Free PDF Download of CBSE Accountancy Multiple Choice Questions for Class 12 with Answers Chapter 6 Financial Statements of Not-for-Profit Organisations (N.P.O.). Accountancy MCQs for Class 12 Chapter Wise with Answers PDF Download was Prepared Based on Latest Exam Pattern. Students can solve NCERT Class 12 Accountancy Financial Statements of Not-for-Profit Organisations (N.P.O.) MCQs Pdf with Answers to know their preparation level.

Financial Statements of Not-for-Profit Organisations (N.P.O.) Class 12 Accountancy MCQs Pdf

Select the Best Alternate and tally your answer with the Answers given at the end of the book :

1. Receipts and Payments Account generally shows :

(A) A Debit balance

(B) A Credit balance

(C) Surplus or Deficit

(D) Capital Fund

Answer

Answer: A

2. Income and Expenditure Account records transactions of:

(A) Revenue nature only

(B) Capital nature only

(C) Both revenue and capital nature

(D) Income of only revenue nature and expenditure of revenue and capital nature.

Answer

Answer: A

3. Income and Expenditure Account reveals :

(A) Surplus or Deficiency

(B) Cash in Hand

(C) Net Profit

(D) Capital Account

Answer

Answer: A

4. The amount of ‘Subscription received from members’ by a Non-profit organi sation is shown in which of the following?

(A) Debit side of Income and Expenditure Account

(B) Credit side of Income and Expenditure Account

(C) Liability side of Balance Sheet

(D) Assets side of Balance Sheet

Answer

Answer: B

5. Donation received for a special purpose :

(A) Should be credited to Income and Expenditure Account

(B) Should be credited to separate account and shown in the Balance Sheet

(C) Should be shown on the assets side

(D) Should not be recorded at all.

Answer

Answer: B

6. Subscription received by a school for organising annual function is treated as:

(A) Capital Receipt (i.e., Liability)

(B) Revenue Receipt {i.e., Income)

(C) Asset

(D) Earned Income

Answer

Answer: A

7. The amount of ‘Entrance Fees’ received by a Non-profit organisation (if it is received regularly) is shown in which of the following?

(A) Liability side of Balance Sheet

(B) Assets side of Balance Sheet

(C) Debit side of Income and Expenditure Account

(D) Credit side of Income and Expenditure Account

Answer

Answer: D

8. Out of following items, which one is shown in the Receipts and Payments Account?

(A) Outstanding Salary

(B) Depreciation

(C) Life Membership Fees

(D) Accrued Subscription

Answer

Answer: C

9. Not-for-profit organisations prepare :

(A) Trading Account

(B) Trading & Profit and Loss Account

(C) Income and Expenditure Account

(D) All of the above

Answer

Answer: C

10. The Receipts and Payments Account is a summary of:

(A) Debit and Credit balance of Ledger Accounts

(B) Cash Receipts and Payments

(C) Expenses and Incomes

(D) Assets and Liabilities

Answer

Answer: B

11. Receipts and Payments Account is a :

(A) Personal Account

(B) Real Account

(C) Nominal Account

(D) Real and Nominal Account, both

Answer

Answer: B

12. Income and Expenditure Account is a :

(A) Personal Account

(B) Real Account

(C) Nominal Account

(D) Real and Nominal Account, both

Answer

Answer: C

13. Credit side balance in Income & Expenditure Account reveals :

(A) Excess of cash receipts overpayments

(B) Excess of cash payments over receipts

(C) Excess of expenditure over income

(D) Excess of income over expenditure

Answer

Answer: D

14. Source of income for a not-for-profit organisation is :

(A) Subscription from Members

(B) Donation

(C) Entrance Fees

(D) All of the above

Answer

Answer: D

15. Which of the following represent capital receipt:

(A) Life Membership Subscription

(B) Donation

(C) Subscription

(D) Interest on Investments

Answer

Answer: A

16. Amount received from sale of grass by a club should be treated as :

(A) Capital Receipt

(B) Revenue Receipt

(C) Asset

(D) Earned Income

Answer

Answer: B

17. The amount received for sale of old sports materials by a Non-profit organisation is shown in which of the following?

(A) Debit side of Income and Expenditure Account

(B) Liability side of Balance Sheet

(C) Credit side of Income and Expenditure Account

(D) Assets side of Balance Sheet

Answer

Answer: C

18. If there is a ‘Match Fund’, then match expenses and incomes are transferred to:

(A) Income and Expenditure A/c

(B) Assets side of Balance Sheet

(C) Liabilities side of Balance Sheet

(D) Both Income and Expenditure A/c and to Balance Sheet

Answer

Answer: C

19. Subscription received in advance during the current year is :

(A) an income

(B) an asset

(C) a liability

(D) none of these

Answer

Answer: C

20. Subscription received in cash during the year amounted to ₹40,000; subscription outstanding at the end of previous year was ₹1,500 and outstanding at the end of current year was ₹2,000. Subscription received in advance for next year was ₹800. The amount credited to Income & Expenditure Account will be:

(A) ₹38,700

(B) ₹39,700

(C) ₹40,300

(D) ₹41.300

Answer

Answer: B

21. Subscription received in cash during the year amounted to ₹5,00,000; subscription outstanding at the end of previous year was ₹20,000 and outstanding at the end of current year was ₹25,000. Subscription received in advance for next year was ₹8,000 and received in advance during previous year was ₹7,000. The amount credited to Income & Expenditure Account will be :

(A) ₹5,04,000

(B) ₹5,06,000

(C) ₹4,96,000

(D) ₹4,94,000

Answer

Answer: A

22. Subscription received in cash during the year amounted to 760,000; subscription received in advance for next year was 73,000 and received in advance during previous year was 72,000. Subscription in arrear at the end of current year was 75,400. The amount credited to Income & Expenditure Account will be :

(A) ₹53,600

(B) ₹66,400

(C) ₹55,600

(D) ₹64,400

Answer

Answer: D

23. Subscription received in cash during the year amounted to ₹3,00,000; subscription received in advance for next year was ₹10,000 and received in advance during previous year was ₹8,000. Subscription in arrear at the end of previous year was ₹18,000 and subscription in arrear at the end of current year was ₹12,000. The amount credited to Income & Expenditure Account will be :

(A) ₹2,96,000

(B) ₹3,04,000

(C) ₹2,92,000

(D) ₹3,08,000

Answer

Answer: C

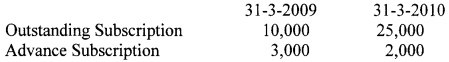

24. What amount will be credited to the Income and Expenditure Account for the year ending 31st March, 2010 on the basis of the following information? :

Subscriptions received during the year 2009-10 were ₹4,00,000.

(A) ₹3,84,000

(B) ₹4,16,000

(C) ₹3,86,000

(D) ₹4,14,000

Answer

Answer: B

25. There are 200 members, each paying an annual subscription of 7 1,000; subscription received during the year 7 1,95,000; subscriptions received in advance at the beginning of the year 73,000 and at the end of the year 72,000. – Amount shown in Income & Expenditure Account will be :

(A) ₹2,00,000

(B) ₹1,96,000

(C) ₹1,94,000

(D) ₹2,01,000

Answer

Answer: A

26. The opening balance of Prize Fund was ₹32,800. During the year, donations reoeived towards this fund amounted to ₹15,400; amount spent on prizes was 712,300 and interest received on prize fund investment was ₹4,000. The closing balance of Prize Fund will be :

(A) ₹56,500

(B) ₹64,500

(C) ₹39,900

(D) ₹31,900

Answer

Answer: C

27. Salary paid in cash during the current year was ₹80,000; Outstanding salary at the end was ₹4,000; Salary paid in advance last year pertaining to the current year was ₹3,200; paid in advance during current year for next year was ₹5,000. The amount debited to Income and Expenditure Account will be:

(A) ₹85,800

(B) ₹77,800

(C) ₹82,200

(D) ₹74,200

Answer

Answer: C

28. Salary paid in cash during the current year was ₹30,000; Outstanding salary at the end of previous year was ₹2,000 and outstanding salary at the end of current year was ₹3,000. Salary paid in advance during current year for next year was ₹2,600. The amount debited to Income and Expenditure Account will be :

(A) ₹33,600

(B) ₹26,400

(C) ₹31,600

(D) ₹28,400

Answer

Answer: D

29. Salary paid for the year ended 31st March, 2010 amounted to ₹75,000. How much amount will be recorded in Income and Expenditure Account in the following case?

(A) ₹75,700

(B) ₹74,300

(C) ₹75,300

(D) ₹74,700

Answer

Answer: D

30. How much amount will be shown in Income and Expenditure Account in the following case?

During 2009-10 payment made for Stationery was ₹60,000.

(A) ₹57,800

(B) ₹62,200

(C) ₹61,800

(D) ₹58,200

Answer

Answer: A

31. How much amount will be shown in Income and Expenditure Account in the following case? :

Payment made for medicines during 2009-10 was ₹2,5 0,000.

(A) ₹2,53,000

(B) ₹2,47,000

(C) ₹2,57,000

(D) ₹2,43.000

Answer

Answer: B

32. If a General Donation of huge amount is received by a school, that donation is treated as :

(A) Revenue Receipt (Income)

(B) Capital Receipt (Liability)

(C) Assets

(D) Earned Income

Answer

Answer: B

33. If a general donation of smaller amount is received by a school, that donation will be shown in :

(A) Liability Side

(B) Asset Side

(C) Debit side of Receipt and Payment A/c

(D) Credit side of Receipt and Payment A/c

Answer

Answer: C

34. Out of the billowing items, which one is shown in the ‘Receipts and Payments Account” of a not for profit organisation?

(A) Accrued subscription

(B) Outstanding salary

(C) Depreciation

(D) None of these

Answer

Answer: D

35. Out of the following items, which is not shown in the ‘Receipts and Payments A/c’ of a not for profit organisation? ‘

(A) Subscription received in advance

(B) Subscription due

(C) Last year subscription received

(D) All of the above

Answer

Answer: B

36. Out of the following items, which is shown in the ‘Receipts and Payments A/c’ of a not for profit organisation?

(A) Subscription received in advance

(B) Last year subscription received

(C) Current year subscription received

(D) All of the above

Answer

Answer: D

We hope the given Accountancy MCQs for Class 12 with Answers Chapter 6 Financial Statements of Not-for-Profit Organisations (N.P.O.) will help you. If you have any query regarding CBSE Class 12 Accountancy Financial Statements of Not-for-Profit Organisations (N.P.O.) MCQs Pdf, drop a comment below and we will get back to you at the earliest.