CBSE Previous Year Question Papers Class 12 Economics 2011 Delhi

Time allowed : 3 hours

Maximum marks: 100

** Answer is not given due to change in the present syllabus

CBSE Previous Year Question Papers Class 12 Economics 2011 Delhi Set – I

Note : Except for the following questions, all the remaining questions have been asked in previous sets.

Section – A

Question 1.

What is a market economy? [1]

Answer:

Market economy is a form of economy where the capitalist or the private entrepreneurs have the major control over all the economic activities. They organize and undertake production with the sole motive of profit making.

Question 2.

When is a firm called “price-taker”? [1]

Answer:

A firm is said to be a price taker when it has no control over the existing market price and accepts the price as determined by the “invisible hands of market”, i.e., by demand for and supply of the commodities.

Question 3.

Define budget set. [1]

Answer:

A budget set represents those combinations of consumption bundles that are available to the consumer given his/her income level and at the existing market prices. In other words, it represents those consumption bundles that the consumer can purchase using his/ her money income (M). It is represented by the following inequality condition:

P1x1 + P2x2 ≤ M

Question 4.

What is meant by “increase” in supply ? [1]

Answer:

When the supply of a good increases due to a favourable change in the factors other than the price of the good (such as a rise in the price of substitute good, appreciation of technology level, etc), then it is called increase in supply.

Question 5.

Define supply. [1]

Answer:

Supply refers to different quantities of a commodity that are offered for sale at different prices in the market.

Question 6.

Why is a production possibilities curve concave? Explain. [3]

Answer:

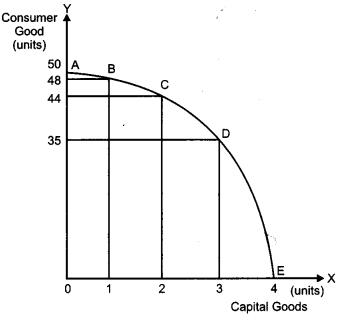

Production Possibility Curve (PPC) is concave to the origin because of the increasing marginal opportunity cost. As we move down along the PPC, to produce each additional unit of one good, more and more units of other good needs to be sacrificed. That is, as we move down along the PPC, the marginal opportunity cost increases. This is called as the law of increasing opportunity cost.

In the above figure, AE represents the PPC for capital goods and consumer goods.

Suppose the initial production point is B, where 1 unit of capital good and 48 units of consumer goods are produced. To produce one additional unit of capital good, 4 units of consumer good must be sacrificed (point C). Thus, at point C the opportunity cost of one additional capital good is 4 units of consumer goods. On the other hand, at point D, the opportunity cost of producing one additional unit of capital good is 9 units of consumer goods. Thus, as we move down the PPC forjn point C to point D, the marginal opportunity, cost increases. This confirms the concave shape of PPC.

Question 7.

8 units of a good are demanded at a price of ₹ 7 per unit. Price elasticity of demand is (-)1. How many units will be demanded if the price rises to ₹ 8 per unit? Use expenditure approach of price elasticity of demand to answer this question.** [3]

Question 8.

Giving examples, explain the meaning of cost in economics. [3]

Answer:

Cost in economics includes the following two components.

(i) Expenditures incurred or payments made by a firm to various factors of production and non-factors of production: In the process of production a firm hires various factor such as land, labour, capital and entrepreneur. In return of the services provided by the factor of production, the firm makes payments to them. Labour is given wages, rent is paid for the land; interest is paid for the capital and profit for the entrepreneur. Such payments made are a cost for the firm. Besides, a firm also uses various non-factors of production such as raw material. Payments made to such non-factors are also included in the cost of the firm.

(ii) Opportunity cost: Cost in economics also includes the opportunity cost. When the resources are allocated towards the production of one good, the production of some other good needs to be sacrificed. It is the cost of producing one good in terms of sacrificing the production of another good is known as the opportunity cost. Such opportunity cost is also included as a cost in economics.

Question 9.

Draw average revenue and marginal revenue curves in a single diagram of a firm which can sell more units of a good only by lowering price of that good. Explain. [3]

Answer:

The firm that can sell more units of a good only by lowering the price of that good is a monopoly firm. A monopoly firm faces a downward sloping AR and MR curves. AR curve is also the demand curve for the monopoly firm. The AR curve and the MR curve for a monopoly firm are depicted below.

A monopoly firm faces a downward sloping demand curve (AR curve) because it has no control over the quantity of the output that he can sell in the market. Although, it is a price maker, it depends on the buyers what quantity of output they want to purchase at the price fixed by the monopolist. If the monopolist fixes a higher price, then lesser quantity of the output will be demanded and lesser quantity will be sold in the market. On the other hand, if he fixes a lower price, then higher quantity of the good will be sold. This implies the negative relationship between the monopolist’s price and the quantity demand by the buyers. This negative relationship is depicted by the falling AR curve and MR curve. Also, MR curve is more elastic than the AR curve and lies below the AR curve.

Question 10.

Explain the implication of ‘freedom of entry and exit to the firms’ under perfect competition. [3]

Answer:

The basic implication of the feature of freedom of entry and exit of the firms under perfect competition is that all firms in the market earn normal profit in the long run. Each individual firm is able to operate at the point where the minimum of long run average cost curve (LAC) is tangent to the price line. This implies that the firm neither earns super normal profits nor suffers losses.

If, the firms are earning super normal profits that is, the price is greater than the minimum of LAC then, it attracts new firms in the market. Consequently, the total output in the industry increases and the price falls. Price continues to fall till it becomes equal to the minimum of the LAC curve and the super-normal profits are wiped out. As against this, if the firms are suffering losses (that is, the price is less than the minimum of LAC) then, it leads some of the firms to exit the market. Consequently, the total output in the industry falls and the price rises. Price continues to rise till it becomes equal to the minimum of the LAC curve and the losses are wiped out. Thus, freedom of entry and exit of firms under perfect competition implies that all firms earn only normal profits in the long run.

OR

Explain the implication of ‘perfect knowledge about market’ under perfect competition. Answer : The implication of perfect knowledge about market under perfect competition is that no seller can either sell their products at higher prices or at lower prices than the market price. Perfect knowledge implies that both buyers as well as the sellers are fully aware of the conditions prevailing in the market. That is, the buyers are fully aware of the prevailing market price of the product at different places and the sellers are also aware of at what prices are the buyers willing to buy the product. Thus, if any individual firm is charging higher (or lower) price for the homogeneous product, then the buyers will shift their purchase to the seller (or shift their purchase from other seller to the firm selling at lower price). Hence, no firm can either sell their products at a price that is higher or lower than the market price.

Question 11.

“A consumer consumes only two goods X and Y”. State and explain the conditions of consumer’s equilibrium with the help of utility analysis. [4]

Answer:

In case of two commodities, the consumer’s equilibrium is attained in accordance with the Law of Equi-Marginal Utility. It states that a consumer allocates his expenditure on two goods in such a manner that the utility derived from each additional unit of the rupee spent on each of the commodities is equal. That is,

Marginal Utility of a Rupee spent on commodity x = Marginal Utility of a Rupee spent on commodity y = Marginal Utility of Money i.e.,

or \(\frac{M U_{x}}{P_{x}}=\frac{M U_{y}}{P_{y}}\) = MUm

In the diagram, OO1 represents the total income of a consumer. MUx and MUy represents the Marginal Utility curves of commodity X and commodity Y, respectively. Equilibrium is established at point E, where, MUx and MUy intersect each other and with MUm.

At this point, OM amount of income is spent on commodity X and the remaining amount of income MO1 is spent on commodity Y.

Suppose, instead of point M, the consumer is at point S, where he spends OS amount of income on commodity X and SO1 amount of income on commodity Y. At point S, however;

\(\frac{M U_{x}}{P_{x}}>\frac{M U_{y}}{P_{y}}\)

Thus, the consumer would increase his consumption of commodity X till the equality is achieved. That is, in other words, the consumer increases his consumption of good X till he reaches point E where,

\(\frac{M U_{x}}{P_{x}}=\frac{M U_{y}}{P_{y}}\)

Question 12.

Explain how the demand for a good is affected by the prices of its related goods. Give examples. [4]

Answer:

Demand for a good depends on the price of other goods (i.e., related goods). Any two goods are considered to be related to each other, when the demand for one good changes in response to the change in the price of the other good. The related goods can be classified into following two categories.

(i) Substitute goods: These are the goods that can be consumed in place of each other. In other words, they can be substituted for each other. In case of substitute goods, if the price of one good increases, then the consumer shifts his demand to the other (substitute) good i.e., rise in the price of one good results in a rise in the demand of the other good and vice-versa. For example, tea and coffee are substitute goods. If, the price of tea rises (falls), the demand for coffee rises (falls).

(ii) Complementary goods: These are the goods that are consumed together. It is the joint consumption of these goods that satisfies wants of the consumer. In case of complementary goods, if the price of one good increase then a consumer reduces his demand for the complementary good as well. That is a rise in the price of one good results in a fall in the demand of the other good and vice-versa. For example, sugar and tea are compliinentary goods. If, the price of tea increases (decreases), the demand for sugar decreases (increases).

Question 13.

Define ‘Market-supply’. What is the effect on the supply of a good when government imposes a tax on the production of that good? Explain. [4]

OR

What is a supply schedule? What is the effect on the supply of a good when government gives a subsidy on the production of that good? Explain.

Answer:

Market supply refers to the total of quantities supplied by all the firms in the market at different price levels. When the government imposes a tax on the production of a good then this implies that the cost of production also rises. Consequently, the firm will supply same quantity at the higher price. The diagrammatic presentation of the effect on the supply of a good when government imposes a tax on production of the good is as follows :

In the diagramme, SS is the original supply curve and the firm is ready to sell OQ quantity of the good at OP price. Now if the government imposes a unit tax of’ ‘K’ per unit of output, then this will raise the cost of production as the firm needs to pay an extra amount of ‘ ‘K’ each unit of the output supplied. Consequently, the cost curve will shift leftward (upwards) to S1S1 from SS. The magnitude of the shift in the cost curve is equal to’ TC. This leftward shift in the supply curve shows that the firm now intends to charge higher price, i.e., OP+K instead of OP to supply OQ quantity of commodity due to imposition of tax.

OR

Supply schedule Is a tabular presentation representing different quantities of a commodity offered for sale corresponding to the different prices at which these quantities are offered for sale. The following table represents a supply schedule.

| Price ₹ | Quantity (in units) |

| 1 | 5 |

| 2 | 10 |

| 3 | 15 |

| 4 | 20 |

| 5 | 25 |

The diagrammatic presentation of the effect on the supply given a subsidy on the production of that good is as follows:

In the diagramme, SS is the supply curve and the firm is ready to sell OQ quantity of the good at OP price. Now if the government provides subsidy of ‘ ‘V per unit of output, then this reduces the cost of production. This results in the rightward shift of the supply curve from SS to S1S1. Hence the firm can supply the same quantity of commodity at lower price, i.e., earlier the firm was supplying OQ quantity of good at OP price. After the provision of subsidy, the firm will supply the same quantity at OP-V price. The magnitude of the shift in the cost curves is equal to’ V.

Question 15.

Explain the three properties of indifference curves. [6]

Answer:

Indifference curve is a curve that depicts various combinations of two goods that provides a consumer with the same level of satisfaction. ”

Properties of Indifference Curve

(i) Indifference curves are downward sloping to the right: Downward slope of the indifference curve to the right implies that a consumer cannot simultaneously have more of both the goods. An increase in the quantity of one good is associated with the decrease in the quantity of the other good. This is in accordance with the assumption of monotonic preferences.

(ii) Slope of IC: The Slope of an fC is given by the Marginal Rate of Substitution (MRS). Marginal rate of substitution refers to the rate at which consumer is willing to substitute one good for each additional unit of the other good.

That is, MRS shows the rate at which the consumer is willing to sacrifice good Y for an additional unit of good X.

(iii) Shape of Indifference Curve : An indifference curve is convex to the origin. As we move down along the indifference curve to the right, the slope of IC (MRS) decreases. This is because as the consumer consumes more and more of one good, the marginal utility of the good falls. On the other hand, the marginal utility of the good which is sacrificed rises. In other words, the consumer is willing to sacrifice less and less for each additional unit of the other good consumed. Thus, as we move down the IC, MRS diminishes. This suggests the convex shape of indifference curve.

At point A,

Therefore, MRS at B < MRS at A, so MRS has fallen.

Question 16.

Market for a good is in equilibrium. There is an ‘increase’ in demand for this good. Explain the chain of effects of this change. Use diagram. [6]

Answer:

Market equilibrium is a state or a position where market demand equals market supply. Now, if the market demand increases, then it results in a change in the equilibrium.

Suppose D1D1 and S1S1 are the initial market demand curve and the initial market supply curve, respectively. The initial equilibrium is established at point E1, where the market demand curve and the market supply curve intersects each other. Accordingly, the equilibrium price is OP1 and the equilibrium quantity demanded is Oq1

Now, if there is an increase in the market demand, the market demand curve shifts parallely rightwards to D2D2 from D1D1, while the market supply curve remains unchanged at S1S1. This implies that at the initial price OP1 there exist excess demand equivalent to (Oq’1 – Oq1) units. This excess demand will increase competition among the buyers and they will now be ready to pay a higher price to acquire more units of the good. This will further raise the market price. The price will continue to rise till it reaches OP2. The new equilibrium is established at point E2, where the new demand curve D2D2 intersects the supply curve S1S1.

At the new equilibrium E2

Equilibrium output has increased from Oq1 to Oq2

Equilibrium price has increased from OP1 to OP2 Hence, an increase in demand with supply remaining constant, results in rise in the equilibrium price as well as the equilibrium quantity.

Increase in Demand ⇒ Excess Demand at the Existing Price ⇒ Competition Among the Buyers ⇒ Rise in the Price Level ⇒ New Equilibrium ⇒ Rise in both Quantity Demanded as well as price.

Section – B

Question 17.

What is nominal gross domestic product? [1]

Answer:

Nominal Gross Domestic Product refers to the market value of all the final goods and services produced within the domestic territory during an accounting year as estimated with reference to current year prices.

Question 18.

Define flow variable. [1]

Answer:

Flow variable refers to those variables that are measured over a period of time. These variables have an element of time attached to them. For example, interest earned on bank deposits for 1 year, i.e., from October 01, 2009 to October 30,2010 is a flow variable.

Question 19.

Define cash variable ratio. [1]

Answer:

Cash Reserve Ratio (CRR) refers to the minimum proportion of the total deposits which the commercial banks are required to keep with the central bank in the form of reserves.

Question 20.

Define money supply. [1]

Answer:

Money supply refers to the total stock of money (in the form of currency notes and coins) held by the people of an economy at a particular point of time.

Question 21.

Define foreign exchange rate. [1]

Answer:

Foreign exchange rate is the rate at which the currency of one country is traded for currency of another country. In other words, it refers to the cost of one currency in terms of another currency.

For example, a rupee-dollar exchange rate of 50 ($1 = ₹ 50) implies that it costs ₹ 50 to purchase $1.

Question 22.

State the components of capital account of balance of payments. [3]

Answer:

Capital Account of Balance of payment (BOP) refers to the account of BOP, which records all the transactions that cause a change in the status of assets and liabilities of the government or any of the residents of a country.

The following are the components of capital account of BOP.

(i) Foreign direct investment (FDI) and Portfolio Investment: Foreign Direct Investment refers to the investment in the assets of a foreign country that allows control over the asset. On the contrary, Portfolio Investment refers to the investment in the assets of a foreign country without any control over that asset. Both FDI and portfolio are non-debt creating capital transactions. They cause an inflow of foreign exchange into the country. Thus, they are recorded as positive items in the Capital Account of BOP.

(ii) Loans and borrowings: A country takes loans and borrowings from the foreign countries and from the international monetary institutions. Loans and borrowings are debt-increasing capital transactions. They result in inflow of foreign exchange into the country. Hence, they are recorded as positive items in the Capital Account of BOP.

(iii) Banking Capital Transactions: Banking capital transactions refer to the transactions of external financial assets and liabilities of the commercial banks and cooperative banks that operate as authorized dealers in the foreign exchange market.

Question 23.

Explain how ‘distribution of gross domestic product is a limitation in taking gross domestic product as an index of welfare. [3]

Answer:

GDP refers to the market value of all the final goods and services produced within the domestic territory during an accounting year. GDP as an index of welfare depends on the distribution of income in the economy. It is possible that even with the rise in the real GDP, the welfare of the people might not increase. This is because an increase in the GDP may be a result of the increase in the income of only a few individuals while the majority of people remain deprived of the benefits of the rise in the GDP. In such a situation, a rise in the GDP does not enhance the economic welfare. In other words, a rise in national income may lead to false interpretation of the social welfare. Thus, it can be said that distribution of GDP is a limitation as a measure of economic welfare.

Question 24.

Given that national income is ₹ 80 crore and consumption expenditure ₹ 64 crore, find out average propensity of save. When income rise to ₹ 100 crore and consumption expenditure to ₹ 78 crore, what will be the average propensity to consume and the marginal propensity to consume? [3]

Answer:

Given:

National Income = Y = 80

Consumption Expenditure, C = 64

We know,

Question 25.

Explain the relationship between investment multiplier and marginal propensity to consume.

Answer:

Investment multiplier (k) implies that any change in the investment leads to a corresponding change in the income and output by multiple times. That is, in other words, the change in the income and output is more than (or multiple times of) the change in investment.

Investment Multiplier, k = \(\frac{\Delta Y}{\Delta I}\)

Investment Multiplier shares a direct positive relationship with marginal propensity to consume. That is, higher the value of MPC, higher will be the value of investment multiplier and vice-versa.

Algebraically, the relationship is expressed as follows,

Thus, as the value of MPC rises from 0.5 to 0.8, the value of investment multiplier rises from 2 to 5. This confirms the direct positive relation between MPC and investment multiplier.

Question 26.

When price of a foreign currency rises, its demand falls. Explain why. [3]

OR

When price of a foreign currency rises, its supply also rises. Explain why.

Answer:

When the price of foreign currency rises then it implies that foreign goods have become expensive for the domestic residents of the country. This results in a fall in the demand for foreign goods by the domestic residents. Consequently, the demand for foreign currency falls.

For example, suppose the rupee-dollar exchange rate (price of dollars in terms of rupees) rises from say, from $1 = ‘ 68 to $1 = ‘ 70. This implies that in order to purchase one dollar worth of foreign goods, the domestic residents now have to pay ‘ 70 instead of ‘ 68. Thereby, the demand for foreign goods decreases. Consequently, the demand for dollars decreases.

OR

When the price of foreign currency rises, this implies that the domestic goods have become cheaper for the foreign residents. This is because they can now buy more goods and services with same worth of foreign currency. As a result, the foreign demand for domestic products rises. This leads to an increase in the exports of domestic country. As a result, the domestic country receives more foreign currency and its supply rises.

For example, suppose the rupee-dollar exchange rate (price of dollars in terms of fupees) rises from say, from $1 = ‘ 68 to $1 = ‘ 70. This implies that the foreign residents can now buy ’70 worth of goods with the same one dollar. Thus, the demand for domestic goods increases. As a result, the supply of dollars increases.

Question 27.

Explain the ‘allocation of resources’ objective of Government budget. [4]

OR

Explain the ‘redistribution of income’ objective of Government budget.

Answer:

Allocation of resources is one of the important objectives of government budget. In a mixed economy, the private producers aim towards profit maximization, while, the government aims towards welfare maximization. The private sector always tend to divert resources towards areas of high profit, while, ignoring areas of social welfare. In such a situation, the government through its budgetary policy reallocates resources to maintain a balance between the social objectives of welfare maximization and economic objective of profit maximization. For example, government levies taxes on socially harmful goods such as tobacco and provides subsidies for the socially desirable goods such as food grains.

OR

Redistribution of income is one of the important objectives of government budget. The government through its budgetary policy attempts to promote fair and right distribution of income in an economy. This is done through taxation and expenditure policy. Through its taxation policy, the government taxes the higher . income groups in the economy. Purchasing power extracted from the higher income groups in the form of taxes is then transferred to the poor sections of the society through the expenditure policy (subsidies, transfer payments, etc.). Thus, with the help of taxation and expenditure policy in the budget, the government aims at redistribution of income such that a fair and just distribution of income is achieved in the society.

Question 28.

From the following data about a Government budget, find out (a) Revenue deficit, (b) Fiscal deficit and (c) Primary deficit: [4]

|

s.No. |

Items |

(₹) Arab |

| (i) | Capital receipts net of borrowings | 95 |

| (ii) | Revenue expenditure | 100 |

| (iii) | Interest payments | 10 |

| (iv) | Revenue receipts | 80 |

| (v) | Capital expenditure | 110 |

Answer:

(a) Revenue Deficit = Revenue Expenditure – Revenue Receipts

= 100 – 80 = ₹ 20 Arab

(b) Fiscal Deficit = Revenue Expenditure + Capital Expenditure – Revenue Receipts – Capital Receipts net of Borrowings

= 100 + 110 – 80 – 95 = ₹ 35 Arab

(c) Primary Deficit = Fiscal Deficit – Interest Payments

= 35 – 10

= ₹ 25 Arab

Question 29.

Giving reasons classify the following into intermediate products and final products : [4]

(i) Furniture purchased by a school.

(ii) Chalks, dusters, etc, purchased by a school.

Answer:

(i) Furniture purchased by the school is a final product as it is used by the school for final consumption purposes and does not undergo any further processing.

(ii) Chalks, dusters, etc, are intermediate product as they are used is the process of teaching service in a school.

Question 30.

Explain the role of the following in correcting ‘deficit demand’ in an economy: [6]

(i) Open market operations.

(ii) Bank rate.

OR

Explain the role of the following in correcting ‘excess demand’ in an economy:

(i) Bank rate.

(ii) Open market operations.

Answer:

(i) Open market operations as an instrument to correct deficit demand: Open Market Operations refer to the buying and selling of securities either to the general public or to the commercial banks in an open market. To correct deficit demand, the central bank purchases securities in the open market. With purchase of securities, the central bank pumps in additional money into the economy. With the additional money, the level of Aggregate Demand in the economy increases. Thus, the deficit demand is corrected.

(ii) Bank rate as an instrument to correct deficit demand: Bank rate refers to the rate at which the central bank provides loan to the commercial banks. To curtail deficit demand, the central bank lowers the bank rate. This implies that cost of borrowing for the commercial banks from the central bank reduces. The commercial banks in turn reduce the lending rate (the rate at which they provide loans) for their customers. This reduction in the lending rate raises the borrowing capacity of the public, thereby, encourage the demand for loans and credit. Consequently, the level of Aggregate Demand in the economy increases and deficit demand is corrected.

OR

(i) Bank rate as an instrument to correct excess demand

Bank rate is the rate at which the cehtral bank provides loan to the commercial banks. To control excess demand, the central bank increases the bank rate. A rise in the bank rate increases the cost of borrowing for the commercial banks from the central bank. The commercial banks in turn raise the lending rate (the rate at which they provide loans) for their customers. This hike in the lending rate reduces the borrowing capacity of the public, thereby, discourages the demand for loans and credit. Consequently, the level of Aggregate Demand in the economy falls and excess demand is curtailed,

(ii) Open market operations as an instrument to correct excess demand

Open market operations refer to the buying and selling of securities either to the public or to the commercial banks in an open market. To curtail excess demand the central bank sells securities . in the open market. By selling the securities in the open market, the central bank withdraws excess money from the economy. This results in a lower Aggregate Demand in the economy and excess demand is controlled.

Question 31.

Explain the process of money creation by the commercial banks with the help of a numerical example. [6]

Answer:

Process of Creation of Money

The process of money creation by the commercial banks starts as soon as people deposit money in their respective bank accounts. After receiving the deposits, as per the central bank guidelines, the commercial banks maintain a portion of total deposits in form of cash reserves. The remaining portion left after maintaining cash reserves of the total deposits is then lend by the commercial bank to the general public in form of credit, loans and advances. Now assuming that all transactions in the economy are routed through the commercial banks, then the money borrowed by the borrowers again comes back to the banks in form of deposits.

The commercial banks again keep a portion of the deposits as reserves and lend the rest. The deposit of money by the people in the banks and the subsequent lending of loans by the commercial banks is a recurring process. It is due to this continuous process that the commercial banks are able to create credit money a multiple times of the initial deposits. The process of creation of money is explained with the help of the following numerical example.

Suppose, initially the public deposited ₹ 10,000 with the banks. Assuming the Legal Reserve Ratio to be 20%, the banks keep ₹ 2,000 as minimum cash reserves and lend the balance amount of ₹ 8,000 (₹ 10,000 – ₹ 2,000) in form of loans and advances to the general public.

Now, if all the transactions taking place in the economy are routed only through banks then, the money borrowed by the borrowers is again routed back to the banks in form of deposits. Hence, in the second round there is an increment in the deposits with the banks by ₹ 8,000 and the total deposits with the banks now rises to’ 18,000 (that is, ₹ 10,000 + ₹ 8,000). Now, out of the new deposits of ₹ 8,000, the banks will keep 20% as reserves (that is, ₹ 1,600) and lend the remaining amount (that is ₹ 6,400). Again, this money will come back to the bank and in the third round, the total deposits rises to ₹ 24,400 (i.e., 18,000 ₹ 6,400).

The same process continues and with each round the total deposits with the banks increases. However, in every subsequent round the cash reserves diminishes. The process comes to an end when the total cash reserves (aggregate of cash reserves from the subsequent rounds) become equal to the initial deposits of ₹ 10,000 that were initially held by the banks. As per the above – schedule, with the initial deposits of ₹ 10,000, the commercial banks have created money of ₹ 50,000.

Question 32.

Calculate National Income and Gross National t Disposable Income from the following : ** [6]

Answer:

GDPmp = P + G + I + (X – M)

= 500 + 200 + (120 – 20 + 20) + (- 30)

= 790 crores

NNPFC = GDPmp + NFIA – Dep – NUT

= ₹ 680 crores.

CBSE Previous Year Question Papers Class 12 Economics 2011 Delhi Set – II

Note: Except for the following questions, all the remaining questions have been asked in previous sets.

Section – A

Question 1.

What is positive economics? [1]

Answer:

The study of economics based on objective analysis. Most economics today focuses on positive economic. For example, the statement/rate of inflation at present is 4%’ is a positive economic statement.

Question 7.

A consumer buys 10 units of a good at a price of ₹ 6 per unit. Price elasticity of demand is (-)1. At what price will buy 12 units? Use expenditure approach of price elasticity of demand to answer this question.** [3]

Question 11.

Explain the conditions determining how many units of a good the consumer will buy at a given price. [4]

Answer:

Given the price of a good a consumer decides how many units of the good to buy based on the marginal utility derived from the good and the marginal utility of money for him. A consumer purchases those many units of good where the marginal utility of a rupee spent on the good becomes equal to the marginal utility of money.

That is where,

Marginal Utility of a Rupee spent on the commodity = Marginal Utility of Money

Marginal Utility of rupee spent on the commodity refers to the utility derived from each additional unit of the rupee spent on the purchase of the good. Algebraically,

Marginal Utility of Rupee = \(\frac{M U_{x}}{P_{x}}\)

Marginal Utility of money refers to the valuation of a unit of a rupee for a consumer. It is assumed to constant. *

Thus, the consumer purchases those many units of the good where,

\(\frac{M U_{x}}{P_{x}}\) = MUm

However, if the marginal utility of the rupee spent on the commodity is greater than the marginal utility of money, (that is, if \(\frac{M U_{x}}{P_{x}}>M U_{m}\)) then, the consumer would continue to consume more and more units of the good until the equality is again reached.

On the other hand, if the marginal utility of the rupee spent on the good is less than the marginal utility of money, (that is, if \(\frac{M U_{x}}{P_{x}}<M U_{m}\)) then, the consumption of the good until marginal utility becomes equal to the price paid by him.

Question 15.

Explain the concept of Marginal Rate of Substitution (MRS) by giving an example. What happens to MRS when consumer moves downwards along the indifference curve? Give reasons for your answer. [6]

Answer:

Marginal Rate of Substitution (MRS) refers to the rate at which a consumer is willing to substitute one good for each additional unit of the other good. Algebraically,

MRS = \(\frac{\Delta Y}{\Delta X}\)

It shows how many units of good Y the consumer is willing to sacrifice to gain one additional unit of good X.

The following schedule explains the concept of MRS

As the consumer moves from consumption combination P to consumption combination Q, consumption of good X increases from 2 units to 3 units while, the consumption of good Y falls from 10 units to 5 units. That is to gain one additional unit of good X, the consumer sacrifices 5 units of good the consumer sacrifices 5 units of good Y. Thus, the MRS is 5.

The Indifference Curve depicting the above consumption combination is drawn as follows.

As we move down along the Indifference curve tb the right, the Marginal Rate of Substitution falls. This is because as the consumer consumes more and more of one good, the marginal utility of the good falls. On the other hand, the marginal utility of the good which is sacrificed rises. In other words, as we move down along the Indifference Curve, the consumer is willing to sacrifice less and less for each additional unit of the other good consumed. Initially, at point Q the consumer has 2 units of good X and 10 units of good Y. As the consumer moves from point P to point Q, he is willing to sacrifice 5 units of good Y for one additional unit of good X. As compared to this, at point R the consumer has 4 units of good X and only 2 units of good Y. Now, as the consumer has 4 units of good X and only 2 units of good Y. Now, as the consumer moves from R to S, he is willing to sacrifice only one unit of good Y for one additional unit of good X. Thus, as the consumer moves down along the IC, he has more of good X and to consume one additional unit of good X he is willing to sacrifice lesser and lesser units of good Y.

Section – B

Question 22.

State the components of capital account of balance of payments. [3]

Answer:

Capital Account of Balance of payment (BOP) refers to that account of BOP, which records all the transactions that cause a change in the status of assets and liabilities of the government or any of the residents of a country. The following are the components of capital account of BOP.

(i) Foreign Direct Investment (FDI) and Portfolio Investment: Foreign Direct Investment refers to the investment in the assets of a foreign country that follows control over

the asset. On the contrary, Portfolio Investment refers to the investment in the assets of a foreign country without any control over that asset. Both FDI and portfolio are non-debt creating capital transactions. They cause an inflow of foreign exchange into the country. Thus, they are recorded as positive items in the capital account of BOP.

(ii) Loans and Borrowings: A country takes loans and borrowings from the foreign countries and from the international monetary transactions. Loans and borrowings are debt- increasing capital transactions. They result in inflow of foreign exchange into the country. Hence, they are recorded as positive items in the Capital Account of BOP.

(iii) Banking Capital Transactions : Banking capital transactions refer to the transactions of external financial assets and liabilities of the commercial banks and cooperative banks that operate as authorized dealers in the foreign exchange market.

Question 24.

If National Income is ₹ 50 crore and Saving ₹ 5 crore, find out average propensity to consume. When income rises to ₹ 60 crore and saving to ₹ 9 crore, what will be the average propensity to consume and the marginal propensity to save? [3]

Answer:

Given:

National Income, Y = 50

Saving, S = 5

We know,

Question 29.

Giving reasons classify the following into intermediate products and final products;

(i) Computers installed in an office.

(ii) Mobile sets purchased by a mobile dealer. [4]

Answer:

(i) Computers installed in an office is a final product as they are used by the office for final consumption purposes and does not undergo any further processing.

(ii) Mobile sets purchased by a mobile dealer are intermediate products as they are purchased by the dealer for resale in the market.

Question 32.

Find the gross National Product at market price and (Net National Disposable **) from the following: [6]

Answer:

GNPMP = P + G + I + (X – M)

= 1000 + 300 + (150 + 30 + 40 – 50) + (-20)

= 1300 + 170 – 20

= 1450

GNPmp = GDPmp + NFIA

= 1450 – (-10)

= ₹ 1460

CBSE Previous Year Question Papers Class 12 Economics 2011 Delhi Set – III

Note : Except for the following questions, all the remaining questions have been asked in previous sets.

Section – A

Question 1.

What is normative economics? [1]

Answer:

A perspective on economics that incorporates subjectivity within its analyses. It is the study or presentation of “wfiat ought to be?” rather than what actually is. Normative economics deals heavily in value judgments and theoretical scenario. For example, the statement ‘what should an ideal rate of inflation be?’ is a normative economic statement.

Question 7.

When a price of a good changes to ₹ 11 per unit, the consumer’s demand falls from 11 units to 7 units. The price elasticity of demand is (-) 1. What was the price before change? Use expenditure approach of price elasticity of demand to answer this question. [3]

Question 15.

What are monotonic preferences? Explain why is an indifference curve (i) Downward sloping from left to right and (ii) Convex. [6]

Answer:

Monotonic preferences refer to those consumer preferences where the consumer prefers those consumption bundles which have at least more of one good and no less of the other good than other consumption bundles.

Suppose, there are two consumption bundles, bundle A (7, 5) and bundle B(3, 5). In this case, consumer preferences would be called monotonic if he prefers bundle A over bundle B. This is because bundle A has more units of good 2 (i.e. 7 unit are compared to only 3 units in bundle B) and less of good 1.

(i) An indifference curve is downward sloping from left to right because a consumer cannot simultaneously have more of both the goods. An increase in the quantity of one good is associated with the decrease in the quantity of the other good. This is in accordance with the assumption of monotonic preferences.

(ii) An indifference curve is convex to the origin because of diminishing MRS. As the consumer consumes more and more of one good, the marginal utility of the good falls. On the other hand, the marginal utility of the good which is sacrificed rises. In other words, as the consumer consumes more of one good he is willing to sacrifice less and less of other good for each additional unit of the good. Thus, as we move down the IC, MRS diminishes. This confirms the convex shape of the indifference curve.

Section – B

Question 22.

What does balance of payments account show? Name the two parts of the balance of payments account. [3]

Answer:

Balance of payment account shows the record of economic transactions of a country with the rest of the world. In other words, it reflects the inflow of foreign exchange into the country and the outflow of foreign exchange from the country.

The two parts of the BOP account are as follows :

(i) Current account: The Current account of BOP is that account which maintains the records of imports and exports of goods and services as well as the record of unilateral transfers.

(ii) Capital account: Capital account of BOP is that account which records all the transactions that cause a change in the status of assets and liabilities of the government or any of the residents of a country.

Question 24.

If national income is ₹ 90 crore and consumption expenditure ₹ 81 crore, find out average propensity to save. When income rises to ₹ 100 crore and consumption expenditure to ₹ 88 crore, what will be the marginal propensity to consume and marginal propensity to save. [3]

Answer:

Given:

National Income, Y = 90

Consumption Expenditure, C = 81

We know,

We know,

Question 29.

Giving reasons identify whether the’following are final expenditure or intermediate expenditure : [4]

(i) Expenditure on maintenance of an office building.

(ii) Expenditure on improvement of a machine in a factory.

Answer:

(i) Expenditure on the maintenance of an office building is a final expenditure as it is used for final consumption purposes.

(ii) Expenditure on the improvement of a machine in a factory is also a final expenditure as it increases the capital formation.

Question 32.

Calculate Net National Product at market Price and Gross National Disposable Income: [6]

Answer:

Expenditure Imports

GDPmp = P + G + I + (X – M)

= 800 + 250 + (100 – 10) – 20

= 1050 + 90 – 20

= 1140 – 20

= ₹ 1120 Arab

NNPmp = GDPmp – Dep + NFIA

= 1120 – 40 – 40

= 1120 – 80

= ₹ 1040 Arab