors of production such as land, labour, capital and entrepreneur. The economy needs to decide a mechanism of distributing the final goods and services among the different segments of population, to reduce the inequality of income. This problem is concerned about who gets more or who gets less? Which goods should be made available free or at low (nominal) price and to which segment?

Question 13.

Complete the following table: [6]

|

Output (units) |

Total Cost (₹) | Average Variable cost (₹) | Marginal Cost (₹) | Average Fixed Cost (₹) |

| 0 | 30 | |||

| 1 | _ | _ | 25 | 30 |

| 2 | 78 | _ | _ | _ |

| 3 | _ | 23 | _ | 10 |

| 4 | _ | _ | 23 | _ |

| 5 | 150 | _ | _ | 6 |

Answer:

Question 14.

From the following table, find out the level of output at which the producer will be in equilibrium (use marginal cost and marginal revenue approach). Give reasons for your answer. [6]

| Output (units) | 1 | 2 | 3 | 4 | 5 |

| Total Revenue (₹) | 16 | 30 | 42 | 52 | 60 |

| Total Cost (₹) | 14 | 27 | 39 | 49 | 61 |

Answer:

The equilibrium level of output will be 4 emits. This is because at this point, the two conditions of equilibrium (using MR-MC approach) are met. This can be seen as follows:

We are given the Toal Revenue (TR) and Total Cost. From here, we can find Marginal Revenue (MR) and Marginal Cost (MC), as given in the following schedule.

tableee

Here, as we can see, the first and other conditions of equibrium through MR-MC approach are being ‘ met at unit 4. i.e., First Condition : MR = MC = 10

Second Condition : MC is rising from this point and meets MR from below.

Thus, equilibrium output is 4 units.

Question 21.

Explain the circular flow of income. [3]

Answer:

Circular flow of income refers to continuous circular flow of goods, services and income among different sectors of an economy. Flow of money is the aggregate value of goods and services either as factor payments or as expenditure on goods and services. It is circular since it has neither any beginning nor an end. It can be explained as household sector supply factor services and spend their income on consumption. The firms use these services in producing goods and other services. The households as owner of factors for production receive the payments in terms of money or reward for rendering productive services. The recipients of these incomes (i.e. households) in turn, spend their incomes on purchase of goods and services to satisfy their wants. In short, income is first generated by production units, then distributed among households for rendering productive services and ultimately • comes back to production units by way of expenditure by the households.

Circular flow works on two principles :

- In an exchange process, the seller (producer) receives the same amount which the buyer (or consumer) spends.

- Goods and services flow in one direction and the money paid to acquire them, flow in the reverse direction giving rise to a circular flow.

Question 28.

Explain the precautions that are taken while estimating national income by value added method. [6]

OR

Will the following be included in the national income of India ? Give reasons for your answer.

(a) Financial assistance to flood victims

(b) Profits earned by the branches of a foreign bank in India

(c) Salaries of Indians working in the Ameri-can Embassy in India.

Answer:

Precautions that are taken while estimating national income by value added method are:

- Imputed rent of owner-occupied houses be included because all houses have rental value irrespective of its use by self or tenant.

- Imputed value of goods and services produced for self-consumption or for free distribution should be included.

- Only value added and not value of output by production units should be included.

- Value of own-account production of fixed assets by enterprises, government and the households should be included.

- The value of sale and purchase of second¬hand goods should be excluded.

- Sale of bonds by a company should also be excluded since it is merely a financial transaction which does not contribute directly to the flow of goods and services.

OR

(a) Financial assistance to flood victims: This will not be included in the national income since it is a part of transfer payment.

(b) Profits earned by the branches of a foreign bank in India: This is not to be included in the national income of India since it is earned by a foreign bank.

(c) Salaries of Indians working in the American Embassy in India: It is included in national income of India since Indian employees of American embassy are the normal residents of India.

Question 29.

Calculate the (a) Net National Product at market price, and (b) Gross National Disposable Income: ** [6]

Answer:

(a) NNPmp = Net national product at market price

NDPfc = COE + MI + OS (Rent + interest + profit)

= (vi) + (i) + (iv) + (v) + (iii)

= 3,000 + 8,000 + 600 + 700 + 1,000

= ₹ 13, 300 crores

(b) NNPmp = NDPfc – (viii) + (vii)

= ₹ 13,300 – 60 + 500

= ₹ 13,740 crores.

CBSE Previous Year Question Papers Class 12 Economics 2017 Outside Delhi Set – III

Note: Except for the following questions, all the remaining questions have been asked in previous sets.

Section — A

Question 7.

Explain the problem of “what to produce”. [3]

Answer:

The problem of what to produce means which goods and services and in what quantities are to be produced by an economy. We can produce a number of commodities with our limited resources, for example, the choice can be between consumer goods and capital goods. Within consumer goods, it is neecessary to decide whether to produce luxuries or necessities. More of one commodity can be produced only at the cost of another. The guiding principle while choosing goods and services, is to obtain maximum utility.

Question 13.

Complete the following table : [6]

|

Output(units) |

Average Fixed Cost (₹) | Average Variable Cost (₹) | Marginal Cost (₹) |

Total Cost (₹) |

| 1 | 120 | 40 | — | — |

| 2 | 60 | 56 | — | 232 |

| 3 | — | 54 | — | — |

| 4 | 30 | — | 54 | — |

| 5 | — | — | — | — |

Answer:

|

Output (units) |

AFC (₹) | AVC (₹) | MC (₹) | TC (₹) |

| 1 | 120 | 40 | — | 160 |

| 2 | 60 | 56 | 72 | 232 |

| 3 | 40 | 54 | 50 | 282 |

| 4 | 30 | 54 | 54 | 336 |

| 5 | — | — | — | — |

Question 14.

From the following data find out the level of output that will give the producer maximum profit (use marginal cost and marginal revenue approach). Give reasons for your answer. [6]

| Output (units) | 1 | 2 | 3 | 4 | 5 |

| Total Cost (₹) | 9 | 17 | 24 | 29 | 36 |

| Total Revenue (₹) | 11 | 20 | 27 | 32 | 35 |

Answer:

The producer will get the maximum profit at the point where firm is in equilibrium. From the above data, it is clear that firm is in equilibrium at unit 4 where, MC=MR. i.e. 5. At this point the two conditions of MC=MR approach fulfills. These conditions are:

(i) MC should be equal to MR.

(ii) At the point of equilibrium. MC should be rising i.e., MC should be rising just after the equilibrium point. Both these conditions are fulfilled at output unit 4. Where, MC = MR and MC is rising on the next unit more than MR. Hence, firm will be in equilibrium at output unit 4.

Section — B

Question 16.

Define revenue deficit. [1]

Answer:

Revenue deficit is the excess of revenue expenditure over revenue receipt. Symbolically, it is represented as Revenue deficit = Revenue expenditure-Revenue receipt.

Question 20.

Define marginal propensity to save. [1]

Answer:

Marginal propensity to save (MPS) is the ratio of change in saving to change in income. It is shown as :

MPS = \(\frac{\Delta S}{\Delta Y}\)

Where, ΔS = change in saving

ΔY = change in income

Question 21.

Distinguish between stocks and flows. Give an example of each. [2]

Answer:

| Stock | Flow |

| (1) Stock refers to the value of a variable at a point of time. | (1) Flow refers to the value of a variable during a period of time |

| (2) It is measured at a specific point of time. | (2) It is measured per hour, per month or per year. |

| (3) Stock impacts the flow Greater the stock of capital, greater is the flow of goods and services. | (3) Flow impacts the stock, greater the flow of income, greater is the stock of wealth with the people. |

| (4) Example: Capital and quantity of money. | (4) Example : Export and imports. |

Question 22.

What are non-debt creating capital receipts ? Give two examples of such receipts. [4]

Answer:

Non-debt creating capital receipts are the receipts which do not create any liability of repayment on the government rather it makes only addition to the existing capital account. For example recovery of loans, proceeds from sale of public enterprises (i.e. disinvestment, etc.). These do not give rise to debt.

Question 29.

Calculate the (a) Gross National Product at market price, and (b) Net National Disposable Income: ** [6]

Answer:

(a) GNPmp = ?

NDPfc = COE + MI + OS (Rent + profit + interest)

(i) + (iii) + (v) + (ii) + (vi)

= 2500 + 7500 + 400 + 700 + 350

= ₹ 11,450 crores

NNPmp = NDPFC + NFIA + Net indirect tax.

= NDPFC + (vii) + (N)

= 11,450 + 50 + 150

= ₹ 11,650 crores

GNPmp = NNPmp + Depreciation

= NNPmp + (x)

= 11,650 + 70

= ₹ 11,720 crores.